Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Comprehensive Guide to SEC Form 4: What You Need to Know

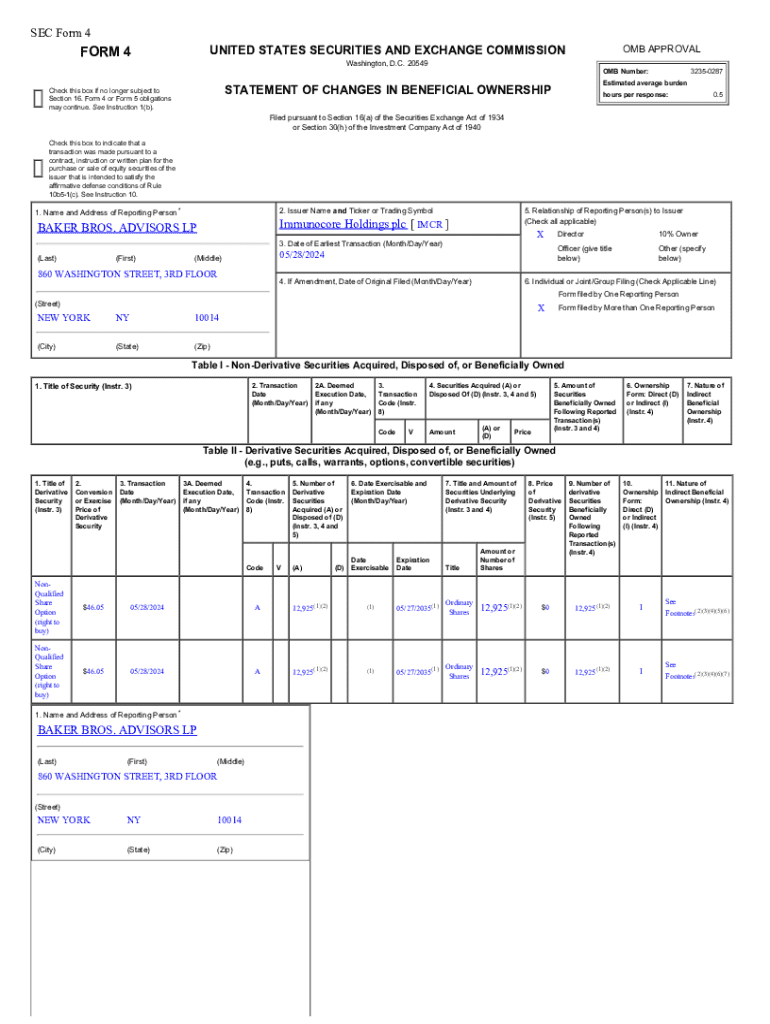

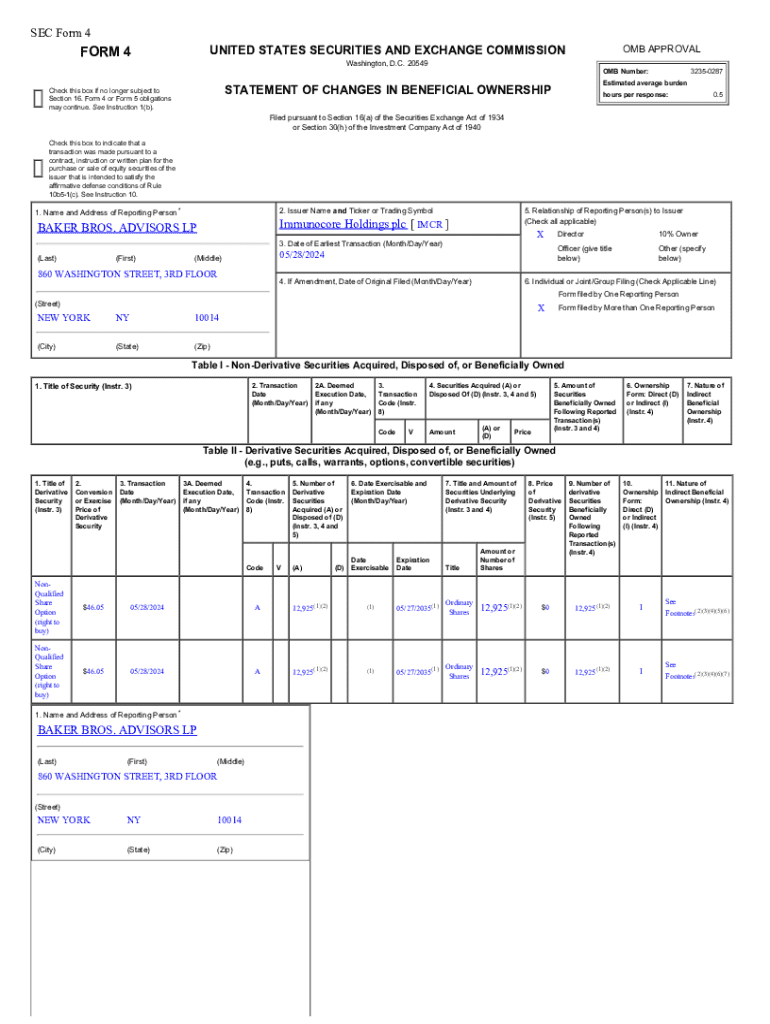

Understanding SEC Form 4

SEC Form 4 is a critical document required by the U.S. Securities and Exchange Commission (SEC) to report changes in ownership of a company's stock by its insiders. This form is designed to provide transparency about transactions involving company securities by key individuals, such as executives and directors. The primary purpose of SEC Form 4 is to inform the public of any changes in ownership that may affect the stock’s price and enable investors to make informed decisions.

The importance of SEC Form 4 in corporate governance cannot be overstated. It serves as a fundamental element of market integrity and investor confidence. By mandating timely disclosures of ownership changes, the SEC aims to discourage insider trading and ensure that all investors have access to the same information. Consequently, shareholders can gauge the commitment of insiders through their buying or selling activities, which often influences market perceptions.

Breakdown of SEC Form 4 components

Understanding the specific components of the SEC Form 4 is vital for accurate completion and compliance. Each section serves a purpose, guiding the filer through the reporting process. The form is divided into several items that need to be filled out comprehensively.

Common types of transactions reported on Form 4

There are several types of transactions that must be reported on SEC Form 4. It is essential to recognize what qualifies as a reportable event to ensure compliance. Each type of transaction can provide different insights to investors and regulators alike.

Step-by-step guide to filling out SEC Form 4

Filling out SEC Form 4 requires careful attention to detail. It’s essential to prepare thoroughly before starting the process. Below is a guide to assist filers in navigating the required steps efficiently.

### Pre-filing considerations

### Detailed instructions for each section

Best practices for filing SEC Form 4

Adhering to best practices for filing SEC Form 4 can help navigate compliance and legal responsibilities effectively. These tips aid in optimizing the filing process while minimizing errors.

Tools and resources for SEC Form 4 management

Harnessing technology can simplify the management of SEC Form 4 filings. Various tools can streamline preparation, signing, and submission processes effectively.

### Interactive tools for form filling on pdfFiller

### Case studies: Successful management of SEC filings

Numerous organizations have successfully utilized pdfFiller to manage their SEC filings, highlighting time savings and error reduction resulting in smoother compliance processes.

Navigating common challenges and errors related to SEC Form 4

Facing challenges during the filing process for SEC Form 4 is not uncommon. Being aware of potential pitfalls can enhance preparation and accuracy.

Real-world implications of SEC Form 4 filings

Understanding the wider implications of SEC Form 4 filings is crucial for investors and analysts alike. The data reported can significantly influence market dynamics and investor behavior.

Leveraging SEC Form 4 data in investment decisions

Investors can utilize data from SEC Form 4 filings to make informed decisions. Understanding insider trading activity can provide unique advantages in trading strategies.

Frequently asked questions (FAQs) about SEC Form 4

Utilizing pdfFiller for SEC Form 4 and document management

pdfFiller offers robust solutions for managing SEC Form 4 and related documents efficiently. Its cloud-based platform provides a host of features making the filing process manageable.

Conclusion

The SEC Form 4 is pivotal in promoting transparency in the securities market. Accurate filings not only comply with legal obligations but also contribute to fair market practices. As an indispensable tool, pdfFiller enhances your approach to document management and SEC filings, enabling individuals and teams to operate effectively in today's corporate landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sec form 4 on a smartphone?

How can I fill out sec form 4 on an iOS device?

How do I complete sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.