Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out closing disclosure

Who needs closing disclosure?

Closing Disclosure Form: How-to Guide

Understanding the closing disclosure form

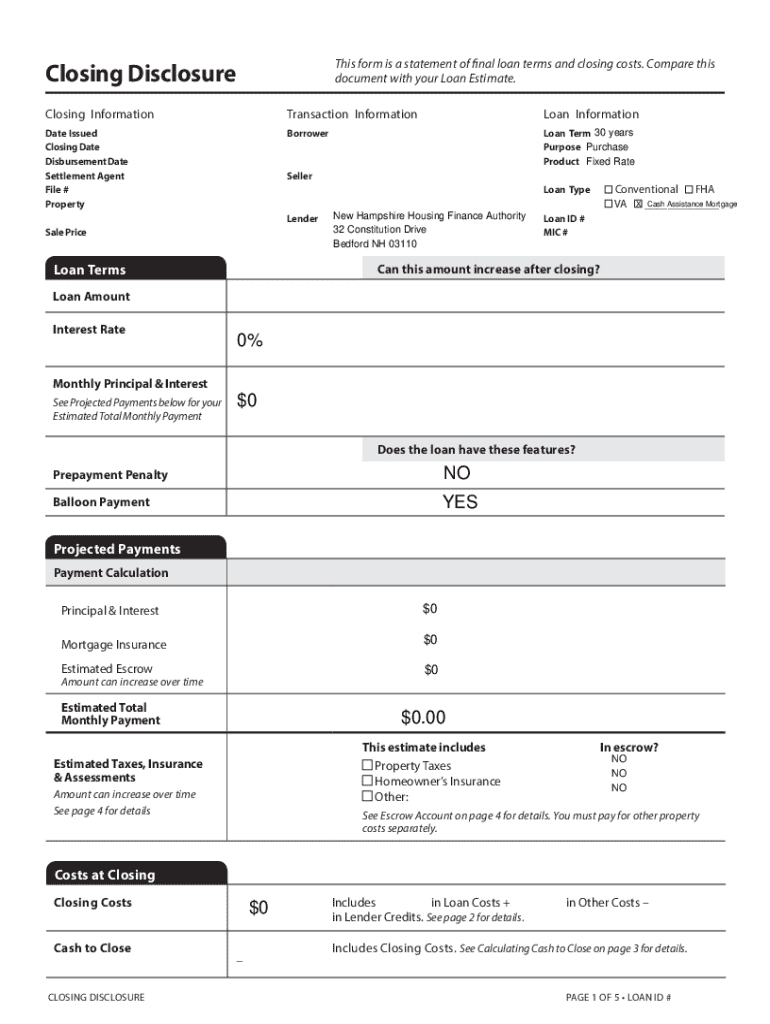

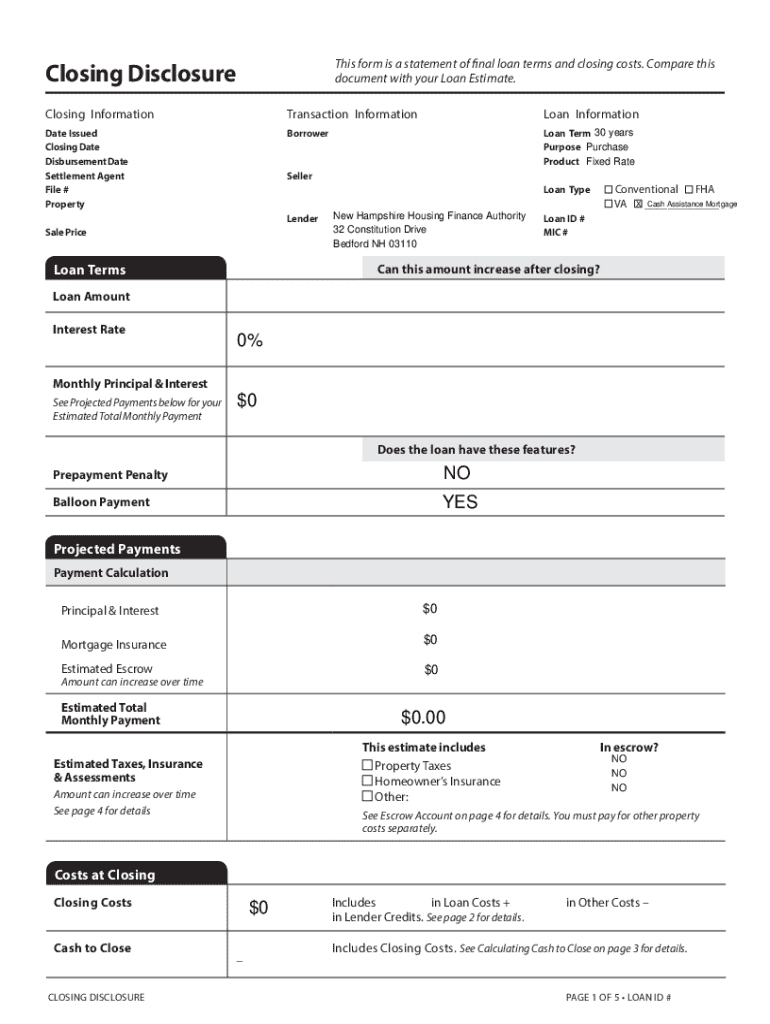

The closing disclosure form is a crucial document that provides a detailed summary of the mortgage loan terms and the final costs associated with purchasing a home. It is designed to ensure that borrowers fully understand the financial obligations they are taking on, detailing the loan amount, interest rate, and breakdown of costs at closing. This transparency is vital in helping you prepare for your financial commitment.

Comparison with the Loan Estimate shows key differences—while the Loan Estimate provides preliminary terms and costs shortly after applying for a mortgage, the closing disclosure form provides the finalized numbers, which are binding at the time of closing. Understanding these distinctions is key to successfully navigating the mortgage process.

Importance of the closing disclosure

The closing disclosure is significant because it serves as a final watchpoint in the mortgage process, making sure that all parties involved are on the same page regarding the terms of the loan. This form highlights essential loan details and ensures that the buyer is not caught off guard by unexpected fees or terms.

Understanding the details of the closing disclosure is vital. It helps you verify that the agreement aligns with what you were initially presented and agreed upon, supplies necessary information to ask the right questions before sealing the deal, and promotes informed decision-making, ultimately empowering you in the home-buying journey.

Overview of the closing disclosure components

The closing disclosure form features several important sections that summarize the terms of your mortgage. Each part plays a role in helping you understand your obligations as well as the overall cost of your purchase.

Filling out the closing disclosure form

Completing the closing disclosure form requires careful attention to detail. You should begin with the loan terms, ensuring the interest rate and the amount aligns with your expectations. Proceed through each section systematically, confirming that all numerals match what was discussed in prior documents. If applicable fields are blank or entries are missing, be pro-active in seeking clarification.

Common pitfalls include miscommunication regarding the loan terms or overlooking cost discrepancies, which can lead to unexpected financial responsibilities. To avoid these issues, double-check each figure and don't hesitate to ask your lender for clarification on any unfamiliar terms.

Reviewing your closing disclosure

Before signing the closing disclosure, it's essential to review the form meticulously. Start by comparing your closing disclosure with your loan estimate. This comparison can highlight any discrepancies between what you expected and what has now been finalized. If you find significant differences in loan amounts, interest rates, or closing costs, raise these issues with your lender promptly.

Key details to verify include the loan amount, interest rate, monthly payment calculations, and the closing costs breakdown. Ensuring these align with your original understanding protects you against unexpected surprises at closing.

Legal requirements and timelines

Understanding the legal obligations regarding the closing disclosure is vital for buyers. The ‘3-day rule’ stipulates that you must receive the closing disclosure at least three business days before your closing day. This timeline allows you to review the finalized terms and ask questions if necessary, ensuring you're fully informed.

Lenders are legally obligated to provide this document in a timely manner, allowing you sufficient time to digest the information presented. This process is designed to protect consumers and promote transparent transactions.

Managing your closing disclosure

Efficient management of your closing disclosure is crucial. Regularly review the document leading up to your closing date to identify any last-minute changes. If you notice that you have not received the closing disclosure within the required time frame, promptly contact your lender to request it.

Best practices involve keeping a digital and paper copy of your closing disclosure. Utilize a secure cloud-based platform, like pdfFiller, to store and access the document from anywhere, ensuring it is easy to reference when needed.

Frequently asked questions (FAQs)

Several essential queries often arise concerning the closing disclosure. What happens after signing the closing disclosure? Your mortgage process will progress towards finalizing your loan and preparing for the closing meeting with your seller or agent.

It is also worth noting that signing the closing disclosure does not obligate you to take on the loan; it is a step towards understanding your commitment. Furthermore, you should receive a copy of this document, and if there are discrepancies between your closing disclosure and the loan estimate, discussions should be held with your lender for resolution.

Next steps after reviewing your closing disclosure

After thoroughly reviewing your closing disclosure, prepare for your closing meeting by ensuring all your documents are in order. Gather any personal identification and financial documents that may be required during the signing process.

Tips for moving forward include formulating a list of final questions to pose during the closing meeting, confirming timing details, and understanding your immediate responsibilities post-closing, including setting up your mortgage payments.

Resources for further assistance

If you seek additional educational content on mortgages and forms, reputable websites and government resources can provide valuable information. Resources like the Consumer Financial Protection Bureau (CFPB) have excellent references on navigating closing disclosures. For personalized guidance, consider reaching out to mortgage experts or brokers who can provide tailored assistance.

Additionally, maintaining contact with your real estate agent can also provide reassurance and support during your closing process.

How pdfFiller can help

pdfFiller offers powerful features for managing your closing disclosure form effectively. With its intuitive interface, users can easily edit PDFs, eSign documents, and collaborate with necessary parties, all from a single cloud-based platform. This accessibility ensures that your closing disclosure is not only up-to-date but also securely stored.

Moreover, pdfFiller enhances the user experience with seamless editing tools and flexible options to sign or send documents from any device, providing peace of mind during this crucial stage of the mortgage process.

Real-life scenarios and examples

Understanding the closing disclosure is sometimes best achieved through illustrative examples. Consider a sample filled-out closing disclosure form that accurately outlines all expenses for a home purchase. This example should clarify how various costs align and helps visualize how funds are allocated at closing.

Case studies of common issues—like discrepancies in loan amounts or unexpected fees—demonstrate the importance of reviewing each section thoroughly. These real-life situations can provide insight into how issues can often be resolved through diligent communication with lenders and real estate professionals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pdffiller form directly from Gmail?

Can I create an eSignature for the pdffiller form in Gmail?

How do I fill out pdffiller form on an Android device?

What is closing disclosure?

Who is required to file closing disclosure?

How to fill out closing disclosure?

What is the purpose of closing disclosure?

What information must be reported on closing disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.