Get the free 457(b) Deferred Compensation Plan Deferral Change Form

Get, Create, Make and Sign 457b deferred compensation plan

Editing 457b deferred compensation plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 457b deferred compensation plan

How to fill out 457b deferred compensation plan

Who needs 457b deferred compensation plan?

Understanding the 457b Deferred Compensation Plan Form

Understanding the 457b deferred compensation plan

A 457b deferred compensation plan is a type of retirement savings plan that allows employees of state and local governments, as well as certain non-profit organizations, to defer a portion of their earnings until retirement. This unique tax-advantaged account is designed specifically for public sector workers, making it a vital component of their retirement strategy.

Key features of a 457b plan include pre-tax contributions that reduce an individual's taxable income and the potential for tax-deferred growth on investments. Unlike other retirement plans, such as 401(k)s or 403(b)s, 457b plans often allow for various types of contribution options and are not subject to the same early withdrawal penalties, making them appealing for many employees.

Eligibility for the 457b deferred compensation plan

Eligibility for a 457b deferred compensation plan largely depends on your employer's participation in this type of program. Generally, employees of state and local governments can enroll. Certain non-profit employees qualified under the Internal Revenue Code may also participate. This feature distinguishes the 457b plan from others like the 401(k), which can have a broader eligibility criterion.

To participate, employees must meet specific criteria, including employment status and the opting into the plan through the appropriate enrollment process. It is a common misconception that only public sector employees can benefit, but non-profit workers under specific conditions may also gain access to these plans.

Contributions to the 457b plan

For 2023, the contribution limit for a 457b deferred compensation plan is set at $22,500. Employees aged 50 and older can take advantage of catch-up contributions, allowing them to contribute an additional $7,500, making for a total of $30,000. It’s essential to maximize these contributions, as they play a significant role in securing a comfortable retirement.

The contributions can be categorized into two types: elective deferrals, where employees choose to postpone a portion of their salary before taxes, and non-elective contributions, which are made by employers. This flexibility allows participants to customize their saving strategy based on personal financial goals.

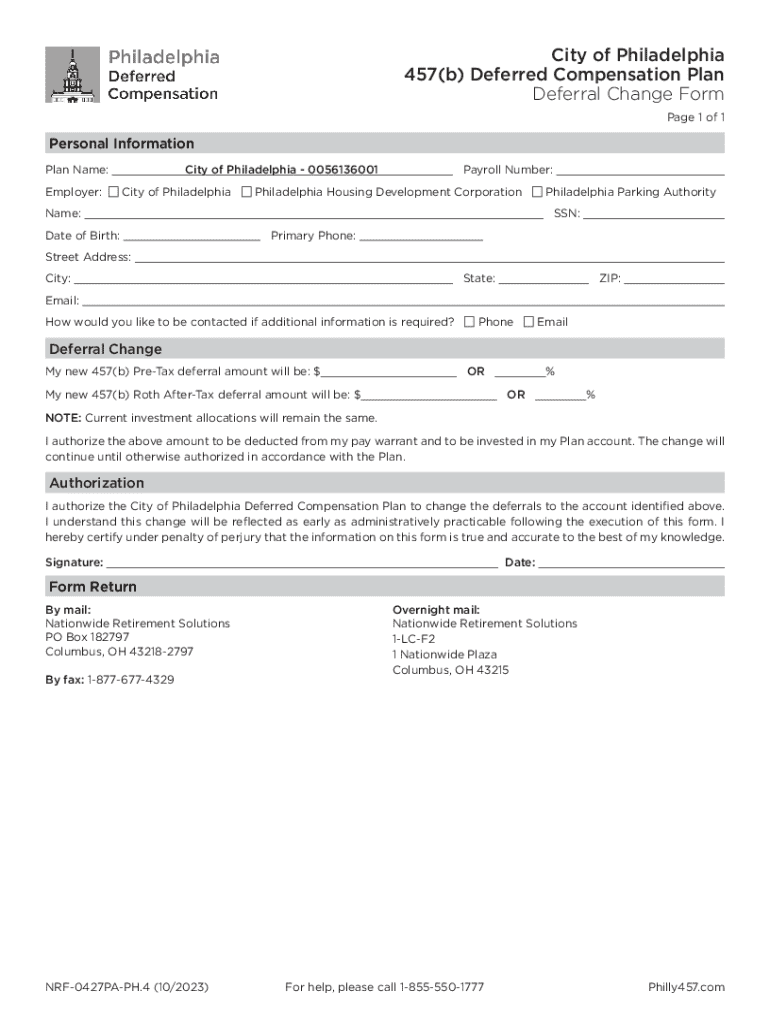

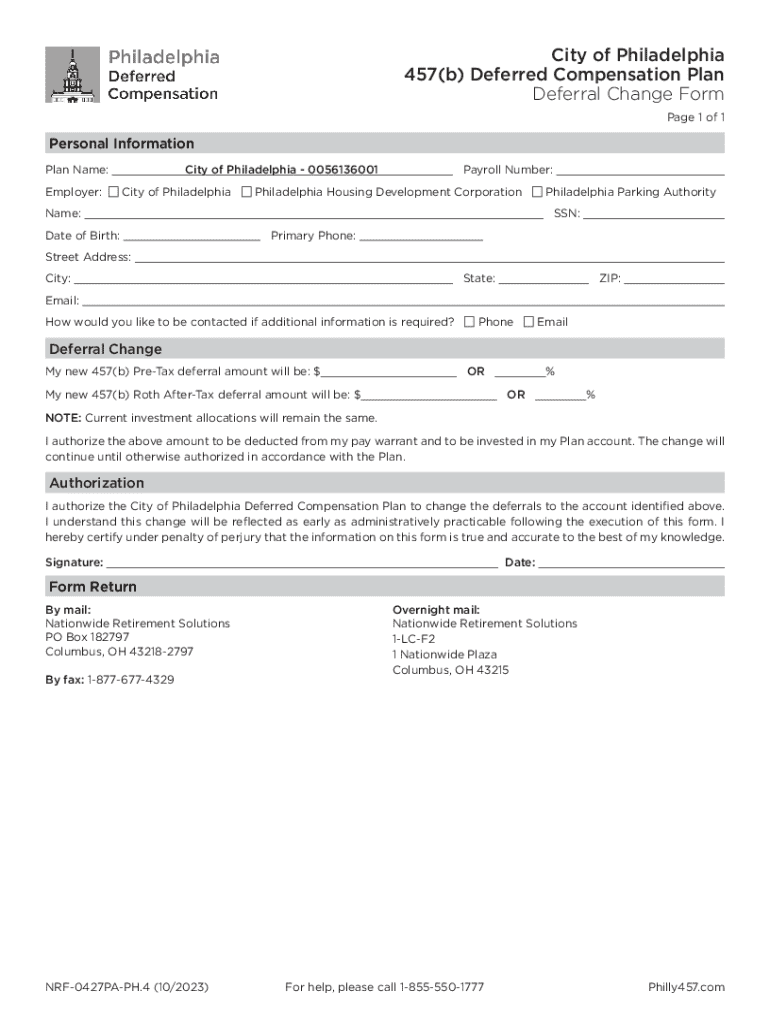

Completing the 457b deferred compensation plan form

Filling out the 457b deferred compensation plan form accurately is critical for a smooth enrollment process. The form typically requires personal information such as your name, address, and social security number, along with your employment details and chosen contribution amounts.

To ensure that you fill it out correctly, follow this step-by-step guide:

Be cautious of common mistakes, such as incorrect social security numbers or miscalculating contribution amounts, which can delay your application process.

Managing your 457b plan

Once enrolled in the 457b deferred compensation plan, managing your account effectively is vital. Utilizing tools such as pdfFiller can greatly streamline your experience. You can easily access your account online, check your contribution status, and even edit your forms when needed, all through a user-friendly interface.

Regularly reviewing your contribution amounts will help you stay aligned with your retirement goals. As life circumstances change, adjusting these amounts is important for optimal savings. pdfFiller provides an interactive platform that allows you to track contributions and review investment performance seamlessly.

Advantages of the 457b plan

One of the principal advantages of a 457b deferred compensation plan is the favorable tax treatment of contributions and withdrawals. Depositing pre-tax dollars means that you'll reduce your taxable income, and your money grows tax-deferred until you withdraw it in retirement, often at a lower tax rate.

Another strength is the flexibility in withdrawal options. Unlike some other retirement plans, 457b participants may withdraw funds without the typical 10% penalty before reaching the age of 59½. This flexibility can be especially beneficial during unforeseen financial circumstances.

Withdrawal rules and distribution options

Understanding the withdrawal rules for the 457b deferred compensation plan helps in effective financial planning. Withdrawals can typically be made in several ways, including early withdrawals, in-service withdrawals, or rollovers to other retirement accounts.

However, taxation of withdrawals varies; they are taxed as ordinary income in the year they are taken. In addition, 457b plans often provide survivor benefits, ensuring that funds can be passed on to beneficiaries under certain conditions, enhancing financial security for loved ones.

Resources for participants

When enrolling in a 457b deferred compensation plan, certain documents are required. These may include proof of employment, identification, and completed enrollment forms. It is often recommended to prepare for frequently asked questions, such as how changing jobs may affect your contributions or the tax implications of your plan.

Educational tools and calculators available through platforms like pdfFiller can also aid participants in understanding their plan better. Utilizing these resources can help ensure that you make informed decisions about your retirement savings.

Employer responsibilities

Employers interested in offering a 457b plan must understand various responsibilities involved in plan management. This includes keeping track of employee contributions, ensuring compliance with regulations, and providing the right resources for employees to understand the plan.

To ensure the plan runs smoothly, employers should customize their support offerings based on employee needs, keeping the lines of communication open and clear. Best practices include keeping employment records accurate and staying updated on any changes in legislation affecting 457b plans.

Future of deferred compensation plans

The landscape of 457b deferred compensation plans is evolving, with new trends emerging in enrollment and contribution strategies. Legislative changes may be on the horizon, and these changes can directly affect how these plans function and what benefits they can offer to employees.

Insights from financial experts suggest that maximizing the benefits of a 457b plan will be increasingly important as the workforce changes. As more non-profit and governmental entities adapt to the needs of modern employees, 457b plans will likely become even more relevant in personal finance strategies.

Interactive tools and examples

Providing practical examples and tools can significantly enhance understanding and engagement with the 457b deferred compensation plan. For instance, a sample completed 457b plan form can clarify how to properly fill it out based on real-world scenarios.

Interactive simulations that illustrate tax savings with deferred compensation can also help prospective participants visualize their future financial benefits. Furthermore, real-life case studies showcasing the success of various individuals who utilized a 457b plan can inspire confidence and provide valuable insights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 457b deferred compensation plan to be eSigned by others?

How do I execute 457b deferred compensation plan online?

How can I edit 457b deferred compensation plan on a smartphone?

What is 457b deferred compensation plan?

Who is required to file 457b deferred compensation plan?

How to fill out 457b deferred compensation plan?

What is the purpose of 457b deferred compensation plan?

What information must be reported on 457b deferred compensation plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.