A comprehensive guide to the notice of servicing transfer form

Understanding the notice of servicing transfer form

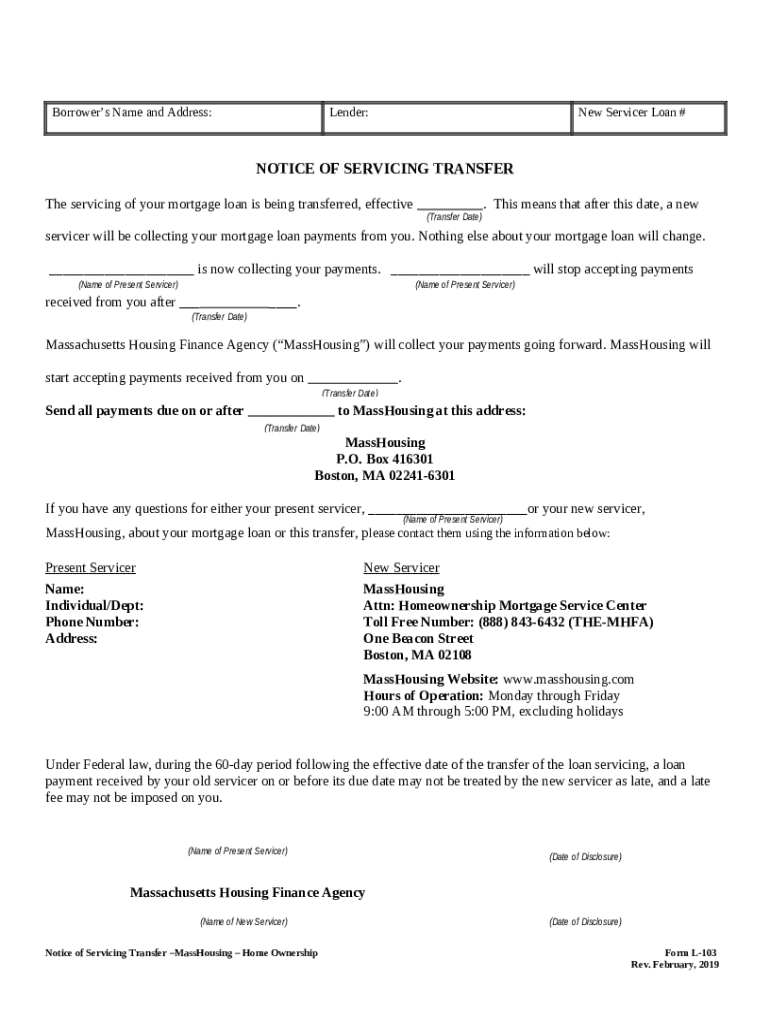

The notice of servicing transfer form is a critical document in the mortgage industry, serving as formal notification to borrowers that their loan servicing rights are being transferred from one lender to another. This notice is crucial for ensuring transparency and maintaining effective communication between borrowers and lenders. The form provides vital information regarding who will be managing the mortgage going forward, allowing borrowers to understand whom to contact for servicing-related inquiries.

Key components of the notice include sender information, recipient information, details of the transferred servicing rights, and the effective date of the transfer. All these elements must be accurately presented to avoid confusion and ensure compliance with regulatory requirements. Common scenarios that necessitate a notice of servicing transfer include changes in mortgage lenders and the sale of loan servicing rights.

When is a notice of servicing transfer sent?

A notice of servicing transfer is typically sent during specific situations, primarily when there is a sale of loan servicing rights or changes among mortgage lenders. For example, if a financial institution decides to sell its portfolio of loans to another lender, a servicing transfer notice is necessary to inform borrowers about the new management of their loans. Such transitions often occur due to mergers, acquisitions, or strategic business decisions, impacting a large number of borrowers.

Timely notifications to borrowers are essential, as these letters help borrower transition smoothly to the new servicer without disruption. Failure to notify borrowers could result in confusion, missed payments, and potential credit issues. Therefore, the timely dispatch of a notice of servicing transfer is not just a good practice; it is a regulatory requirement.

How to prepare the notice of servicing transfer form

Preparing the notice of servicing transfer form requires a systematic approach to ensure that all necessary information is included and compliant with relevant regulations. Here’s a step-by-step guide to help you effectively fill out the form:

Collect required information, including sender and recipient details, and specifics about the servicing rights being transferred.

Ensure compliance with regulations, particularly the Real Estate Settlement Procedures Act (RESPA), to avoid legal issues.

Verify sender and recipient details for accuracy to ensure that the right parties are informed.

Clearly include the effective date of the transfer to avoid any ambiguity regarding when the borrower should start dealing with the new servicer.

Common mistakes to avoid while filling include omitting important details such as the effective date or sending the notice to the wrong recipient. Double-checking information can save time and reduce complications during the transfer process.

Editing and customizing your notice of servicing transfer

Customizing your notice of servicing transfer is essential to align with company branding and specific borrower needs. Utilizing pdfFiller's editing tools streamlines this process. First, upload and open your document on the platform, which allows for easy access to editing features.

Utilize pdfFiller’s tools to add text, comments, or annotations that clarify any complex points in the notice.

Incorporate digital signatures to authenticate the notice, increasing its legitimacy and compliance.

Make use of customizable templates to streamline the creation process while ensuring that the notice meets specific requirements.

These customization features not only enhance the professionalism of the notice but also improve communication clarity between you and the borrower.

Filing and sending the notice of servicing transfer

Once the notice of servicing transfer form has been completed and customized, the next step is to file and send it appropriately. There are two primary methods of delivery: electronic and traditional mail. Electronic submissions can be faster and more efficient, while traditional mail remains a viable option for those less familiar with digital processes.

Choose the delivery method based on borrower preferences and technology comfort levels.

Utilize best practices for confirmation of receipt, such as requesting signatures or read receipts for electronic mails.

Store records of sent notices for future reference, ensuring compliance with regulations and providing proof of communication if necessary.

This careful attention to filing and sending enhances reliability and fosters trust between lenders and borrowers.

What happens after sending the notice?

After sending the notice of servicing transfer, it is crucial for both lenders and borrowers to understand their roles. Borrowers should carefully review the notice upon receipt, noting the new servicer's contact information and effective date. This understanding will help them know who to reach out to for future queries or payments.

It’s advisable for borrowers to confirm the validity of the notice, especially if they receive it unexpectedly or inaccurately. For lenders, follow-up procedures are equally important. This may include checking whether the borrower has acknowledged the notice or needs further assistance in understanding the transfer.

Legal framework surrounding the notice of servicing transfer

The notice of servicing transfer form is governed by a series of laws and regulations, chiefly the Real Estate Settlement Procedures Act (RESPA). RESPA mandates that lenders provide borrowers with timely notifications and other critical information regarding their mortgage servicing. Non-compliance can result in fines and significant repercussions for lenders.

Additionally, state-specific guidelines vary and should be checked to ensure full compliance. Lenders must consider these regulations to avoid legal issues and maintain good standing within the industry. Compliance is not just about adhering to regulations but also about enhancing borrower trust and satisfaction.

Frequently asked questions about the notice of servicing transfer form

Borrowers often have questions about the notice of servicing transfer, particularly regarding their responsibilities and rights. First, borrowers should know that they have the right to seek clarification from either the old servicer or the new one upon receiving the notice. Understanding the notice’s contents is vital for ensuring loan payments are directed to the correct entity.

What should borrowers know about their rights during a transfer?

How can borrowers protect their interests if they suspect inaccuracies?

What actions can be taken if notification is received inaccurately or unexpectedly?

Being proactive in these instances can help reduce potential issues surrounding mortgage payments and servicing.

Resources available for users

Users can access a variety of helpful resources on pdfFiller, including interactive tools and calculators designed to streamline the document creation process. Additionally, a range of templates related to mortgage documentation, such as loan modification agreements, are available for users to tailor their needs effectively.

For those seeking legal assistance, pdfFiller connects users with professionals who can provide expert advice, ensuring all documentation is handled correctly.

Support options for users

pdfFiller offers comprehensive support options to assist users throughout the document creation and management process. Customers can reach out to support for assistance with specific inquiries, utilizing live chat features or accessing the help center for FAQs. Furthermore, community forums provide platforms for users to share experiences and tips, creating a supportive environment for all users.

Related tools and documents

Users can benefit from a variety of related mortgage documents available on pdfFiller. This includes not only the notice of transfer of servicing rights but also loan modification agreements and other critical forms that facilitate smooth transactions in the mortgage process.

Links to download these additional forms can enhance borrowers' and lenders' ability to manage documentation effectively, ensuring compliance and clarity at every step.

Staying informed about changes in mortgage servicing

With the dynamic nature of the mortgage industry, subscribing to updates about servicing regulations is essential. Keeping up with the latest news helps borrowers and lenders navigate changes effectively and strategically adjust their practices.

Available subscription options on pdfFiller ensure that users receive timely information about the mortgage servicing landscape, enhancing their ability to manage their loans proactively.

About pdfFiller

pdfFiller is a leading document management platform that empowers users to edit PDFs, eSign, collaborate, and manage documents seamlessly from a single, cloud-based solution. The platform provides an array of features that enhance the document management experience, thereby simplifying processes for individuals and teams seeking a reliable solution.

User testimonials and success stories highlight the efficiency and effectiveness of pdfFiller in managing documentation, showcasing its value across a variety of sectors.

Conclusion

Understanding the notice of servicing transfer form is essential for both lenders and borrowers to ensure a smooth transition of servicing rights. Utilizing the resources available on pdfFiller not only simplifies this process but also enhances compliance and communication. By following best practices and staying informed about regulations, users can effectively manage servicing transfers and maintain strong relationships within the mortgage industry.