Get the free Form W-4

Get, Create, Make and Sign form w-4

Editing form w-4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form w-4

How to fill out form w-4

Who needs form w-4?

How to Fill Out the W-4 Form

Understanding the W-4 Form

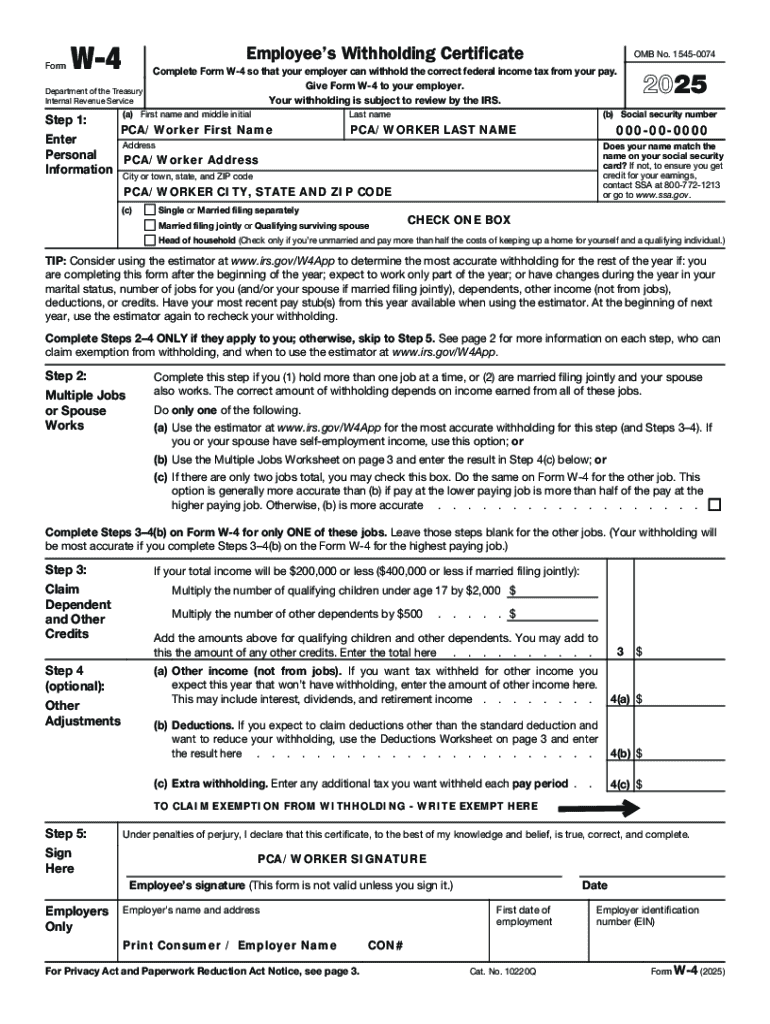

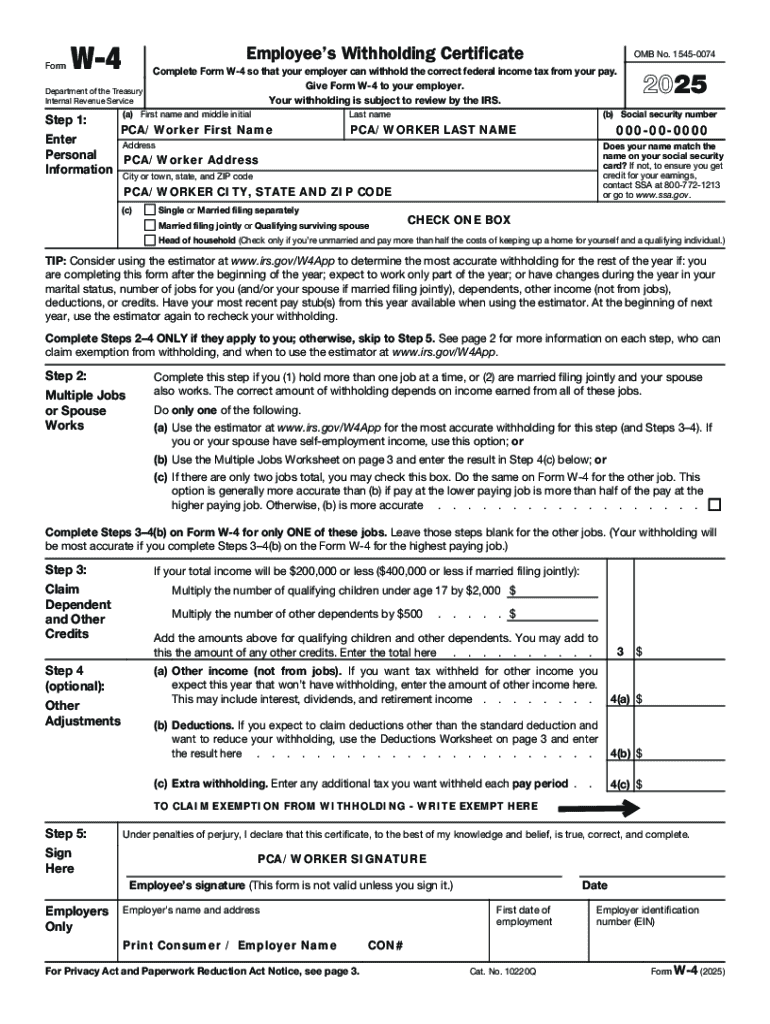

The W-4 form is the Employee's Withholding Certificate, used by employers to determine how much federal income tax to withhold from employee wages. It's essential for ensuring that you aren't over- or under-withheld on your tax obligations. For new hires, submitting a W-4 is crucial for setting your withholding accurately from your first paycheck.

Starting in 2025, notable changes have been proposed to the W-4 form that will aim to simplify the withholding process and make it more aligned with current economic conditions. As you prepare to complete your W-4, being aware of these forthcoming adjustments can aid in ensuring you're correctly withholding the necessary amounts based on your financial situation.

Overview of W-4 Form Sections

Detailed Steps to Fill Out the W-4 Form

Filling out the W-4 can appear daunting, but breaking it down into digestible steps ensures accuracy and efficiency. Begin with entering your personal information accurately. Double-check your spelling and ensure your Social Security number is correct to avoid tax complications.

Next, account for all jobs or spousal income. The IRS provides worksheets that assist in determining the total income and withholding needs. When claiming dependents, it's essential to follow the guidelines for calculating tax credits, particularly for qualifying children.

Refining your withholdings in Step 4 is also important. This section allows for additional adjustments based on specific financial situations. Just as crucial is remembering to sign and date your W-4, as an unsigned form will lead to delays in processing your withholding requests.

Managing Your W-4 After Submission

Updating your W-4 form is recommended any time there are significant life changes, such as marriage, divorce, or the birth of a child. These events may change your tax situation quite dramatically and can affect how much you should withhold.

In addition, if you change jobs, it's essential to revise your W-4 to adjust for any new pay structures or additional jobs. Keeping your W-4 updated helps you maintain proper withholding levels throughout the year.

Utilizing tools for your W-4

Online W-4 calculators can simplify the process of determining the right amount of withholding. These tools, such as those found on the IRS website, help you input your data and will provide tailored guidance based on your unique circumstances.

Additionally, pdfFiller offers interactive features for W-4 management. Our platform not only allows you to edit your W-4 but also enables eSigning and seamless collaboration with teams, ensuring all data remains securely stored in the cloud.

Common FAQs about the W-4 form

Conclusion of the W-4 process

Completing the W-4 form is a necessary step in managing your taxes effectively. After filling out the form, ensure that you keep a copy for your records, as it will be vital should any discrepancies arise during tax season. Remember that adjusting your withholdings as needed is always a smart move, ensuring you remain compliant and avoid surprises come tax time.

By following this structured guide on how to fill out the W-4 form, individuals and teams can streamline the process of managing their tax withholdings with confidence, leveraging pdfFiller’s comprehensive, cloud-based solutions for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form w-4 online?

Can I create an eSignature for the form w-4 in Gmail?

Can I edit form w-4 on an iOS device?

What is form w-4?

Who is required to file form w-4?

How to fill out form w-4?

What is the purpose of form w-4?

What information must be reported on form w-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.