Get the free Employee Apportionment Worksheet

Get, Create, Make and Sign employee apportionment worksheet

Editing employee apportionment worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee apportionment worksheet

How to fill out employee apportionment worksheet

Who needs employee apportionment worksheet?

Employee Apportionment Worksheet Form: A Complete How-to Guide

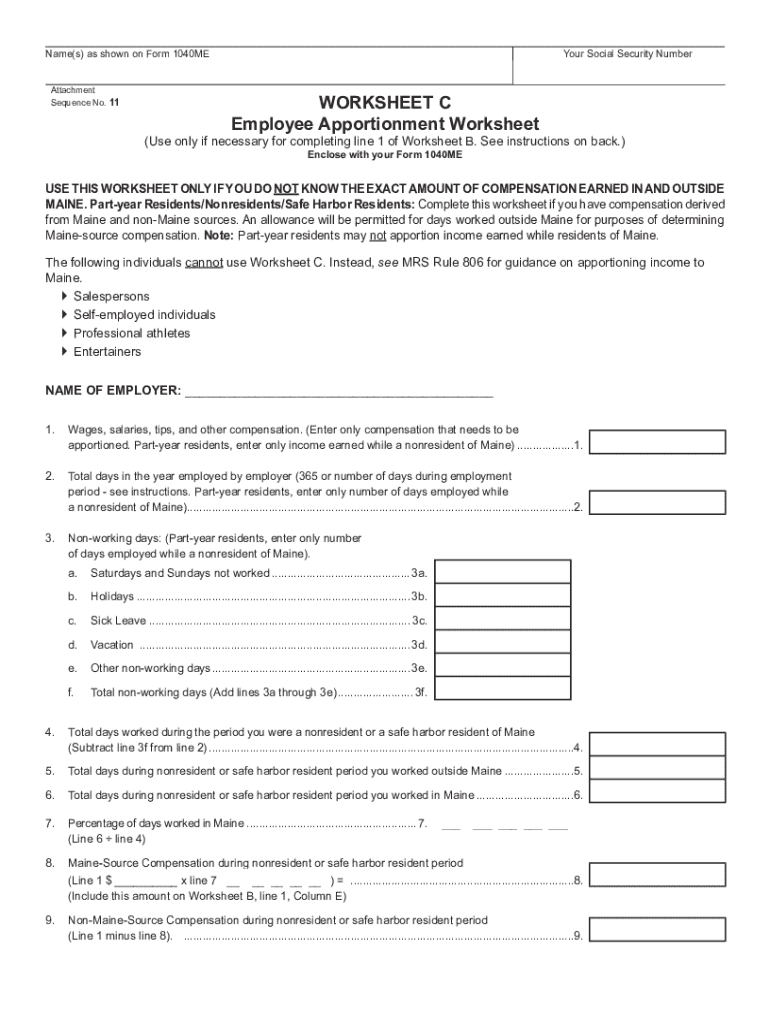

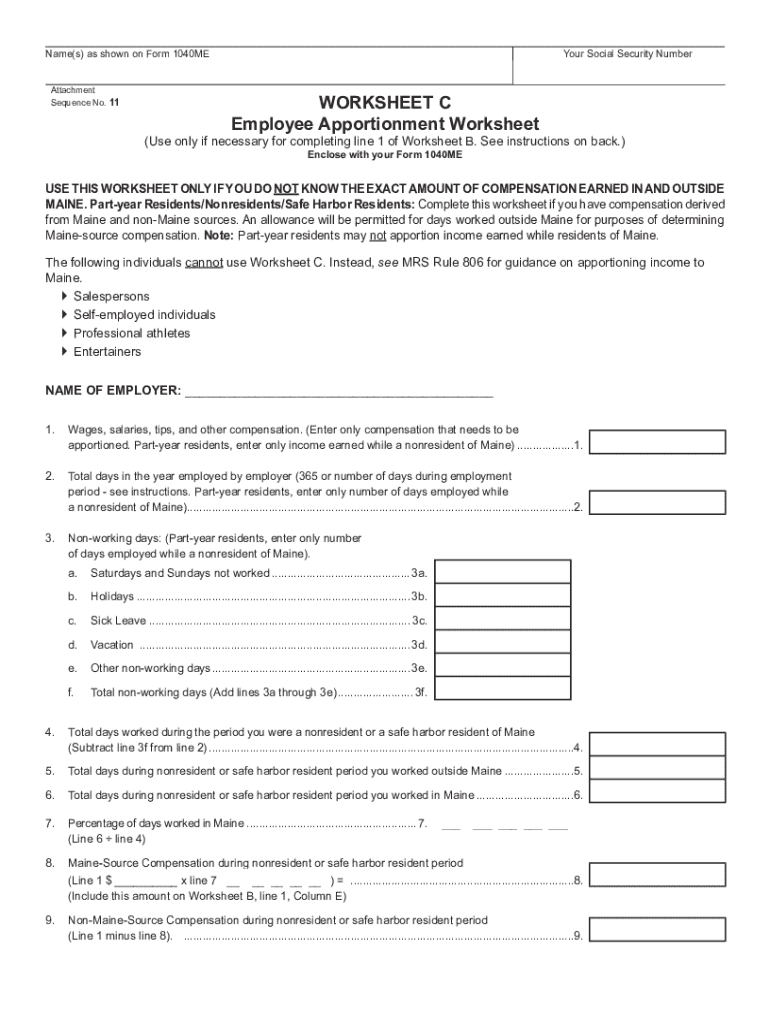

Understanding the Employee Apportionment Worksheet Form

The Employee Apportionment Worksheet Form is a critical tool for businesses to allocate costs associated with employee compensation accurately. This document allows organizations to break down employee expenses in a structured manner, which is essential for internal budgeting and external tax compliance. By maintaining clarity in how costs are distributed among various projects or departments, businesses can ensure they meet financial obligations while maximizing operational efficiency.

The importance of this worksheet extends beyond mere paperwork; it plays a pivotal role in payroll management and tax preparations. Collecting accurate data helps organizations avoid costly mistakes and potential audits, compliance violations, or penalties.

Who Needs This Worksheet?

The Employee Apportionment Worksheet is indispensable for several stakeholders within an organization. Human Resources departments utilize it for accurate payroll processing and to ensure that benefits and compensations are allocated correctly. Finance teams rely on it to prepare budgets and generate reports that guide financial decision-making.

Freelancers and business owners also find immense value in the worksheet as it aids in planning budgets and managing project costs. Properly filled out, this tool ensures that all parties are aligned on employee-related expenses and can plan accordingly, leading to smoother business operations.

Features and benefits of using the Employee Apportionment Worksheet

One of the primary features of the Employee Apportionment Worksheet Form is its ability to enhance accuracy. By using a structured format, organizations can minimize errors that often arise from manual calculations. This not only aids in maintaining precise financial documentation but also fosters trust among stakeholders regarding financial disclosures.

Another significant benefit is time efficiency. Digital formats, particularly ones hosted by pdfFiller, streamline data entry and processing, reducing the time spent on paperwork. This efficiency frees up valuable resources within teams, allowing them to focus on strategic tasks rather than mundane data entry.

Furthermore, the cloud-based convenience of tools like pdfFiller means that users can access their Employee Apportionment Worksheet from anywhere, at any time. This flexibility is indispensable for remote teams and companies operating across multiple locations, making collaboration on financial matters simpler than ever.

How to access and create your Employee Apportionment Worksheet Form

Creating your Employee Apportionment Worksheet Form is a straightforward process. Here is a step-by-step guide to getting started:

After following these steps, you'll have a customizable template that you can fill out with your employee information. The user-friendly interface of pdfFiller makes it easy to adapt the worksheet to your specific business needs.

Filling out the Employee Apportionment Worksheet

When it comes to filling out the Employee Apportionment Worksheet, attention to detail is paramount. The worksheet typically comprises several key sections, each requiring specific information.

In the personal information section, include vital employee details such as names, positions, and department affiliations. This allows for a clear identification of who the expenses pertain to.

Next, the income categories should be detailed meticulously. It’s vital to break down methods for accurate data input, such as base salary, bonuses, and any project-based earnings. The more precise you are in documenting these categories, the more streamlined your financial overview will be.

Deductions and overhead are another critical area. Common deductions to consider include health insurance premiums, retirement contributions, and taxes. Understanding the various components will enable you to calculate totals accurately without overlooking essential details.

Lastly, it's essential to manage how these calculations are derived. Include notes on how final totals are reached, which can be particularly useful for audits or internal reviews.

Common scenarios, like full-time versus part-time employees, can further complicate the worksheet. Offering flexibility for situations with temporary workers and freelancers is vital. Tailor the sections appropriately to reflect variable bases of compensation.

Editing and customizing the worksheet

Once you’ve filled out the Employee Apportionment Worksheet Form, making any necessary edits or customizations is seamless with pdfFiller’s intuitive editing tools. These features allow you to edit text, adjust field placements, and even add or remove sections based on your unique requirements.

Collaboration is also a critical aspect of customizing your worksheet. With various team members often providing input or needing access to the form, pdfFiller enables simultaneous collaboration, facilitating feedback and alterations in real time. This ensures that everyone involved is on the same page, improving overall accuracy.

Beyond simple edits, tailoring the worksheet language and specific sections for different industries can offer distinct advantages. For instance, construction firms may require different terminology and breakdown criteria compared to a tech startup, emphasizing the need for adaptability within the worksheet.

eSigning the Employee Apportionment Worksheet

Not only does pdfFiller streamline your editing process, but it also simplifies the signing of your completed Employee Apportionment Worksheet. Using the platform, you can easily add electronic signatures, ensuring that your document is legally binding without the hassle of printing and scanning.

It's important to note that eSignatures hold legal validity under both state and federal regulations, making them a reliable method for authenticating documents. Utilizing pdfFiller’s robust eSigning capabilities eliminates any potential delays in processing and maintains an efficient workflow.

Managing your Employee Apportionment Worksheets

After successfully filling out and signing your Employee Apportionment Worksheet, it's crucial to manage these documents effectively. pdfFiller offers an array of options for organizing saved documents, which can be immensely beneficial as the number of forms increases.

Employing a structured storage system will help in quick retrieval during audits or internal assessments. Additionally, keeping track of changes over time allows business leaders to maintain comprehensive records concerning employee cost apportionments, providing insight into financial trends and practices.

Version control is another significant aspect of managing your Employee Apportionment Worksheets. By retaining an updated document history, teams can reference prior versions, ensuring all stakeholders can see how calculations and inputs evolve over time. This transparency promotes accountability and smooth communication among various departments.

Frequently asked questions (FAQs)

Navigating the complexities of the Employee Apportionment Worksheet occasionally raises questions among users. Here are some common concerns and their solutions:

For users experiencing technical difficulties, pdfFiller offers dedicated support available through their website. Assistance is just a click away, ensuring any potential roadblocks won’t hinder your workflow.

Related articles and resources

For those looking to expand their understanding of employee cost management, several articles can further guide informed decision-making. Topics like tax implications of employee compensation and compliance regulations provide valuable insights that can enhance overall understanding.

Moreover, pdfFiller hosts various guides on effective payroll practices that go hand-in-hand with using the Employee Apportionment Worksheet. Exploring related forms will further equip users with essential templates for efficient administration.

Exploring related categories

Understanding the Employee Apportionment Worksheet Form is essential, but it is equally important to explore broader categories for context. Resources in employee management and payroll will enrich your knowledge around efficient operational practices.

Compliance forms and reporting templates are also crucial for any organization looking to thrive in an increasingly complex regulatory landscape. Keeping abreast of these categories will empower your organization to adapt and excel.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit employee apportionment worksheet online?

How can I fill out employee apportionment worksheet on an iOS device?

How do I edit employee apportionment worksheet on an Android device?

What is employee apportionment worksheet?

Who is required to file employee apportionment worksheet?

How to fill out employee apportionment worksheet?

What is the purpose of employee apportionment worksheet?

What information must be reported on employee apportionment worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.