Get the free Form 8655 Reporting Agent Authorization

Get, Create, Make and Sign form 8655 reporting agent

Editing form 8655 reporting agent online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8655 reporting agent

How to fill out form 8655 reporting agent

Who needs form 8655 reporting agent?

Comprehensive Guide to Form 8655: Reporting Agent Form

What is Form 8655?

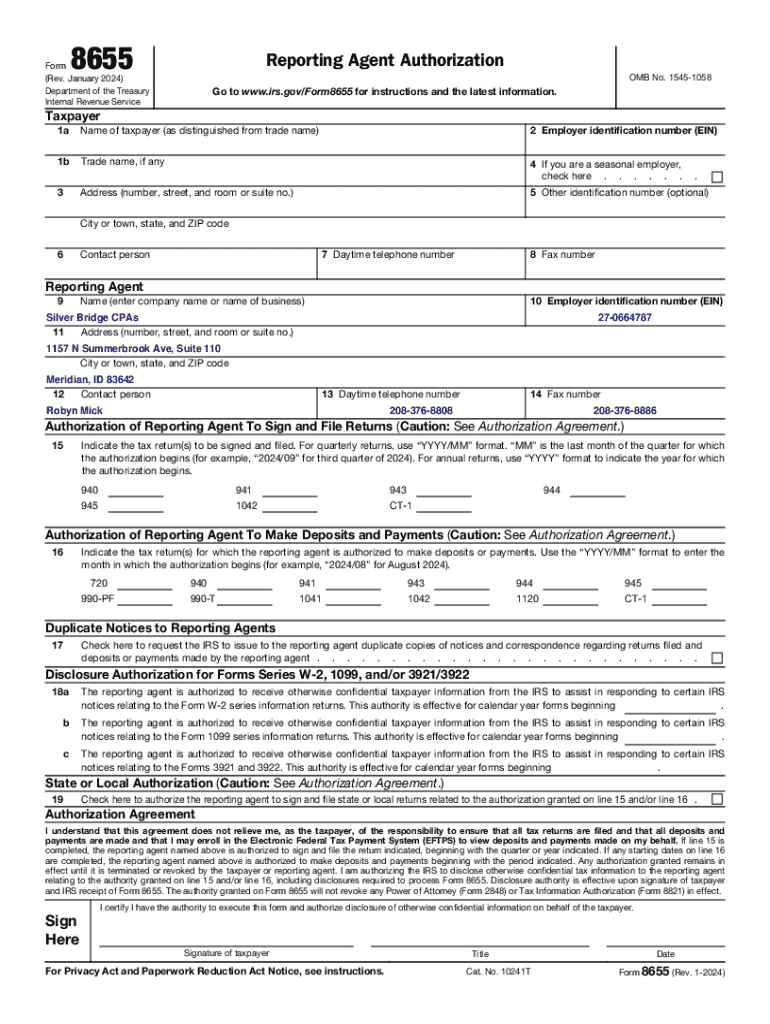

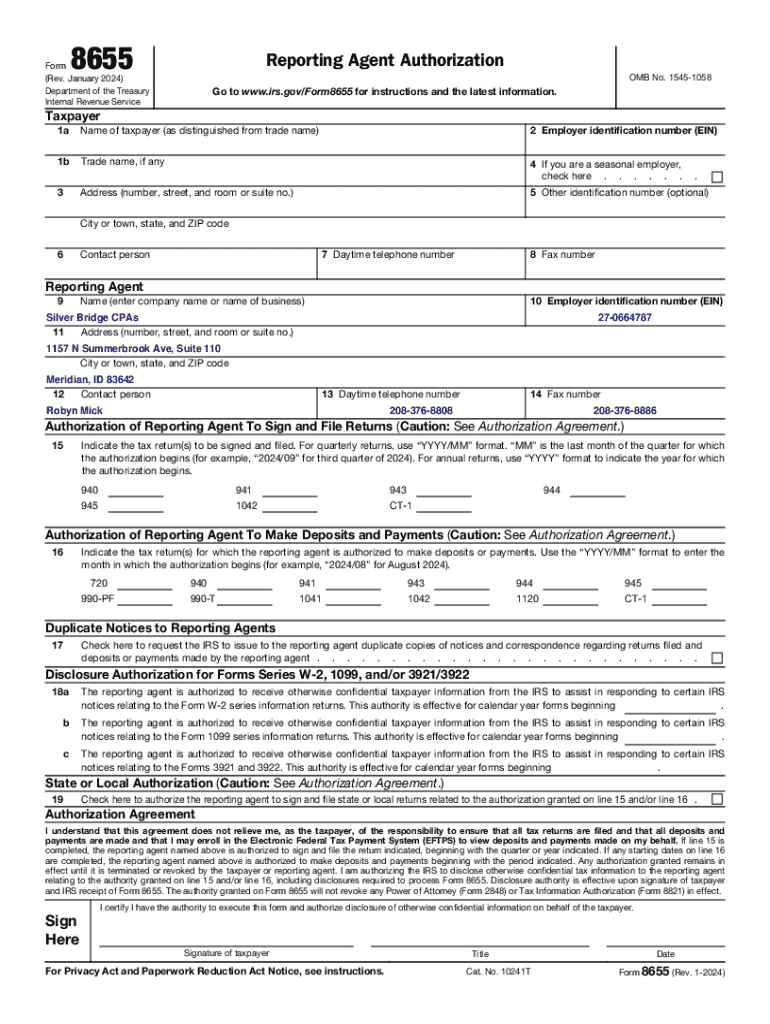

Form 8655, also known as the Reporting Agent Authorization, is a crucial document used by businesses and tax professionals to designate a reporting agent authorized to represent them in tax matters with the IRS. This authorization allows reporting agents to file tax forms and make deposits on behalf of their clients, ensuring a streamlined process for managing tax obligations.

The importance of Form 8655 cannot be overstated. It is essential for individuals and businesses who wish to delegate their payroll tax responsibilities or other tax filings to a third-party agent. By filing this form, taxpayers can ensure that their reporting agent has the authority to act on their behalf, which can help reduce errors and improve compliance with IRS regulations.

Purpose of Form 8655

Form 8655 serves a vital purpose in tax management, primarily for taxpayers who prefer not to handle their tax filings directly. By completing this form, businesses and individuals can authorize a designated reporting agent to manage payroll taxes, quarterly filings, and other related tax duties. This setup is especially beneficial for those running small to medium enterprises that may not have the resources to maintain an in-house tax department.

The benefits of using Form 8655 extend to both individuals and businesses. For taxpayers, it reduces the burden of directly dealing with tax obligations, allowing them to focus on their core business activities. Reporting agents, on the other hand, gain greater efficiencies and can leverage their expertise to ensure compliance. The distinction between taxpayer and reporting agent roles is critical; while the taxpayer is ultimately responsible for tax liabilities, the reporting agent acts on their behalf, which fosters a collaborative approach to tax filing.

Understanding the structure of Form 8655

Form 8655 is divided into specific sections designed to collect necessary information from both the taxpayer and the reporting agent. The structure includes vital components such as taxpayer information, reporting agent details, and signature requirements, all of which ensure clarity and compliance when submitted to the IRS.

Understanding the terminology and the specific fields within the form can greatly assist in ensuring an accurate and complete submission. Recognizing terms such as 'taxpayer identification number' (TIN) and 'Employer Identification Number' (EIN) is crucial for both parties involved.

Step-by-step instructions for filling out Form 8655

To begin filling out Form 8655, it is important to prepare properly by gathering all necessary documents. These documents include prior tax returns, identifying numbers, and any existing agreements with your reporting agent. Additionally, setting up an account on pdfFiller can help streamline the completion process, as it provides various tools for document editing and signing.

Filling out Form 8655 can be broken down into several sections:

To ensure accuracy and compliance, cross-check all entered information against official documents and verify that all required signatures are obtained prior to submission.

How to edit and customize Form 8655 on pdfFiller

Editing and customizing Form 8655 on pdfFiller is designed to be user-friendly. Start by logging into your pdfFiller account and accessing the form template directly. The platform's intuitive interface allows you to add or modify text easily, insert checkboxes, and include electronic signatures with a few simple clicks.

Consider these steps for customization:

Utilizing pdfFiller's seamless editing features helps create a polished and compliant Form 8655.

eSigning and collaborating on Form 8655

Among the standout features of pdfFiller is the ability to electronically sign documents directly within the platform. To create a legally binding signature, select the eSigning option and follow the guided steps to apply your signature. Once signed, the document automatically updates, indicating the completion of that stage.

Collaboration is another essential feature, ensuring that all stakeholders can participate in the review process of Form 8655. Users can invite team members or relevant parties by sending an invitation via email, making it easy to gather insights and confirm accuracy before final submission.

Filing Form 8655: What you need to know

Filing Form 8655 can be conducted in various ways, including online submissions through the IRS e-file system or mailing a hard copy of the form. Each method has its own timelines and considerations. Be mindful of important deadlines, as late filings can result in penalties or delays in the processing of your tax matters.

When filing online, ensure you have all required documents and identification numbers ready. For those opting to mail the form, a confirmed receipt may be beneficial for record-keeping purposes. After filing, always expect a confirmation communication from the IRS with details pertaining to your submission.

Troubleshooting common issues with Form 8655

Despite diligent efforts, issues may arise during the form-filling process. Common questions include how to correct errors on an already submitted form or what to do if the taxpayer's information doesn't match IRS records. Being aware of these potential challenges can save time and anxiety.

Here are some strategies for dealing with errors or mistakes:

For additional support and expert advice, consider consulting tax professionals or utilizing resources offered by pdfFiller.

Ongoing management and updates

Tax regulations and procedures are dynamic, and staying compliant with IRS updates regarding Form 8655 is essential. Regularly reviewing updates on IRS publications or tax professional advisories can help ensure that you remain informed about any changes that may affect your filings.

Setting reminders for filing and renewals is also crucial to avoid missed deadlines. Tools available within pdfFiller can assist in managing documents, ensuring that Form 8655 and other essential tax forms are up-to-date and filed on time.

Additional considerations for reporting agents

As a reporting agent, understanding your responsibilities is key to successful client relations and compliance. A reporting agent has the authority to handle the taxpayer’s filings and must adhere strictly to IRS regulations while submitting forms and payments on behalf of their clients.

Authorization agreements are critical, serving as the foundation of trust between the taxpayer and the reporting agent. Proper execution of these agreements mitigates risks associated with tax liabilities, ensuring that agents are not unnecessarily exposed to legal consequences for mistakes made by taxpayers.

Staying informed on payroll and tax standards

Continuous learning about tax forms, including Form 8655, is essential for both taxpayers and reporting agents. Engaging with training sessions, webinars, and establishing a connection with the pdfFiller community can provide valuable insights into best practices for tax filing and regulatory compliance.

Furthermore, individuals and teams focused on payroll management should consult reliable resources and stay up-to-date with the latest tax regulations to enhance their understanding and operational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 8655 reporting agent on a smartphone?

How do I complete form 8655 reporting agent on an iOS device?

Can I edit form 8655 reporting agent on an Android device?

What is form 8655 reporting agent?

Who is required to file form 8655 reporting agent?

How to fill out form 8655 reporting agent?

What is the purpose of form 8655 reporting agent?

What information must be reported on form 8655 reporting agent?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.