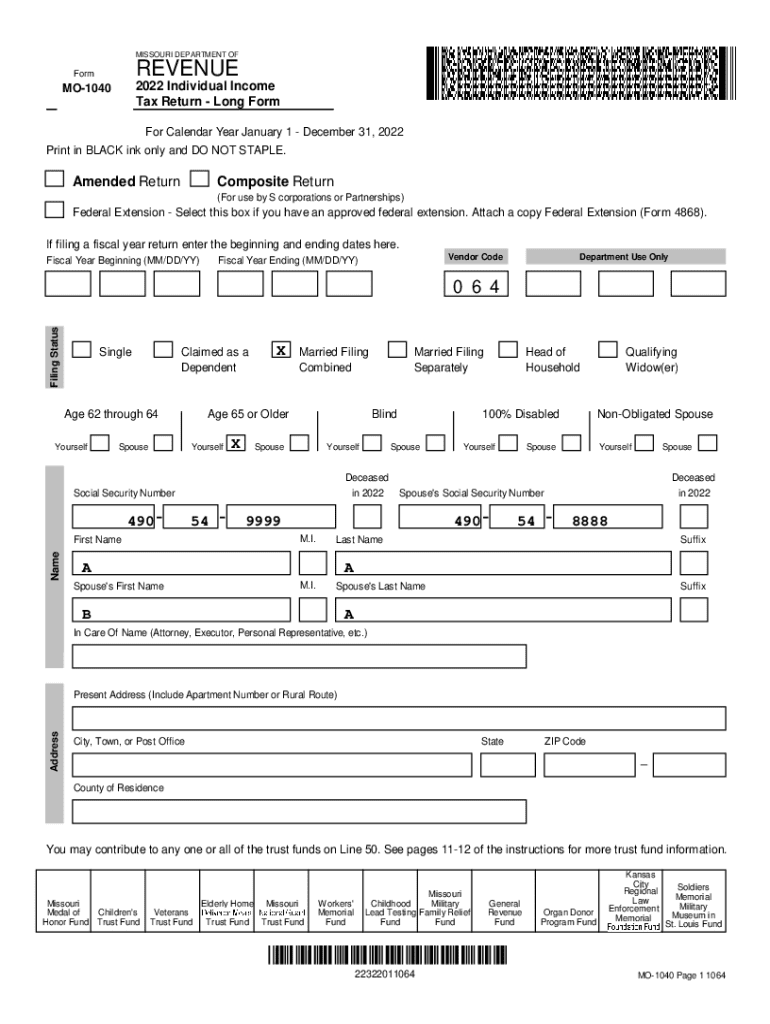

Get the free 2022 Individual Income Tax Return - Long Form

Get, Create, Make and Sign 2022 individual income tax

How to edit 2022 individual income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2022 individual income tax

How to fill out 2022 individual income tax

Who needs 2022 individual income tax?

2022 Individual Income Tax Form: A Comprehensive How-to Guide

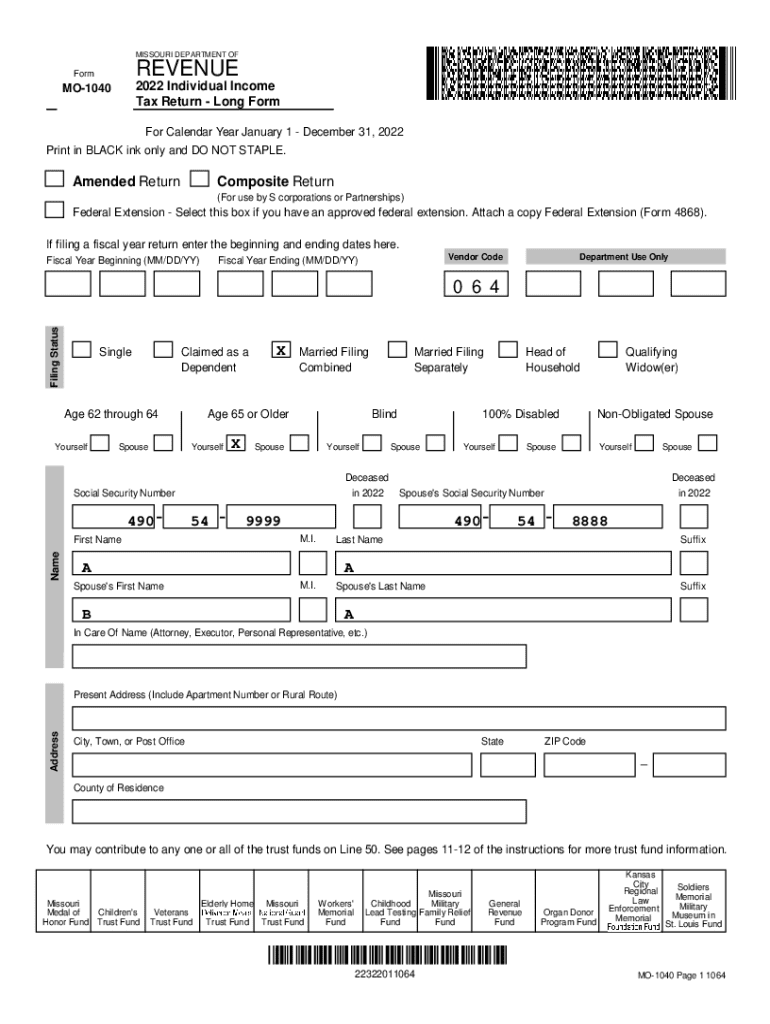

Overview of the 2022 individual income tax form

The 2022 individual income tax form is a crucial document that every U.S. taxpayer must complete to report their earnings, calculate tax liability, and determine eligibility for refunds. Understanding this form not only facilitates compliance with federal tax laws but also enhances one's financial literacy.

Several changes and updates for the 2022 tax year came in response to evolving economic conditions and legislative adjustments. For instance, the standard deduction amounts increased, allowing taxpayers to reduce their taxable income more significantly than in previous years. Moreover, enhancements to tax credits like the Child Tax Credit aimed to provide further support to families.

Tax brackets determine the percentage of income that is taxed, which varies depending on filing status. Understanding where you fall within these brackets can significantly affect your overall tax liability.

Preparing to file your 2022 taxes

Before diving into the nuances of the 2022 individual income tax form, it's vital to gather all necessary documentation. This ensures you accurately report your income and claim any deductions or credits you may be entitled to. Key documents include W-2 forms from employers, which report your earnings and withheld taxes, and 1099 forms that represent income from other sources such as freelance work or interest from savings.

In addition to income forms, you'll need detailed records for deductions and credits you plan to claim. This can encompass itemized receipts, mortgage interest statements, and proof of educational expenses. Collecting these documents ahead of time aids in a smoother filing experience.

Setting up a PDF editor for tax filing

Leveraging a PDF editor like pdfFiller can facilitate the editing of tax forms, making it far more efficient. Using pdfFiller offers a collaborative cloud-based environment to manage your documents effectively.

Filling out the 2022 individual income tax form

To accurately complete the 2022 individual income tax form, attention to detail is essential. Begin by entering your personal information, which includes your name, address, and Social Security number. This section also establishes your filing status, which has significant implications for your tax rate and deduction benefits.

Next, move to the income section where you'll report various income sources such as wages from your W-2 forms, interest from bank accounts, and dividends from investments. Ensuring each line is filled out correctly is paramount as discrepancies can lead to audits or incorrect tax liabilities.

Tax credits and deductions to consider

Exploring available tax credits can significantly reduce your tax liability. For instance, the Child Tax Credit was expanded, thereby offering substantial savings for qualifying families. The Earned Income Tax Credit is another opportunity for low to moderate-income earners to receive a refund even if they owe no tax.

You also have the option between itemizing deductions, which can maximize your deductions through specific expenses, or taking the standard deduction, which is a flat amount determined by your filing status. Evaluate which approach provides more financial benefit.

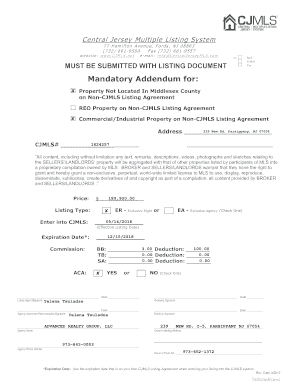

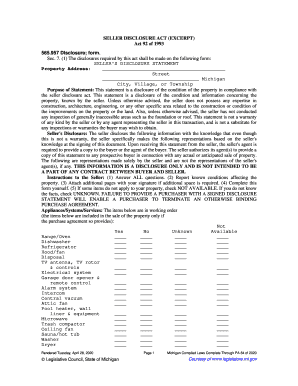

State-specific considerations

Filing your 2022 individual income tax form can also involve state-specific taxes, which vary widely across the U.S. Each state has its own regulations regarding income tax, ranging from tax-exempt states to those with a progressive income tax structure. It's crucial to access your state's specific forms and instructions to ensure compliance.

Reviewing and verifying your completed form

Once your form is filled out, reviewing it for errors is essential. Common mistakes often stem from miscalculations in reported income or deductions and inaccuracies in personal information. Taking the time to double-check figures can save you from future headaches with the IRS.

pdfFiller aids this process with its error correction features. You can use its editing tools to make adjustments, ensuring everything is accurate before submission. Collaborating with a tax professional via eSigning and sharing options within the platform allows for additional verification and peace of mind.

Managing your tax submission

Choosing how to submit your tax form can affect not only how quickly your return is processed but also how securely your data is handled. eFiling offers the advantage of faster processing, while paper filing might seem appealing for those uncomfortable with tech.

Additionally, tracking your tax return status is straightforward. The IRS provides a tracking tool that enables you to stay updated on your return’s progress. Understanding the typical IRS timeline for processing returns can help manage your expectations surrounding refunds.

Post-filing actions

After successfully filing your 2022 individual income tax form, you may face either a refund or a balance due notification from the IRS. If expecting a refund, options include direct deposit, which is the fastest way to receive your money, or a paper check, which takes longer.

Managing your tax records is crucial for future reference. Keeping organized records not only helps during audits but also simplifies the next tax season. With pdfFiller’s secure document storage, you can retain these records easily and access them whenever needed.

Frequently asked questions (FAQs)

Taxpayers often have questions regarding the 2022 individual income tax form. Common queries revolve around the eligibility for certain deductions or credits, how to amend a submitted tax return, and the timeline for receiving refunds.

For more specific guidance, the IRS offers resources and FAQs on their website or for personalized assistance, reaching out to a tax professional can be a worthwhile investment.

Enhancing your document management with pdfFiller

In a collaborative work environment, pdfFiller excels at allowing teams to work together on tax forms securely. You can share documents with team members easily and make use of features like comments and suggestions, ensuring smooth communication throughout the filing process.

Building on this, setting up templates within pdfFiller for future filings streamlines the process for next year, saving time and reducing errors. Moreover, features continue to evolve, providing users with more dynamic options for document management and signing.

Appendices

In-depth knowledge of tax terms relevant to the 2022 individual income tax form can make your filing process smoother. Gathering a glossary of terms can aid in understanding complex language often used in tax documents.

Additionally, utilizing tools available within pdfFiller can facilitate documentation management such as real-time cooperation, sophisticated editing capabilities, and secure recording of changes, ensuring comprehensive documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2022 individual income tax to be eSigned by others?

Can I create an eSignature for the 2022 individual income tax in Gmail?

How do I edit 2022 individual income tax on an iOS device?

What is 2022 individual income tax?

Who is required to file 2022 individual income tax?

How to fill out 2022 individual income tax?

What is the purpose of 2022 individual income tax?

What information must be reported on 2022 individual income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.