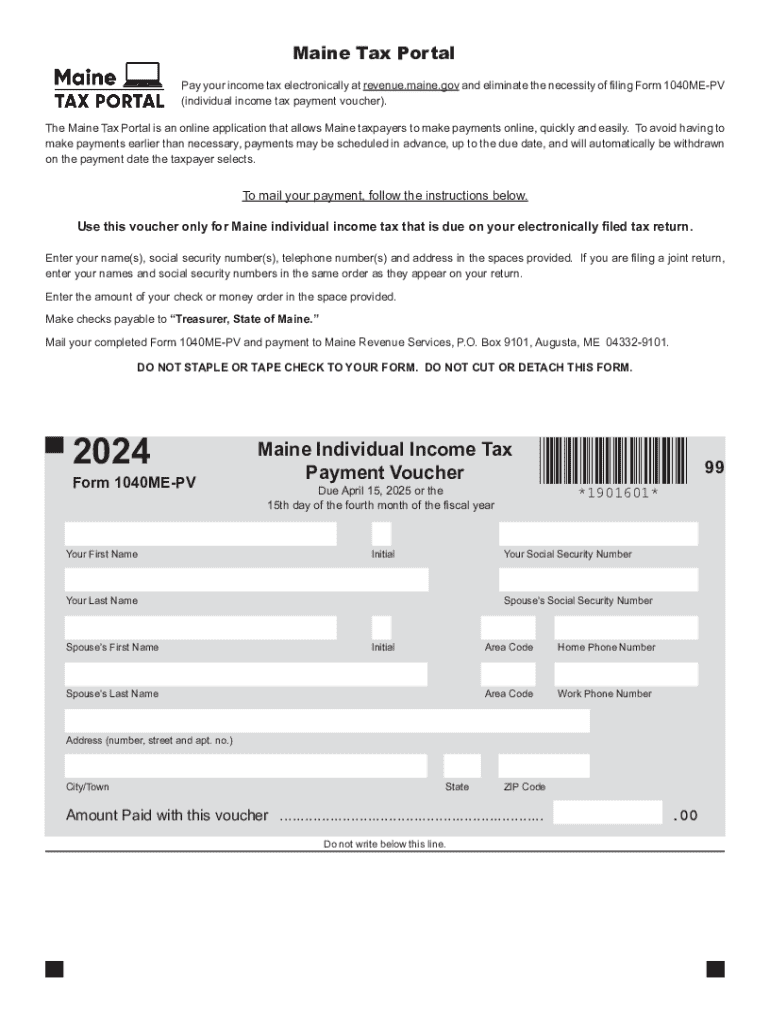

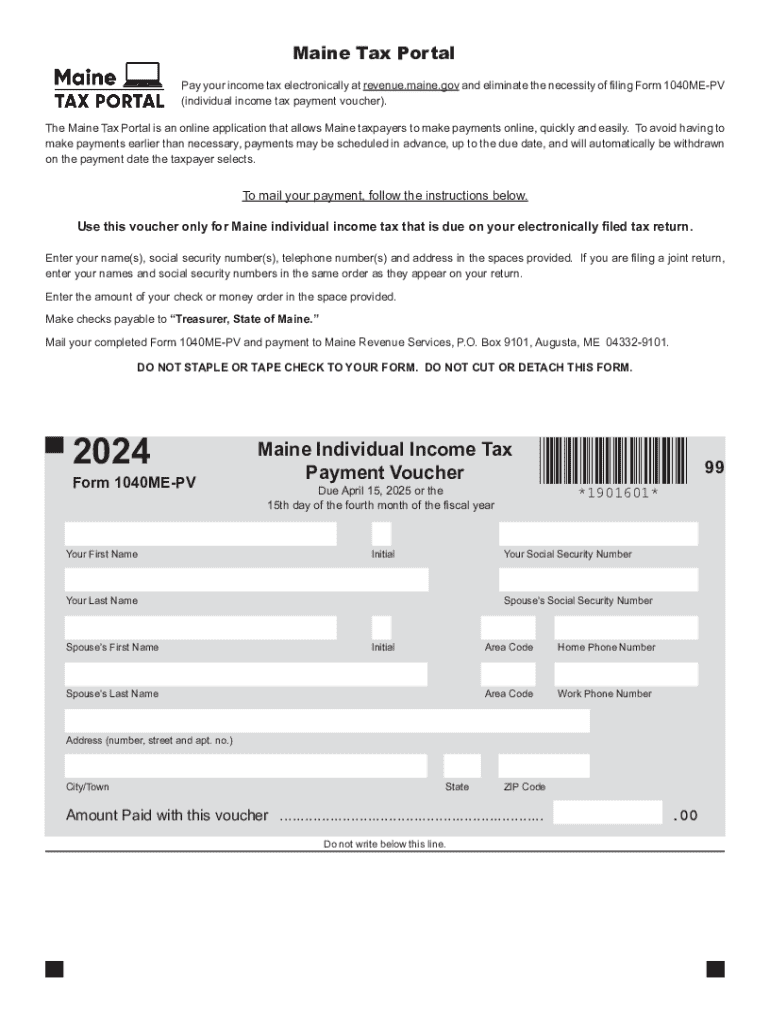

Get the free Form 1040me-pv

Get, Create, Make and Sign form 1040me-pv

Editing form 1040me-pv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1040me-pv

How to fill out form 1040me-pv

Who needs form 1040me-pv?

A Comprehensive Guide to the 1040me-pv Form

Overview of Form 1040me-pv

The 1040me-pv form is a specific tax form utilized by residents of Maine to report their income and calculate their state tax liabilities. It provides taxpayers with a streamlined approach to fulfilling their state tax obligations, ensuring compliance with Maine's tax regulations. This form is essential for residents who have earned income within the state and wish to accurately assess what they owe or are entitled to receive in refunds.

Who should be using the 1040me-pv form? Primarily, it's designed for individual taxpayers residing in Maine. This includes full-time residents and part-time residents who have generated income within the state boundaries. By utilizing this form, individuals can leverage tax deductions and credits available to Maine residents, ultimately impacting their tax return positively.

Understanding the 1040me-pv Form Requirements

Eligibility to file the 1040me-pv form ties closely with certain criteria. Primarily, potential filers should be aware of specific income thresholds set by the State of Maine, which dictate whether they are required to file or not. For the 2023 tax year, individuals with a gross income over a certain limit may need to file, whereas those below it can choose to file for a refund of any taxes withheld.

Additionally, residency requirements play a crucial role. Only individuals considered full-time or part-time residents in Maine can submit this form. Being a full-time resident means maintaining a permanent home within the state for the entirety of the tax year, while part-time residency can include individuals who meet the residency requirements within specific months.

Step-by-step instructions for completing the 1040me-pv Form

Completing the 1040me-pv form requires meticulous attention to detail and preparation. Start by gathering necessary documents such as W-2s and 1099s that represent your income from various sources throughout the year. Additionally, collect any receipts or documentations that substantiate claims for deductions or credits.

Once you’ve gathered your documentation, begin filling out the form. The personal information section is your starting point; provide your name, address, and Social Security number meticulously. Then move on to income reporting, detailing all sources of income on the form. As part of the deductions and credits section, be sure to highlight any that apply to your situation, which can significantly reduce the amount owed. Lastly, don’t forget to sign the form—this final step validates your filing.

A few common mistakes to avoid include: overlooking the importance of signing the form, misreporting income figures, and not claiming eligible deductions. Each of these can lead to unnecessary delays or complications with your filing.

How to fill out the 1040me-pv Form online

In today’s digital age, filing your 1040me-pv form online has its advantages. The online process eliminates paperwork, reduces the chance of errors, and provides a quick turnaround for filing your taxes. Through pdfFiller, you can find the 1040me-pv form directly and utilize the digital features for an efficient experience.

To access the form on pdfFiller, simply search for the 1040me-pv form within their document library. The interactive tool features allow you to edit, eSign, and collaborate effectively. This makes your filing process smooth and efficient. For example, if you need to edit any information after initial filling, the tool allows you to do so seamlessly without starting over.

Editing and modifying your 1040me-pv Form

Editing your 1040me-pv form is essential, especially if you need to make changes after completing your initial entry. Leveraging pdfFiller’s features allows you to easily add text, images, or annotations, which can help clarify information or correct mistakes. For instance, if there’s a change in your address or a misreported figure, you can quickly modify these details without hassle.

Moreover, collaboration is a key aspect if you’re filing as a household or team. By sharing forms, feedback can be collected, enabling real-time editing options to ensure accuracy before submission. This collaborative feature makes pdfFiller an excellent choice for those looking to manage their tax forms effectively.

Signing and submitting your 1040me-pv Form

Signing your 1040me-pv form is crucial, as it signifies that the information is accurate and submitted under penalty of perjury. At pdfFiller, you can use eSigning options which are secure and easy to navigate. eSigning allows you to add your signature electronically, expediting the filing process by eliminating the need for printing and scanning.

Once your form is signed, you can choose your submission method. Options generally include electronic filing or mailing the form directly to the state tax department. Electronic submissions are often quicker and may provide instant confirmation of receipt, whereas mailed submissions could take longer depending on postal service timeframes.

Frequently asked questions about the 1040me-pv Form

Many taxpayers have common questions regarding the 1040me-pv form that can clarify uncertainties. One prevalent inquiry is about the process following an error in submission. If you make a mistake, it’s crucial to rectify it by filing an amended return with the necessary corrections as soon as possible to avoid penalties.

Another common question pertains to the ability to amend a filing post-submission. Yes, you can amend your tax return, but ensure that you follow the procedural requirements outlined by Maine's tax department to avoid complications.

Related forms and documents

Completing your 1040me-pv form is part of a broader context of understanding Maine’s tax framework. There are various related forms, such as the 1040me form for full temperatures and income documentation, each serving different purposes within the Maine tax system. Familiarity with these forms can enhance your overall filing experience and ensure compliance.

For comprehensive tax filing, it's imperative to consult additional documents and resources provided by the State of Maine. Links to essential documents can invariably assist you in navigating these requirements effectively, ensuring that no critical forms are overlooked.

Maine state tax information

Understanding Maine state tax rates is pivotal in successfully navigating your tax obligations. Maine generally has a progressive tax rate for individuals, meaning that as your income increases, your tax rate also increases. Familiarizing yourself with this tax structure, including rates and brackets, allows for more accurate projections of tax liabilities.

Moreover, the State of Maine provides various resources to assist taxpayers in maneuvering through the filing process. Whether it's online resources or support hotlines, utilizing these tools can facilitate a better understanding of state regulations and ensure compliance.

Additional considerations

When it comes to paying Maine state taxes, you have several options. You can choose to pay online through the state's website, via mail using checks, or even set up a payment plan if applicable. Ensuring the timely payment of any taxes owed is crucial in avoiding penalties.

Understanding tax refunds is equally important. Post-filing, monitoring the status of your refund can provide peace of mind. Refunds from the state typically take a few weeks to process, but this can vary based on the method of filing and any outstanding issues that may arise.

Quick navigation links

To enhance your experience while reading this guide, we’ve provided quick navigation links to key sections. This will allow you to jump directly to information that is most pertinent to your needs, streamlining the process of understanding and completing your 1040me-pv form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 1040me-pv in Chrome?

Can I create an electronic signature for signing my form 1040me-pv in Gmail?

How can I edit form 1040me-pv on a smartphone?

What is form 1040me-pv?

Who is required to file form 1040me-pv?

How to fill out form 1040me-pv?

What is the purpose of form 1040me-pv?

What information must be reported on form 1040me-pv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.