Financial report template template form: A comprehensive guide

Understanding financial reports

Financial reports play a critical role in providing insights into a company's economic status. These reports summarize financial activities and performance over a specific period, ensuring stakeholders, including management, investors, and regulators, have accurate and up-to-date information for decision-making.

There are several types of financial reports, each serving unique purposes: 1. **Income Statements** summarize revenues and expenses over a period, highlighting profitability. 2. **Balance Sheets** present a snapshot of assets, liabilities, and equity at a specific point in time. 3. **Cash Flow Statements** detail cash inflows and outflows, essential for understanding liquidity. 4. **Statement of Shareholder Equity** shows changes in equity from various transactions, including retained earnings and dividends paid.

Significance of using templates

Incorporating financial report templates can greatly enhance the process of creating crucial documents. Templates provide a predefined structure, ensuring financial reports maintain consistency and professionalism, which is vital when communicating with stakeholders.

The benefits of financial report templates include:

1. **Consistency in Reporting**: Established formats help maintain uniformity across reports, enhancing clarity and professionalism.

2. **Time Efficiency**: Templates significantly reduce the time required to compile reports by providing a ready-made structure that only needs specific data filled in.

3. **Accuracy and Compliance**: Templates often integrate pertinent regulations and standards so that users are less likely to overlook critical compliance information.

Moreover, financial report templates are useful during quarterly reviews, budget preparations, and year-end assessments, helping to streamline preparatory tasks.

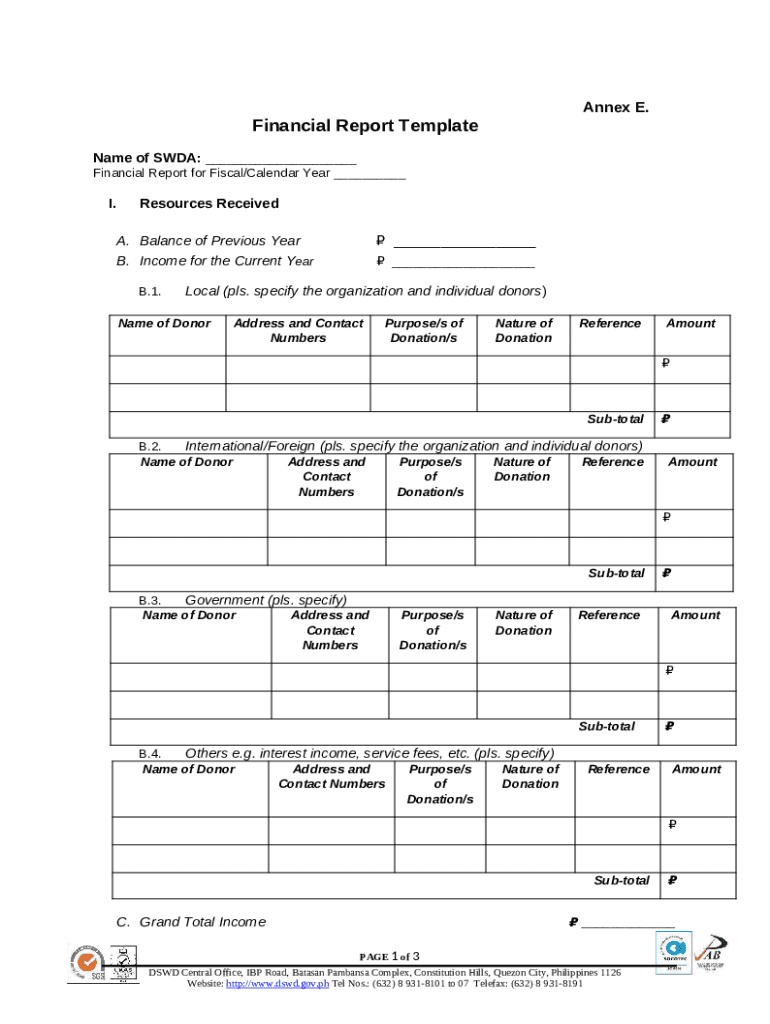

Overview of the financial report template

A robust financial report template serves as an invaluable tool for both individuals and businesses. Key components typically included in these templates are essential sections like header information, income and expense sections, asset and liability details, and the statement of shareholder equity.

Format and structure are crucial considerations when choosing or designing a financial report template. Templates should be user-friendly, ensuring that data entry is straightforward. Customization options allow users to integrate branding elements such as logos and color schemes, which can enhance professionalism in business contexts. Furthermore, personal usage might require simpler designs focused mainly on core financial data.

Interactive tools for creating financial reports

pdfFiller offers a range of interactive tools tailored for creating financial report templates. This platform allows users to easily access existing templates or create new ones with a few clicks that can cater to unique needs.

To get started, first navigate to pdfFiller's website and search for financial report templates using the search feature. The step-by-step process includes: 1. Selecting a relevant template. 2. Editing the template to suit your specific requirements, including adding your financial data. 3. Utilizing features like eSigning and real-time collaboration for enhanced team engagement. Utilizing these features ensures your financial reports are completed efficiently and accurately.

Tips for effectively utilizing interactive templates include:

- Familiarizing yourself with the editing tools and options available on pdfFiller.

- Regularly saving your progress to avoid data loss.

- Utilizing the collaboration features to get feedback from team members.

Step-by-step instructions to fill out the financial report template

When filling out your financial report template, it is essential to gather accurate and comprehensive financial data. Sources of information can include bank statements, invoices, previous financial reports, and accounting software outputs.

The filling-out process follows a structured approach:

1. **Header Information**: Insert the report title, your business name, and date.

2. **Income Section**: List all income sources and the total revenues generated during the period.

3. **Expenses Section**: Categorize and detail expenses incurred, leading to net profit calculations.

4. **Assets and Liabilities**: Include current and fixed assets, alongside liabilities, and compute net assets.

5. **Additional Notes and Comments**: Provide insights or explanations related to your financial data.

To ensure accuracy in data entry, it's advisable to double-check all figures against original source documents. This validation step is critical for compliance and for maintaining trustworthy reporting that stakeholders can rely on.

Editing and customizing your financial reports

Editing your financial report template in pdfFiller is straightforward and intuitive. Users can easily modify sections of the template to better reflect their financial situation, whether that means adding more lines for expenses or incorporating complex financial charts for visualization.

The primary editing features include:

- **Adding and Removing Sections**: Tailor the template as needed, ensuring all relevant financial components are captured.

- **Incorporating Charts and Graphs**: Visual representations can enhance understanding among stakeholders about various financial metrics.

Version control is also significant in managing changes to financial reports. Keeping track of different versions allows users to reflect on financial progress over time and refer back to previous reports for comparative analysis.

Signing and sharing your financial reports

Utilizing pdfFiller’s eSignature tools allows users to sign financial reports digitally, streamlining the process of finalizing documents. The eSigning process involves: 1. Selecting the designated areas where signatures are needed. 2. Inviting team members or stakeholders to review and sign. 3. Finalizing the document within the application.

When it comes to sharing financial documents, consider best practices such as:

- **Secure Sharing Options**: Utilize password protection or encrypted sharing for sensitive financial information.

- **Collaboration with Team Members**: Employ pdfFiller’s collaborative features to ease the review process and gather input on reports.

Managing your financial reports

Organizing your financial reports in the cloud is vital for easy access and management. pdfFiller allows users to create a structured folder system, tagging reports based on categories like dates, types, or departments. This organization not only simplifies retrieval but also enhances the management process.

Regularly updating your financial templates is just as important as maintaining organization. Keeping financial reports current ensures compliance with new regulations and allows stakeholders to operate based on the most recent data.

Common mistakes to avoid

When preparing financial reports, it’s crucial to avoid common pitfalls that can lead to inaccuracies. Typical errors include miscalculating figures, omitting key financial information, or misclassifying assets and liabilities. These mistakes can result in misleading reports that affect decision-making.

To verify the accuracy of your financial reports before submission, consider these practices:

- Double-check calculations against original documents.

- Have another team member review the report for a fresh perspective.

- Utilize financial software tools available through pdfFiller for automated calculations and checks.

Conclusion: Streamlining financial reporting with templates

Implementing a financial report template from pdfFiller can significantly streamline your reporting process. The combination of customizable templates and interactive tools empowers users to create, manage, and share business financial reports efficiently.

For individuals and teams aiming to enhance their document creation process, now is the perfect time to start utilizing a financial report template. The ease of access and the robust features offered by pdfFiller ensure that you can focus more on using your data for informed decision-making rather than spending hours drafting reports.