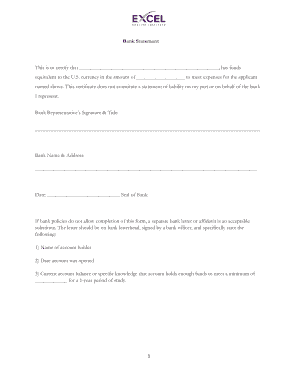

Get the free Nc-5 Withholding Return

Get, Create, Make and Sign nc-5 withholding return

Editing nc-5 withholding return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nc-5 withholding return

How to fill out nc-5 withholding return

Who needs nc-5 withholding return?

Your Complete Guide to the NC-5 Withholding Return Form

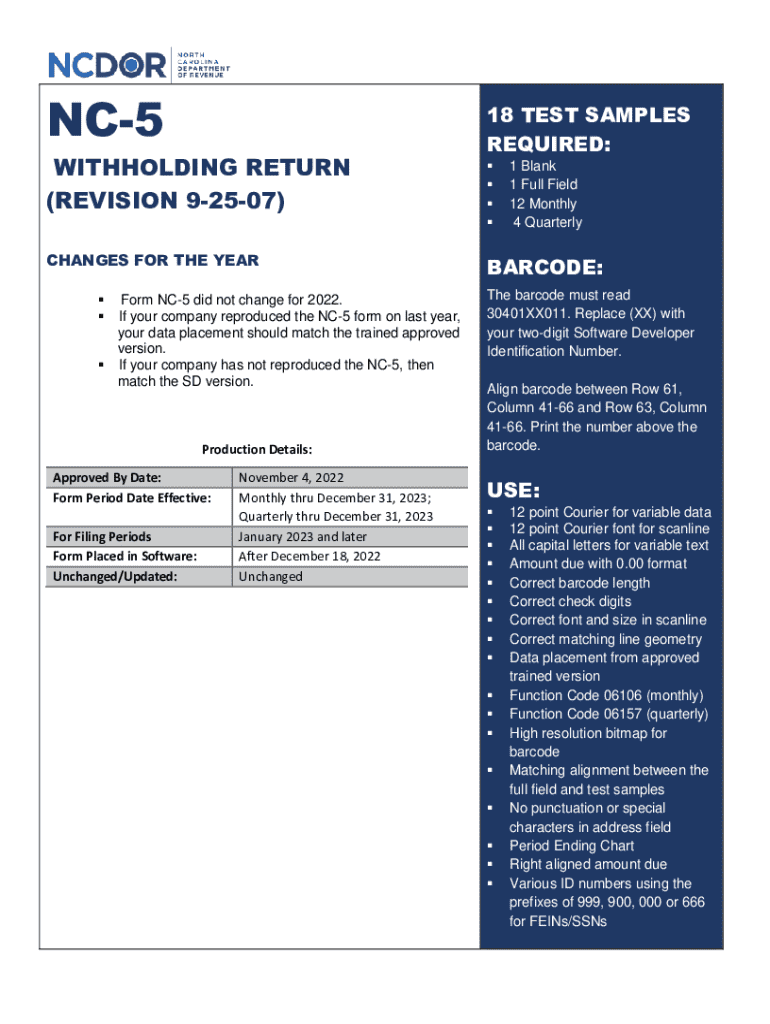

Overview of the NC-5 Withholding Return Form

The NC-5 Withholding Return Form is a crucial document that employers in North Carolina are required to complete and submit to report state income taxes withheld from employees’ wages. Its primary purpose is to ensure that the appropriate amount of state tax is collected and remitted to the North Carolina Department of Revenue on behalf of employees. By consistently filing this form, employers contribute to the accurate reporting and collection of state taxes, which are essential for funding public services.

Timely filing of the NC-5 form is vital not only for compliance but also for maintaining good relations with employees and state authorities. Employees depend on correct withholding to meet their tax obligations, and employers are expected to fulfill this duty accurately. Failure to comply with NC-5 filing requirements can lead to severe consequences, including penalties, interest on unpaid taxes, and potential audits, making it imperative for employers to handle this responsibility diligently.

Key features of the NC-5 Withholding Return Form

The NC-5 form features several key sections that serve distinct functions in the completion process. Typically, it includes sections for reporting the employer's information, total wages paid to employees, total withholding amounts, and a summary of any adjustments due to previous reporting periods. Each part of the form is designed to guide the employer in providing precise figures, thereby minimizing errors in reporting.

To fill out the NC-5 thoroughly, specific information is required. Employers must enter details such as their North Carolina tax identification number, the total number of employees paid during the period in question, and the cumulative total of wages that have been withheld. Proper calculation is critical, as it directly affects the amount remitted to the state. The withholding amounts are generally based on the employee's gross wages, personal exemptions claimed, and the applicable tax rates, reflecting the employee's tax bracket.

Who should use the NC-5 Withholding Return Form?

The NC-5 Withholding Return Form is primarily intended for employers operating within North Carolina who have employees subject to state income tax withholding. Both small businesses and large organizations must utilize this form to report their withholding responsibilities accurately. Even if an employer has only one employee, they are still required to file the NC-5 whenever payroll processing occurs.

Certain instances necessitate the completion of the NC-5 form, such as when hiring new employees, terminating employees, or making adjustments to previously submitted forms. Employers must remain vigilant on both federal and state guidelines concerning employee taxation, as variations can exist. For instance, federal guidelines may differ in terms of tax rates and filing schedules, making it crucial for employers to stay informed on both levels.

Step-by-step instructions for filling out the NC-5 form

To ensure accuracy and compliance while filling out the NC-5 form, careful attention is required at each stage of the process. Here is a detailed step-by-step guide.

Options for filing the NC-5 Withholding Return

Employers in North Carolina have several options for filing the NC-5 withholding return. The online e-filing process is particularly streamlined, allowing for real-time submissions and quicker processing times. Many employers prefer electronic filing due to its convenience, ensuring they meet deadlines without the potential delays associated with mailing paper forms.

Filing electronically offers several advantages over traditional mailing. These include instant confirmation of submission, reduced risk of lost documents, and the ease of correcting errors, which can all contribute to a more efficient workflow. It’s essential to be aware of the filing deadlines specific to the NC-5 form to avoid any penalties or late fees, reinforcing the need for timely compliance.

How to edit the NC-5 Withholding Return Form online

Utilizing tools like pdfFiller enables users to edit the NC-5 Withholding Return Form with ease. With its intuitive interface, making changes to a saved version of your form becomes a straightforward process. Users can access pdfFiller's editing features directly from any internet-connected device, facilitating a flexible approach to document management.

To edit your NC-5 form effectively, follow these steps: First, upload the saved form to pdfFiller. Use the editing tools to make necessary changes to any fields. Finally, review your modifications for accuracy before saving and proceeding with submission. Keeping a record of any edits made through pdfFiller not only helps with compliance but also ensures a clear audit trail in case of future inquiries.

Frequently asked questions about the NC-5 form

Many queries arise concerning the NC-5 Withholding Return Form, particularly regarding filing procedures and calculation clarifications. Questions like, 'What happens if I miss the filing deadline?' and 'How do I calculate the correct withholding amount?' are common among employers. These inquiries highlight the need for detailed understanding among those responsible for payroll.

Moreover, troubleshooting filing issues is essential for preventing potential complications down the line. For instance, understanding the method for reporting discrepancies can save time and resources if an error occurs. It's advisable for employers to familiarize themselves with both the procedures and common pitfalls associated with the NC-5 form.

Related documents and resources

Understanding the NC-5 form also involves recognizing its associated documents, such as the NC-5X Amended Withholding Return. Employers may need to file an amended return in situations where they discover errors in previous submissions or when adjusting to changes in employee status that impact withholding amounts. Knowing when and why to file an amended return is crucial for the integrity of tax reporting.

In addition to the NC-5, there are other forms relevant to withholding and payroll tax that employers should be familiar with. Quick access to state resources can provide additional guidance, ensuring that employers are well-equipped to navigate their filing responsibilities.

Utilizing pdfFiller for streamlined document management

pdfFiller offers numerous features that greatly simplify the NC-5 filing process. With its cloud-based platform, users can easily create, edit, and share their NC-5 forms securely. This ease of access allows teams to collaborate effectively on document preparation without being restricted to physical locations, fostering a more productive work environment.

The platform's security features ensure that sensitive information remains protected, which is paramount for both employers and employees when dealing with tax documents. By leveraging pdfFiller, organizations can streamline their document management processes, enhancing overall efficiency and compliance with state guidelines.

Additional support options

For those navigating the complexities of the NC-5 Withholding Return Form, additional support options are readily available. Employers can contact state tax offices for direct assistance with questions or concerns regarding their filing status. Furthermore, there are numerous online resources that offer guidance on form completion, tax regulations, and filing procedures.

Community forums often serve as an additional source of support, providing a platform for sharing experiences, tips, and troubleshooting advice related to form submission. Engaging with these communities can offer valuable insights, helping employers avoid common mistakes and navigate the nuances of state tax compliance effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nc-5 withholding return without leaving Google Drive?

How do I make edits in nc-5 withholding return without leaving Chrome?

How do I edit nc-5 withholding return on an iOS device?

What is nc-5 withholding return?

Who is required to file nc-5 withholding return?

How to fill out nc-5 withholding return?

What is the purpose of nc-5 withholding return?

What information must be reported on nc-5 withholding return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.