Get the free Return of Organization Exempt From Income Tax 990

Get, Create, Make and Sign return of organization exempt

How to edit return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt Form: A Comprehensive Guide

Understanding the Return of Organization Exempt Form (Form 990)

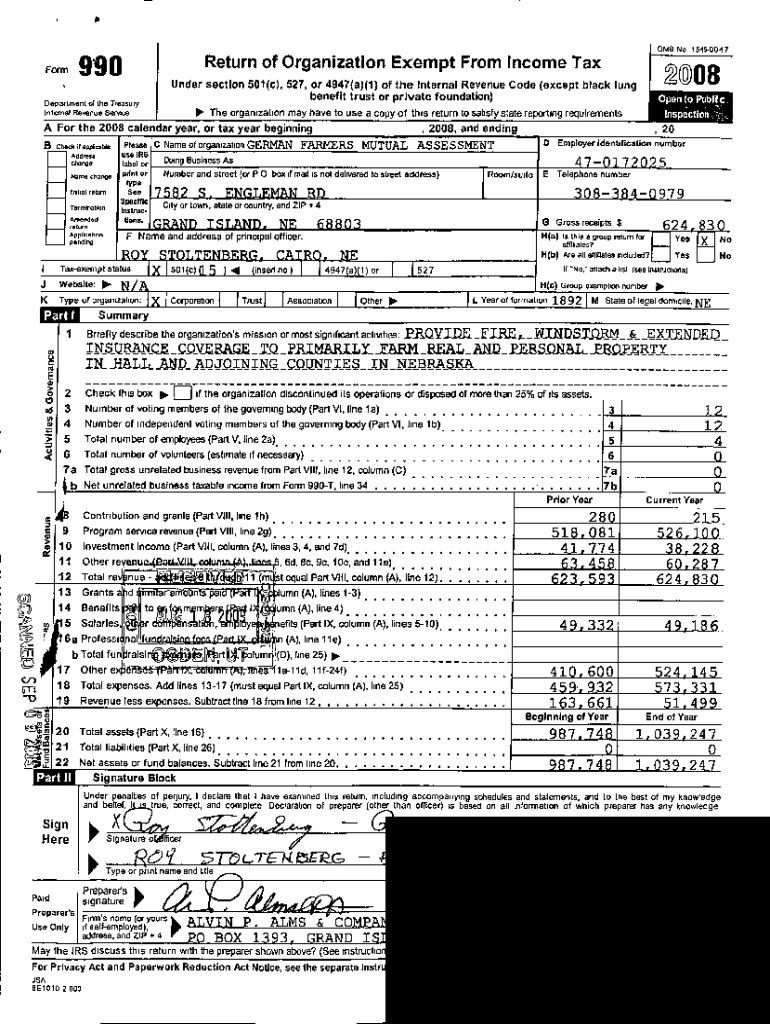

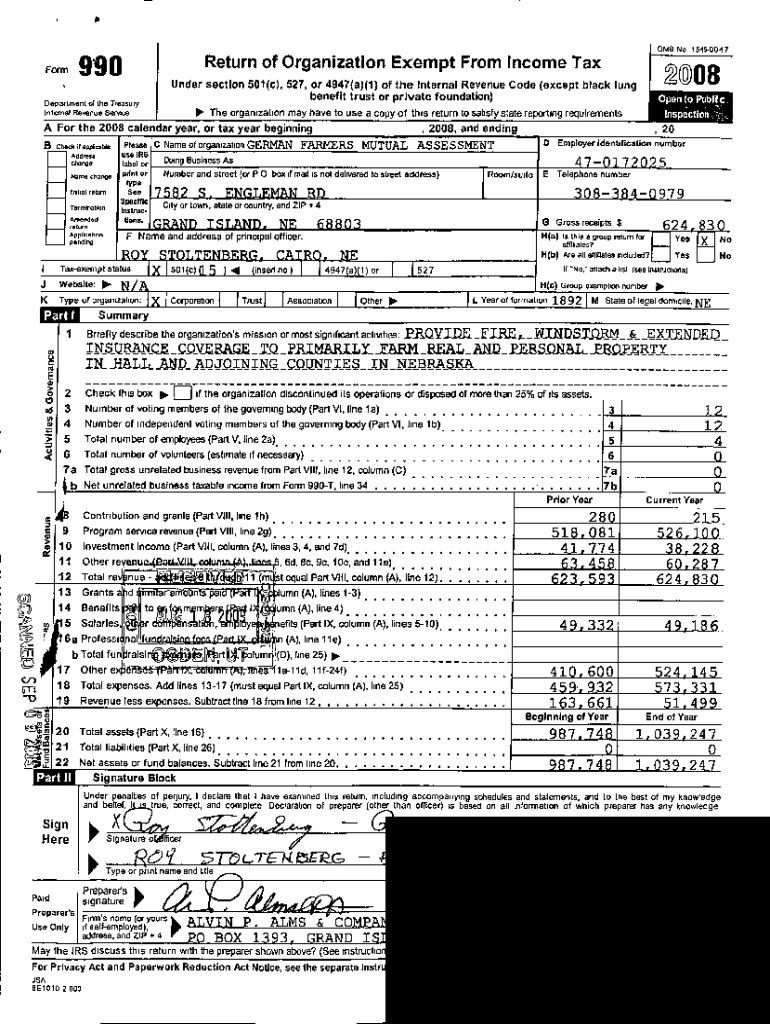

Form 990, officially known as the Return of Organization Exempt from Income Tax, is a vital document that tax-exempt organizations in the United States must file annually. This form provides a detailed account of the organization’s financial performance, governance, and compliance with tax regulations. By fulfilling this requirement, organizations can maintain their tax-exempt status and retain public trust.

Filing Form 990 is crucial for not just compliance with tax laws but also for fostering transparency and accountability. With stakeholders increasingly demanding clear insights into how organizations utilize their resources, Form 990 enhances credibility and trust.

Eligibility for Filing Form 990

Various organizations are required to file Form 990, depending on their size and revenue thresholds. Generally, tax-exempt organizations, including charities, educational institutions, and associations, must submit Form 990 annually unless they fall under specific exemptions.

There are special cases where smaller organizations might be exempt from filing. For instance, religious institutions often have different filing guidelines. Understanding these nuances is essential for ensuring compliance.

Navigating the form: Structure and sections

Understanding the structure of Form 990 is critical for efficient completion. The form is divided into several key sections, each designed to gather specific information about the organization’s operations and financial activities.

Each section is integral to ensuring a clear representation of the organization's financial health and governance structure. Sections are interconnected, and accuracy in one will affect the overall integrity of the filing.

Step-by-step guide to completing Form 990

Filing Form 990 can be a complex process, but breaking it down into steps makes it manageable. Before you begin filling out the form, preparation is key.

Following these steps helps avoid common pitfalls and ensures compliance with IRS requirements.

Filing methods for Form 990

Organizations have several options for filing Form 990, each with distinct benefits. Understanding these methods can streamline the filing process.

Utilizing online resources can facilitate a smoother filing experience and reduce the likelihood of errors.

After filing: What’s next?

Once Form 990 is submitted, it's essential for organizations to have a plan for record-keeping and public disclosures. Well-managed records ensure compliance and support future reporting.

Being transparent about financial practices fosters trust and strengthens relationships with stakeholders.

Additional considerations when filing Form 990

Certain situations may demand additional attention during the filing of Form 990. Awareness of these will ensure appropriate compliance.

Organizations should also be prepared for IRS inquiries or audits, ensuring swift and informed responses to maintain compliance and confidence.

Frequently asked questions about Form 990

Understanding common questions about Form 990 can clarify uncertainties surrounding the form's requirements and processes. Here are several frequently asked topics.

Having clear answers to these questions aids in strategic planning and filing preparedness.

Leveraging Form 990 for organizational growth

Form 990 serves not only as a compliance tool but also as a vehicle for organizational growth. By analyzing the insights gleaned from the form, organizations can identify financial trends and make informed decisions.

By seeing Form 990 as a means for growth, organizations can transform compliance into a strategic asset.

Explore our interactive tools for completing Form 990

At pdfFiller, we provide powerful tools specifically designed for document management, including the seamless completion of Form 990. Our platform allows users to edit, sign, and collaborate on the document from anywhere.

Join the ranks of successful organizations that have streamlined their filing process with pdfFiller, empowering their mission-driven initiatives through effective documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the return of organization exempt in Gmail?

How can I edit return of organization exempt on a smartphone?

How do I fill out return of organization exempt using my mobile device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.