Get the free Canada Return Policy

Get, Create, Make and Sign canada return policy

How to edit canada return policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out canada return policy

How to fill out canada return policy

Who needs canada return policy?

Your Comprehensive Guide to Canada Return Policy Forms

Understanding the Canada return policy form

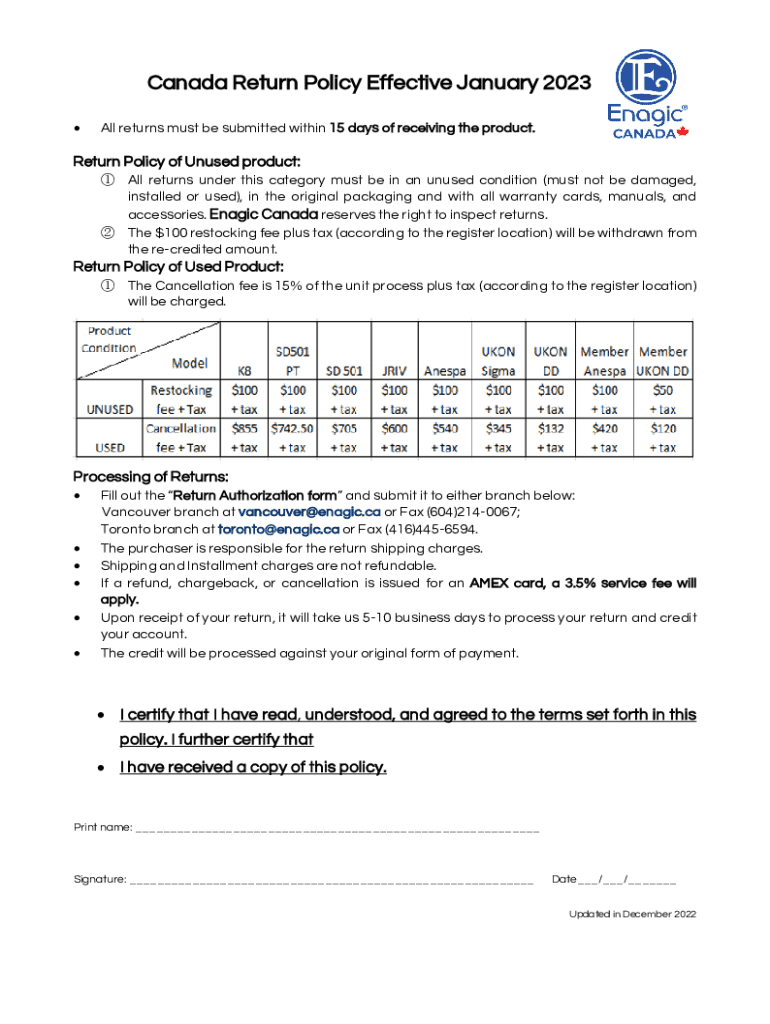

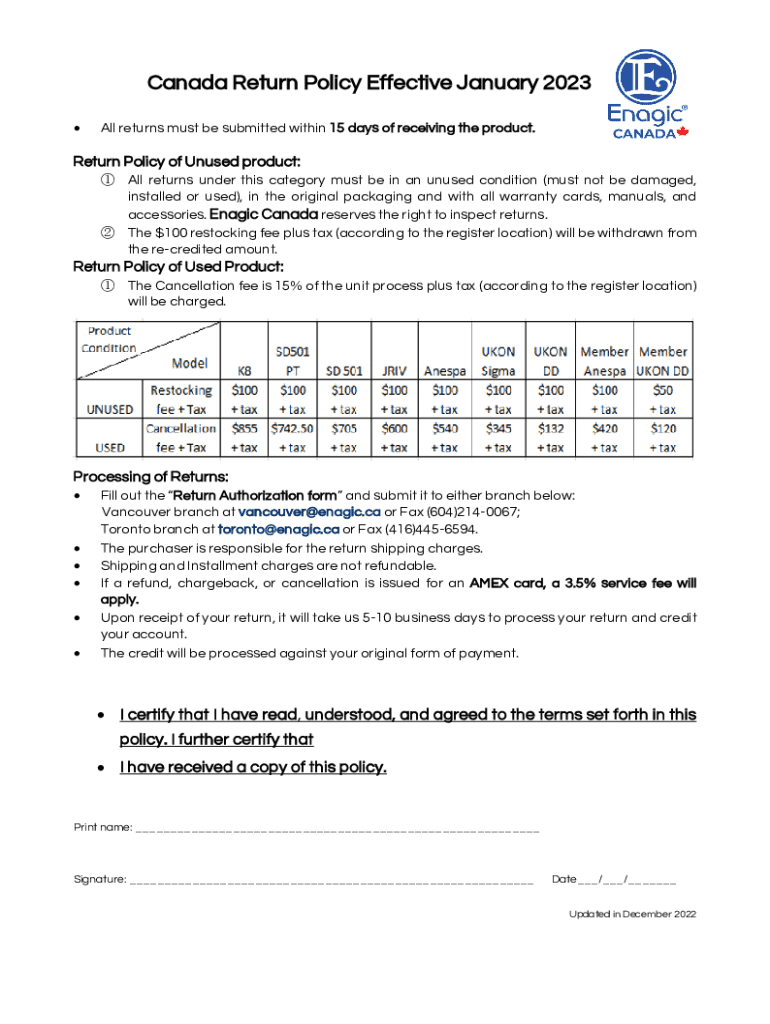

Return policies in Canada vary significantly by retailer, yet they are a crucial component of customer service. A well-defined return policy form allows businesses to streamline their return processes, ensuring clarity for both customers and employees. In Canada, the importance of having a return policy form cannot be overstated; it sets expectations for consumers and protects businesses from potential disputes.

Return policies can typically be categorized into three types: refunds, exchanges, and store credits. Refunds return the original payment to customers, exchanges allow them to swap their items for a different one, while store credits provide them with a monetary value to use for future purchases. Understanding these distinctions is essential when crafting a return policy form, as it impacts the overall customer experience.

Legal considerations for return policies in Canada

While return policies are not legally mandated in Canada, there are essential guidelines and best practices that businesses must follow. Most retailers establish their return policies to enhance consumer trust and confidence. It's important to note that the absence of a documented policy could lead to misunderstandings and potentially harm a business's reputation.

Key legal requirements include adhering to consumer protection laws that dictate businesses must not mislead customers about their return policies. This means policies should be transparent, accessible, and clearly communicated to shoppers. Violation of these regulations can result in consumer complaints and fines.

Components of an effective Canada return policy form

An effective Canada return policy form should contain several essential elements to ensure clarity and consistency in processing returns. These elements include:

Additionally, the format of the policy should prioritize clarity, with sections clearly titled and adequately spaced for easy reading. Highlighting key points helps customers navigate the conditions effectively.

Crafting your Canada return policy form

Creating a return policy form can be a straightforward process when you follow these steps:

Sample templates are also helpful. For example, a standard return policy template can outline the basics, while a refund policy template can focus on the specifics of money-back guarantees.

Implementing the return policy in your business

Integration of the return policy into your checkout process is vital. When customers make a purchase, providing them with clear information about your return policy can mitigate post-purchase regret and enhance satisfaction. Display the policy prominently on your website, ideally on the checkout page, and offer a link in purchase confirmation emails.

Beyond digital integration, ensure your staff is adequately trained on all return and exchange procedures. Consistency in applying the policy across all team members promotes a seamless experience for customers, enhancing their trust in your business.

Communicating the return policy to customers

Making your return policy easily accessible is paramount. Customers should be able to locate it quickly, whether on your website, in the app, or at the point of sale. Best practices for effective policy display include using pop-ups on the website or placing clear signage in-store.

Additionally, leveraging your return policy to enhance customer trust is crucial. Communicate it in a friendly tone, explaining the benefits consumers will receive, such as easy exchanges or hassle-free refunds. Customers appreciate transparency, and a well-communicated policy can bolster loyalty.

Managing returns: Tips and best practices

Efficient management of returns relies on clear processes. When handling returned items, establish a logistics framework that quickly evaluates the condition of returns and updates inventory as needed. Managing customer expectations is equally important; keeping communication lines open ensures customers understand timelines and processes.

Quickly addressing customer queries or complaints related to returns can prevent dissatisfaction. Train your team to not only enforce the return policy but to empathize with customer frustrations. Avoid common pitfalls, such as excessive delays or lack of communication, which can damage repeat business.

Analyzing and improving your return policy

Regularly analyzing your return policy is essential for adaptation and improvement. Gather customer feedback regarding their return experiences to identify pain points or areas for enhancement. Using surveys and direct inquiries can yield valuable insights into how your policy functions in practice.

Updating your policy regularly based on these trends can ensure it remains customer-centric. Consider the addition of a money-back guarantee, which can enhance overall customer satisfaction and drive repeat business, demonstrating confidence in your products.

Regional considerations and specifics

Return policies can vary across Canada’s provinces due to local consumer protection laws. For instance, while Ontario has specific regulations regarding online sales, provinces like British Columbia offer different guidelines that businesses need to comply with. Understanding these regional specifics is crucial for retailers operating in multiple areas.

Additionally, for businesses selling internationally to Canadian customers, it’s vital to clearly communicate different return procedures for digital versus physical products, as the expectations and legal requirements may differ significantly.

Future trends in return policies

The rise of e-commerce increasingly shapes return policies, with online retailers emphasizing customer experience. Trends like free returns, simplified exchange processes, and enhanced customer service are becoming the norm. Companies are using technology, such as automated return management systems, to streamline returns and enhance efficiency.

Moreover, retailers are exploring innovative solutions, such as virtual try-ons and augmented reality applications, to reduce the number of returned items altogether. Remaining mindful of these trends can help businesses adapt their return policies and strategies effectively.

Resources for further assistance

When drafting or updating your Canada return policy form, resources such as pdfFiller can provide assistance. Users can access customizable return policy forms to ensure their business meets customer needs effectively. Utilizing online tools for managing documents helps to streamline document creation and edits.

For complex concerns, seeking consultation services can provide tailored advice on developing an effective return policy, ensuring your business is compliant and aligned with industry best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete canada return policy online?

How do I edit canada return policy online?

How do I complete canada return policy on an iOS device?

What is Canada return policy?

Who is required to file Canada return policy?

How to fill out Canada return policy?

What is the purpose of Canada return policy?

What information must be reported on Canada return policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.