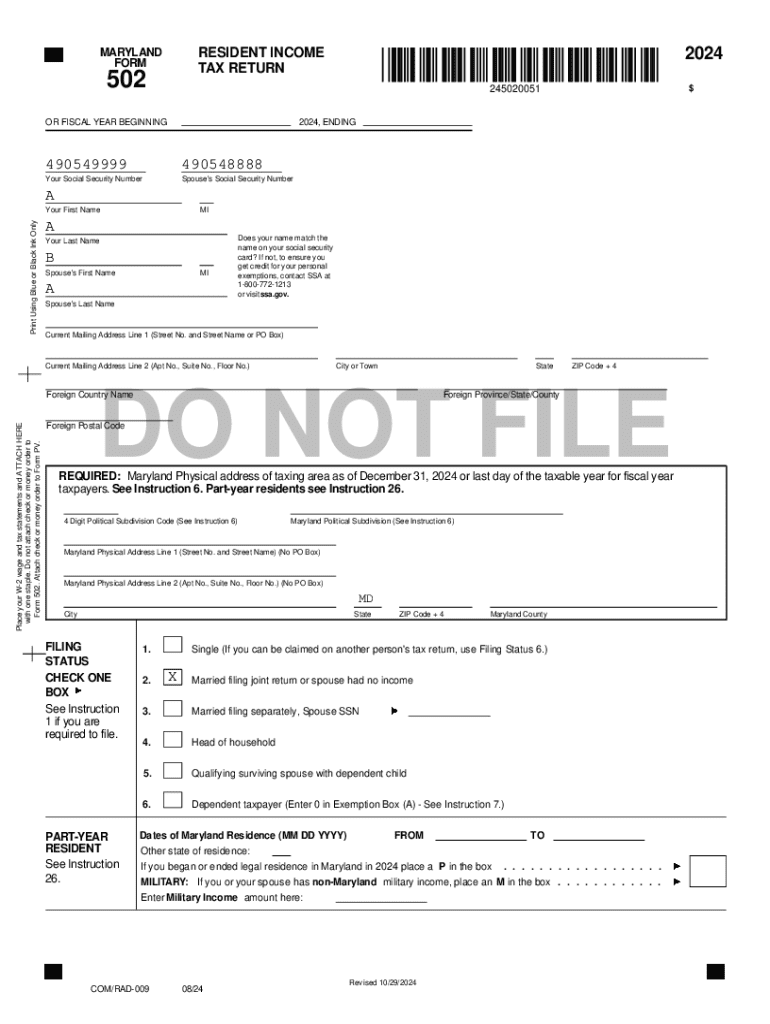

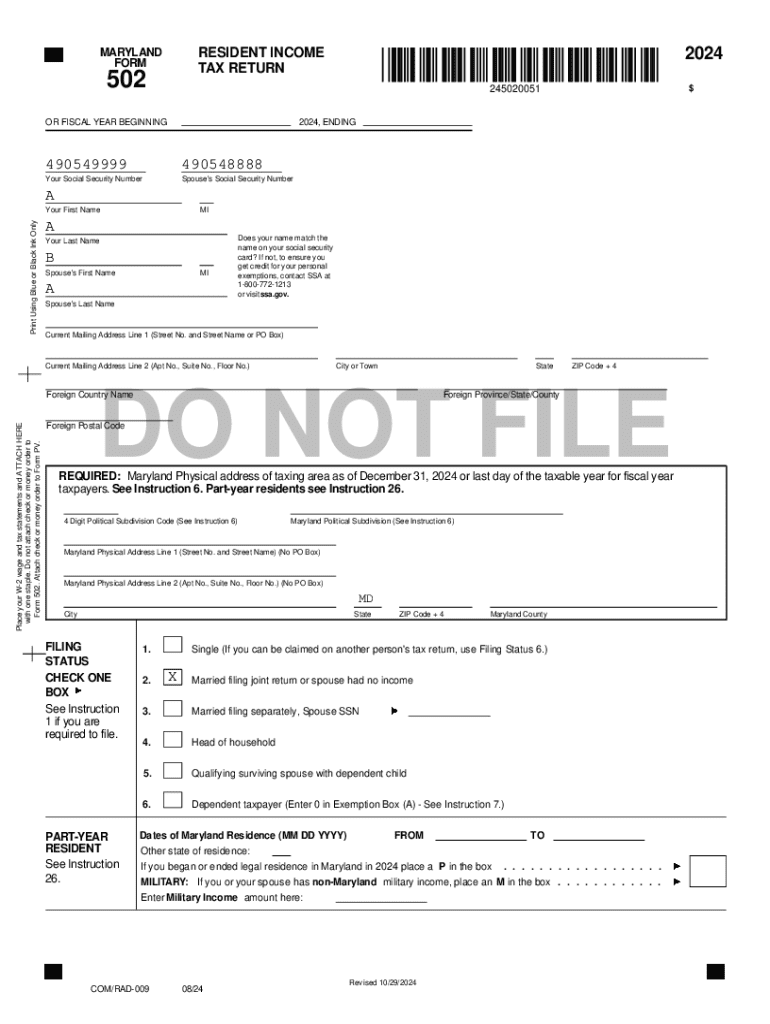

Get the free Maryland Resident Income Tax Return 502 2024

Get, Create, Make and Sign maryland resident income tax

How to edit maryland resident income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland resident income tax

How to fill out maryland resident income tax

Who needs maryland resident income tax?

A comprehensive guide to the Maryland resident income tax form

Overview of the Maryland resident income tax form

The Maryland resident income tax form, commonly referred to as Form 502, is a crucial document used by Maryland residents to report their annual income and calculate their state tax obligation. This form serves multiple purposes: it ensures that accurate tax assessments are made based on the income of the state’s residents, and it allows taxpayers to claim eligible deductions and credits. Filing this form correctly is vital not only for compliance but also for minimizing tax liabilities.

Accuracy in filing is paramount, as mistakes can lead to penalties, delays in tax refunds, or audits. All individuals who earn income while residing in Maryland, regardless of their employment state or type of income, are generally obligated to file. This includes self-employed persons, salaried employees, and recipients of investment income.

Key features of the Maryland resident income tax form 502

Form 502 is structured into distinct sections that guide users through the process of reporting income, claiming deductions, and calculating tax due. Each section has a clear purpose and contains specific information required by the Maryland State Comptroller’s office. Important dates for tax filing typically align with federal tax deadlines, usually ending on April 15 each year, with extensions available under certain criteria.

Eligibility to file Form 502 generally applies to all Maryland residents whose income meets the minimum threshold set by the state tax regulations. This includes those who are employed, self-employed, or receive income from other sources, provided they are considered residents for tax purposes.

Step-by-step instructions for filling out the Maryland resident income tax form

Personal information section

The personal information section requires basic details such as name, address, Social Security number, and filing status. Ensuring that this information is accurate is critical, as discrepancies may cause delays in processing. Common mistakes include typos in Social Security numbers or incorrect addresses.

Income reporting

In the income reporting section, you are required to report all forms of income, including wages, salaries, tips, interest, dividends, and business income. Collecting necessary documentation such as W-2s and 1099s beforehand can simplify this process and minimize errors.

Deductions and credits

Maryland provides several deductions and credits to help reduce tax liability. Common deductions include those for student loans, medical expenses, and property taxes. To determine eligibility for state tax credits, take the time to review any changes in tax laws for the current year and consult the instructions with care.

Tax calculation

Understanding Maryland's tax rates is fundamental to correctly calculating your tax due. Maryland’s tax rates are progressive, which means the tax rate increases as income increases. Tax calculation involves applying the rate to your taxable income and accounting for deductions and credits claimed.

Finalization of the form

Before submitting Form 502, make essential checks to verify that all sections are completed accurately and all supporting documentation is included. You can choose between e-filing, which is often faster and more efficient, or paper filing, which may take longer to process.

Editing, signing, and managing your form online

pdfFiller offers a cloud-based solution for managing your Maryland resident income tax form effortlessly. With its suite of editing tools, users can make necessary adjustments directly within the document, saving time and ensuring accuracy.

Editing the Maryland resident income tax form

Interactive tools are available on pdfFiller to help users modify the Maryland resident income tax form with ease. These tools allow you to highlight errors or make changes, ensuring that your form is accurate before submission.

eSigning your tax form

Once the form is filled out, eSigning it on pdfFiller is straightforward. You can create your signature online and place it directly onto the document. Utilizing eSignatures not only speeds up the process but also provides an additional layer of security and authenticity.

Sharing the form for collaboration

pdfFiller makes it easy to share your Maryland resident income tax form with tax professionals or family to collaborate on entries. Users can manage permissions, allowing others to view or edit the document while ensuring the original content remains intact.

Frequently asked questions (FAQs)

When dealing with taxes, questions are bound to arise. Common inquiries include: What if you make a mistake on your tax form after submission? In most cases, you can file an amendment to correct any errors. Tracking the status of your Maryland tax return can typically be done online through the state tax office's portal. Additionally, be aware that penalties for late filing can apply, so it's important to file on time. Finally, if you need to amend a submitted Maryland resident income tax form, you may do so by using Form 502X.

Related documents and forms

In addition to Form 502, several other Maryland state tax forms may be relevant, including Form 515 for nonresidents and Form 502B for the Maryland tax credits. Links to these forms can be found on the Maryland State Comptroller’s website. Additionally, business owners may need to file other specific forms depending on their business structure and income.

Tips for efficient tax filing

To streamline your tax filing process, organizing tax documents ahead of time is critical. Create a checklist of required documentation to minimize the chances of overlooking details. Using pdfFiller's features not only saves time but also assists in ensuring that your information is accurate and easily accessible. Familiarize yourself with key dates for filing and payment to avoid last-minute rushes.

Understanding next steps after filing

After submitting your Maryland resident income tax form, keep an eye on the post-filing process. Expect confirmation from the Maryland State Tax Office regarding your submission and any subsequent assessments. If notified of an audit, responding promptly and providing necessary documentation is critical. Being aware of tax adjustment resources and support services can also be beneficial.

Exploring further assistance options

Should you need additional help, the Maryland State Tax Office provides a wealth of resources for taxpayers. Contact information is available online, along with detailed answers to common tax questions. Furthermore, local community support groups and online forums offer platforms for sharing filing experiences and seeking advice from others facing similar situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my maryland resident income tax directly from Gmail?

How do I complete maryland resident income tax online?

How do I complete maryland resident income tax on an Android device?

What is Maryland resident income tax?

Who is required to file Maryland resident income tax?

How to fill out Maryland resident income tax?

What is the purpose of Maryland resident income tax?

What information must be reported on Maryland resident income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.