Get the free Maryland Form 502b

Get, Create, Make and Sign maryland form 502b

How to edit maryland form 502b online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland form 502b

How to fill out maryland form 502b

Who needs maryland form 502b?

A comprehensive guide to Maryland Form 502B

Understanding the Maryland Form 502B

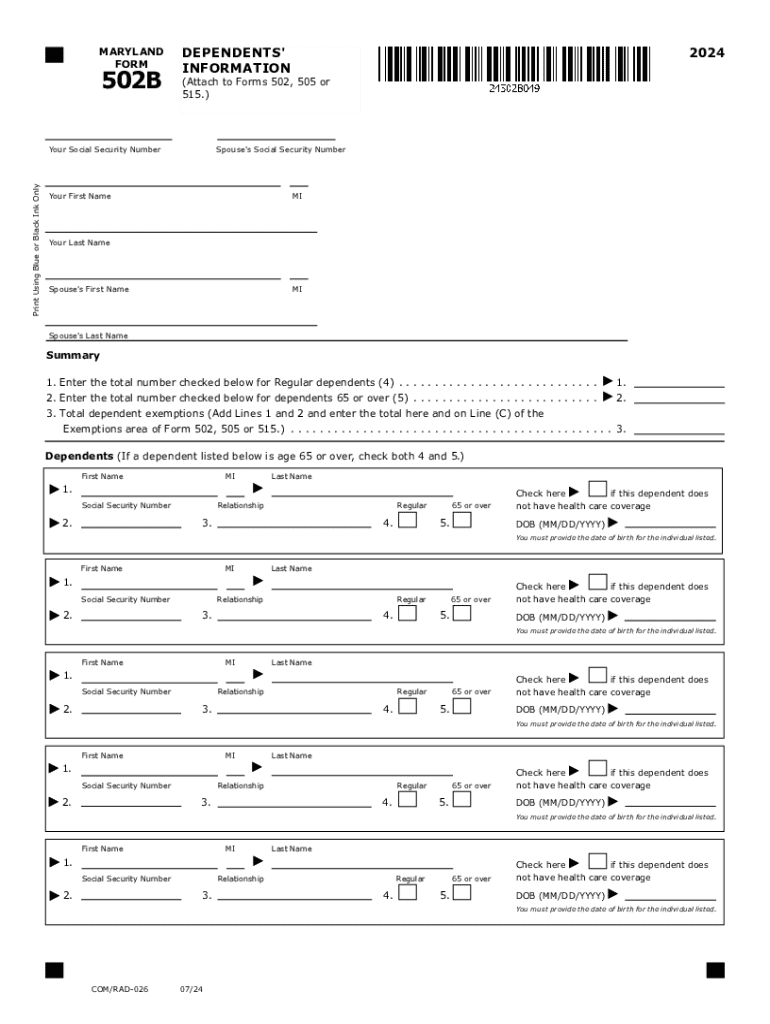

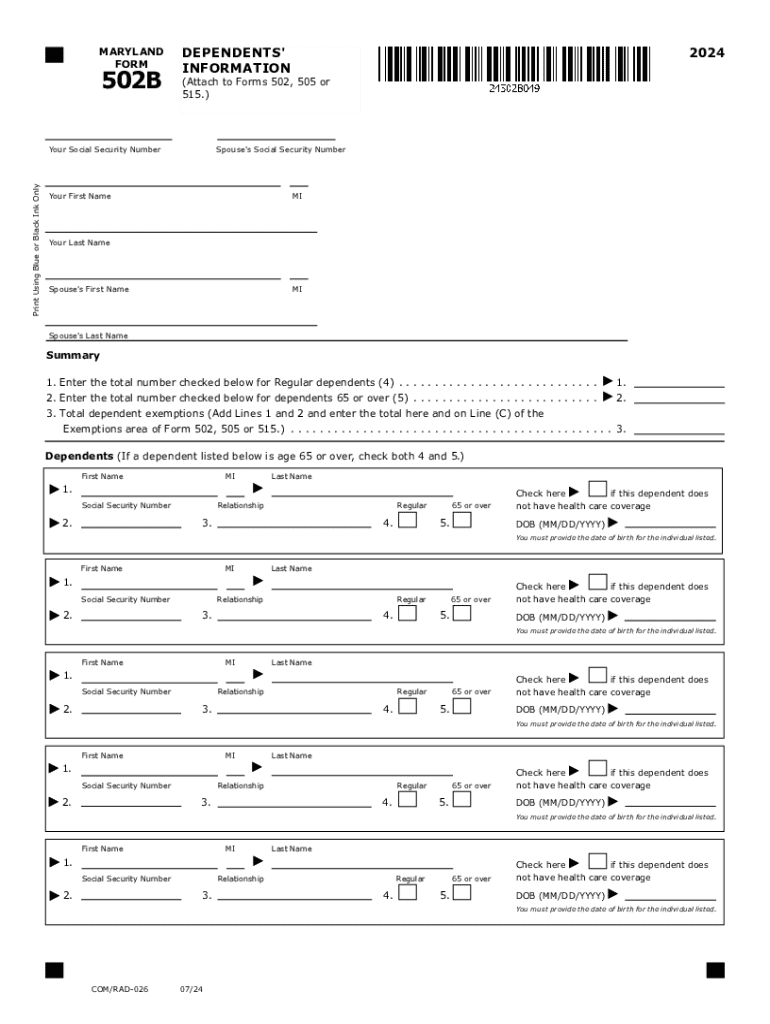

Maryland Form 502B, officially known as the 'Dependents Schedule,' serves a vital role in Maryland's tax filing process. This form is specifically designed for taxpayers to provide detailed information about their dependents when submitting their Maryland personal tax returns. The primary purpose of Maryland Form 502B is to establish eligibility for various tax benefits and credits associated with dependents.

Filing accurately on the Maryland Form 502B is crucial. Any discrepancies or omissions can lead to tax-related issues, including delayed processing or loss of potential deductions. Therefore, understanding this form is essential for anyone who qualifies to claim dependents on their taxes.

Typically, individuals who need to complete the Maryland Form 502B include taxpayers claiming dependents, such as children or other qualifying relatives, on their Maryland income tax return. This includes parents, guardians, or anyone financially responsible for dependents.

Key requirements for filling out Maryland Form 502B

To fill out the Maryland Form 502B correctly, it’s essential to be aware of the eligibility criteria for dependents. In Maryland, a dependent must typically be a child under 19, a full-time student under 24, or an individual of any age who is permanently disabled. Understanding these specifics is crucial, as they determine whether you can claim certain tax credits and exemptions.

Before diving into filling out the form, gather necessary information about each dependent. This includes not only your personal information as the taxpayer — such as your social security number, filing status, and address — but also specific information about each dependent like their names, social security numbers, relationship to you, and dates of birth.

Step-by-step guide to completing Maryland Form 502B

Accessing the Maryland Form 502B is straightforward. Taxpayers can find the form online through the Maryland State Comptroller's website or directly via the pdfFiller platform. You can also request a physical copy through local tax offices if you prefer to fill it out by hand.

When filling out the Maryland Form 502B, start by entering your personal information in Section 1. This part collects essential data about the taxpayer. Next, move to Section 2 where you will provide information about each dependent. It’s crucial to double-check all entries for accuracy, as errors can lead to delays or complications in processing your tax return.

Section 3 allows space for any additional notes or comments. If there are special circumstances concerning a dependent, detailing them here can be beneficial.

Editing and managing your Maryland Form 502B with pdfFiller

Using pdfFiller to manage your Maryland Form 502B makes the editing process seamless. You can upload the form directly to the platform, where various tools allow for easy editing. With just a few clicks, you can modify text, add new entries, or correct any mistakes.

Additionally, pdfFiller enables users to annotate the form. If you’re collaborating with team members or family members, you can share the form using pdfFiller's collaboration features. This makes it easy to gather input from others before finalizing your submission.

After you've completed your form, you can eSign it directly in pdfFiller. This feature is particularly convenient, as it accelerates the submission process by allowing you to handle everything in one place.

Submission process for Maryland Form 502B

Once completed, Maryland Form 502B needs to be submitted alongside your Maryland income tax return. You can file your return either electronically or via mail, depending on your preference. If you choose to file electronically, ensure that all forms are carefully reviewed for correctness.

It’s vital, as well, to be aware of any deadlines associated with the submission. Maryland's tax return due date typically aligns with the federal deadline, falling on April 15th each year. Missing this deadline can result in penalties or loss of potential refunds.

After submission, your next steps will depend on whether you filed electronically or by mail. Keep an eye out for any communications from the Maryland State Tax Office, especially if there are issues or further clarifications required on your form.

Troubleshooting common issues with Maryland Form 502B

Filing taxes can sometimes lead to questions. What if you made a mistake on your form? If you realize you’ve made an error after submission, you can amend your return, but it’s best to do so as soon as possible to mitigate any potential penalties.

Common issues faced include missing dependent information or providing incorrect social security numbers. To help resolve any issues, it’s advisable to consult the Maryland State Tax Office. Their staff can provide guidance and support, ensuring your concerns are addressed efficiently.

Related documents and resources

Filing your Maryland taxes may require other forms alongside the Maryland Form 502B. For example, Maryland Form 502 is the primary Individual Income Tax Return, capturing more comprehensive financial information. Non-residents might also need to fill out Maryland Form 505, which addresses Nonresident Income Tax Returns, ensuring all sources of income are accurately reported.

Accessing these documents is essential for a smooth filing process. Resources such as the Maryland State Comptroller's website provide downloadable forms and detailed guidance on the filing process, making it easier to manage your tax obligations.

The benefits of using pdfFiller for document management

pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. This functionality eliminates the need for multiple apps or services, making tax preparation a more streamlined and efficient experience.

Key features such as effortless editing and signing capabilities enhance user experience. With pdfFiller, you can also easily track changes and revisions in your documents, creating an organized filing system for your tax records.

Additional tools and features on pdfFiller

Beyond managing the Maryland Form 502B, pdfFiller also offers additional tools that can significantly improve your document workflow. You can merge multiple PDF files into one, simplifying the compilation of related forms and documents.

Creating fillable forms is another advantageous feature, allowing you to design custom documents tailored to your specific needs. With these tools, you can boost productivity, ensuring that your documentation processes are as efficient as possible.

User testimonials and case studies

Many users have found success with pdfFiller while managing their Maryland Form 502B. One user reported significant time savings when collaborating with family members on dependent information, as pdfFiller’s features allowed for seamless input and review.

Another success story comes from a small business team that needed to prepare multiple tax forms for several employees. Utilizing pdfFiller simplified their document management significantly, providing a cohesive platform for all their needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute maryland form 502b online?

Can I create an eSignature for the maryland form 502b in Gmail?

How do I edit maryland form 502b on an Android device?

What is Maryland Form 502B?

Who is required to file Maryland Form 502B?

How to fill out Maryland Form 502B?

What is the purpose of Maryland Form 502B?

What information must be reported on Maryland Form 502B?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.