Get the free Schedule 2k-1 Beneficiary’s Massachusetts Information

Get, Create, Make and Sign schedule 2k-1 beneficiarys massachusetts

How to edit schedule 2k-1 beneficiarys massachusetts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 2k-1 beneficiarys massachusetts

How to fill out schedule 2k-1 beneficiarys massachusetts

Who needs schedule 2k-1 beneficiarys massachusetts?

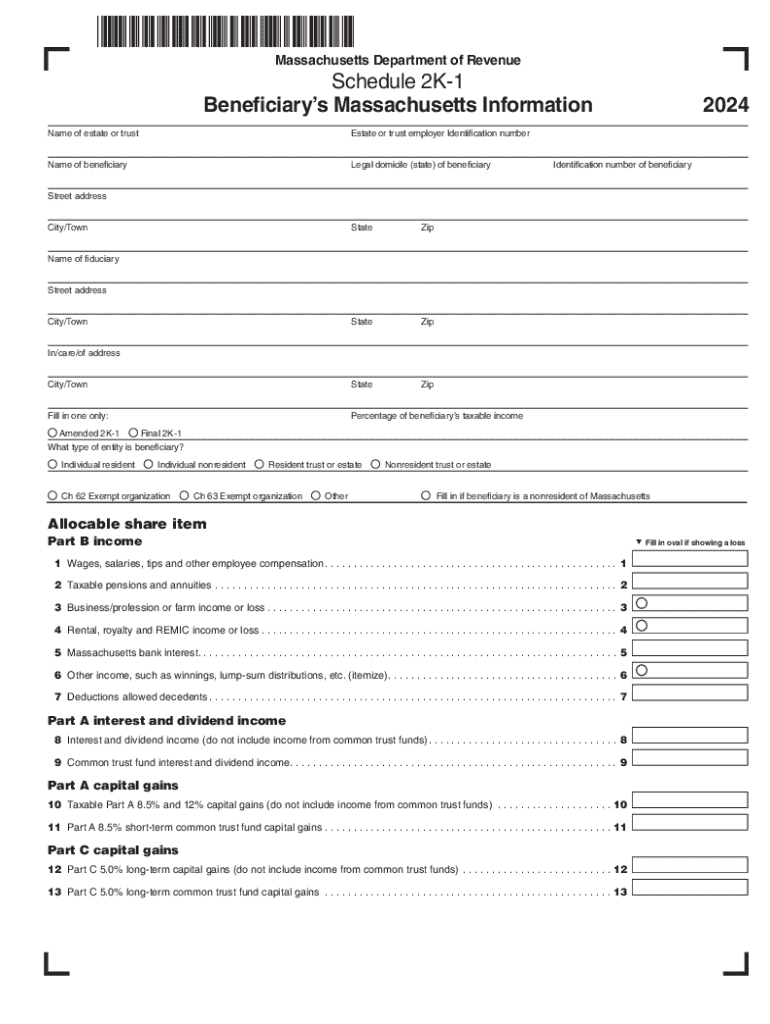

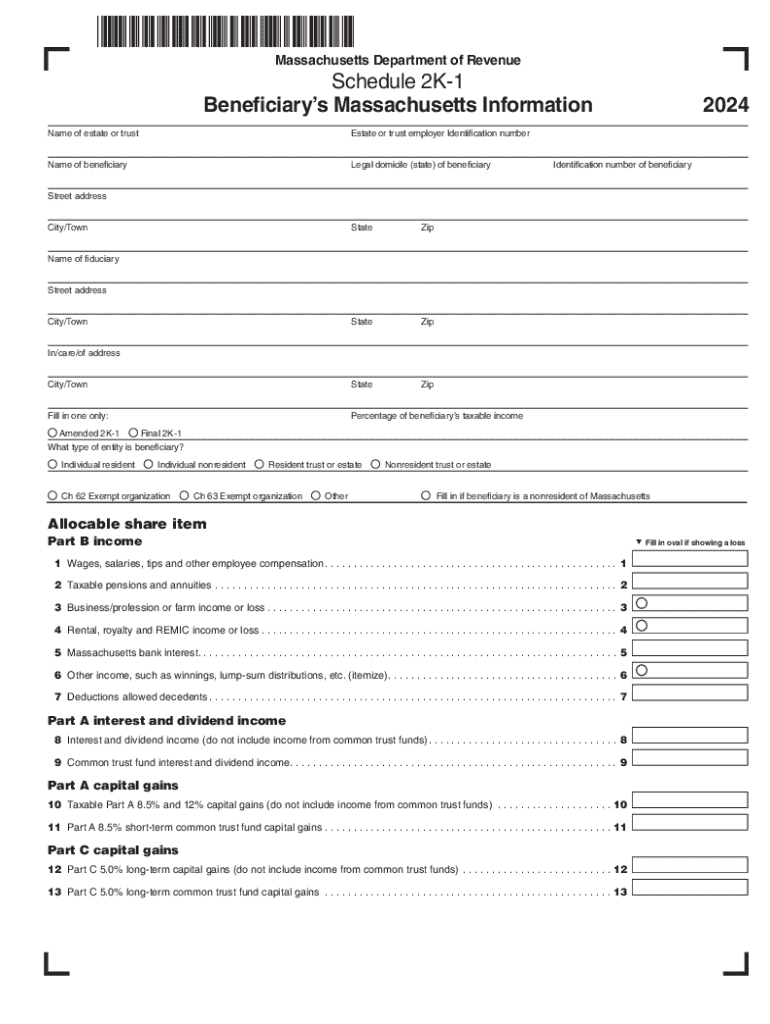

Guide to Schedule 2K-1 Beneficiaries Massachusetts Form

Understanding the Schedule K-1 and its significance

Schedule K-1 is a crucial tax form used to report income, deductions, and credits from partnerships, S-Corporations, and estates to the IRS and state taxing authorities. For Massachusetts taxpayers, understanding this form is essential, as it's integral in ensuring accurate tax reporting and compliance with state laws.

Beneficiaries receiving a Schedule K-1 play an important role in tax reporting as they must report the income and deductions passed through from the entity. The key differences between federal and state requirements also underscore the importance of being meticulous; Massachusetts has its own specific guidelines which must be adhered to ensure compliance.

Who needs to file the Schedule 2K-1 in Massachusetts?

In Massachusetts, individuals who are part of a partnership or hold shares in an S-Corporation are required to file the Schedule 2K-1 form. Specifically, both the partnerships themselves and individual partners must be aware of their obligations regarding this tax form.

Various conditions can trigger the need for filing, including any distributions received from the entity or shares of income allocated. Common scenarios where Schedule 2K-1 is relevant include partnership profits shared among partners and declarations of income distributed to S-Corporation shareholders.

Step-by-step guide to completing the Schedule 2K-1

Section A: Gathering necessary information

To accurately complete the Schedule 2K-1, begin by gathering the necessary personal information, including your name, address, and Social Security number. Additionally, ensure you collect financial data from the entity, such as income received, expenses incurred, and distributions made throughout the tax year.

Documentation needed for accurate filing includes prior year tax returns, financial statements, and records of any distributions. This foundational information will help ensure that all pertinent figures are accurately reported.

Section B: Filling out the Schedule 2K-1

Filling out the Schedule 2K-1 involves detailed steps. Part I requires information about the entity, such as its legal name and address. In Part II, you input the beneficiary's information, ensuring accuracy to avoid potential tax issues. Part III is critical; it details your share of income, deductions, and credits. Be particularly cautious about Massachusetts-specific requirements which may differ from federal guidelines.

Common mistakes to avoid

Misreporting income or deductions on the Schedule 2K-1 can lead to complications with the Massachusetts Department of Revenue. Common mistakes include neglecting to report certain income streams or deductions that beneficiaries qualify for, resulting in potential audits or penalties.

Another frequent issue is failing to include all beneficiaries on the form. It's crucial to accurately reflect all individuals who have received income or distributions from the entity. Additionally, be mindful of the deadlines for submission, as missed deadlines can result in late fees and interest charges.

Interacting with the form: Advantages of using pdfFiller

Adobe PDF editing can be cumbersome, but with pdfFiller, you can seamlessly edit your Schedule 2K-1 form with user-friendly tools. This cloud-based platform offers incredible flexibility; users can access forms anytime, anywhere, which is particularly useful during tax season.

In addition to editing, pdfFiller offers eSigning capabilities for quick processing, enabling you to finalize your forms efficiently. The collaborative features available on the platform allow you to share documents with tax advisors or team members to maximize team efficiency.

Frequently asked questions (FAQs)

What if I receive a Schedule K-1 but didn't actively earn income? If you receive a Schedule K-1, you’re required to report it, regardless of your active involvement in the entity. It's important to discuss with a tax professional how to handle such situations.

How do I handle discrepancies in reported income? It's advisable to contact the issuing entity for clarification and possibly request a corrected K-1 if necessary. Keeping thorough records and communication can aid in resolving these discrepancies.

What should I do if I need to amend my Schedule K-1? If amendments are required, the entity will need to issue a corrected K-1, which you must then accurately reflect on your tax return.

Help and support resources

For assistance, you can contact the Massachusetts Department of Revenue. Their website contains a plethora of resources, guides, and contact numbers for support. Utilizing pdfFiller’s customer service is also a solid option if you have form-specific inquiries; their representatives are trained to assist with taxes and forms efficiently.

Community forums can also provide valuable peer assistance, especially for those navigating unique tax conditions or seeking practical advice based on personal experiences.

Tax tools and tips for Massachusetts filers

Using tax preparation software can simplify dealing with Schedule 2K-1. Many software options are tailored for Massachusetts tax filers, offering automated calculations and reminders for deadlines. Keeping an eye on important tax deadlines is critical — ensuring timely submission can save you from penalties.

Moreover, it is vital to stay informed about state-specific deductions and credits for beneficiaries, as these can significantly impact your tax liability.

Enhancing your document management with pdfFiller

pdfFiller offers a robust overview of document organization tools, ensuring that all your forms are not only easily accessible but also well-managed. This feature is especially useful during tax season when accessing various forms quickly is essential.

Managing all your documents on one platform minimizes hassle, while secure sharing options allow for reliable communication with tax advisors or partners without exposing sensitive information.

The future of filing: Understanding tax changes in Massachusetts

As tax laws continue evolving, staying updated on upcoming changes, especially those affecting Schedule 2K-1 filings, is crucial for Massachusetts taxpayers. Potential changes may impact eligibility, reporting requirements, or available deductions and credits.

To remain compliant, regularly check for legislative updates from the Massachusetts government and ensure that you adapt your filing strategy as necessary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify schedule 2k-1 beneficiarys massachusetts without leaving Google Drive?

How do I complete schedule 2k-1 beneficiarys massachusetts online?

How can I fill out schedule 2k-1 beneficiarys massachusetts on an iOS device?

What is schedule 2k-1 beneficiarys massachusetts?

Who is required to file schedule 2k-1 beneficiarys massachusetts?

How to fill out schedule 2k-1 beneficiarys massachusetts?

What is the purpose of schedule 2k-1 beneficiarys massachusetts?

What information must be reported on schedule 2k-1 beneficiarys massachusetts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.