Understanding and Using a Trust Transfer Deed Template Form

Understanding the trust transfer deed

A trust transfer deed is a legal document that facilitates the transfer of property assets into a trust. This instrument plays a pivotal role in estate planning, allowing individuals to manage their assets during their lifetime and specify wishes for distribution after death. The use of a trust transfer deed is vital for ensuring the orderly transition of assets, minimizing legal disputes, and potentially saving on estate taxes.

Employing a trust transfer deed not only aids in asset management but also affords beneficiaries better protection. By formally transferring assets to a trust, the trustor can dictate terms that govern how and when the assets will be distributed, thereby providing security and peace of mind for both trustors and beneficiaries.

Types of trust transfer deeds

Trust transfer deeds can vary significantly based on their structure and function. The primary types include revocable and irrevocable trust deeds, which offer distinct levels of control. A revocable trust allows the trustor to maintain control over the assets and amend the trust terms at any time. In contrast, irrevocable trusts typically relinquish the trustor's control, providing asset protection and potential tax benefits.

Revocable Trust Deeds: Allows for changes and can be dissolved.

Irrevocable Trust Deeds: Permanently transfers ownership to the trust.

Additionally, specialized trust deeds such as Lady Bird Deeds and Transfer on Death Deeds serve unique purposes. A Lady Bird Deed allows the trustor to retain control over the property during their lifetime while designating beneficiaries that automatically inherit the property without going through probate. On the other hand, Transfer on Death Deeds offer a straightforward means to pass property upon death without the complexities of trust management.

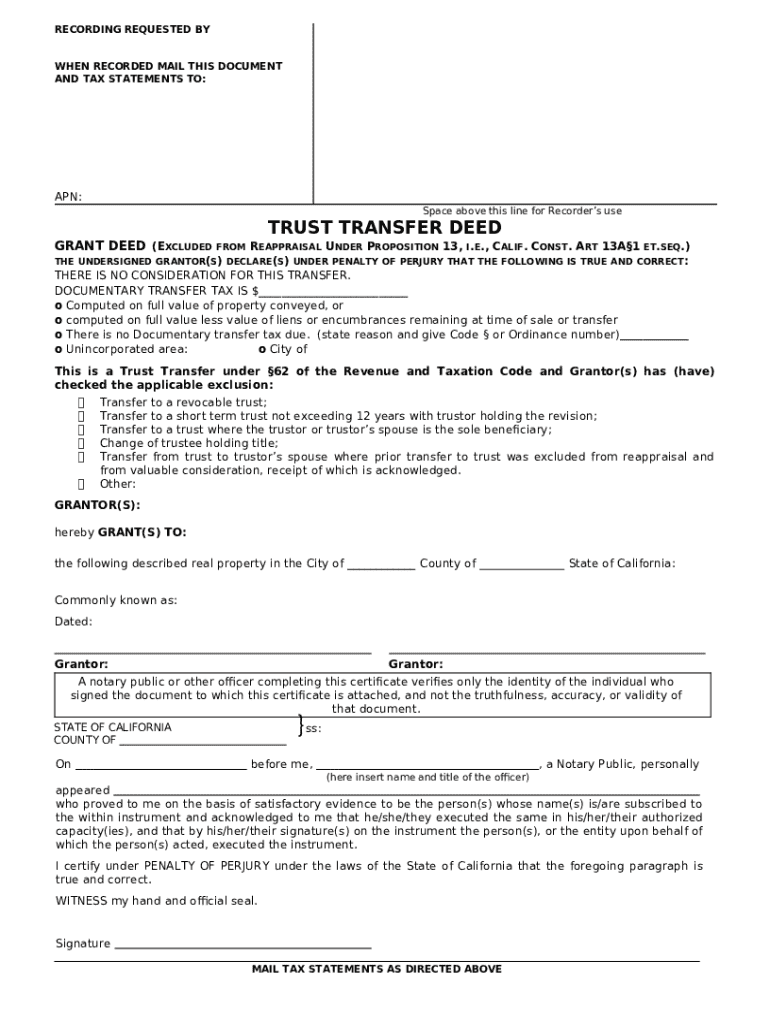

Key components of a trust transfer deed

Each trust transfer deed must be meticulously crafted to ensure all essential elements are included, thus preventing legal challenges and confusion. Key components of the document include the names and details of the trustor and trustee, which establish who is granting and who is receiving the trust. A thorough description of the property being transferred is crucial, providing specifics such as address, type, and any pertinent parcel information. Furthermore, the deed should clearly identify the beneficiaries and their respective rights.

Understanding the legal terminology frequently used in trust transfer deeds can also mitigate confusion. Key terms such as 'grantor,' 'trustee,' and 'beneficiary' are fundamental to comprehending the document's intent and stipulations, helping individuals navigate their legal responsibilities effectively.

Legal considerations and requirements

The execution of a trust transfer deed requires careful attention to state-specific regulations. Each jurisdiction may have unique laws regarding the validity of the deed, so it's crucial to familiarize yourself with your state’s requirements. Additionally, most states require the deed to be notarized and may need one or more witnesses present at the signing, ensuring the authenticity of the document.

Check state-specific laws regarding trust transfer deeds.

Ensure notarization and witness requirements are satisfied.

Beyond legal formalities, potential tax implications should be on the radar of anyone creating a trust transfer deed. Understanding how estate taxes and gift taxes may be influenced by the transfer of various assets can lead to better financial planning and cost savings down the line.

Step-by-step guide to completing a trust transfer deed

Completing a trust transfer deed can feel daunting, but following a structured approach can simplify the process. Start by gathering all necessary information, including personal details of the trustor and trustee, and comprehensive property descriptions. Next, utilizing a trust transfer deed template from pdfFiller can streamline the process. These templates are designed for user-friendly navigation.

Gather necessary information: personal details, property descriptions.

Access the trust transfer deed template on pdfFiller.

Fill out each section according to the instructions and double-check for accuracy.

Finalize the deed by having it notarized and submitting it to the relevant authorities.

Properly reviewing the completed deed is crucial. Ensuring all information is accurate can prevent complications later and secure the wishes of the trustor. Finally, consolidating the document by notarizing it elevates its validity and acknowledges its legal standing.

Managing and storing your trust transfer deed

Once the trust transfer deed is complete, effective management and storage become paramount. It's advisable to keep the original copy in a safe place, while also creating digital backups to prevent loss due to unforeseen circumstances. PdfFiller's platform offers versatile options for securely storing documents in the cloud, making them accessible from anywhere, anytime.

Store original documents securely to prevent loss.

Utilize cloud solutions like pdfFiller for easy access and updates.

Moreover, users should remain vigilant about updating their trust transfer deed as circumstances change, like the addition of new beneficiaries or changes in property ownership. Document management platforms can facilitate these updates efficiently while maintaining historical versions should the need for previous documents arise.

Common mistakes to avoid

Creating a trust transfer deed requires meticulous attention to detail, as even minor errors can lead to significant legal repercussions down the road. Common mistakes include failing to include all required parties, overlooking property descriptions, and not understanding the necessary legal terminology.

Ensure all parties are correctly named in the document.

Double-check property descriptions to avoid ambiguity.

Understand the legal terms used to prevent misinterpretation.

Each of these oversights could result in legal disputes or failures in executing the trust as intended. By being careful and thorough, one can avoid the pitfalls that lead to complications in estate management.

Frequently asked questions (FAQs)

As you delve into the complexities of trust transfer deeds, questions naturally arise. One significant query is the difference between a trust transfer deed and a will. Unlike a will, which becomes effective only upon death, a trust transfer deed transfers assets during the trustor's lifetime, allowing immediate management and oversight.

What is the difference between a trust transfer deed and a will?

How can I amend an existing trust transfer deed?

Who should I consult about creating a trust transfer deed?

Addressing these questions with a qualified legal advisor can ensure the trust transfer deed aligns with federal and state laws, optimizing the intended outcomes for all parties involved.

Additional support and resources

Utilizing innovative platforms such as pdfFiller can significantly ease the process of managing your trust transfer deeds. The platform offers intuitive features for editing, signing, and collaborating on documents, simplifying the complexities of legal documentation.

Explore other relevant documents like wills and powers of attorney.

Access legal aid resources for guidance in document preparation.

By ensuring that all necessary forms are at your fingertips and having legal support available, you can navigate estate planning more effectively, ultimately contributing to peace of mind for you and your beneficiaries.