Get the free Schedule B (form 941)

Get, Create, Make and Sign schedule b form 941

How to edit schedule b form 941 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule b form 941

How to fill out schedule b form 941

Who needs schedule b form 941?

Schedule B Form 941 Form: A Comprehensive Guide

The Schedule B (Form 941) serves as a crucial element for employers when reporting payroll taxes. It provides the IRS with a detailed account of federal tax liabilities, helping businesses accurately reflect their tax obligations. This guide will explore everything you need to know about Schedule B, ensuring compliance and accuracy for all businesses.

What is Schedule B (Form 941)?

Schedule B, an attachment to Form 941, is essential for businesses that must report their payroll tax liabilities. Specifically, it summarizes the employer's tax dues for Social Security and Medicare and accounts for any adjustments or credits that may apply. This form offers a snapshot of federal tax liabilities, ensuring that employers maintain full transparency and compliance with IRS regulations.

Purpose and importance of Schedule B

The primary purpose of Schedule B is to provide the IRS with a detailed breakdown of an employer's tax deposits and liabilities. By accurately reporting these figures, employers can prevent discrepancies that could lead to fines or audits. Furthermore, it allows businesses to track their tax obligations more effectively, ensuring that they can manage cash flow and budgeting for payroll taxes.

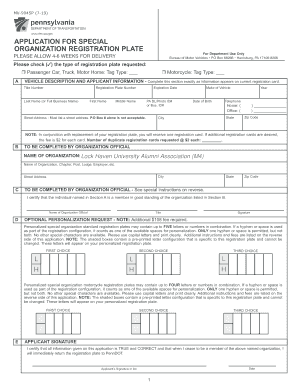

Who needs to file Schedule B (Form 941)?

Any business that meets specific criteria must file Schedule B with Form 941. Generally, employers who are required to make quarterly tax deposits, those who owe $100,000 or more in payroll taxes during a lookback period, and those who have a history of late payments are mandated to submit this form. This requirement is designed to ensure that larger employers and those with irregular payment histories are closely monitored.

Filing and reporting requirements

Filing requirements for Schedule B depend largely on how frequently a business deposits payroll taxes. For example, weekly and monthly depositors generally need to complete this form, while annual employers may not. Submission should be done quarterly, aligning with the Form 941 due dates to maintain compliance with IRS regulations. Employers must report both the amount due and the deposits made to accurately reflect their tax position.

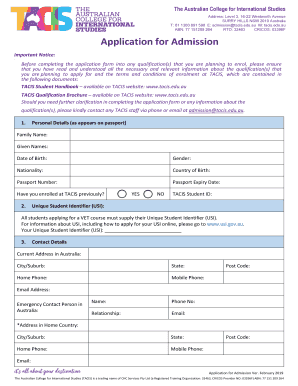

Step-by-step instructions on how to complete Schedule B (Form 941)

Completing Schedule B involves several key preparation steps. Gather necessary documentation, including payroll records, to ensure accurate reporting. Decide whether to fill the form online via the IRS e-File system or print a hard copy to complete manually. Each approach offers unique advantages, but electronic filing is generally faster and more efficient.

Common errors and how to fix them

Errors in Schedule B can lead to severe repercussions, including fines and audits. Some common mistakes include incorrect calculations of tax liabilities, failing to account for previous deposits, or neglecting to file altogether. If an error is discovered after submission, it's essential to correct it promptly by filing an amended return.

Penalties for not filing Schedule B (Form 941)

Failing to file Schedule B can result in serious financial repercussions, including penalties ranging from a fixed amount to a percentage of the unpaid taxes. Additionally, interest may accrue on any amount owed, impacting a business's cash flow. Consistently missing deadlines can also harm a business's credit and reputation.

Changes & updates to Form 941 Schedule B for 2023

2023 saw several updates to Form 941 and its Schedule B. These updates are aimed at simplifying reporting requirements and improving compliance. Employers are encouraged to familiarize themselves with these changes to ensure that their filings meet current standards and avoid penalties.

IRS due dates and important filing information

Understanding filing deadlines is crucial for effective tax management. Schedule B typically aligns with the quarterly deadlines for Form 941, which are the last day of April, July, October, and January. The lookback period, which helps determine deposit schedules, typically spans the previous calendar year.

Frequently asked questions about Schedule B (Form 941)

Employers frequently have questions regarding Schedule B. Essential details include understanding the importance of timely filings, the implications of late submissions on payroll processing, and steps to take when deadlines cannot be met. It's vital to stay informed and proactive in managing payroll duties.

Additional tools and resources

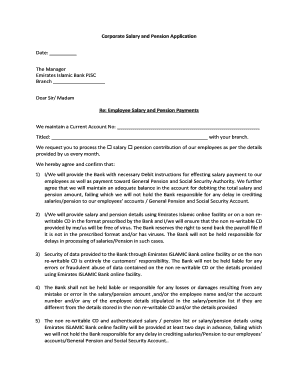

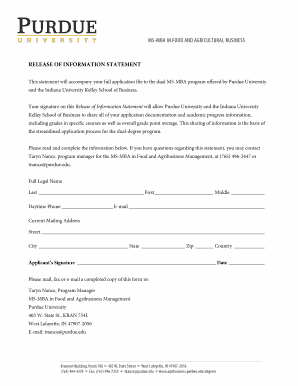

Resources like pdfFiller’s document management system can greatly simplify the filing process. By using interactive tools, users can easily edit, sign, and collaborate on Schedule B forms without hassle. Accessing webinars and guides on payroll tax preparations can dramatically enhance understanding, facilitating smooth compliance with IRS regulations.

User empowerment

pdfFiller empowers users to manage their tax documents efficiently through its cloud-based platform. This approach not only simplifies the filing of Form 941 and Schedule B but also enhances the overall document management process. A seamless user experience allows employers to maintain compliance while saving time and reducing stress—whether in the office or on-the-go.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my schedule b form 941 in Gmail?

How do I edit schedule b form 941 online?

How do I complete schedule b form 941 on an Android device?

What is schedule b form 941?

Who is required to file schedule b form 941?

How to fill out schedule b form 941?

What is the purpose of schedule b form 941?

What information must be reported on schedule b form 941?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.