Get the free Claims Form - i-c-w co

Get, Create, Make and Sign claims form - i-c-w

Editing claims form - i-c-w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claims form - i-c-w

How to fill out claims form

Who needs claims form?

Understanding the --W Claims Form: A Comprehensive Guide

Understanding the --W Claims Form

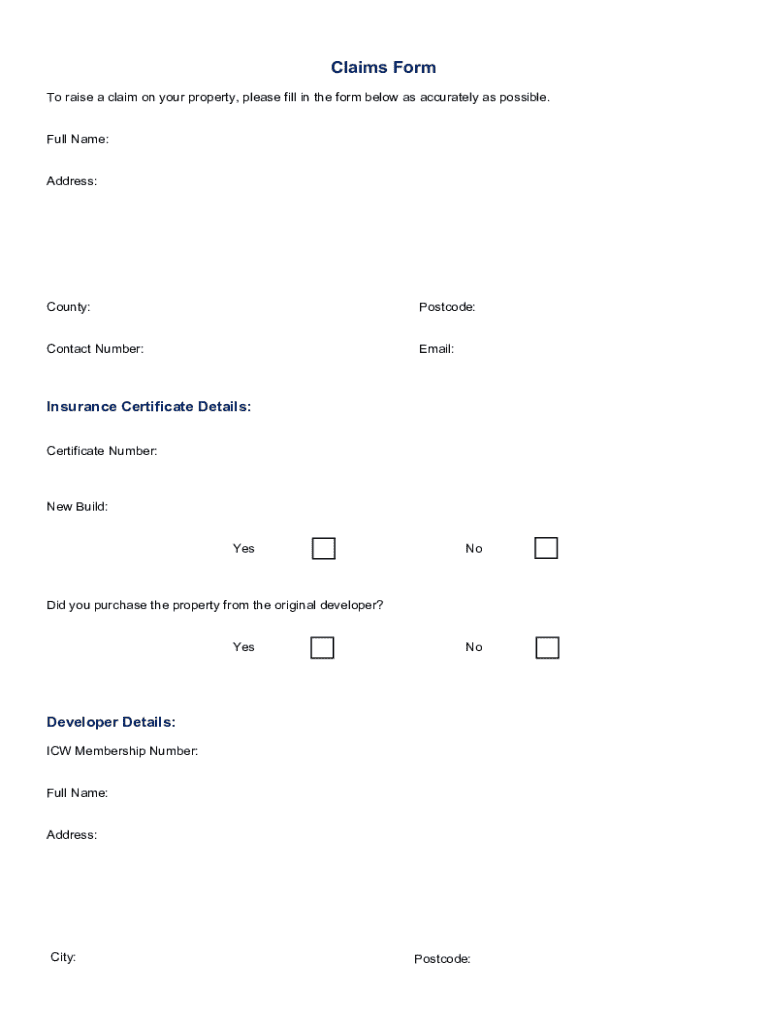

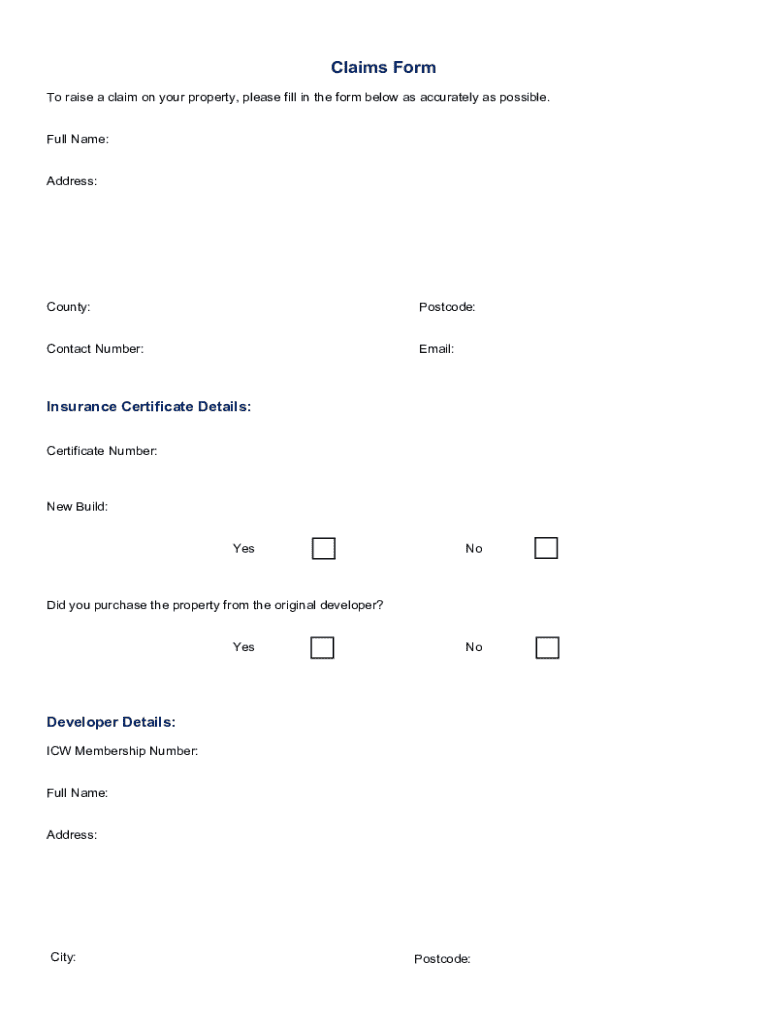

The I-C-W Claims Form is a specialized document used in the insurance claims process, primarily aimed at reporting incidents and seeking compensation for various types of losses. This form serves as an official record, detailing the circumstances surrounding the claim, the parties involved, and related evidence. As a pivotal tool within the claims mechanism, it ensures that all pertinent information is conveyed clearly, facilitating a smoother processing experience for the claimant.

The purpose of the I-C-W Claims Form extends beyond mere submission; it encapsulates the narrative of your claim, providing insurance companies with essential data they need to evaluate the situation effectively. Whether you are filing for medical expenses, wage loss, or other types of claims, this form acts as the foundational document that can significantly influence the outcomes of your claims process.

When to use the --W Claims Form

Understanding when to use the I-C-W Claims Form is crucial for both individuals and teams involved in various claims situations. Common scenarios for utilizing this form include incidents such as workplace accidents, personal injury events, or vehicle accidents. Essentially, if there is a situation where an individual or entity seeks compensation for a loss incurred due to another party's actions, the I-C-W Claims Form is typically required.

Additionally, teams often find themselves needing to utilize the I-C-W Claims Form in instances such as group health claims or collective injuries arising from a single event. Recognizing the moments when this form is applicable can lead to a more organized and efficient claims process, ensuring that all relevant details are documented in a timely manner.

Preparing to fill out the --W Claims Form

Before diving into filling out the I-C-W Claims Form, being prepared is key to ensuring all information is captured correctly. Essential information needed includes personal details such as your full name, contact information, and any relevant identification numbers. Additionally, a detailed description of the claim is vital; this includes information about the incident, the date it occurred, and the nature of the claim you are filing.

Gathering supporting documents is equally important. These can include medical reports outlining treatments received, photographs from the incident scene, and any prior correspondence related to the claim. Having these documents ready will not only streamline the filling process but also strengthen your case when submitted.

Step-by-step instructions for filling out the --W Claims Form

Filling out the I-C-W Claims Form can seem daunting, but breaking it down into manageable sections simplifies the process. Start with Section 1: Claimant Information, where you will provide your personal identification details, including your full name and contact information. Accuracy here is crucial, as this information ensures that claim correspondence reaches you without issue.

Next, proceed to Section 2: Incident Details, and describe the incident accurately. Include crucial information such as the date, location, and specifics of what transpired. The more detail you provide, the better the claims adjuster will understand the context.

In Section 3: Nature of the Claim, clearly state the type of claim you are filing, whether it pertains to medical expenses, lost wages, or property damage. Section 4: Supporting Information focuses on attaching relevant documents and evidence; ensure documents are clearly labeled and organized.

Finally, conduct a thorough review of the form before submission. Check for completeness and accuracy in every section to avoid delays in processing your claim.

Editing and signing the --W Claims Form

After filling out the I-C-W Claims Form, editing it for any mistakes or necessary adjustments is essential. Utilizing tools like pdfFiller simplifies this process considerably. With pdfFiller, users can easily edit the PDF document, ensuring all information is accurate before finalization. This cloud-based solution not only streamlines the editing process but also allows for collaboration among team members who may need to review the claim details.

Once the editing is complete, eSigning the I-C-W Claims Form is the next step. pdfFiller provides an easy platform for signing documents electronically, making it a secure and efficient method to authorize your claim without the need for physical paperwork. This modern approach to signing ensures quicker turnaround times and enhances the user experience.

Submitting the --W Claims Form

With the I-C-W Claims Form completed and signed, the next step is submission. Knowing where to send your claim is crucial to ensure timely processing. Typically, you will submit the form to your insurance provider's claims department. Refer to your insurance policy for specific details on where to send your claim, as many providers offer online submission portals.

In addition to mailing, alternative submission options may include faxing or in-person delivery to an insurance office. Whichever method you choose, it’s important to maintain documentation of your submission, as this will help in case of any disputes regarding your claim status. After submitting, you can expect a confirmation from your provider, which may take several business days depending on their procedures.

Managing your claim post-submission

Once your I-C-W Claims Form is submitted, the next phase involves actively managing your claim's status. It's advisable to monitor your claim closely, checking in regularly for updates. Many insurance providers offer online claim tracking utilities, which can give you insights into your claim status and any required follow-up actions.

Following up with your claims examiner is another key step post-submission. When reaching out to them, be prepared with your claim number and any relevant information regarding your submission. This preparation can facilitate a smoother communication experience and potentially clear up any questions that the claims examiner may have regarding your claim.

Troubleshooting common issues with the --W Claims Form

In the realm of insurance, it's not uncommon for claims to face delays or rejections. Understanding common reasons for these issues can enable you to address them proactively. Insufficient documentation is a frequent cause for denial; thus, ensuring your I-C-W Claims Form is well-supported with the correct documents is vital.

If you discover that your claim is delayed or rejected, familiarize yourself with the process for amending your claim if necessary. This may involve gathering additional information and resubmitting the form. Furthermore, if you disagree with a claim decision, resources are often available for disputing these decisions, allowing you to advocate for your rights effectively.

Frequently asked questions (FAQs) about the --W Claims Form

Navigating the I-C-W Claims Form may raise questions, and knowing the answers can help ease your process. One common query pertains to deadlines; it’s crucial to familiarize yourself with your specific insurance provider's time frames for filing the I-C-W Claims Form to avoid any complications.

Another frequent question is whether you can file a claim without all supporting documents. While it’s encouraged to submit all required documentation upfront for a stronger claim, some insurance providers may allow you to file a claim initially and provide supporting documents later. Lastly, if information needs to be updated after submission, contacting your claims examiner promptly is essential, as this can help keep your claim on track.

Resources for assistance

Should you require further support regarding the I-C-W Claims Form, numerous resources are available. Websites like pdfFiller provide comprehensive guides, videos, and tutorials on filling out and managing various claims forms. Additionally, pdfFiller offers customer support via live chat or email, ready to assist you with any questions or challenges you may encounter during your claims journey.

Utilizing these resources can enhance your understanding and streamline the completion of your I-C-W Claims Form, aiding you in successfully navigating the claims process. With the right tools and knowledge, achieving a positive outcome from your claim becomes increasingly possible.

Enhancing your document creation skills with pdfFiller

To truly maximize your efficiency in handling the I-C-W Claims Form and other documents, leveraging platforms like pdfFiller can significantly enhance your document creation capabilities. The platform offers collaboration tools that allow teams to manage claims collectively, ensuring that everyone is aligned and informed throughout the process.

Moreover, pdfFiller’s cloud-based storage ensures that your essential claims documents are secure yet readily accessible from anywhere. Adopting best practices for document security and storage, such as regular backups and enabling two-factor authentication, can further protect your sensitive information, ensuring a seamless experience when managing your claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify claims form - i-c-w without leaving Google Drive?

How do I edit claims form - i-c-w in Chrome?

Can I create an electronic signature for the claims form - i-c-w in Chrome?

What is claims form?

Who is required to file claims form?

How to fill out claims form?

What is the purpose of claims form?

What information must be reported on claims form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.