Get the free Budget/revenue Preparation Worksheet

Get, Create, Make and Sign budgetrevenue preparation worksheet

How to edit budgetrevenue preparation worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budgetrevenue preparation worksheet

How to fill out budgetrevenue preparation worksheet

Who needs budgetrevenue preparation worksheet?

Budget Revenue Preparation Worksheet Form: A Comprehensive Guide

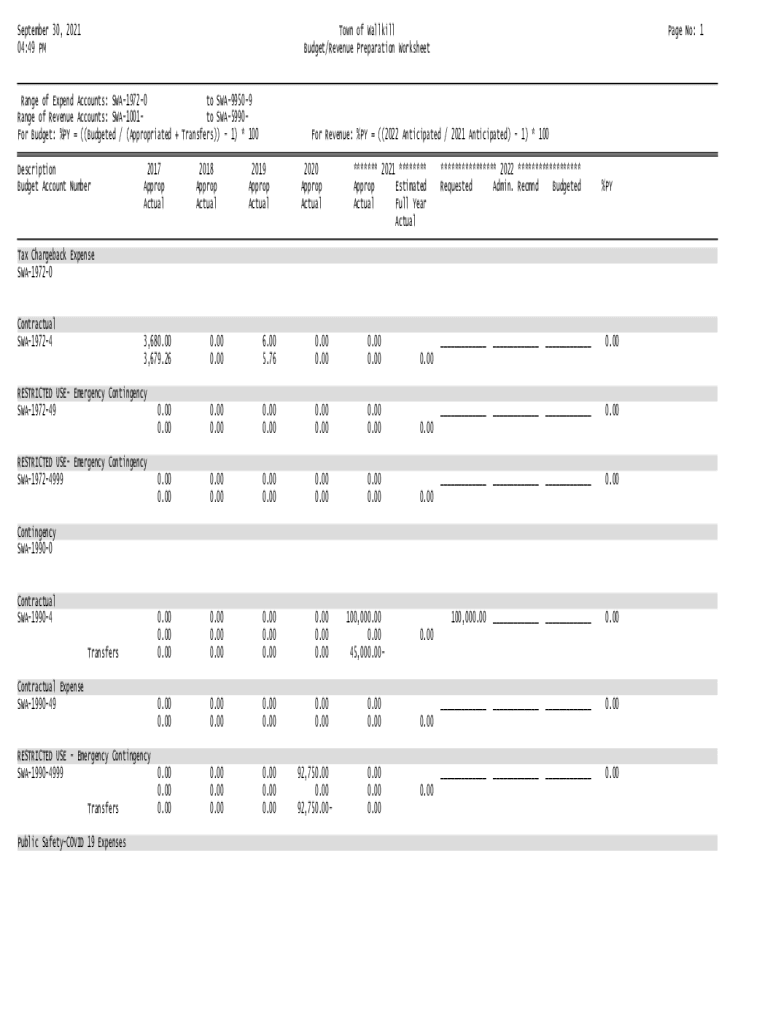

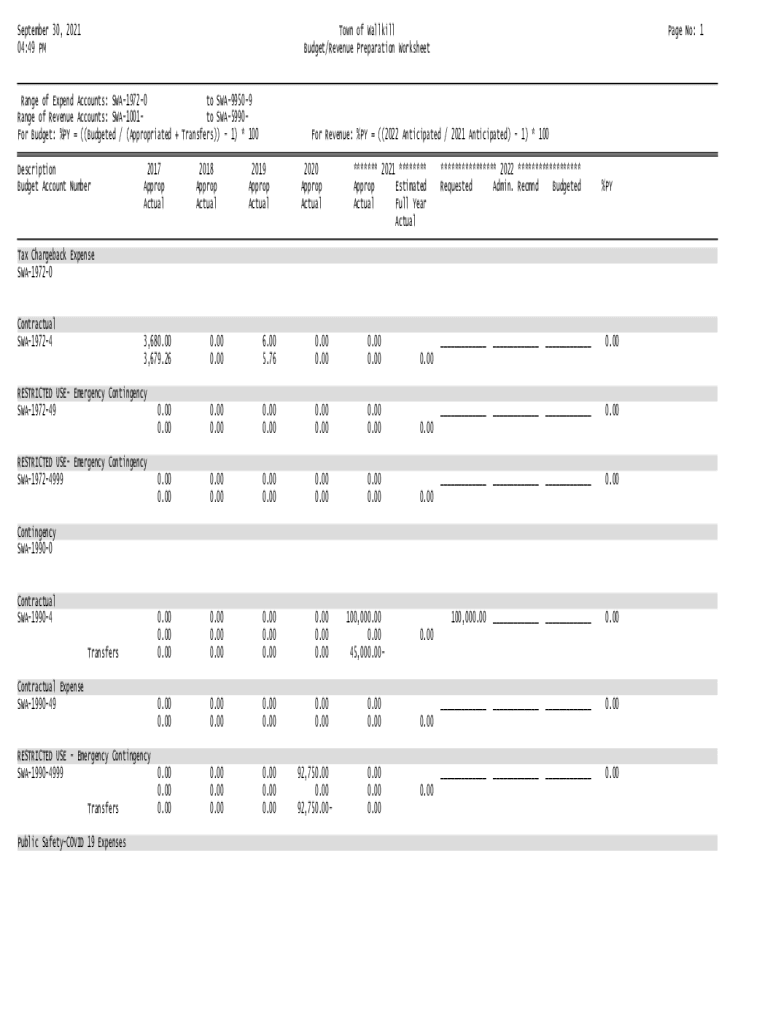

Understanding the budget revenue preparation worksheet form

A budget revenue preparation worksheet form is a crucial financial document that helps organizations plan and forecast their expected income for a specific period. This form not only aids in predicting revenue but also acts as a financial roadmap, guiding decision-makers throughout the budgeting process. Without effective revenue worksheets, businesses can struggle to allocate resources efficiently or identify potential financial shortfalls.

The importance of revenue worksheets in budgeting cannot be overstated. They serve as the backbone for financial planning, allowing organizations to evaluate past performance and project future income. This is particularly vital in sectors such as non-profit, education, and corporate finance, where revenue plays a pivotal role in sustainability and growth.

Various industries utilize the budget revenue preparation worksheet form for distinct purposes. For example, in retail, it assists in forecasting sales based on seasonal trends, while in services, it may focus more on projected client engagements or contracts.

Key components of the budget revenue preparation worksheet

The key components of a budget revenue preparation worksheet form include revenue projections, associated expenses, and income forecasting. Understanding each element is vital for effective budgeting.

Revenue projections

When estimating revenue, consider multiple streams such as product sales, service income, grants, and investments. It's essential to categorize these to grasp where the bulk of income originates. Techniques such as trend analysis, market research, and customer surveys are effective in estimating future revenues, providing a robust framework for your projections.

Expenses associated with revenue generation

Understanding the costs associated with generating revenue is just as important as projecting incomes. Recognize fixed costs—those that remain constant regardless of production volume—and variable costs, which fluctuate with output level. Operating expenses, including marketing, labor, and overhead, play a vital role in effectively managing a budget.

Income forecasting

Accurate income estimation is foundational to successful budgeting. Methods such as historical averaging, regression analysis, and scenario forecasting can enhance precision in income predictions. It's also crucial to consider factors that influence income variability, such as market conditions, economic changes, and consumer behavior.

Step-by-step instructions for using the budget revenue preparation worksheet form

Step 1: Gathering necessary financial documents

Start by collecting all relevant financial documents. These may include past income statements, balance sheets, cash flow statements, and investment reports. Accessing consistently recorded historical financial data will create a strong foundation for making informed assumptions regarding future income.

Step 2: Inputting revenue data

Input revenue sources into the worksheet carefully. Include all anticipated income streams and employ forecasting techniques like trend analysis to project future revenue accurately. An organized presentation allows for easy tracking and review during budgeting discussions.

Step 3: Documenting expenses

Documenting expenses requires careful categorization for clarity. Break down fixed and variable costs, providing detailed estimations for variable expenses based on expected revenue levels. This not only enables accuracy but also keeps surprises at bay when financial results roll in.

Step 4: Analyzing the completed worksheet

Once the worksheet is completed, it’s time to analyze the projections and results. Identify whether expected revenues align with projected expenses for a balanced budget. Pay attention to common pitfalls, such as overestimating revenues or underestimating costs, to help refine future predictions.

Interactive tools and features on pdfFiller for worksheet management

Leveraging interactive tools available on pdfFiller simplifies budget revenue management. With cloud-based accessibility, users can edit and save their worksheets across various devices, allowing them to remain agile and responsive.

The eSigning capabilities offered by pdfFiller safeguard financial documents, providing assurance against unauthorized changes. Collaborative features enable teams to work together, sharing insights in real-time to build a more comprehensive budget.

Best practices for budget revenue planning

Setting realistic revenue goals is essential for maintaining a productive budgeting environment. Regularly review and adjust your budget based on actual performance versus projections, and keep a close eye on fluctuations in market conditions that could impact revenue.

Utilizing historical data enables organizations to generate more accurate estimates, while engaging teams in the budgeting process fosters a sense of ownership and accountability. This collaborative approach often leads to better decision-making and enhanced financial health.

FAQs on budget revenue preparation worksheet form

Related forms for comprehensive financial management

Unique features of pdfFiller in document creation

pdfFiller stands out with a user-friendly interface designed for users who may not be tech-savvy. This ensures individuals from diverse backgrounds can efficiently utilize the platform.

Advanced editing tools customized for financial forms enable users to make the necessary adjustments with ease. Moreover, secure data storage ensures that all sensitive financial information complies with privacy regulations, giving organizations peace of mind.

Real-world examples and case studies

Many businesses have successfully utilized the budget revenue preparation worksheet to achieve financial stability. For instance, a small business in the retail sector leveraged this form to identify seasonal sales trends and optimize inventory levels, thus ensuring maximum profitability.

Case studies reveal that even small adaptations in budgeting can significantly affect organizational sustainability. Adopting a systematic approach similar to larger companies helps smaller organizations scale effectively while learning valuable lessons from budgeting mistakes.

Troubleshooting common issues with the worksheet

As with any financial document, common errors may occur in projections. It's important to review calculations regularly and consult financial experts when necessary. If you encounter incomplete information, revisiting historical documents can often provide the critical insights needed to fill in the gaps.

For additional assistance with the budget revenue preparation worksheet form, reaching out to customer support teams on platforms like pdfFiller proves beneficial. They can guide users through complex financial intricacies and ensure that the form is used to its full potential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my budgetrevenue preparation worksheet directly from Gmail?

How can I send budgetrevenue preparation worksheet to be eSigned by others?

Can I edit budgetrevenue preparation worksheet on an Android device?

What is budgetrevenue preparation worksheet?

Who is required to file budgetrevenue preparation worksheet?

How to fill out budgetrevenue preparation worksheet?

What is the purpose of budgetrevenue preparation worksheet?

What information must be reported on budgetrevenue preparation worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.