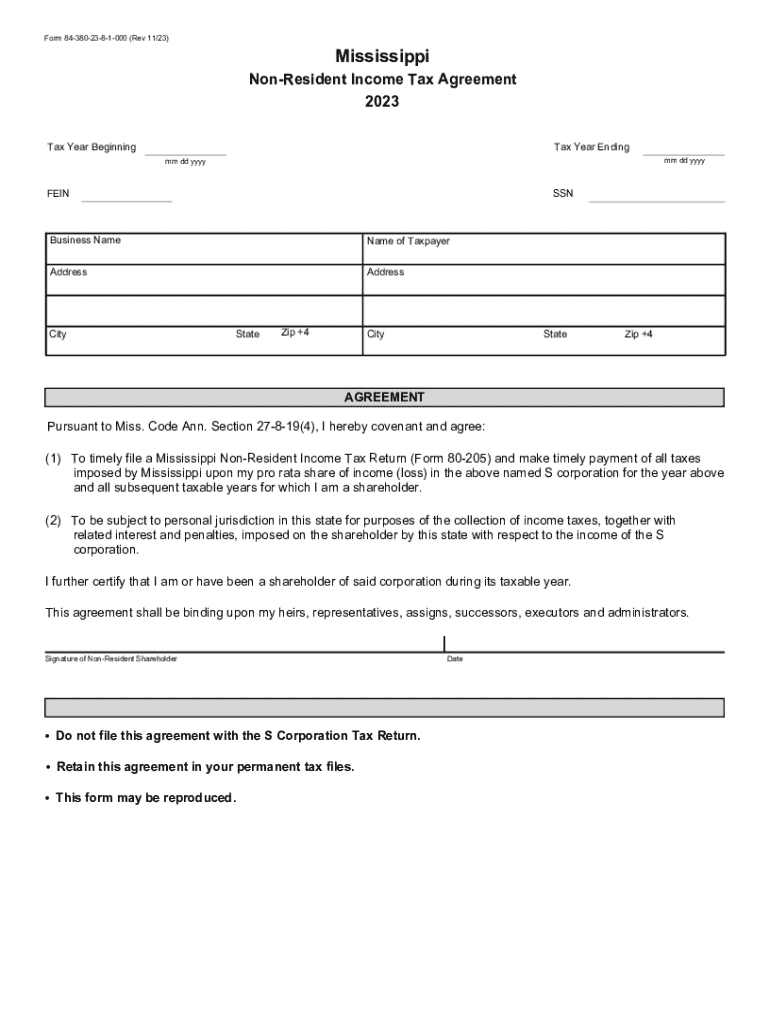

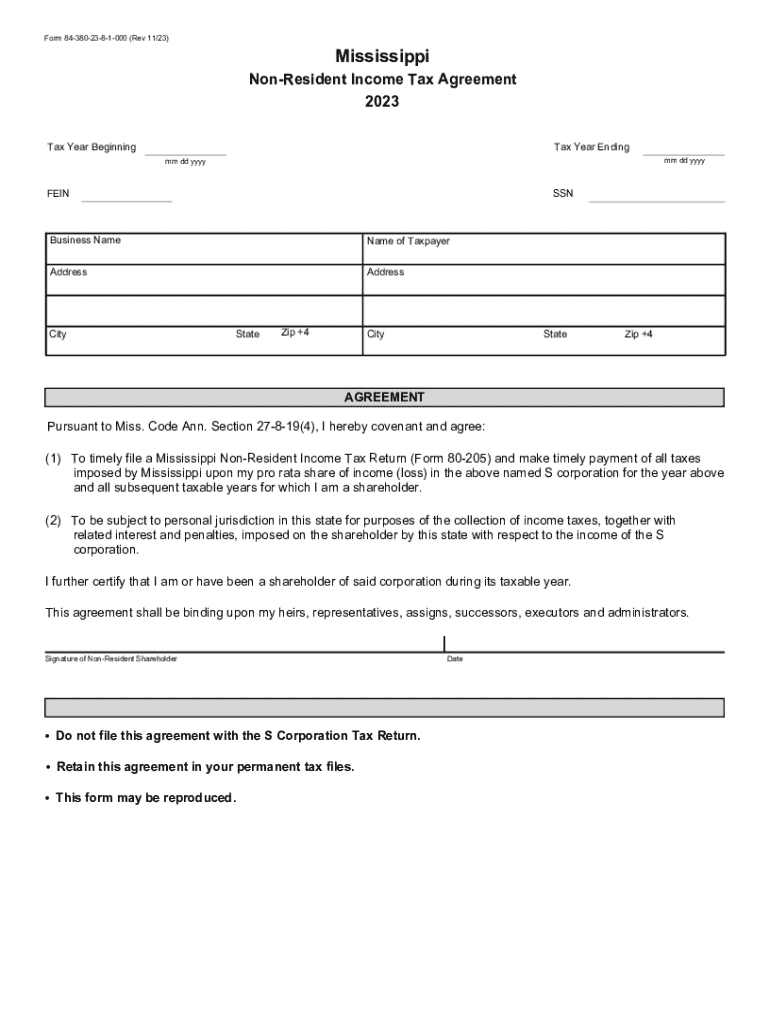

Get the free Non-resident Income Tax Agreement

Get, Create, Make and Sign non-resident income tax agreement

How to edit non-resident income tax agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-resident income tax agreement

How to fill out non-resident income tax agreement

Who needs non-resident income tax agreement?

Your Comprehensive Guide to the Non-Resident Income Tax Agreement Form

Understanding non-resident income tax agreements

Non-Resident Income Tax Agreements (NITAs) are essential for individuals who earn income in a country where they do not reside. This framework aims to prevent double taxation, ensuring that non-residents only pay taxes on income sourced in the host country. For instance, a Canadian citizen working remotely for a U.S. company is subject to NITA regulations to avoid being taxed by both Canada and the U.S. Understanding these agreements helps non-residents comply with tax obligations while taking full advantage of applicable benefits.

The process of submitting the Non-Resident Income Tax Agreement Form is crucial. Failure to properly fill out and submit this form could lead to overpayment of taxes or, conversely, non-compliance penalties. Key terms associated with NITAs include 'residency status,' 'source of income,' and 'withholding tax rates,' each playing a critical role in the overall tax landscape for international earners.

The non-resident income tax agreement form

The Non-Resident Income Tax Agreement Form serves as a declaration of your income sources and residency status. Completing this form accurately ensures that you benefit from reduced withholding tax rates as stated in the applicable tax treaties. Individuals or entities employed abroad or receiving payment from a foreign source typically need to complete this form to clarify their tax responsibilities.

The types of income covered under NITAs include salaries, wages, rental income, dividends, and royalties. Each category may have different tax implications, depending on specific agreements between countries, making it essential for non-residents to understand how their income types affect their tax obligations.

Step-by-step instructions for completing the form

Completing the Non-Resident Income Tax Agreement Form involves several steps. To ensure accuracy, gather the required information and documentation beforehand. You'll need personal identification details, income reporting specifics, and your residency status information.

Follow these detailed instructions for each section of the form: In Section 1, provide your personal information, ensuring correct spelling and formatting. Section 2 requires a clear breakdown of your income sources; be meticulous here, as inaccuracies can lead to processing delays. Section 3 is crucial for affirming your residency status—double-check this information for completeness.

Editing and managing your form with pdfFiller

After completing the Non-Resident Income Tax Agreement Form, you might want to refine and manage your document effectively. This is where pdfFiller shines, offering powerful editing tools that cater to your form management needs.

Saving progress is essential—pdfFiller allows you to save drafts temporarily or store final versions permanently, streamlining your document management. If you are working on multiple versions of the Non-Resident Income Tax Agreement Form, pdfFiller's version control makes it easy to track edits and manage updates seamlessly.

eSigning your non-resident income tax agreement form

eSigning the Non-Resident Income Tax Agreement Form is an integral part of the submission process. Digital signatures save time and ensure security, with many jurisdictions accepting eSignatures under electronic signature laws.

Completing the eSigning process accurately helps ensure that your form is accepted without issue. Post-signature, you're ready to submit the form confidently.

Common mistakes to avoid when completing the form

Non-residents must be vigilant when filling out the Non-Resident Income Tax Agreement Form to avoid common pitfalls. Frequently overlooked sections include income categorization and residency status confirmation, both of which are crucial for accurate tax assessment.

Taking the time to avoid these mistakes can save you considerable time and money in potential penalties or overpayments.

Frequently asked questions (FAQs)

After submitting the Non-Resident Income Tax Agreement Form, many recipients wonder about the next steps. Typically, processing involves cross-verifying your information with state or federal tax records.

Understanding what to expect post-submission is vital for managing your tax obligations effectively.

Interactive tools available on pdfFiller

pdfFiller not only simplifies form management but provides several interactive tools tailored to enhance your experience while completing the Non-Resident Income Tax Agreement Form.

With these tools, pdfFiller enhances your overall productivity and accuracy in tax form submissions.

Related forms and publications

Navigating tax obligations can often lead to the need for supplementary forms and publications. Several forms relate to the Non-Resident Income Tax Agreement Form, providing additional insight into specific regulatory requirements.

These resources can be invaluable in ensuring you're compliant and aware of your rights and responsibilities.

Getting support and assistance

If you encounter questions or challenges while completing the Non-Resident Income Tax Agreement Form, pdfFiller facilitates ease of access to support. Numerous resources are available to assist users in navigating the complexities of tax forms.

Leveraging these support options will ultimately enhance your form completion experience.

Success stories and user testimonials

Many users have shared how pdfFiller has transformed their experience with form management. Clients across various industries have found that utilizing pdfFiller for the Non-Resident Income Tax Agreement Form allows them to focus on their primary tasks instead of document chaos.

These testimonials further reinforce pdfFiller's commitment to empowering users in their document management endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find non-resident income tax agreement?

Can I create an electronic signature for signing my non-resident income tax agreement in Gmail?

How do I complete non-resident income tax agreement on an Android device?

What is non-resident income tax agreement?

Who is required to file non-resident income tax agreement?

How to fill out non-resident income tax agreement?

What is the purpose of non-resident income tax agreement?

What information must be reported on non-resident income tax agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.