Get the free Form 10-k

Get, Create, Make and Sign form 10-k

Editing form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

The Comprehensive Guide to Form 10-K

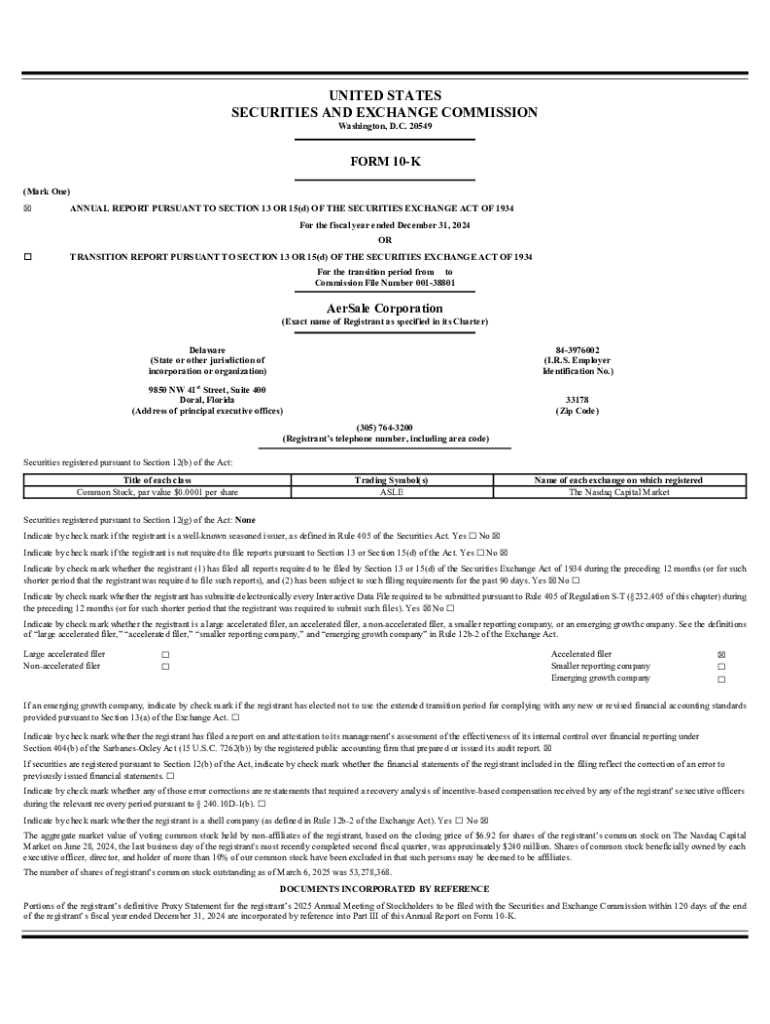

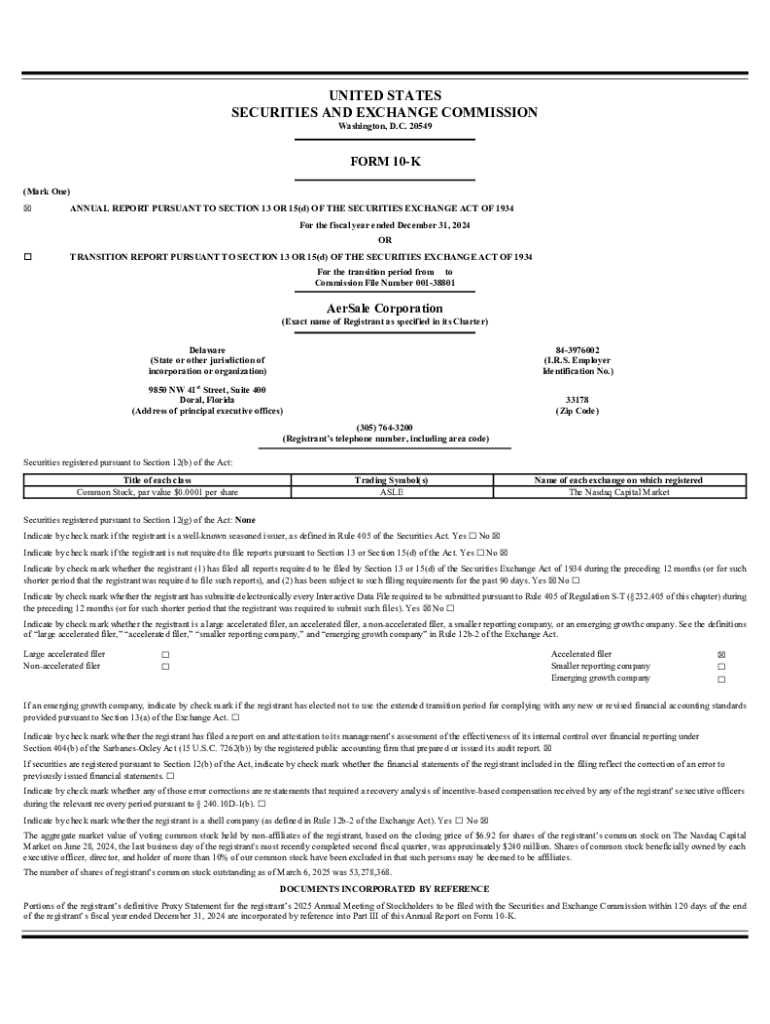

Overview of Form 10-K

Form 10-K is an annual report mandated by the Securities and Exchange Commission (SEC) for publicly traded companies in the United States. This comprehensive document provides a detailed overview of a company's financial performance, risks, and operations, making it an essential resource for investors and analysts alike.

The importance of filing a Form 10-K cannot be overstated. First, it meets regulatory requirements that necessitate transparency and accountability in corporate reporting. Companies must adhere to strict timelines and content guidelines, promoting an accurate representation of their financial health. Investors rely on this transparency to make informed decisions, evaluate potential investments, and engage in risk assessments.

Unlike other SEC filings such as the quarterly Form 10-Q or the current Form 8-K, the Form 10-K is a more comprehensive snapshot of a company's annual performance. While Form 10-Q provides interim financial updates, the 10-K integrates overall disclosures, offering a full fiscal year’s worth of insights.

Structure of Form 10-K

The structure of Form 10-K consists of several key components, including the cover page and a table of contents. The cover page contains vital information such as the company's name, fiscal year-end, and the SEC file number. The table of contents serves as a roadmap, guiding readers through the various sections of the report.

Diving deeper, Form 10-K is typically divided into four parts:

Specific items included in Form 10-K

Within the Form 10-K, several specific items provide detailed insights into a company's operations and risks. Each item serves a particular purpose, ensuring that investors have access to critical information.

Filing deadlines for Form 10-K

Companies must file their Form 10-K within a specified timeframe, with deadlines dependent on their public float, which is calculated from the market capitalization of the company. Typically, companies with a public float of over $700 million are required to file within 60 days after the end of the fiscal year, whereas smaller companies must submit their forms within 90 days.

It's crucial for companies to calendar these deadlines and adhere strictly to them, as penalties for late filing can include fines and increased scrutiny from the SEC, which could jeopardize investor confidence.

How to access and navigate Form 10-K

Accessing Form 10-K documents is straightforward via the SEC's EDGAR (Electronic Data Gathering, Analysis, and Retrieval) database. Investors and researchers can easily navigate the platform to locate specific company filings.

To find a Form 10-K, follow these steps:

Understanding the layout of Form 10-K in EDGAR is vital for efficient research. The format allows users to jump to specific sections, enhancing the comprehensiveness of data retrieval.

Analyzing the data in Form 10-K

Analyzing data within Form 10-K provides insights into a company’s financial health and operational risks. Investors should focus on various metrics presented throughout the report.

To derive meaningful insights, consider the following:

Tools and resources for managing Form 10-K filings

For companies managing Form 10-K filings, pdfFiller offers a suite of tools designed to facilitate the editing, signing, and collaboration needed for document creation. Its platform is user-friendly, ensuring that firms can efficiently meet their reporting obligations.

Expert insights and best practices

Navigating the complexities of Form 10-K can be daunting, especially for first-time filers. However, adhering to a set of best practices can make the process smooth.

Related forms and filings

Form 10-K is just one part of the broader ecosystem of SEC filings. Understanding related forms enhances context and provides a more comprehensive view of a company’s reporting.

Accessibility and support

When managing Form 10-K filings, accessibility and support resources are critical. Companies can establish free accounts with pdfFiller to enable smooth document handling.

Customer support resources are available to address any questions during the filing process, ensuring users have guidance when needed. Additionally, community guidelines serve as another layer of support, offering tips and best practices for successful filings.

Additional insights and advanced topics

As the landscape of corporate reporting evolves, so does Form 10-K. Staying informed about trends and changes in the regulatory environment is essential for compliance.

Gaining advanced insights can also benefit financial modeling initiatives. Analysts can leverage detailed data from Form 10-K to make predictions about future performance and establish benchmarks.

Lastly, recognizing the SEC's supervisory role in corporate reporting enhances understanding and compliance, ensuring companies uphold high reporting standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 10-k for eSignature?

How do I make edits in form 10-k without leaving Chrome?

How do I fill out the form 10-k form on my smartphone?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.