Get the free C3 Cash Receipts Monetary Contributions - web pdc wa

Get, Create, Make and Sign c3 cash receipts monetary

Editing c3 cash receipts monetary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out c3 cash receipts monetary

How to fill out c3 cash receipts monetary

Who needs c3 cash receipts monetary?

A comprehensive guide to the -3 cash receipts monetary form

Overview of the -3 cash receipts monetary form

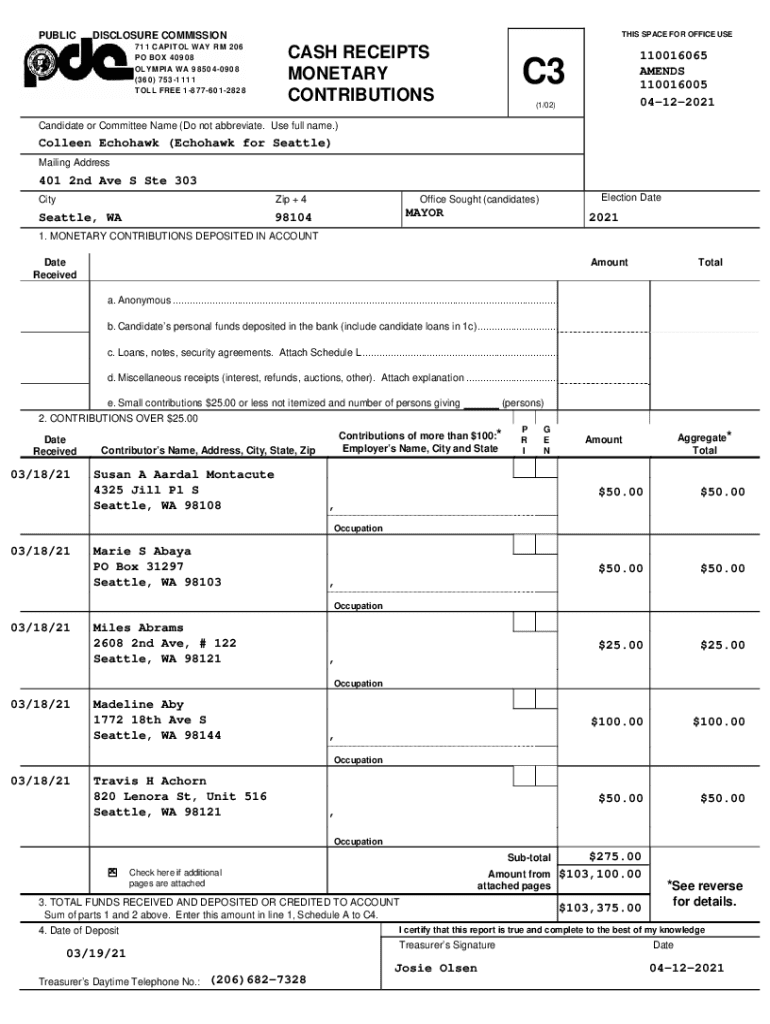

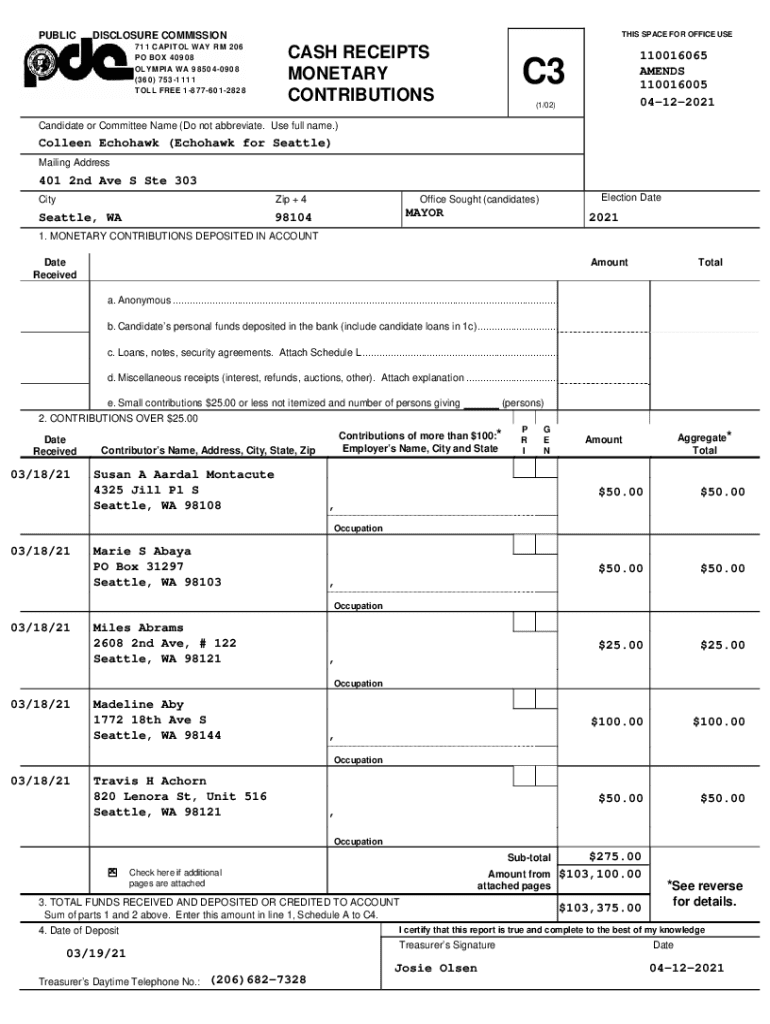

The C-3 cash receipts monetary form is a vital document used in various sectors to accurately track and report monetary contributions received by organizations. This form serves as a record of all cash transactions, ensuring transparency and accountability in financial practices. Its significance cannot be overstated, as it directly impacts financial reporting accuracy, compliance with regulatory standards, and the overall integrity of an organization’s financial health.

Inaccuracies in cash receipts reporting can lead to serious implications, including non-compliance with tax regulations, misrepresentation of funds, and potential reputational damage. Entities utilizing the C-3 form must prioritize accuracy in their reporting to avoid penalties and ensure they meet the required financial transparency standards. This importance is underscored by regulatory requirements that dictate thorough record-keeping and reporting practices.

Understanding key components of the -3 form

The C-3 form encompasses several key components that must be meticulously filled out to comply with reporting standards. Required information includes personal details of contributors such as names, addresses, and the amount contributed. Additionally, organizations need to provide their own details, including name, address, and type of entity to ensure correct identification in financial reports.

Monetary contributions eligible for reporting on the C-3 form include various forms such as cash, checks, and electronic payments. Each contribution type must be documented accurately to reflect the true nature of the funds received. Furthermore, it's essential to clarify any exemptions or special cases that may apply, such as contributions from anonymous sources or specific sponsorship arrangements that might not require reporting.

Step-by-step instructions for completing the -3 form

Completing the C-3 form requires careful attention to detail. Preparation before filling out the form includes gathering all necessary documents, such as contributor records and previous financial reports. A checklist of essential items to have on hand includes identification numbers, contribution amounts for each source, as well as dates and types of monetary contributions.

Begin the form by entering accurate contributor information, such as full names and addresses. Then, report each contribution, specifying the amount and type of payment. It’s crucial to classify receipts correctly, distinguishing between cash, checks, and electronic transactions. Finally, ensure to total the receipts at the end of the reporting period, allowing for easy reference and verification.

Common errors to avoid include mismatches in contributor information and misclassifying contribution types, which can lead to compliance issues. Double-check all entries for accuracy before submission to ensure a smooth filing process.

Filing and submitting the -3 cash receipts form

Filing the C-3 form can be conducted electronically or through traditional paper methods. For those opting to file online, pdfFiller offers straightforward options for submitting the form quickly and efficiently. Users should follow the platform's prompts to ensure that all required fields are filled before moving to the submission stage.

Important deadlines for submission include the end of each fiscal quarter or specific reporting periods mandated by regulatory bodies. It's crucial to be aware of these deadlines to avoid late penalties. For paper submissions, guidelines generally dictate that the form should be mailed to the proper authority or dropped off during designated office hours to ensure timely processing.

Managing cash receipts using pdfFiller

pdfFiller provides interactive tools that simplify document management, making the completion and submission of the C-3 form more efficient. Users can leverage features that allow for the easy editing of PDF files, integration of electronic signatures, and options to collaborate with team members in real time, enhancing the overall productivity of financial reporting tasks.

With pdfFiller's collaboration features, teams can work together more seamlessly, allowing for multiple contributors to review and modify the document simultaneously. Security measures implemented in pdfFiller ensure that sensitive financial information is protected, providing users peace of mind regarding the confidentiality of their data.

Addressing common questions and concerns

Common queries surrounding the C-3 cash receipts monetary form often focus on aspects such as correction procedures and verification of contributions. If a mistake is made on the C-3 form, it is essential to amend the details promptly by following the specified correction protocols outlined by regulatory bodies. Contribution verification typically involves cross-referencing contributor details with their provided data to ensure authenticity and compliance.

Failure to file the C-3 form properly can lead to significant consequences, including fines and legal repercussions. Maintaining compliance demands regular review and adherence to best practices, including keeping comprehensive records and completing forms meticulously to uphold financial integrity.

Related forms and reports

Understanding the C-3 form is enhanced by exploring related forms such as the C-1 and C-4 forms, which might serve different reporting purposes. Each of these forms contributes to an overall financial reporting framework that organizations must navigate to ensure comprehensive compliance.

The C-3 cash receipts form notably complements other financial reports by providing essential monetary tracking, ensuring all contributions are duly recorded, and fulfilling regulatory demands with accuracy. Recognizing how these forms interlink can significantly aid organizations in enhancing their financial documentation procedures.

Leveraging pdfFiller for a seamless document experience

Utilizing pdfFiller for managing the C-3 cash receipts monetary form brings numerous advantages, such as streamlining document creation and editing processes. The platform’s user-friendly interface and robust features make it easier for individuals and teams to stay organized and compliant in their reporting.

User testimonials highlight the effectiveness of pdfFiller in optimizing financial documentation practices, with many reporting increased efficiency in completing forms and improved collaboration among team members. Real-world examples illustrate how pdfFiller has transformed the document management experience for various organizations.

Enhancements and updates to pay attention to

Keeping abreast of recent changes in reporting requirements or regulations related to the C-3 cash receipts monetary form is essential for compliance. Organizations must be proactive in adapting to updates that might affect how they report contributions, ensuring an ongoing commitment to financial integrity.

The future outlook for electronic filing systems and document management highlights an evolution toward increased automation and enhanced functionalities. Innovations in document management tools will likely provide even greater opportunities for ensuring compliance and facilitating easier submission processes, thereby setting a standard for best practices in financial reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send c3 cash receipts monetary for eSignature?

How do I edit c3 cash receipts monetary straight from my smartphone?

How do I edit c3 cash receipts monetary on an iOS device?

What is c3 cash receipts monetary?

Who is required to file c3 cash receipts monetary?

How to fill out c3 cash receipts monetary?

What is the purpose of c3 cash receipts monetary?

What information must be reported on c3 cash receipts monetary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.