Understanding the Confidential Business Personal Property Form

Breadcrumbs

Home > Forms > Business Documents > Confidential Business Personal Property Form

Sidebar

What is Confidential Business Personal Property?

Understanding confidential business personal property

Confidential business personal property encompasses assets that a business owns but does not wish to disclose publicly. This includes sensitive information such as proprietary technologies, trade secrets, client lists, and processes that give companies a competitive edge. The confidentiality of such information is crucial for asset protection, ensuring that businesses can operate without the risk of intellectual property theft or competitive disadvantages.

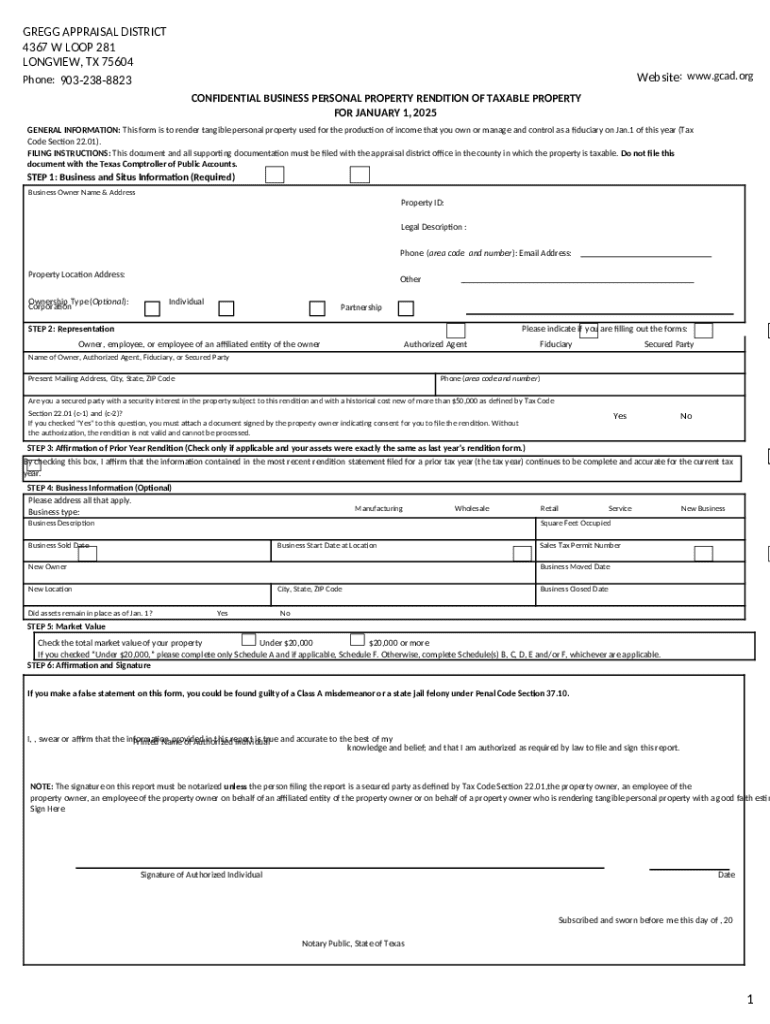

To formalize confidentiality, businesses often need to file a document known as the Confidential Business Personal Property Form. This form is essential for declaring the specific assets a business wants to keep confidential while meeting regulatory requirements.

Overview of the Confidential Business Personal Property Form

The Confidential Business Personal Property Form serves as a formal declaration by a business regarding its confidential assets. The primary purpose is to notify the appropriate governmental authority about the nature and value of these personal properties, ensuring they are not subject to public disclosure. Businesses that possess any tangible or intangible personal property that constitutes a trade secret, intellectual property, or sensitive business information must consider completing this form.

The form typically requires key information, such as the business name, address, type of business entity, and a detailed list of the confidential assets. Both small and large businesses stand to benefit from this form as it helps protect their valuable information from prying eyes.

Filing requirements and deadlines

Filing deadlines for the Confidential Business Personal Property Form vary by jurisdiction. However, many states require the submission to be completed annually in conjunction with property tax filings. It is crucial for businesses to stay informed about their local regulations to avoid potential penalties that can arise from missing deadlines.

In some states, late submissions may incur penalties that can add up over time, impacting the financial health of the business. Thus, businesses are encouraged to maintain a calendar of important dates and set reminders to ensure timely submissions.

Eligibility and exemption

Certain businesses may qualify for exemptions from filing this form based on specific criteria. For example, small businesses with total assets below a specified threshold or independent contractors working from home may not need to file. Understanding exemption criteria is vital to ensure businesses are not unnecessarily burdened with filings that do not apply to them.

To confirm eligibility for exemption, businesses should consult local tax guidelines or seek advice from a tax professional who specializes in business filings.

Filling out the form

Completing the Confidential Business Personal Property Form can be streamlined with proper preparation. The first step is to gather all necessary documentation, which may include previous filings, business registration papers, and detailed descriptions of confidential assets.

Gather Necessary Documentation: Collect all relevant papers, including past declarations and proofs of ownership.

Fill in Business Information: Provide details such as the business name, address, type of entity, and years in operation.

Provide Asset Information: Itemize the types of confidential properties owned, ensuring clarity on what constitutes confidential.

Declaration and Signature: Accurately represent the information on the form and include appropriate signatures, including eSigning options if available.

Accurate representation is critical as any discrepancies can lead to penalties or complications. Thus, reviewing the form multiple times before submission is a best practice.

Common mistakes to avoid

Completing the Confidential Business Personal Property Form may seem straightforward, but there are common pitfalls that could derail the process. One frequent error is neglecting to include all confidential assets, which can result in incomplete underscoring of a business's value.

Another common mistake is failing to update previous submissions with any new or devalued assets. Businesses should take care to ensure that their filings accurately reflect their current standing.

Lastly, individuals often rush through the eSigning process without fully comprehending the implications. Ensuring that all information is correct and understood before signing is essential. All these mistakes can lead to potential legal issues or financial penalties.

Managing your confidential business personal property

Once confidential business personal property has been identified and documented through the appropriate form, proper management practices must follow. Organizing records effectively is crucial for businesses to maintain clarity and compliance. Using digital tools can greatly assist in keeping track of assets, ensuring that businesses stay updated on changes in status or value.

pdfFiller provides advanced document management tools that allow users to store, edit, and share documents conveniently. This includes functionality for categorizing documents, making retrieval simple and straightforward.

Confidentiality tips

Maintaining confidentiality should come hand-in-hand with assiduous records management. Businesses can adopt strategies such as employing non-disclosure agreements (NDAs) with employees and business partners to help safeguard sensitive information. Furthermore, employing cybersecurity measures to protect digital assets is essential in today's technology-driven world.

pdfFiller ensures that all documents uploaded to their platform are protected using industry-standard encryption techniques. This provides peace of mind when managing sensitive business documents, making it crucial for businesses to choose secure platforms.

Frequently asked questions (FAQs)

General questions about the form

What happens if I miss the filing deadline? Missing filing deadlines can lead to penalties. Local authorities may prescribe fines or additional interest on owed taxes, highlighting the necessity of adhering to submission timelines.

Can the form be submitted online? Many jurisdictions allow the online submission of the Confidential Business Personal Property Form. Utilizing online tools can expedite the process and reduce errors associated with manual filing.

Where can I find assistance if needed? There are multiple resources for support, including consulting tax professionals or seeking assistance directly from the tax office that oversees business filings.

Specific situations

What if my business changes ownership? In the event of a change in ownership, it is crucial to review and potentially refile the Confidential Business Personal Property Form, as ownership impact on confidential asset classifications.

How to handle asset depreciation in the context of this form? Businesses should reflect accurate values for all assets, including any depreciation factors. Keeping meticulous records aids in providing truthful valuations in filings.

Clarifications about confidentiality

Is the information provided on the form public? Depending on jurisdiction, some information may become public record, while critical confidential data tends to remain protected. Understanding local laws concerning public disclosures is key.

How can I ensure my business data remains confidential? Adopting solid data protection practices and using secure platforms like pdfFiller assures that your business data is shielded from unauthorized access.

Special considerations

Non-traditional business structures

Filing as a sole proprietor versus a corporation can require different considerations. Sole proprietors must understand that while personal and business assets may be intermingled, they still owe a duty of care regarding keeping business information confidential.

Corporations may have more complex structures regarding confidentiality and are often required to outline various asset classes in significant detail. Ensuring clarity in filings can help avoid future complications.

New business filing tips

New business owners should familiarize themselves with the Confidential Business Personal Property Form early on. This ensures they understand the importance of confidentiality in protecting their intellectual property and competitive advantages.

Leveraging resources, including tutorials and guides on platforms like pdfFiller, can provide valuable insights into legal obligations while clarifying how to effectively manage filings throughout the business lifecycle.

Interactive tools and resources

Document creation and management tools on pdfFiller

pdfFiller offers a suite of document creation and editing tools designed specifically for the seamless management of business forms, including the Confidential Business Personal Property Form. These tools empower users to customize forms and streamline the submission process.

Features like eSigning, collaboration support, and cloud storage remove the barriers typically associated with form management. Users can work on documents from anywhere, significantly enhancing efficiency.

Accessing support and training

pdfFiller ensures access to robust customer support. Users can reach out via live chat or email for immediate assistance with any form-related queries.

Additionally, pdfFiller provides a library of training materials and webinars designed to further assist users in adapting successfully to digital document management.

Contact information

For direct support regarding the Confidential Business Personal Property Form, users can contact customer service through the pdfFiller website. Completed forms can typically be submitted via the provided online portals, ensuring that processes remain simple and efficient.

Whether you have queries about specific forms or need clarification on your filings, pdfFiller enhances the experience by offering direct lines of communication to knowledgeable staff eager to assist.