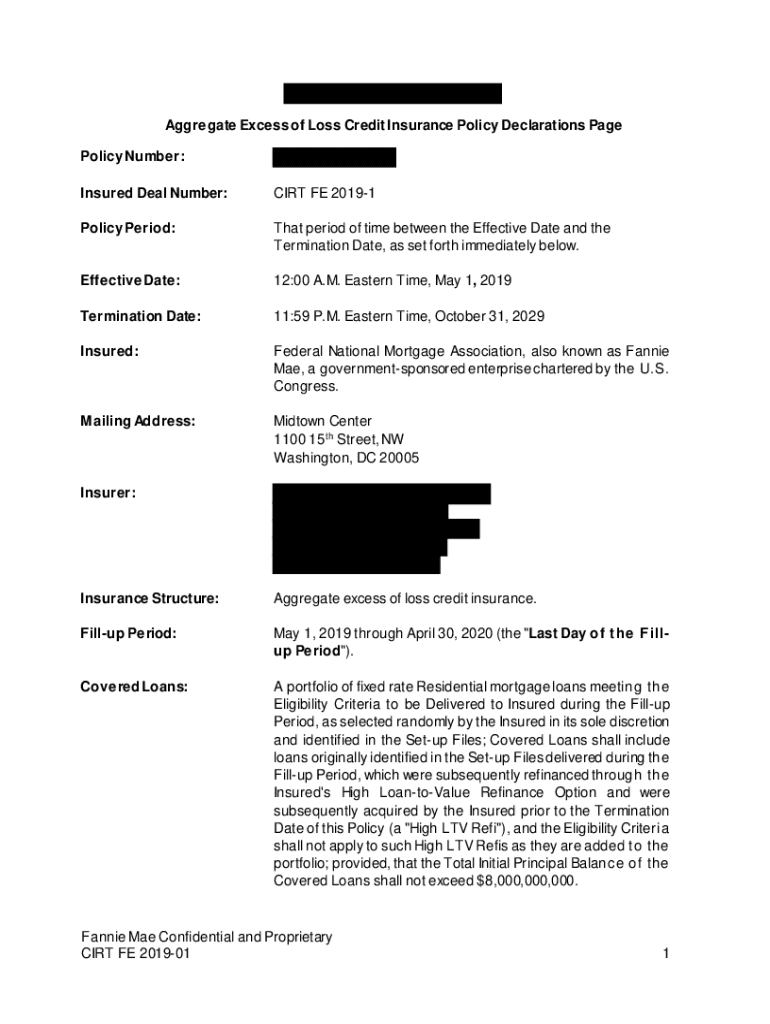

Get the free Aggregate Excess of Loss Credit Insurance Policy Declarations Page

Get, Create, Make and Sign aggregate excess of loss

How to edit aggregate excess of loss online

Uncompromising security for your PDF editing and eSignature needs

How to fill out aggregate excess of loss

How to fill out aggregate excess of loss

Who needs aggregate excess of loss?

Understanding the Aggregate Excess of Loss Form and Its Importance in Risk Management

Understanding the aggregate excess of loss form

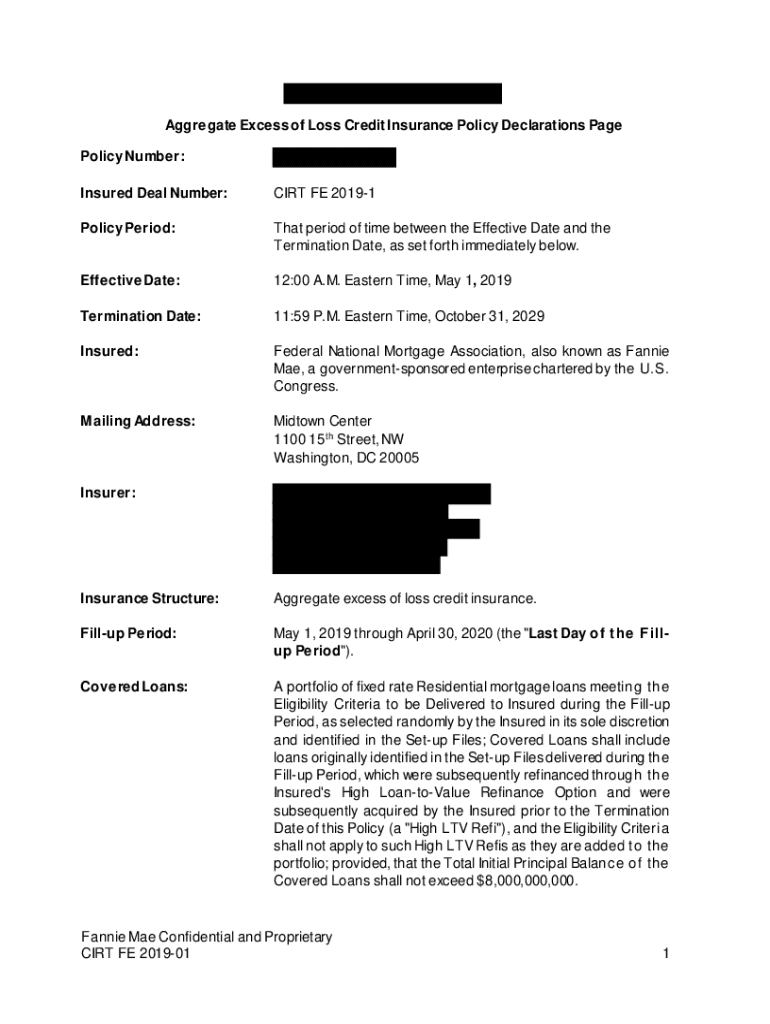

The aggregate excess of loss form is a crucial component in the field of insurance, particularly in reinsurance. It serves as a risk mitigation tool that helps organizations manage their exposure to significant losses by protecting against aggregated claims above a specified threshold. Essentially, this form outlines the terms and conditions under which an insurer will cover losses that exceed an established aggregate limit, typically over a defined policy period.

Key components of the aggregate excess of loss form include the attachment point, which is the minimum loss level that triggers coverage, and the limit of coverage, which indicates the maximum amount an insurer will pay. Additionally, it contains details regarding the duration of coverage and the specific type of losses it applies to, making it indispensable for organizations looking to safeguard their financial stability.

In the realm of reinsurance, the aggregate excess of loss form plays a crucial role in risk management strategies. By providing coverage for cumulative losses, it allows insurers to balance their risk profiles and protect against catastrophic events that could otherwise destabilize their operations. This understanding is vital for individuals and teams involved in risk assessment and management.

Importance of the aggregate excess of loss form in risk management

The aggregate excess of loss form is not just a technical document; it offers significant benefits for individuals and teams engaged in insurance and risk management. One of the primary advantages is the enhancement of financial stability. By capping potential losses, organizations can avoid devastating impacts on their balance sheets, ensuring continued operations even in the face of adverse circumstances.

Furthermore, the use of this form facilitates better loss management strategies. With a clear understanding of their aggregate exposure, companies can allocate resources more effectively, plan for potential payout scenarios, and implement risk mitigation practices tailored to their specific needs.

Case studies illustrate the effective use of aggregate excess of loss forms in diverse organizations. For instance, a regional healthcare provider utilized this form to safeguard its finances against unexpected surges in medical claims, allowing it to maintain essential services during a challenging economic downturn. Another example can be found in the manufacturing sector, where a company leveraged the form to protect against large product recall costs, ensuring its long-term viability.

Step-by-step guide to completing the aggregate excess of loss form

Completing the aggregate excess of loss form can be straightforward if approached methodically. Begin with a preparation checklist to gather all necessary information and documents such as prior year loss data, financial statements, and claims history. Each of these components will play a vital role in accurately filling out the form.

When you are ready to complete the form, follow these section-by-section instructions: first, accurately input your organization’s details, including name, address, and the nature of your business. Next, clearly outline the attachment point and limit of coverage, ensuring these figures reflect a realistic assessment of your risks. Common pitfalls include underestimating expected losses or failing to provide complete data, both of which can lead to coverage gaps.

Digital tools for managing the aggregate excess of loss form

Embracing technology can simplify the management of the aggregate excess of loss form. Platforms like pdfFiller offer essential features that allow users to edit and electronically sign the form online. This not only streamlines the completion process but also ensures that all revisions are made seamlessly without the hassle of printing and scanning.

Collaboration tools within pdfFiller enable teams to work together, irrespective of their physical locations. Multiple users can access and edit the form concurrently, making it easier to compile data and finalize submissions quickly. Additionally, accessibility features allow you to manage the form from various devices, ensuring you can stay on top of your documentation even when on the move.

Legal considerations and compliance

Understanding the legal framework surrounding the aggregate excess of loss form is essential for compliance. Different jurisdictions may impose unique regulatory requirements, which could affect how the form is produced and submitted. Organizations must be aware of local laws governing insurance contracts to ensure that they are in alignment with legal expectations.

Best practices for compliance include reviewing policy language carefully, ensuring that all required disclosures are made, and maintaining records of communications with stakeholders. Organizations should regularly consult legal advisors to keep abreast of any changes that could impact their use of the aggregate excess of loss form.

Strategies for effective aggregate excess of loss submission

Submissions of the aggregate excess of loss form can be fraught with opportunities for mistakes. Common errors often include incorrect data entries, failure to report all relevant risks, and missing deadlines. Highlighting these frequent mistakes can help organizations in developing a comprehensive review process before submission.

Optimal submission timing also plays a critical role in the process. It is advisable to submit the form ahead of renewal deadlines or changes in terms to ensure adequate time for review and resolution of potential queries. Additionally, filing well in advance allows for adjustments based on financial performance trends or loss histories.

Analyzing the financial impact post submission

After submitting the aggregate excess of loss form, understanding coverage and payouts becomes paramount. Aggregate limits fundamentally influence the insurance payouts that an organization may receive in the event of a claim. Thus, a well-structured aggregate form translates to better loss recovery strategies should the necessity arise.

Organizations can assess their financial risks through a combination of loss projection tools and calculators available online. These tools can provide insights into potential exposure levels based on changes in business operations or market conditions, essential for sound financial decision-making.

FAQs about the aggregate excess of loss form

Addressing common concerns associated with the aggregate excess of loss form is integral for effective usage. Users often inquire about how to interpret specific terms, where to find additional support, or what to do in case of discrepancies. Engaging with experts in the field can help clarify these points and offer insights into best practices.

Industry professionals recommend organizations stay informed through continuous learning opportunities, such as workshops and seminars focused on risk management and insurance practices. Networking with peers can also yield valuable tips for maximizing the benefits of the aggregate excess of loss form.

Future developments in aggregate excess of loss practices

The landscape of reinsurance, particularly regarding the aggregate excess of loss form, is ever-evolving. Innovations in technology and analytics are shaping practices in ways that promote efficiency and accuracy in risk assessment. Insurers are increasingly adopting data-driven approaches to determine coverage needs and adjust policy terms.

To prepare for upcoming changes, organizations should actively monitor trends in the reinsurance market and be willing to adopt new tools that enhance their risk management strategies. Continuous improvement in processes and adherence to emerging best practices will ensure they remain agile and ready for whatever changes lie ahead in aggregate excess of loss practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in aggregate excess of loss?

How do I fill out aggregate excess of loss using my mobile device?

Can I edit aggregate excess of loss on an iOS device?

What is aggregate excess of loss?

Who is required to file aggregate excess of loss?

How to fill out aggregate excess of loss?

What is the purpose of aggregate excess of loss?

What information must be reported on aggregate excess of loss?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.