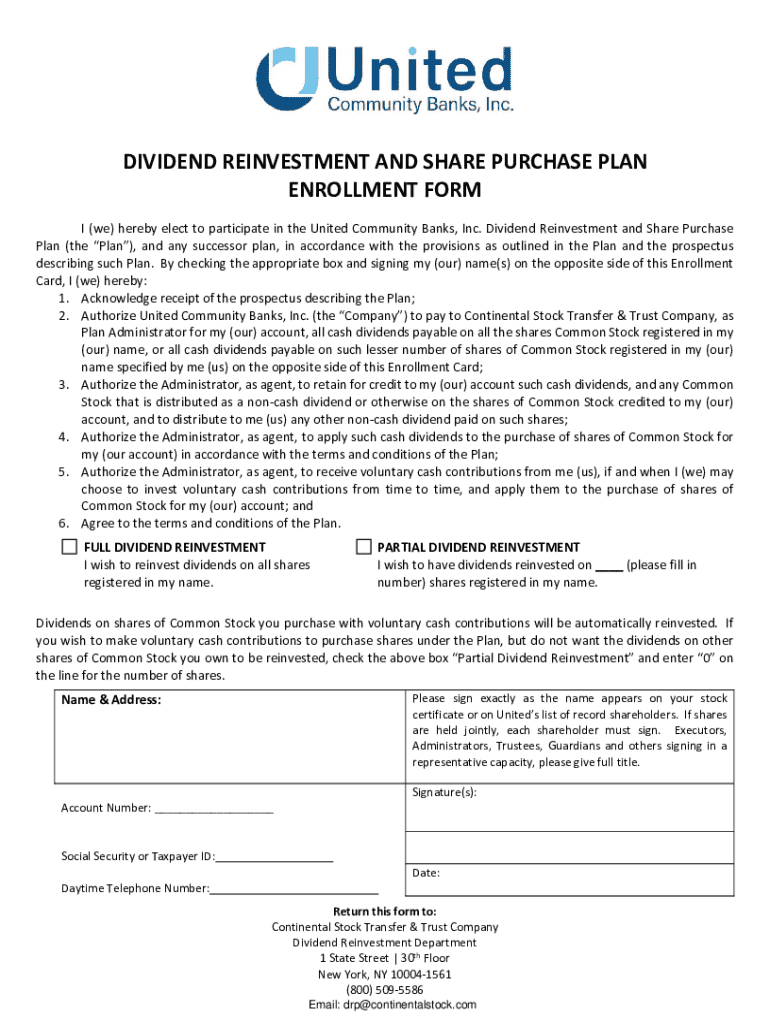

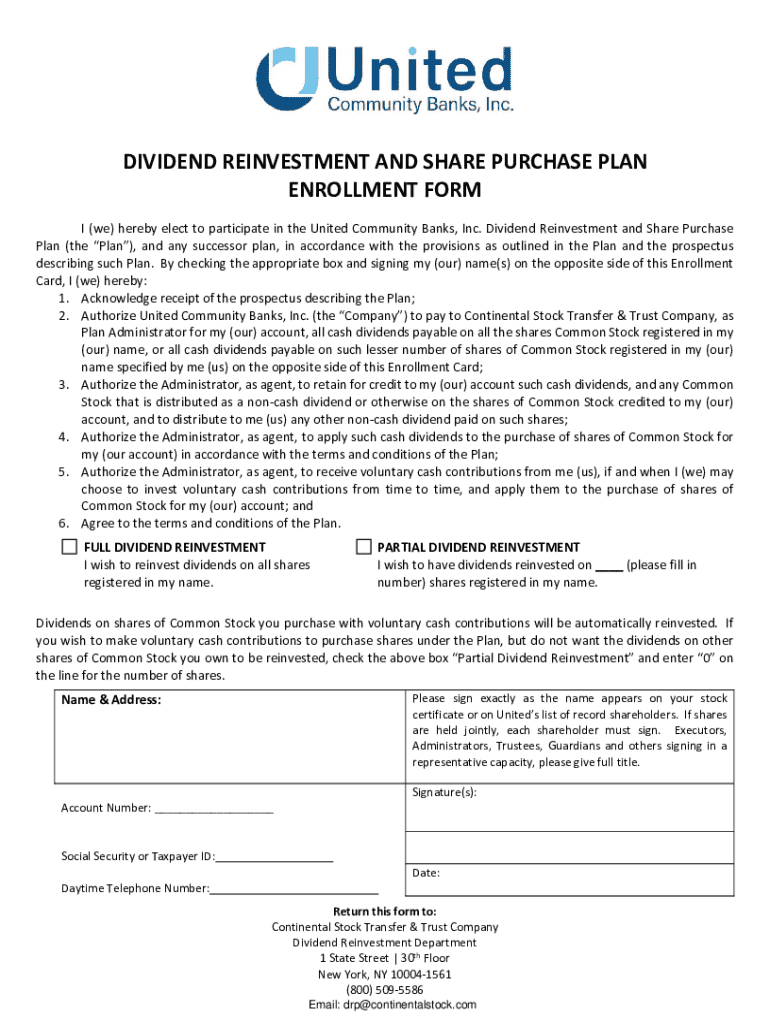

Get the free Dividend Reinvestment and Share Purchase Plan Enrollment Form

Get, Create, Make and Sign dividend reinvestment and share

Editing dividend reinvestment and share online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dividend reinvestment and share

How to fill out dividend reinvestment and share

Who needs dividend reinvestment and share?

Understanding Dividend Reinvestment and Share Form

Understanding Dividend Reinvestment Plans (DRIPs)

Dividend Reinvestment Plans (DRIPs) provide investors with a systematic approach to enhance their investment portfolios by allowing them to reinvest dividends earned from their investments into additional shares. Through this mechanism, investors can capitalize on the power of compounding, effectively increasing their stake in the company without incurring transaction fees typically associated with buying shares in the open market.

When dividends are issued, rather than receiving cash, participants can opt to reinvest those funds automatically in more shares. This strategy not only promotes growth but also leads to a larger aggregate number of shares owned over time, potentially translating to higher earnings as the company continues to perform well.

Types of DRIPs Available

Investors can choose from two main types of DRIPs: company-sponsored and broker-sponsored plans. Company-sponsored DRIPs are directly offered by the corporation, allowing the shareholder to purchase additional shares at a discount. In contrast, broker-sponsored DRIPs utilize a brokerage firm to manage investments in various companies, offering flexibility and broader investment options.

Selecting the right DRIP is critical, as some come with varying fees, minimum investment requirements, and different policies concerning the buying of fractional shares, which can influence overall investment growth.

Importance of the Dividend Reinvestment and Share Form

The Dividend Reinvestment and Share Form is a crucial document for investors looking to manage their DRIPs effectively. This form serves not only as a means to enroll in a DRIP but also allows for the updating of critical investment information, such as dividend preferences and personal details.

Completing this form can initiate an immediate reinvestment of dividends. However, investors should be aware of the implications regarding timing — submissions may affect whether reinvestments take place promptly or in future dividend cycles.

Investors should also understand the tax considerations tied to their investments, as reinvested dividends may still be taxable events, impacting their overall financial strategy.

Step-by-step guide to completing the Dividend Reinvestment and Share Form

Completing the Dividend Reinvestment and Share Form requires careful attention to detail and the gathering of necessary information before submission. First, investors should collect personal identification details, such as their full name, address, Social Security number, and investment account number.

Next, the form typically consists of several sections, including personal identification, dividend preferences (either cash payout or reinvestment), and any signature requirements. Investors should read each section thoroughly to avoid common mistakes, such as omitting required fields or submitting incorrect numbers.

After submission, investors should monitor the confirmation status to ensure the form is processed correctly and promptly.

Tools and features for managing your dividend reinvestment plans

Using platforms like pdfFiller enhances the document management process related to Dividend Reinvestment Plans. With interactive tools available on pdfFiller, users can edit forms with customizable fields that allow for easy adjustments to their investment preferences. This flexibility is essential as market conditions change or as personal financial strategies evolve.

Moreover, pdfFiller’s eSigning capabilities streamline the approval process, ensuring that forms can be signed, stored, and shared electronically, which is ideal for those managing joint accounts or working as part of an investment team.

Troubleshooting common issues with the Dividend Reinvestment and Share Form

Errors on the Dividend Reinvestment and Share Form can lead to significant issues, particularly if incorrect information is submitted. If investors discover mistakes after submission, they must take immediate steps to rectify these errors to avoid delays in enrollment or incorrect investment allocation.

Additionally, understanding the average processing times for enrollment can mitigate frustration. Should delays occur, a follow-up with customer service can provide clarity on the status of form processing and help resolve any potential complications.

Tips for efficient document management

Keeping track of your DRIP enrollments and related documents is essential for effective investment management. Maintaining an organized record of each transaction, reinvestment, and form can provide insights into your overall investment strategy and performance. It’s particularly valuable during tax preparation, ensuring you have documentation readily available about earned dividends.

Utilizing pdfFiller's capabilities, including their cloud storage solutions, allows you to access your investment documents from any device, streamlining your investment management process. This ensures that you can make informed decisions promptly based on your most current financial data.

Essential guidelines for investors

Regularly reviewing your investment strategy is crucial for any investor engaging with Dividend Reinvestment Plans. Importantly, you should establish criteria that signify when it might be appropriate to adjust DRIP participation, such as changes in financial goals or significant shifts in market conditions.

Investors should also weigh the merits of diversification versus reinvestment. While reinvesting can compound growth within a single company, diversifying investments can help mitigate risks associated with exposure to individual stocks, thus contributing to overall financial security.

Contact pdfFiller for assistance

Navigating document-related inquiries, especially concerning the Dividend Reinvestment and Share Form, is made easier with pdfFiller’s customer service options. The platform offers live support during business hours, ensuring that users can receive timely assistance with their questions.

For users who prefer written communication, email support is also available. pdfFiller is dedicated to providing personalized assistance for your investment forms, ensuring you can manage your documents efficiently and confidently.

Employing the tools offered by pdfFiller, users can enhance their document-organizing capabilities while ensuring they have comprehensive knowledge regarding mutual investments and accounting processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit dividend reinvestment and share from Google Drive?

Can I sign the dividend reinvestment and share electronically in Chrome?

How do I edit dividend reinvestment and share straight from my smartphone?

What is dividend reinvestment and share?

Who is required to file dividend reinvestment and share?

How to fill out dividend reinvestment and share?

What is the purpose of dividend reinvestment and share?

What information must be reported on dividend reinvestment and share?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.