Get the free Certificate of Withdrawal (foreign Corporation)

Get, Create, Make and Sign certificate of withdrawal foreign

How to edit certificate of withdrawal foreign online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of withdrawal foreign

How to fill out certificate of withdrawal foreign

Who needs certificate of withdrawal foreign?

Understanding the Certificate of Withdrawal Foreign Form: A Comprehensive Guide

Understanding the certificate of withdrawal foreign form

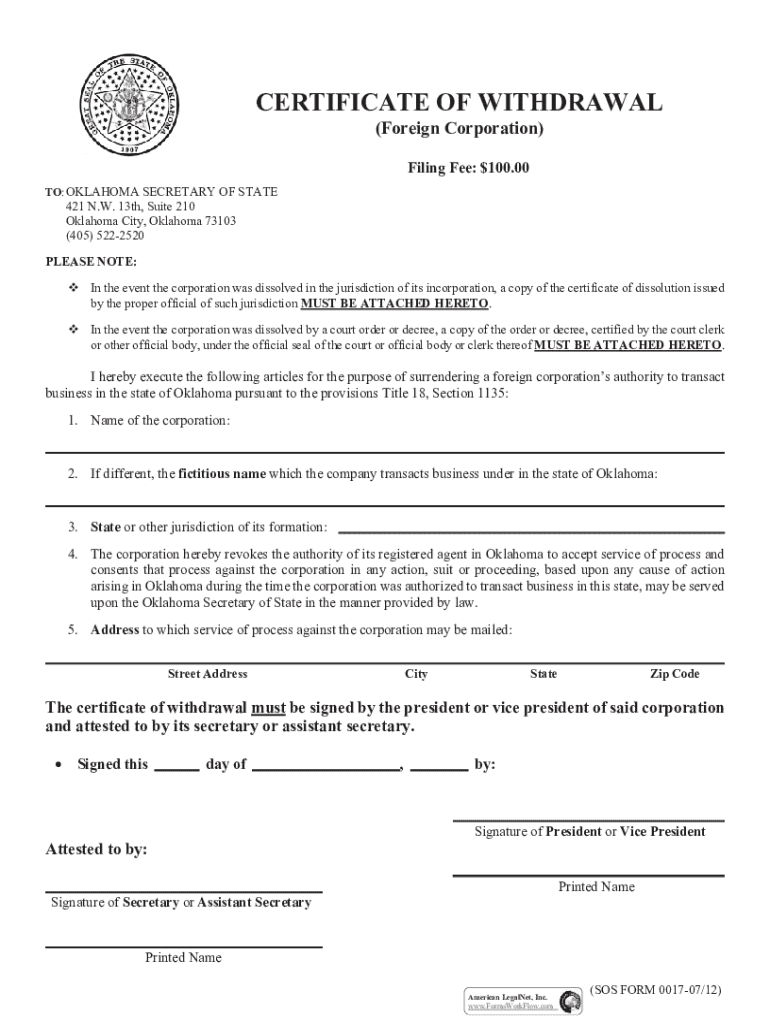

A Certificate of Withdrawal is an official document that allows foreign corporations or LLCs to formally withdraw their registration from a state where they are not conducting business. This form is crucial for firms looking to simplify their operations by ceasing to be registered in states where they no longer engage in commerce.

The significance of the foreign form lies in its necessity for compliance with state laws when a business decides to terminate its active status in a jurisdiction. It serves as an indication that a business is retracting its permission to operate, ensuring that it is not liable for any future taxes or legal obligations in that state.

Eligibility criteria for filing the certificate of withdrawal

Not all businesses need to file a Certificate of Withdrawal. Eligibility varies based on the business structure. Primarily, corporations and limited liability companies (LLCs) registered as foreign entities must file if they are ceasing operations in a specific state. To determine eligibility, businesses should consult their registration status and state regulations.

Geographic location also plays a critical role. Businesses should ensure they are registered as foreign entities in the relevant state before filing this form. Before proceeding with the application, companies must maintain compliance with any state-specific pre-requisites, such as paying all outstanding taxes and submitting required reports.

Key components of the certificate of withdrawal foreign form

Filing a Certificate of Withdrawal Foreign Form requires several key pieces of information. This typically includes the name of the business, its registered address, and the date of original registration in the foreign state. Additionally, the jurisdiction of formation is often required to establish the legal basis of the business.

Some states may also request additional identification documents or information, such as the Tax Identification Number (TIN) or a statement indicating that the business is not engaged in any business activities within the state. It’s important to check specific state requirements for fees associated with filing as these can vary widely.

Step-by-step guide to completing the certificate of withdrawal foreign form

Completing the Certificate of Withdrawal can seem daunting, but breaking it down into manageable steps can simplify the process. Start by gathering the necessary information outlined previously to ensure you have everything at hand.

Next, access and download the form from pdfFiller, a reliable platform for document management that simplifies the creation and customization of forms you need. Filling out the form accurately is essential; therefore, avoid common mistakes such as mismatching names or inaccurate addresses. After filling, use pdfFiller's e-signature tool to sign your document digitally, making the entire process efficient.

Filing methods for the certificate of withdrawal foreign form

When it comes to submitting your completed Certificate of Withdrawal Foreign Form, you have several options. Filing online is the fastest method, allowing you to submit documents effortlessly via pdfFiller. Not only does electronic submission offer convenience, but it also reduces the time it takes for processing and eliminates the risk of postal delays.

If you prefer to file by mail or in-person, instructions for mailing the form include ensuring that you send it to the correct address provided by your state’s Secretary of State. For those opting to file in person, it's crucial to bring the original form, any required copies, and identification to confirm your identity.

Review process after submission

After submitting your Certificate of Withdrawal Foreign Form, what comes next? Expect a review process that can take several weeks, depending on the state’s workload and regulations. Each jurisdiction has different processing times, so understanding the average in your state can prepare you for any follow-ups.

Many states offer tracking systems to monitor the status of your application, enabling you to stay informed about any needed actions or necessary documentation, removing uncertainties from the withdrawal process.

Common pitfalls and challenges

Filing a Certificate of Withdrawal may seem straightforward, but businesses often encounter common pitfalls. Frequent challenges include incomplete forms, incorrect information, or failing to pay necessary fees. Such oversights can lead to delays or rejections of the application.

To mitigate these issues, double-check that all information is accurate, maintain a checklist of requirements from your state, and adhere to submission deadlines to avoid any unwanted complications or penalties.

Fees and payment methods for filing

Filing a Certificate of Withdrawal Foreign Form generally incurs a state-specific filing fee that can vary significantly. States may charge anywhere from $50 to $500 depending on the business entity and your jurisdiction. Understanding the fee structure in advance can facilitate a smoother filing experience.

Most states accept multiple payment methods, including credit cards, checks, and sometimes even electronic funds transfers. Always ensure payment is made correctly to prevent any delays in processing your form.

Contacting the relevant state authorities

If you encounter issues or have questions during your Certificate of Withdrawal Foreign Form filing process, contacting the appropriate state authorities is crucial. Identify the department or office responsible for business registrations in your state to get accurate assistance.

When reaching out, have your registration details handy, including your business name and any reference numbers that may facilitate your inquiry. This preparation will help the authorities assist you more efficiently.

Further assistance and resources

Utilizing pdfFiller offers a seamless experience for managing your Certificate of Withdrawal Foreign Form and other essential business documents. With pdfFiller, you can not only complete and eSign your forms but also store and organize them efficiently for future reference.

In addition to the Certificate of Withdrawal, pdfFiller provides access to a multitude of other forms and templates for varying business needs, enhancing overall document management and compliance efforts.

Success stories: users who used the certificate of withdrawal foreign form successfully

Many users have successfully navigated their withdrawal processes thanks to the Certificate of Withdrawal Foreign Form. Testimonials highlight how pdfFiller streamlined their experience, making it possible to submit required documents efficiently and without hassle.

Users report reduced stress during withdrawal procedures, saving them time and enabling them to focus on their business’s core activities. Leveraging pdfFiller has brought significant benefits, showcasing the platform's effectiveness.

Stay updated on state regulations

Finally, staying informed about filing requirements and potential changes in state regulations is vital for maintaining compliance. Subscribe to updates from your state agencies or set reminders to check for revisions to ensure your business remains compliant.

Understanding the nuances of the Certificate of Withdrawal Foreign Form will empower businesses to undertake withdrawal processes confidently, avoiding pitfalls and ensuring a smooth transition out of states where they no longer wish to operate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my certificate of withdrawal foreign directly from Gmail?

How can I send certificate of withdrawal foreign to be eSigned by others?

Can I create an electronic signature for the certificate of withdrawal foreign in Chrome?

What is certificate of withdrawal foreign?

Who is required to file certificate of withdrawal foreign?

How to fill out certificate of withdrawal foreign?

What is the purpose of certificate of withdrawal foreign?

What information must be reported on certificate of withdrawal foreign?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.