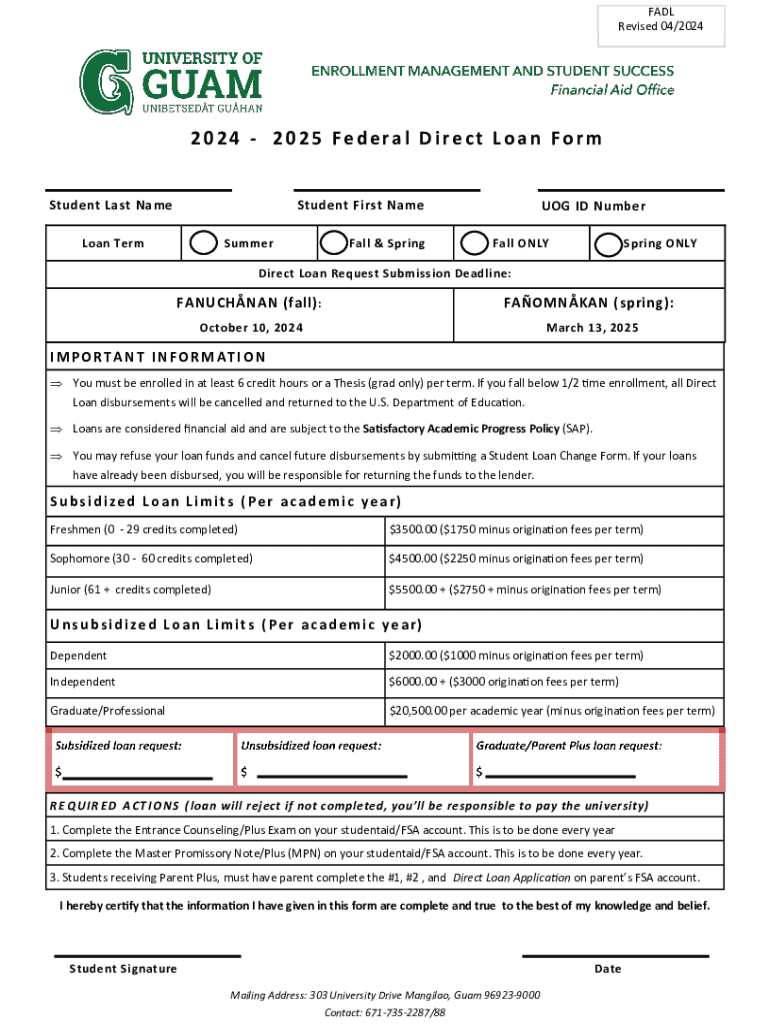

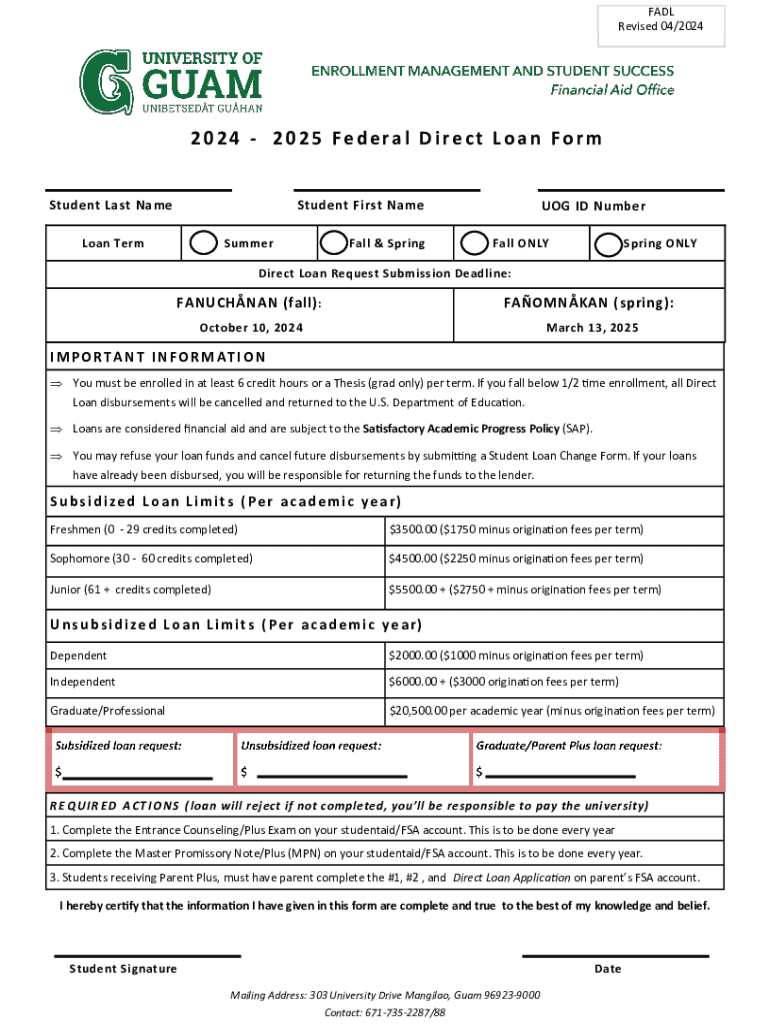

Get the free 2024 - 2025 Federal Direct Loan Form

Get, Create, Make and Sign 2024 - 2025 federal

How to edit 2024 - 2025 federal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 - 2025 federal

How to fill out 2024 - 2025 federal

Who needs 2024 - 2025 federal?

Comprehensive Guide to the 2024 - 2025 Federal Form

Overview of federal forms for 2024 - 2025

Federal forms play a crucial role in the financial landscape of 2024 - 2025, particularly for students seeking financial aid and individuals managing their tax obligations. These forms are vital in determining eligibility for grants, loans, and tax refunds, making their accurate completion essential.

Key changes from previous years include updates to eligibility criteria and the introduction of new forms that accommodate changes in federal laws. Additionally, a shift towards digital platforms simplifies the submission process, catering to a more tech-savvy population.

Detailed breakdown of specific federal forms

Navigating the specifics of federal forms can be daunting. The FAFSA, essential for securing educational funding, demands attention to detail and adherence to deadlines.

FAFSA: Filling out guide

To apply for financial aid through the FAFSA, applicants must meet specific eligibility criteria. These include being a U.S. citizen or eligible non-citizen, working toward a degree or certificate, and maintaining satisfactory academic progress.

Important deadlines are crucial — the opening date is typically October 1 of the year prior to attending college. To ensure timely processing, it's recommended to submit the FAFSA before the federal deadline, which is usually June 30.

Completing the FAFSA online involves a step-by-step process, including providing personal information, financial details, and school codes for institutions you are considering attending. Easy access to the FAFSA can be done via the official website.

Tax forms overview

For 2024 - 2025, significant updates to IRS tax forms ensure compliance with tax law changes. The W-4 form is redesigned to simplify the withholding process for employees. Understanding key revisions will help in correctly adjusting withholdings.

Understanding the federal form requirements

Each federal form requires a specific set of information to ensure proper processing. Generally, personal identification information such as your Social Security number, date of birth, and address is mandatory.

Additionally, applicants must provide detailed financial information, including income, savings, and investments. These factors influence eligibility for aid or tax deductions, making their accurate reporting critical.

Common mistakes to avoid

Many applicants overlook sections of federal forms, potentially delaying their processing or leading to inaccuracies. Double-checking all information, particularly numbers, is essential.

Verification is another crucial aspect; this process ensures that the information provided is accurate and complete. Responding promptly to requests for verification materials helps prevent delays in receiving aid.

How to edit and manage federal forms

pdfFiller provides a powerful solution for editing federal forms, enabling users to fill out and manage documents seamlessly. This tool facilitates easy uploads and detailed edits, making it a preferred choice for individuals and teams.

Using pdfFiller to edit your forms

Uploading a PDF is straightforward in pdfFiller. Simply drag and drop or select the file to edit. Features include text editing, adding images, and completing fields directly on your PDF forms.

eSigning documents for submission

Submitting federal forms often requires eSigning. pdfFiller offers a secure way to eSign documents, which is legally recognized and accepted for federal submissions. Following a few simple steps, users can easily add their signature electronically.

Collaborative features for teams

For teams working on federal forms, pdfFiller's collaborative features are invaluable. Users can invite team members to review documents, edit together, and track changes with ease. This ensures that all perspectives are considered before submission.

Interactive tools for effective form management

Interactive tools enhance the user experience in managing federal forms on pdfFiller. Form filling tutorials and real-time assistance are available to guide users at every step.

Form filling tutorials on pdfFiller

pdfFiller offers interactive video guides that elevate the form-filling process. These tutorials cover specific forms like the FAFSA and IRS tax forms, addressing common user queries.

Real-time form assistance

Users can access live chat support directly through pdfFiller, making immediate assistance available. Community forums also provide answers to frequently asked questions, creating a user-driven support environment.

Frequently asked questions about federal forms and pdfFiller features

Additional considerations for specific group scenarios

Federal forms are designed to accommodate diverse applicant backgrounds, including returning students and first-time applicants. Understanding the distinctions and requirements for each group is vital.

Returning students vs. new applicants

While returning students may have previous financial data available, new applicants must provide comprehensive details about their family's financial status. It's also essential for returning students to update any changes in status.

Veterans and adult learners are often eligible for specific aids and benefits under various programs, highlighting the importance of thorough documentation.

International students and financial aid

International students often face different requirements when applying for financial aid. Understanding eligibility for federal aid and the necessary documentation is crucial for success.

Updates and announcements for 2024 - 2025 federal forms

Players in the financial aid landscape that provide federal forms can expect several legislative updates impacting their completion and submission. Staying informed is critical.

Key legislative changes impacting federal forms

Legislative changes can directly affect eligibility and disbursement of financial aid. Awareness of these changes helps applicants to navigate potential impacts on their applications.

Upcoming workshops and webinars

Various organizations will host workshops and webinars throughout the year. These educational opportunities offer insights on navigating federal forms and complying with new regulations.

Important links and resources

Access to federal form portals is necessary for successfully navigating the submission process. Knowing where to go for the correct forms is essential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2024 - 2025 federal online?

How do I fill out 2024 - 2025 federal using my mobile device?

How do I complete 2024 - 2025 federal on an iOS device?

What is federal?

Who is required to file federal?

How to fill out federal?

What is the purpose of federal?

What information must be reported on federal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.