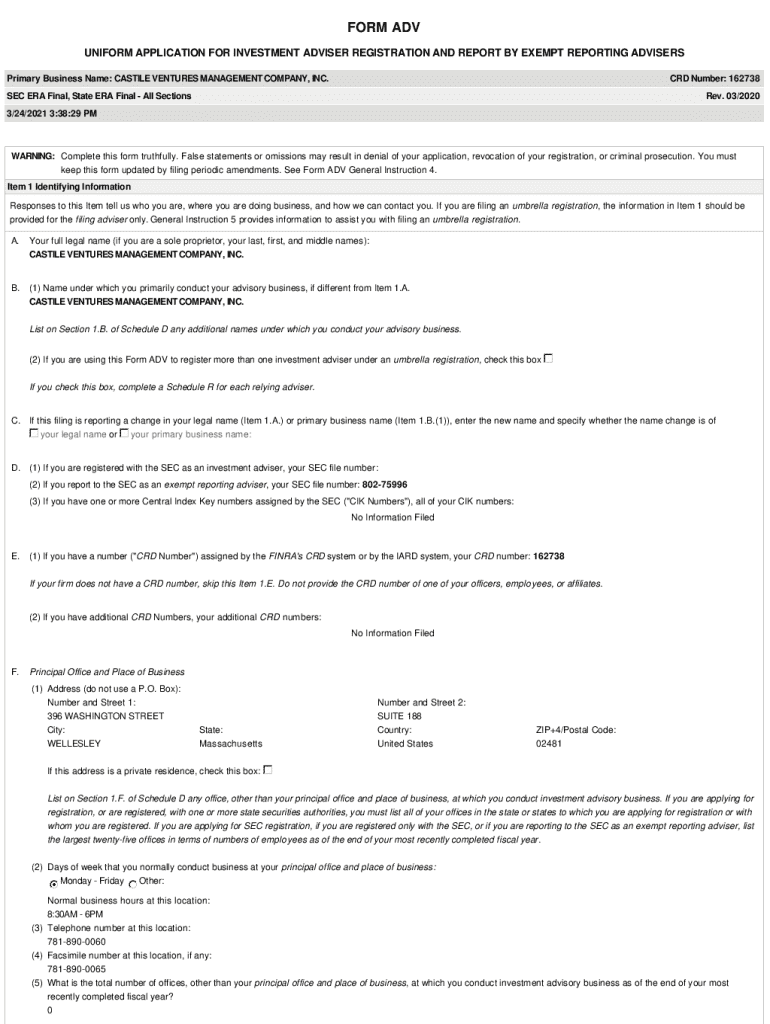

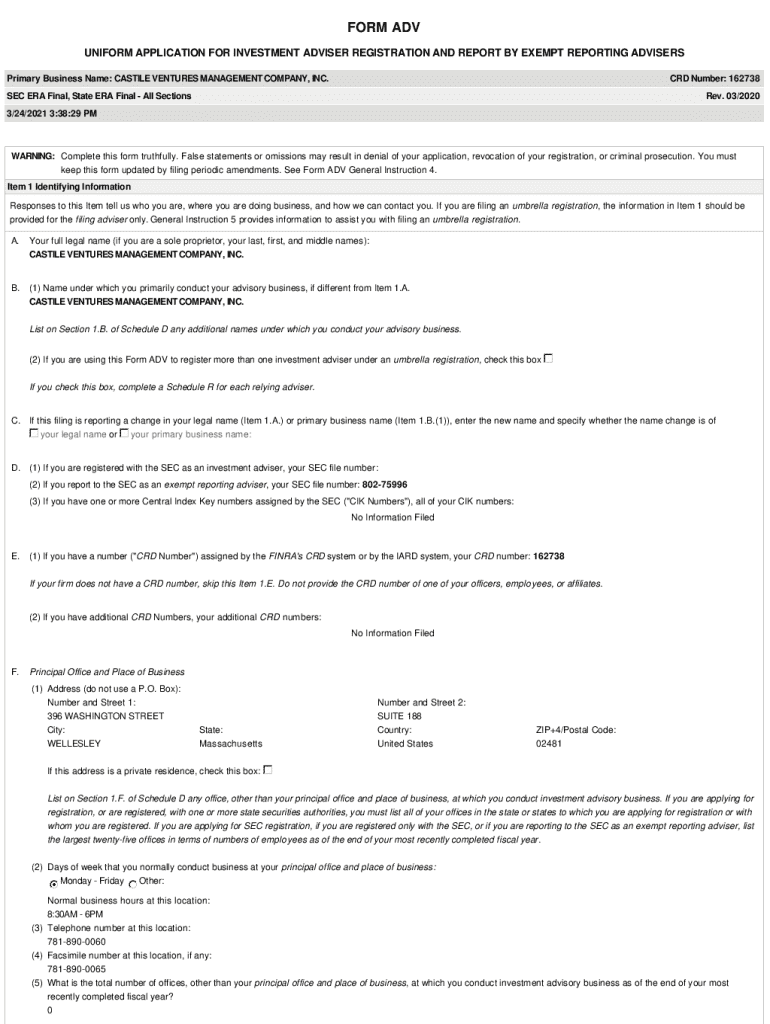

Get the free Form Adv

Get, Create, Make and Sign form adv

How to edit form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Form ADV: A Comprehensive How-to Guide

Understanding Form ADV: An overview

Form ADV is a crucial document that investment advisers must file with the Securities and Exchange Commission (SEC) and state regulators. It serves as a key resource for both compliance and transparency, outlining the structure, strategies, and financial dealings of investment advisory firms. This form helps to assure that these firms operate within the law, thus safeguarding investors' interests.

The importance of Form ADV in the financial services industry cannot be overstated. It acts as a public disclosure document, enabling potential clients to understand the adviser’s qualifications, services offered, and any potential conflicts of interest. Among its critical components, Form ADV consists of multiple sections detailing the adviser’s business practices, backgrounds, and financial information.

Purpose and functionality of Form ADV

Filing Form ADV is a legal requirement for advisory firms, and it serves several essential functions. Primarily, it functions as a tool for regulatory compliance, ensuring that advisers adhere to both federal and state laws governing financial services. This adherence is vital for maintaining investor trust and a legitimate market.

Moreover, Form ADV plays a critical role in protecting investors by providing them with the necessary information to make informed decisions. This transparency allows clients to assess the risks associated with engaging a particular adviser, thereby enhancing their overall safety in financial dealings.

Who must file a Form ADV?

Investment advisers of various types must file a Form ADV. Generally, if a firm provides advice or provides specific services concerning securities for compensation, filing is mandatory. This includes registered investment advisers (RIAs), as well as firms managing investment portfolios and financial planning services.

While most advisers must file, there are certain exemptions. For example, firms that only provide advice to fewer than fifteen clients in a twelve-month period or whose sole advisory clients are other registered investment advisers may not need to register and file Form ADV.

Form ADV filing process

Filing Form ADV involves a structured process that can be broken down into several key steps.

Timing and deadlines for Form ADV

Timing is critical when it comes to filing Form ADV. The initial filing timeline varies depending on the registration process, but new advisers generally must submit it before engaging in advisory business. Moreover, annual updates are required to keep the information accurate and compliant with regulations.

Event-driven amendments are another essential aspect to consider. Firms must file amendments whenever there are material changes, such as changes in business structure, address, or ownership. Understanding these timelines ensures that firms maintain their compliance and avoid penalties.

Updating and amending your firm's Form ADV

Advisers must update their Form ADV to reflect significant changes that occur within their firm. Common scenarios that require amendments include alterations in the firm's operations, mergers or acquisitions, or the addition of new advisory services. Staying proactive with updates is essential in maintaining compliance.

The process for amending the Form ADV is relatively straightforward. Advisers can submit updated versions of specific parts of the form online. However, caution is advised, as failing to accurately reflect changes can lead to compliance issues down the line.

Common questions and concerns regarding Form ADV

As with most regulatory documents, Form ADV raises several questions among investment advisers and their teams. Here are some frequently asked questions that can shed light on common concerns:

Compliance and regulatory considerations

Form ADV is fundamentally tied to compliance within the investment advisory industry. Its correct filing helps firms meet regulatory requirements, allowing them to avoid potential penalties. Compliance challenges frequently arise, especially for smaller firms or those with complex structures, necessitating a high level of diligence.

Firms that navigate potential pitfalls effectively, such as incorrect or incomplete filings, can leverage tools such as pdfFiller to streamline document management and compliance. This allows advisers to focus on their core operations while ensuring they remain in line with regulations.

Leveraging pdfFiller for efficient form management

pdfFiller presents an advantageous solution for investment advisers seeking to efficiently manage their forms, including Form ADV. The platform allows users to edit and sign documents electronically, facilitating a smoother filing process.

Collaborative tools within pdfFiller further enhance team efficiency, enabling multiple users to work on form submissions from anywhere. The cloud-based nature of the platform means that access to documents is not location-dependent, making it easier for firms with remote teams or multiple offices.

Specific features of pdfFiller, such as template management and automated reminders for upcoming deadlines, provide users with a comprehensive solution for form-filling and management.

Additional resources for Form ADV and compliance

For firms navigating the intricacies of Form ADV, there are numerous resources available. The SEC website contains official regulatory guidelines, while pdfFiller offers a wealth of educational materials, helpful tips, and tools tailored to the needs of investment advisers. These resources can make the compliance journey more manageable and understandable.

Additionally, there are various tools and software available that can assist firms in keeping track of their compliance schedules and regulatory changes. Staying informed and equipped with the right resources is essential for ongoing compliance and optimal operations in the advisory industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form adv from Google Drive?

How can I send form adv for eSignature?

How do I edit form adv online?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.