Get the free 2025 Sales, Use and Withholding Taxes Annual Return

Get, Create, Make and Sign 2025 sales use and

How to edit 2025 sales use and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 sales use and

How to fill out 2025 sales use and

Who needs 2025 sales use and?

2025 Sales Use and Form: A Comprehensive Guide

Understanding sales use tax in 2025

Sales use tax is a crucial obligation for both consumers and businesses, designed to ensure fairness in taxation on goods and services. In 2025, the landscape of sales use tax continues to evolve. Changes in regulations and compliance requirements can significantly impact how sales tax is calculated, reported, and remitted. Staying informed about these changes is essential for individuals and businesses alike.

Compliance with 2025 sales tax regulations is paramount to avoid fines or legal complications. Misunderstanding or neglecting these regulations can lead to hefty penalties, which may cost businesses not only in fines but also in reputation.

Who needs to file sales use tax?

Both individuals and businesses are required to file for sales use tax, though their motivations and requirements differ significantly. While businesses must ensure tax is collected on sales, individuals may need to report sales for which tax was not collected.

Certain exemptions can apply, including purchases made by nonprofit organizations and items purchased for resale. Knowledge of these exemptions helps both consumers and businesses navigate their tax obligations more effectively.

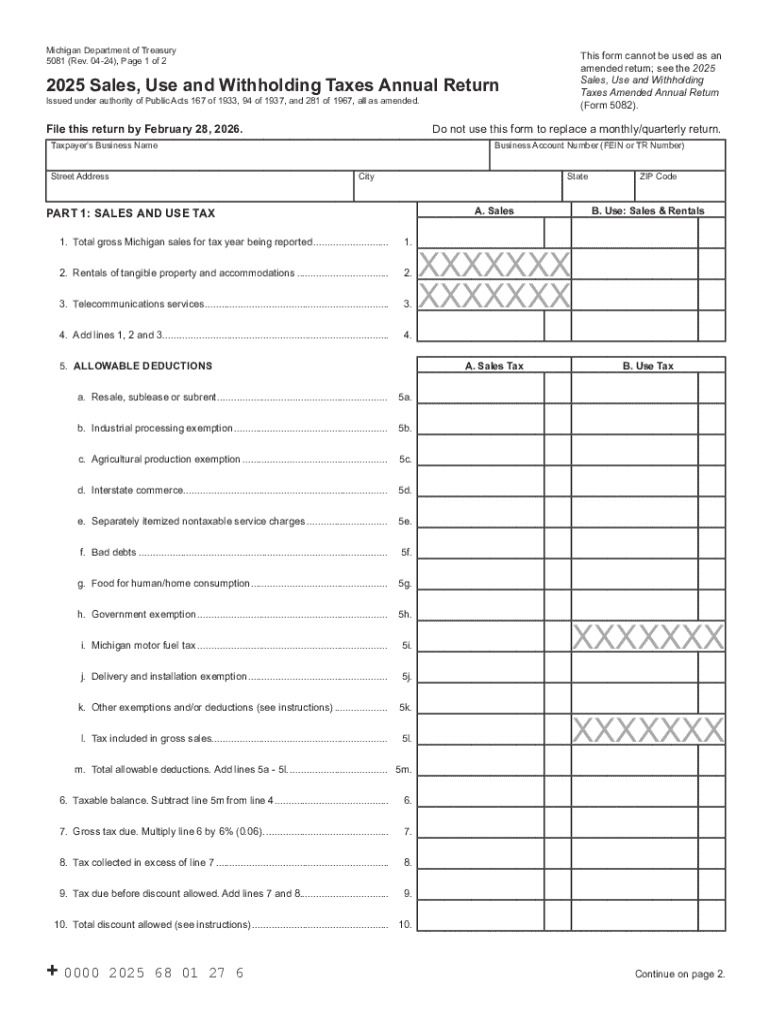

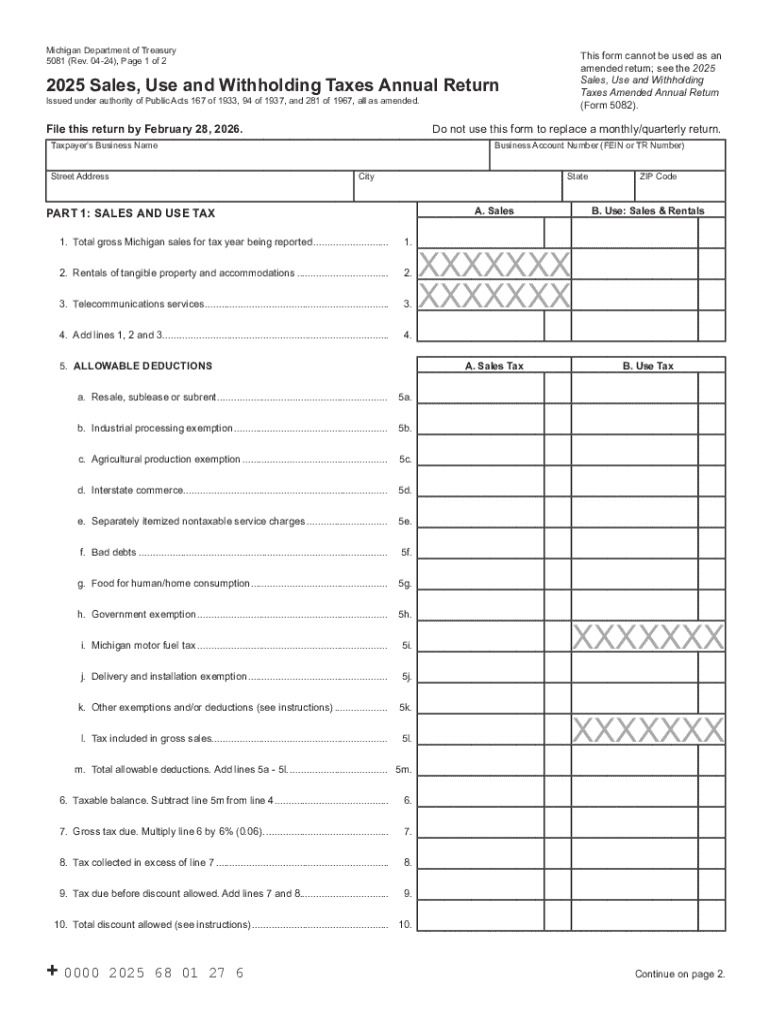

Key components of the 2025 sales use form

The 2025 sales use form consists of several key sections that must be accurately filled out to ensure compliance. The first section is personal and business information, which includes the filer’s name, address, and tax identification number.

Subsequently, the itemized sales details section requires a breakdown of all taxable purchases. Correctly calculating total sales and use taxes is crucial, as errors can lead to significant issues. To help avoid mistakes, common errors include overlooking to report some purchases or miscalculating tax amounts.

Step-by-step guide to filling out the sales use form

Filling out the sales use form can be straightforward if broken down into steps. Start by gathering all necessary data and documentation concerning your purchases, sales transactions, and applicable tax rates.

Next, utilize user-friendly online tools like pdfFiller to complete the form electronically. The streamlined platform allows easy navigation through various sections of the form, facilitating efficient completion.

Frequently asked questions about sales use tax in 2025

Filing sales use tax forms can raise many questions. A prevalent concern is the consequences of failing to file on time—ranging from fines to potential audits. To amend a submitted form, filers should follow their state’s specific procedures for corrections.

If an error is discovered post-submission, it’s critical to act quickly and utilize the correction processes outlined by the relevant tax authority. Understanding these processes can help mitigate any negative repercussions.

Tools and resources for managing sales use tax

Taking advantage of available tools and resources can simplify the management of sales use tax. Online calculators for tax estimations can provide valuable insights into potential obligations, aiding individuals and businesses in planning their finances.

For document management, pdfFiller offers robust storage options and collaboration features, which can be especially beneficial for teams navigating complex tax matters.

State-specific sales use tax considerations

Sales use tax regulations can vary markedly between states, creating nuances that individuals and businesses must navigate. It is beneficial to stay updated with your state's specific sales tax laws to ensure compliance.

Resources for finding state-specific sales use forms tailored to local requirements are paramount for filers. Always check the official state revenue websites for the most accurate and relevant information.

Managing sales tax in your business

To stay compliant with sales tax obligations, businesses should adopt best practices for record-keeping. Maintaining accurate sales records fosters transparency and reduces the likelihood of errors. Implementing training programs for staff regarding sales tax compliance can further support diligent practices.

Leveraging pdfFiller for document management streamlines these processes, allowing teams to edit and collaborate on relevant forms seamlessly. Adopting an organized approach to managing sales tax documentation is beneficial for any business.

Future trends in sales use tax

Future predictions indicate a continuing shift in regulations post-2025, primarily influenced by the growth of e-commerce. This surge demands adaptations in tax collection mechanisms, pushing for more streamlined and digital approaches to sales tax administration.

Awareness of these trends, along with proactive adjustments, can significantly benefit both individuals and businesses. Staying engaged with industry news and resources can ensure everyone remains informed and prepared for future changes.

Navigating sales use tax audits

Understanding the sales use tax audit process can safeguard individuals and businesses from misunderstandings and penalties. An audit typically necessitates thorough documentation of sales tax remittances and purchases.

Preparing for a tax audit can be made easier through organized document management, which pdfFiller is well-suited for. Collecting all pertinent receipts and forms in advance strengthens the odds of a favorable audit outcome.

Real-world case studies

Examining real-world case studies can provide invaluable insights into effective sales use tax submissions. Successful examples highlight the importance of accuracy in filings and understanding specific exemptions that apply. Additionally, lessons learned from businesses that faced penalties often serve as cautionary tales regarding the significance of compliance.

Most notably, businesses that engage in diligent practices and utilize available resources tend to report higher compliance rates, enabling smoother operations and mitigating risks associated with audits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 sales use and for eSignature?

Where do I find 2025 sales use and?

How do I fill out 2025 sales use and using my mobile device?

What is sales use and?

Who is required to file sales use and?

How to fill out sales use and?

What is the purpose of sales use and?

What information must be reported on sales use and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.