Get the free Form Adv

Get, Create, Make and Sign form adv

Editing form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Form ADV: A Comprehensive How-to Guide

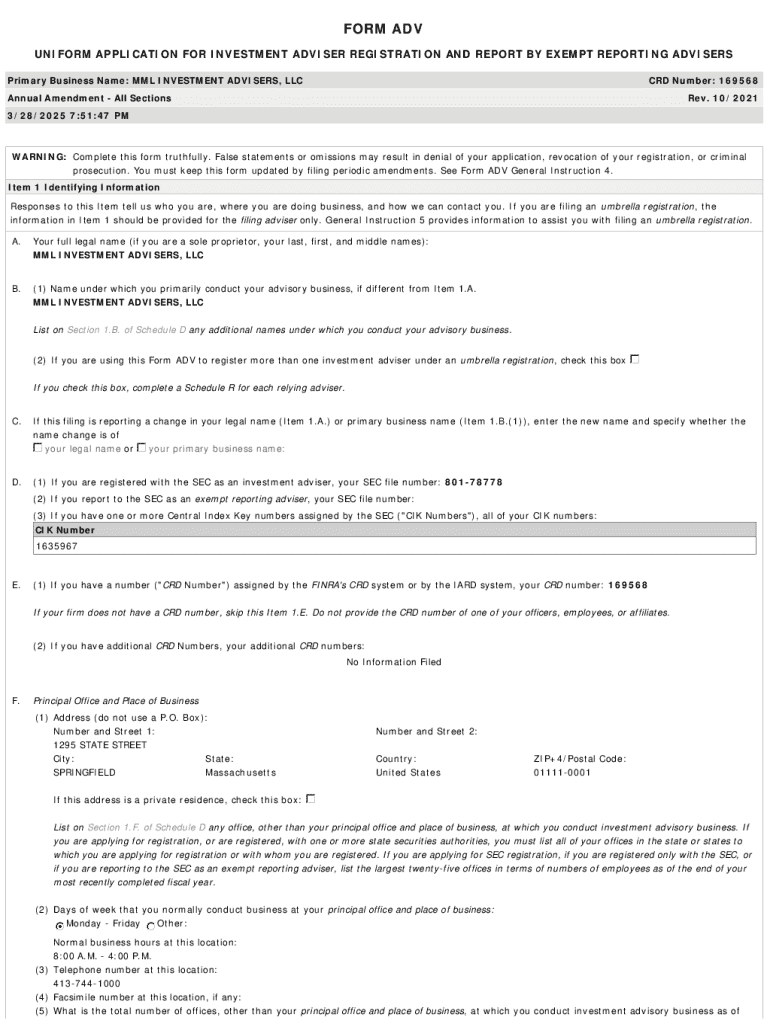

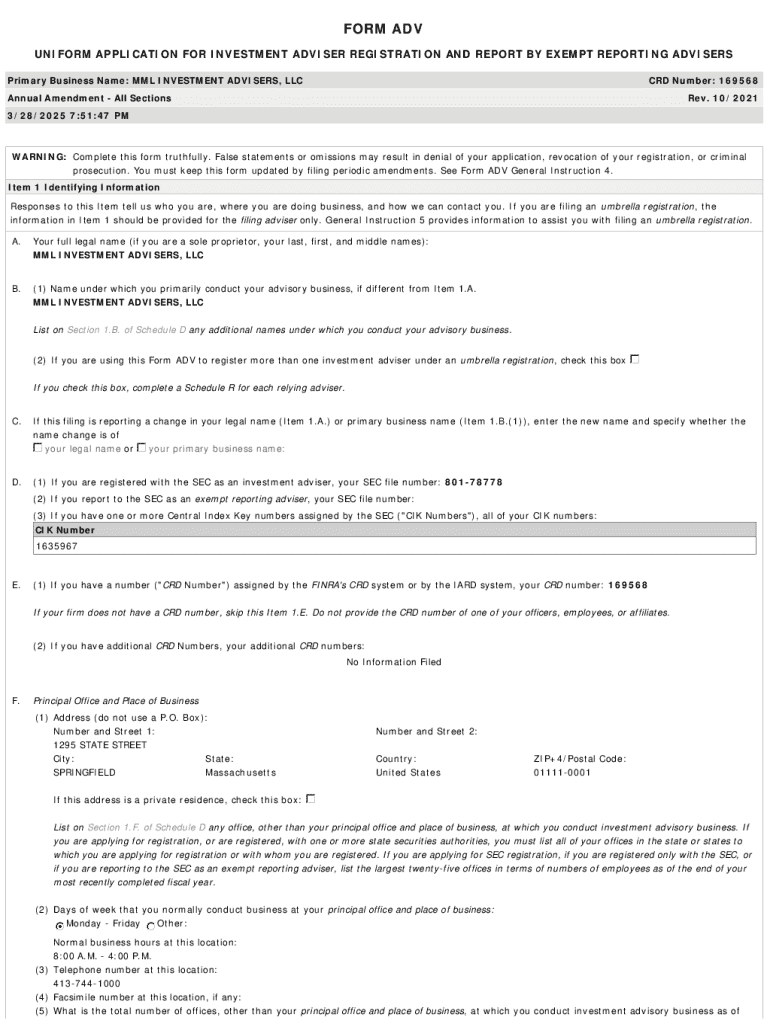

Understanding Form ADV

Form ADV, officially known as the 'Uniform Application for Investment Advisor Registration,' is a crucial document in the realm of investment advisory and financial services. It serves multiple purposes, primarily functioning as a-registration form for investment advisors with the Securities and Exchange Commission (SEC) and state regulators. By requiring a detailed account of an advisor's business, practices, and qualifications, Form ADV helps safeguard the interests of investors and ensures compliance within the financial industry.

The importance of Form ADV extends beyond mere regulatory compliance; it plays a vital role in instilling trust and transparency. Investors rely on this information to assess the credibility and expertise of investment advisors, making informed decisions about where to entrust their resources.

Components of Form ADV

Form ADV is composed of two main parts: Part 1 and Part 2. Each serves distinct functions and contains specific information.

Who needs to file Form ADV?

Understanding who is required to file Form ADV is essential for compliance with investment regulations. Basically, any individual or business entity that provides investment advice for a fee must file this form. This requirement applies to various entities, including registered investment advisors (RIAs) and financial planners.

Filing requirements differ based on whether advisors are state-registered or federally registered with the SEC. While RIAs managing $110 million or more in assets are required to register with the SEC, those managing less typically register with state authorities. Hence, a thorough understanding of the threshold and requirements pertaining to each entity is vital.

However, certain exemptions to filing exist. For instance, advisors who only offer advice to clients under a specific asset limit, or those only providing investment recommendations to specific groups, may not be required to file.

The filing process for Form ADV

Filing Form ADV may seem daunting, but with a clear process, individuals and firms can navigate it successfully. Preparation is key before filing this form.

Gathering all necessary documentation, including personal identification, business registration details, and comprehensive financial information, is essential. Being thorough and accurate in filling out the forms can prevent delays and issues down the line.

It's also critical to be aware of key filing deadlines. Initial registrations must be submitted promptly, while annual updates are typically due within 90 days of the fiscal year-end.

Keeping Form ADV up-to-date

Once filed, Monitoring and updating your Form ADV becomes an ongoing responsibility. Certain events trigger the need for frequent amendments, such as changes to the firm’s investment strategy, significant fee adjustments, or alterations in ownership.

Material changes must be reported to maintain compliance and keep clients accurately informed. Understanding what qualifies as a material change can simplify this process significantly.

Using effective tools, such as pdfFiller, can streamline the process. Not only can you amend your Form ADV efficiently, but you also gain access to collaborative features that help manage revisions seamlessly.

Navigating public access to Form ADV

One of the hallmarks of Form ADV is its public nature. Once filed, these forms are accessible to the general public, which fosters transparency in the investment advisory profession.

Individuals looking to review a firm's Form ADV can do so through the SEC’s EDGAR database or specific state regulatory websites. Ease of access allows potential clients to scrutinize the qualifications and business practices of advisors before forming a professional relationship.

The implications of having Form ADV publicly available emphasize regulatory transparency, ultimately protecting investors and maintaining integrity in the financial ecosystem.

Common questions about Form ADV

Considering the complexities surrounding Form ADV, various questions often arise. Addressing these FAQs can demystify the process and clarify common uncertainties.

Resources for completing Form ADV

As you embark on the process of filing Form ADV, various resources can assist you. Tools, templates, and professional assistance enhance the efficiency and accuracy of your filing experience.

pdfFiller offers interactive tools and templates specifically tailored to guide users through the completion of Form ADV. By leveraging these resources, you can navigate the complexities of document completion and management with ease, ensuring accuracy and compliance.

Understanding when to seek help and utilizing the right tools is critical for maintaining compliance and ensuring your documents are prepared correctly.

Success stories: How pdfFiller enhances the filing experience

Using platforms like pdfFiller has transformed the way firms handle their Form ADV filings. Many users report significant time savings and enhanced accuracy thanks to the platform's collaborative features.

For instance, firms have experienced a reduction in errors, as pdfFiller automatically alerts users to missing information or discrepancies, ensuring thoroughness. User testimonials indicate improved overall satisfaction and efficiency in managing regulatory compliance.

The blend of user-friendly tools and robust support mechanisms makes pdfFiller an invaluable resource for investment advisors navigating the complexities of Form ADV.

Join our community

Engagement doesn’t stop with filing Form ADV. By subscribing to our newsletter, you can remain informed about necessary updates, changes in regulations, and industry news surrounding investment advisory practices.

Connect with us on social media to join discussions with fellow professionals, share insights, and contribute to a community focused on transparency and ethical practices in finance. Engaging with the community opens doors to shared knowledge and experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form adv?

How do I execute form adv online?

Can I create an electronic signature for signing my form adv in Gmail?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.