Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out beneficial ownership form

Who needs beneficial ownership form?

Beneficial Ownership Form: A Complete How-to Guide

Understanding beneficial ownership

Beneficial ownership refers to the identification of individuals who ultimately own or control a company or entity, irrespective of the name registered on legal documents. This concept plays a crucial role in ensuring transparency in financial transactions and corporate governance.

Capturing beneficial ownership information is essential for preventing fraud, money laundering, and other illicit activities. It creates a clear picture of who is behind a corporate structure and ensures that appropriate due diligence can be conducted.

Across various jurisdictions, regulations mandate disclosure of beneficial ownership, reflecting a global effort to combat financial crimes and promote transparency. Understanding these regulations is vital for businesses to remain compliant and avoid potential legal repercussions.

Why you might need a beneficial ownership form

Many businesses are required to file a beneficial ownership form, particularly as governments globally tighten regulations. Large corporations often have more complex ownership structures that necessitate clear identification of beneficial owners.

Small businesses are not exempt from these requirements, especially when they engage with financial institutions or government contracts. Non-compliance can lead to significant penalties, reputational damage, and hindering business operations.

Reporting requirements for the beneficial ownership form

Reporting requirements are primarily influenced by federal mandates which require businesses to maintain up-to-date beneficial ownership records. The obligations can vary significantly depending on the industry and the financial institutions involved.

It's important to differentiate between federal reporting requirements and those established by financial institutions since each may have specific stipulations that influence how beneficial ownership details should be documented.

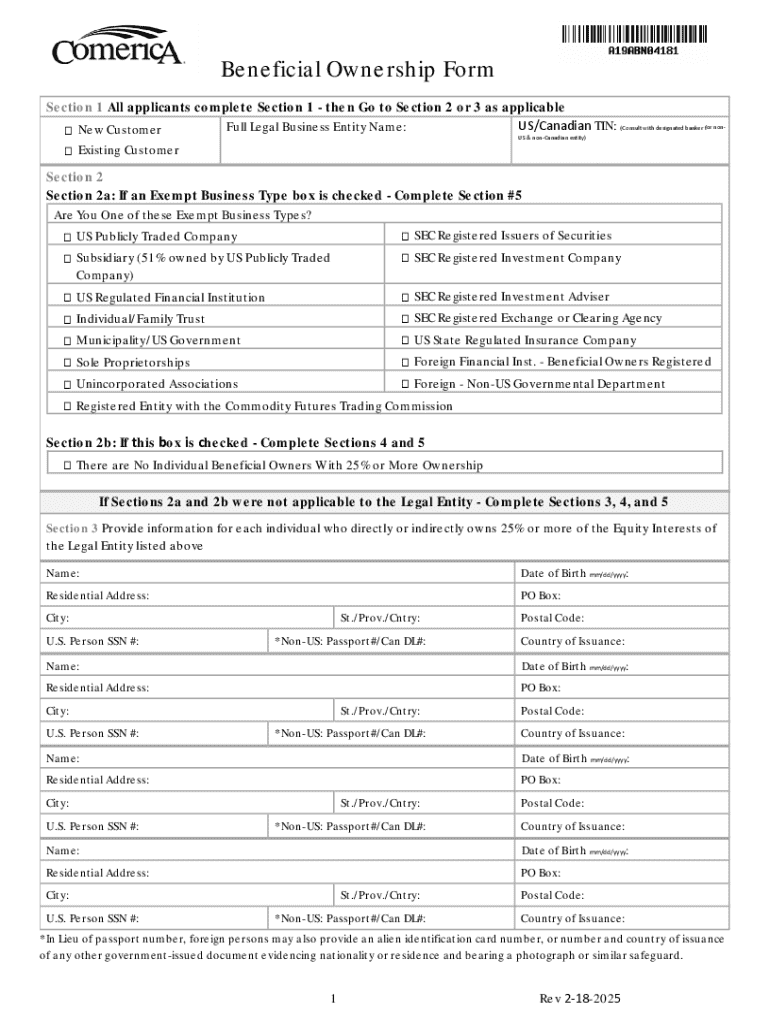

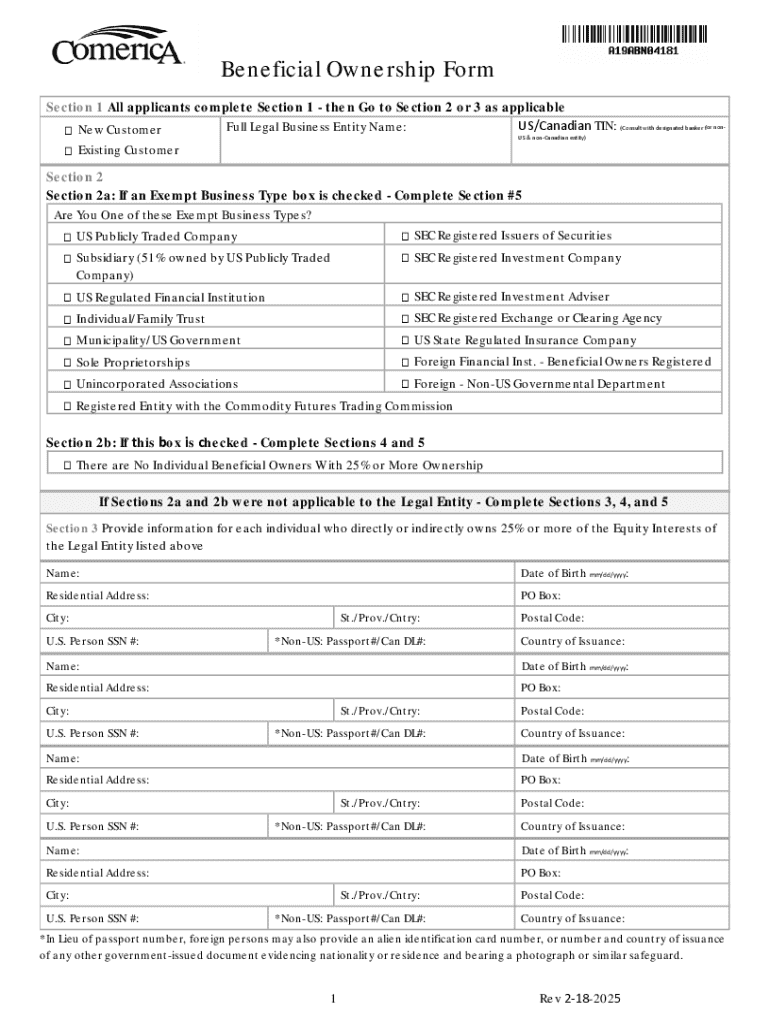

Step-by-step guidance on completing the beneficial ownership form

Step 1: Determine your business's obligations

The first step in completing a beneficial ownership form is assessing your business structure. If your business is a corporation, the ownership reporting requirements may differ from those of a partnership or limited liability company (LLC).

Key factors to establish the necessity of filing include the size of the business, where larger entities more often face stringent reporting mandates, and the nature of operations, as specific industries have their unique regulatory environments.

Step 2: Identifying your beneficial owners

Beneficial owners are defined as individuals who directly or indirectly possess significant ownership interest or control over the company. Identifying them involves assessing both ownership percentages and the control they exert over business decisions.

To complete this accurately, documentations such as share certificates, voting records, and corporate governance documents may be required. This step ensures that all stakeholders understand the true nature of ownership.

Step 3: Creating your reporting procedure

Establishing internal compliance protocols is crucial. Designating specific responsibilities within your team for maintaining and updating ownership information protects against lapses when reporting periods arrive.

Additionally, leveraging technology, such as document management systems provided by pdfFiller, can streamline the process. By centralizing ownership data, businesses can easily access and update this information as necessary.

Step 4: Filling out the beneficial ownership form

When filling out the beneficial ownership form, each section requires detailed personal and ownership information. Clarity in this stage is critical, as inaccuracies can lead to compliance issues.

Common mistakes to avoid include not verifying owners' information and failing to represent the ownership structure accurately. Take time to thoroughly review all data before submission to mitigate any potential errors.

Step 5: Filing your report online

Accessing the online filing system is the final step, where you will submit your completed beneficial ownership form. Follow the system prompts for efficient submission, and be mindful of deadlines to ensure compliance.

Avoid last-minute filings; instead, establish a timeline that allows ample time to revise and confirm all information is accurate.

Managing your beneficial ownership records

Maintaining updated beneficial ownership records is essential for ongoing compliance. Establish a best practices framework for document management, ensuring information remains current and easily accessible.

Leveraging tools like pdfFiller offers multiple features for seamless editing, collaboration, and eSign capabilities. By utilizing document history features, businesses can track ownership changes and maintain a comprehensive audit trail.

FAQs on beneficial ownership forms

Navigating the complexities of beneficial ownership forms can lead to common questions and concerns. One frequently asked question is about uncertainty regarding the identification of beneficial owners. It’s vital to seek legal counsel if there is any confusion.

Many businesses wonder if they can update the form after submission. Generally, yes; filing updates can be done as changes occur in the ownership structure. Additionally, some may inquire about the duration of the filing process, which often depends on the specifics of the jurisdiction and the thoroughness of the documentation provided.

Final thoughts on beneficial ownership reporting

Complying with beneficial ownership reporting not only helps in adhering to regulatory standards but also builds trust with stakeholders and regulatory bodies. This transparency is increasingly expected in today's business landscape.

Using resources like pdfFiller can facilitate the process of reporting, allowing businesses to focus on their core operations while maintaining compliance and ensuring responsible governance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pdffiller form directly from Gmail?

How do I complete pdffiller form online?

How can I fill out pdffiller form on an iOS device?

What is beneficial ownership form?

Who is required to file beneficial ownership form?

How to fill out beneficial ownership form?

What is the purpose of beneficial ownership form?

What information must be reported on beneficial ownership form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.