CT DRS CERT-112 2024-2026 free printable template

Show details

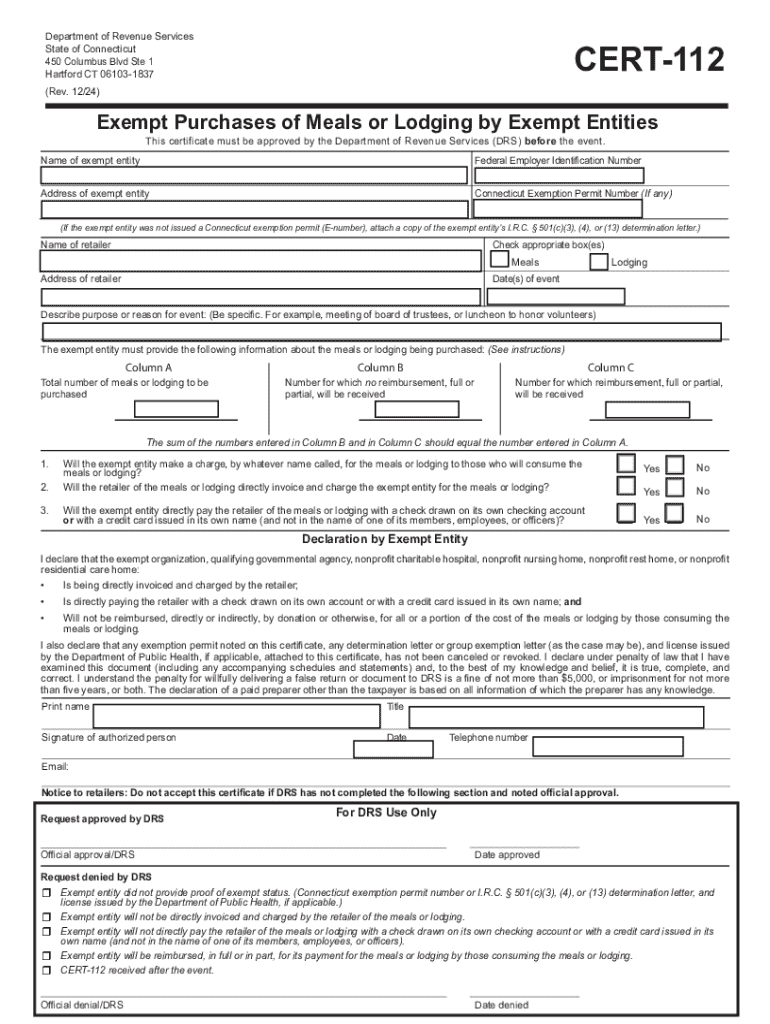

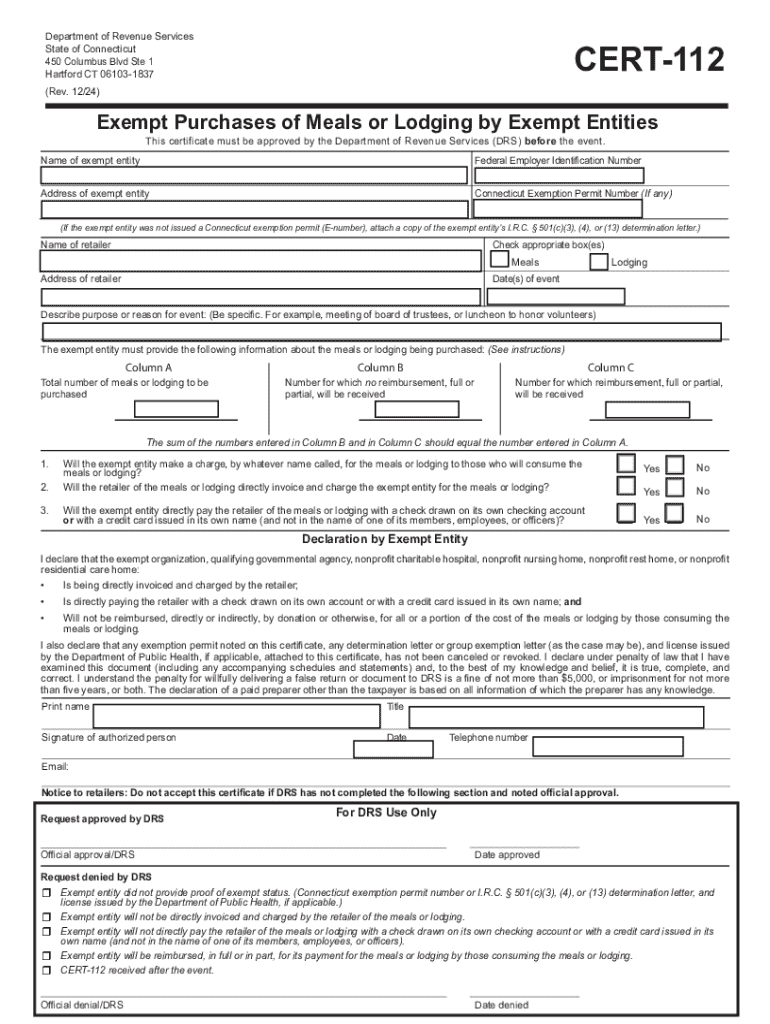

Department of Revenue Services State of Connecticut 450 Columbus Blvd Ste 1 Hartford CT 061031837CERT112 Clear Fields(Rev. 12/24)Exempt Purchases of Meals or Lodging by Exempt Entities This certificate

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CERT-112

Edit your CT DRS CERT-112 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CERT-112 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS CERT-112 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CT DRS CERT-112. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CERT-112 Form Versions

Version

Form Popularity

Fillable & printabley

Fill

form

: Try Risk Free

People Also Ask about

What is an St 12 in Massachusetts?

This form may be used by a contractor when purchasing or leasing tangible personal property from a vendor in connection with fulfilling a contract with its customer if the property will be used for one of the exempt uses described in Massachusetts General Laws (MGL) chapter 64H, section 6(r) or (s), which include the

What is a sales tax exemption certificate in Massachusetts?

An exempt use certificate relieves the vendor from the burden of proof only if it is taken in good faith from a purchaser who, at the time of purchase, intends to use the property in an exempt man- ner, or is unable to ascertain at the time of purchase that it will be used in an exempt manner.

What is the tax exemption form for Massachusetts?

In order to claim an exemption from sales tax on purchases in MA, a copy of the Certificate of Exemption (Form ST-2) must be presented to the vendor at the time of purchase. In addition, Form ST-5 must be completed.

What is the exempt form for NYS sales tax?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

Do Connecticut tax exempt certificates expire?

How long is my Connecticut sales tax exemption certificate good for? Most blanket exemption certificates is considered to be valid for precisely three years from the from the date that they were issued, so long as the tax exempt situation is still in effect.

What is the exemption statute in CT?

The homestead exemption generally permits the debtor to exclude his or her home from execution of a judgment up to $250,000, or $75,000 for money judgments for claims of sexual abuse or exploitation of a minor, sexual assault, or other willful, wanton, or reckless misconduct.

What is exempt from sales tax in CT?

Tax-exempt goods Some goods are exempt from sales tax under Connecticut law. Examples include bicycle helmets, most non-prepared food items, medicines, and some medical devices and supplies.

What is the tax exempt form for lodging in CT?

CERT-112 allows an exempt entity to purchase meals or lodging, or both, tax exempt for a single event and may not be used for repeat purchases.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CT DRS CERT-112?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the CT DRS CERT-112 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in CT DRS CERT-112?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your CT DRS CERT-112 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit CT DRS CERT-112 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your CT DRS CERT-112, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Fill out your CT DRS CERT-112 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CERT-112 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.