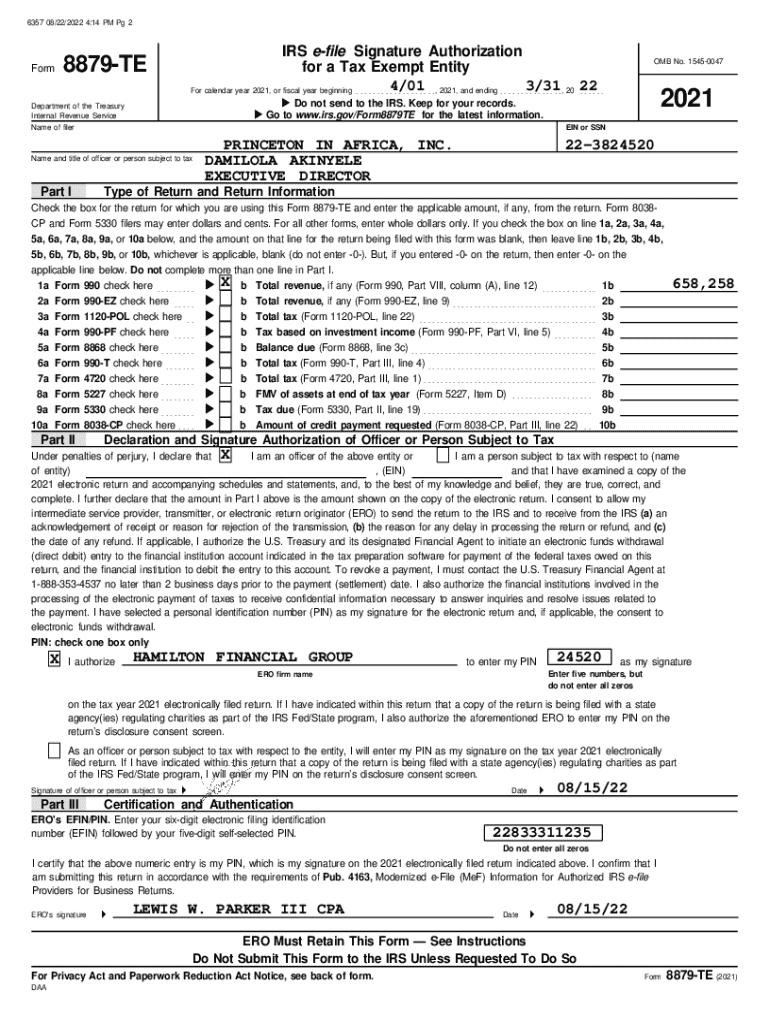

Get the free Form 8879-te

Get, Create, Make and Sign form 8879-te

Editing form 8879-te online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8879-te

How to fill out form 8879-te

Who needs form 8879-te?

Form 8879-TE: How to Fill It Out and Manage It

Overview of form 8879-te

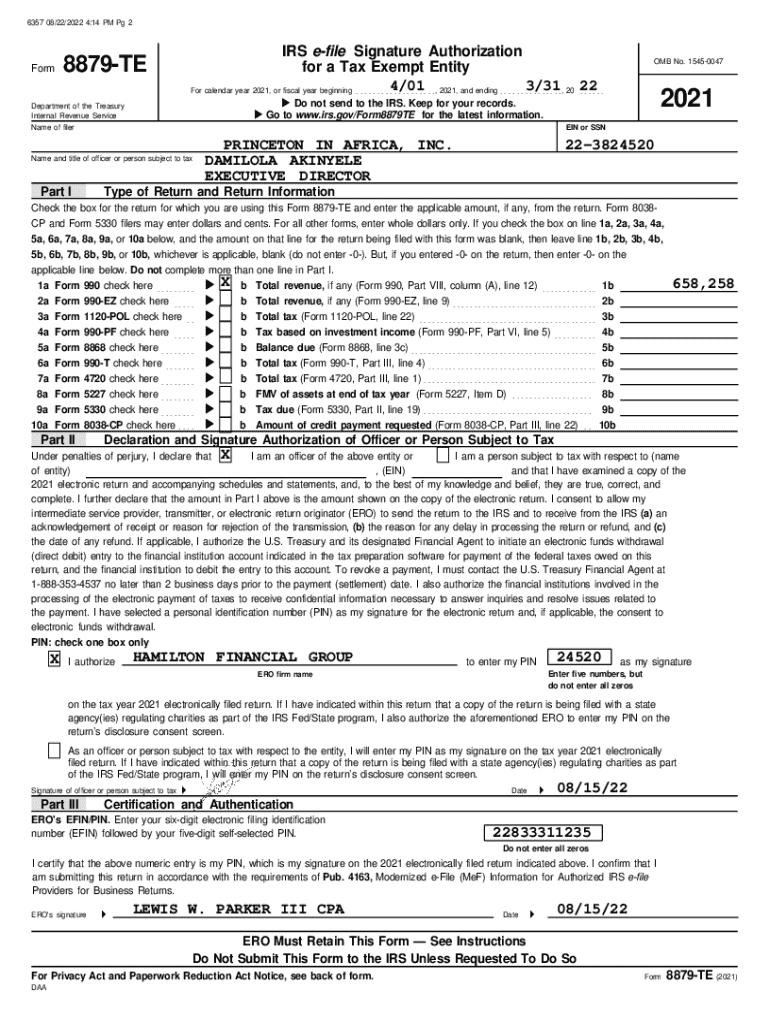

Form 8879-TE, also known as the IRS e-file Signature Authorization for Tax Exempt Entities, is a critical document used by certain tax-exempt organizations. It provides authorization for a tax return preparer to electronically file a Form 990 series or Forms 990-N, 990-EZ, or 990-PF on behalf of the organization. The importance of this form lies in its role in facilitating electronic filing, which has become crucial for compliance with IRS regulations, streamlining the tax process, and maintaining accurate organizational records.

The form serves as a security measure, ensuring that the information transmitted during e-filing is legitimate and authorized. When a tax-exempt organization chooses to e-file its tax return, Form 8879-TE ensures that they are adhering to IRS guidelines, safeguarding sensitive information, and contributing to quicker processing times.

Who needs to use form 8879-te?

Specific stakeholders are required to utilize Form 8879-TE. This includes tax-exempt organizations, such as charities or non-profits, engaging tax professionals, and preparers managing filings for these entities. Any situation where an authorized representative of a tax-exempt entity is filing a Form 990 series return electronically necessitates the completion and submission of this form.

Key components of form 8879-te

Understanding the components of Form 8879-TE is essential for effective completion. This form includes several sections, each requiring specific information from the tax-exempt organizations and their preparers. Key sections of the form include taxpayer information, tax return information, and the e-signature section, which collectively provide the IRS with the necessary details to validate the electronic filing.

By breaking down the sections, the form allows users to ensure accuracy and relevance in their filings. Emphasis on careful input of organizational identification details and financial information can significantly impact the affirmation of the e-filed return. Misunderstandings with the terms used in the form can lead to inaccuracies; therefore, familiarity with the terminology is crucial.

Common terminology in form 8879-te

Tax terminology can often seem complex, yet it is vital to grasp these concepts when working with Form 8879-TE. Terms such as ’electronic filing’, ‘e-signature’, and ‘tax-exempt organization’ are fundamental for navigating this documentation. Using these terms correctly ensures a clearer understanding of the filing process and elevates compliance accuracy.

Step-by-step instructions for completing form 8879-te

Before diving into the completion of Form 8879-TE, it’s important to prepare adequately. This involves gathering all necessary documents, including the organization’s prior tax returns, financial statements, and relevant identification numbers. Consider creating a checklist to streamline this process; ensuring all crucial information is readily available will make filling out the form more efficient.

Detailed instructions for each section

1. Taxpayer Information: Begin by accurately inputting the organization’s full name, address, and Employer Identification Number (EIN). This sets a foundation of correctness, as any discrepancies in these details could cause filing issues.

2. Tax Return Information: Next, provide details related to the specific tax return being filed. This could include the type of return and the period it covers. Being precise here is essential, so ensure the correct selections correspond to the filing being performed.

3. Electronic Signature: Here, the authorized individual must date and sign the form, providing a legally binding e-signature that certifies the accuracy of the information submitted. This is a crucial part of the process, as it marks the official agreement to proceed with electronic filing.

Common mistakes to avoid

Common mistakes include inputting incorrect EINs, omitting signatures, or failing to check specific return details. To enhance accuracy, use tools like pdfFiller that provide functionalities such as form validation and error checks to guide you in completing the form correctly.

Editing and managing form 8879-te

Using pdfFiller to edit Form 8879-TE makes managing this document a breeze. With its user-friendly interface, individuals and companies can easily input and modify details. The editing features allow users to annotate, highlight, and clarify specific sections of the form, ensuring that all necessary information is conveyed accurately.

Moreover, pdfFiller offers real-time collaboration tools, which are invaluable for teams. Multiple users can work on the document simultaneously, allowing for efficient review processes that align with deadlines while ensuring accuracy and compliance.

Saving and storing form 8879-te

Once Form 8879-TE is completed, storing it safely is crucial. pdfFiller allows users to save their completed forms securely in its cloud storage. This means accessing your documents anywhere, anytime, on any internet-enabled device. Storing forms in a cloud environment guarantees that even if devices fail, your vital documents remain intact and retrievable.

Signing and submitting form 8879-te

eSignature integration within pdfFiller streamlines the signing process for Form 8879-TE. With just a few clicks, users can provide their legally binding signatures, which are authenticated and recognized by the IRS. This eliminates the traditional hassles associated with physical signatures, offering both convenience and compliance.

After signing, you can submit the form electronically through various channels, including direct filing through the tax software. Tracking the submission status is also manageable through pdfFiller, which keeps you updated on whether the IRS has accepted or rejected your filing.

Troubleshooting common issues

Errors can occur even with diligent care. If you encounter issues, such as problems with submission or form validation errors, check the information entered against IRS guidelines. Missing signatures and incorrect Tax Identification Numbers (TINs) are common problems that can be rectified by reviewing the details again.

If persistent issues arise, contacting pdfFiller support can provide the necessary assistance to resolve these matters promptly. The support team is well-versed in troubleshooting and can guide you through specific challenges with Form 8879-TE.

FAQs about form 8879-te

Common questions surrounding Form 8879-TE typically include inquiries about who qualifies as eligible to e-file, what to do if mistakes are made after submission, and the timeframe for IRS acceptance. Addressing these queries upfront helps to demystify the form and encourages compliance among tax-exempt organizations.

Advanced tips for teams and professionals

For teams using pdfFiller, collaboration is vital. Encourage communication among team members during the document completion process, ensuring that everyone involved understands their roles. Utilizing pdfFiller’s advanced collaboration features, such as comments and tagged notifications, can keep everyone in the loop and facilitate efficient workflows.

Employing templates and automated workflows in pdfFiller can significantly enhance efficiency. Custom templates tailored to the needs of your organization can be reused, reducing redundant work and expediting the overall process of filling out and filing Form 8879-TE.

Maximizing efficiency with pdfFiller tools

To further maximize efficiency, explore all the features that pdfFiller offers. From automated reminders for filing deadlines to extensive security options for managing sensitive documents, these tools enable organizations to focus on their core missions without being bogged down by administrative tasks.

Conclusion on the importance of properly managing your 8879-te

The proper completion and management of Form 8879-TE cannot be understated, as it significantly impacts tax compliance and organizational efficiency. Utilizing pdfFiller provides a seamless solution for editing, signing, and managing your documents accurately and securely. Organizations can enhance their filing processes dramatically, achieve timely submissions, and ultimately fulfill their obligations with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 8879-te in Chrome?

How can I edit form 8879-te on a smartphone?

How do I complete form 8879-te on an iOS device?

What is form 8879-te?

Who is required to file form 8879-te?

How to fill out form 8879-te?

What is the purpose of form 8879-te?

What information must be reported on form 8879-te?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.