Get the free Mo W-4

Get, Create, Make and Sign mo w-4

Editing mo w-4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mo w-4

How to fill out mo w-4

Who needs mo w-4?

Understanding the MO W-4 Form: A Comprehensive Guide

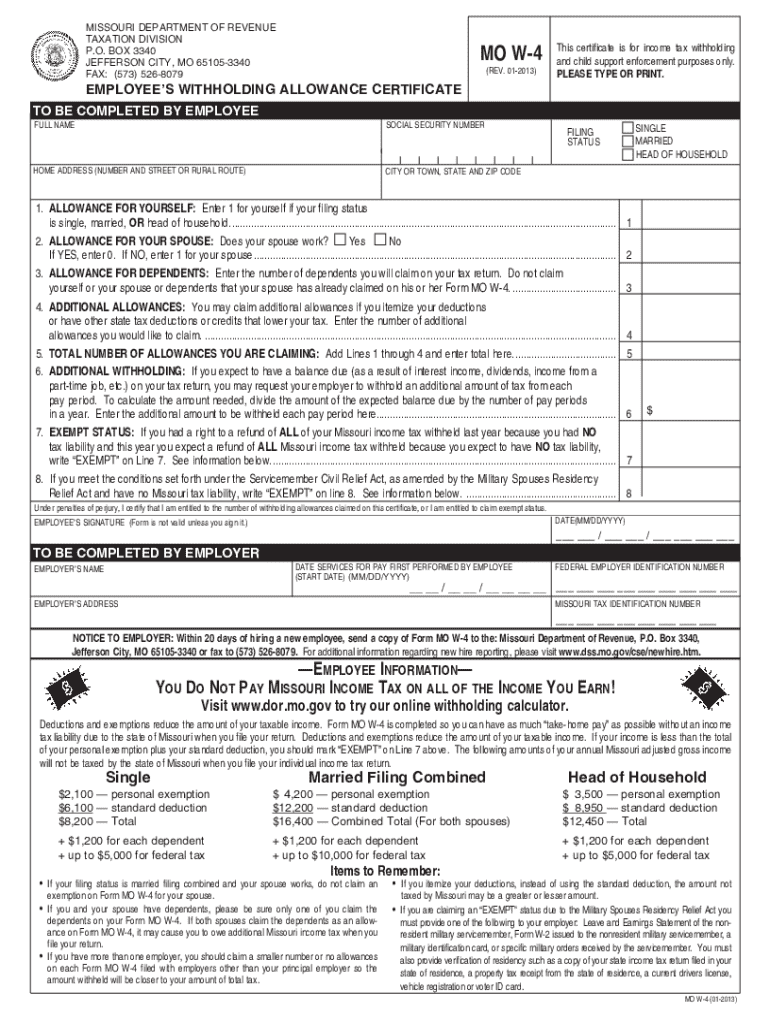

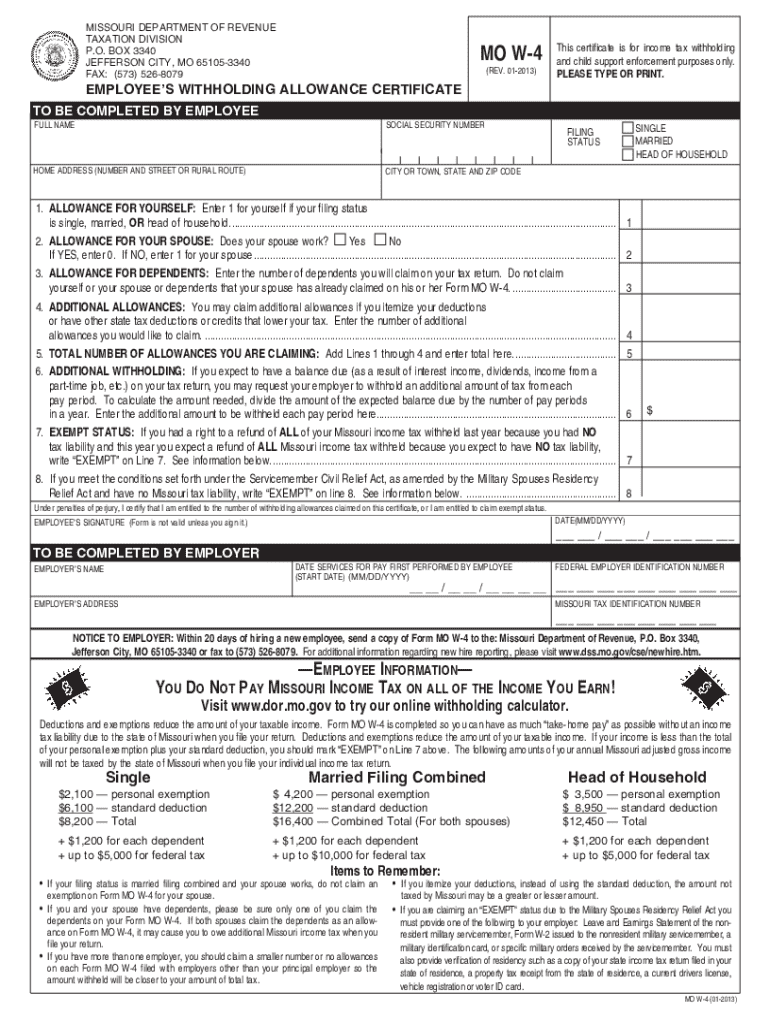

Overview of the MO W-4 form

The MO W-4 form, also known as the Employee's Withholding Certificate, is a crucial document for employees working in Missouri. This form enables you to specify how much state income tax should be withheld from your paycheck. The MO W-4 plays an essential role in ensuring that you pay the correct amount of taxes throughout the year, preventing any substantial tax bills or penalties during tax season.

It's important to stay informed about any updates, especially as tax laws can change. For the current tax year, the MO W-4 form has seen key updates focusing on simplifying the process for employees and enhancing clarity on withholding amounts.

Who should use the MO W-4 form?

Any employee working in Missouri is required to complete the MO W-4 form. This includes not only new hires but also current employees who may need to adjust their tax withholding due to changes in their financial situation, such as marriage, having children, or a change in job status.

Providing accurate information on the MO W-4 form is critical for determining the correct amount of state income tax withheld. Failing to do so can result in either under-withholding, which could lead to a tax bill, or over-withholding, which means less take-home pay. It's best practice to review your withholding amount annually or whenever a major life event occurs.

Step-by-step guide on filling out the MO W-4 form

Filling out the MO W-4 form is straightforward if you follow these steps carefully.

Editing the MO W-4 form

If you need to make changes to your MO W-4 form, accessing it online has never been easier. pdfFiller provides a user-friendly interface for editing your documents directly from the cloud.

Within pdfFiller, you can update personal information, correct any errors, and add new details without hassle. After editing, you can save and download the updated form in various formats.

eSigning the MO W-4 form

Electronic signatures are gaining traction due to their convenience, especially for documents like the MO W-4 form. pdfFiller allows for seamless eSigning, making the process quick and straightforward.

To eSign the MO W-4, simply follow these steps within the pdfFiller platform. Once you create your eSignature, it can be placed on your document, providing you with the legal standing that adheres to Missouri laws.

Sharing and submitting the MO W-4 form

Once your MO W-4 form is complete, you'll need to share it with your HR department. You can do this through various methods such as emailing the finalized document or uploading it to your company’s HR portal.

Best practices for submitting your form include ensuring that it is completed in full, double-checking for errors, and submitting it promptly to avoid any issues with your tax withholding.

Common mistakes to avoid when filling out the MO W-4 form

While filling out the MO W-4 form may seem straightforward, several common pitfalls can arise if you’re not careful.

Frequently asked questions (FAQs)

When using the MO W-4 form, you may have several questions regarding its use. Here are some frequently asked questions.

Related documents and forms

In addition to the MO W-4 form, it's important to be aware of other similar forms, such as the Federal W-4, which is used at the national level, and other state-specific withholding forms.

Understanding the differences between these forms helps ensure you're compliant with state and federal tax regulations, thereby preventing any issues with your taxable income.

Resources for additional help

If you find yourself needing further assistance, the Missouri Department of Revenue provides various resources to help taxpayers understand their responsibilities regarding withholding forms. Additionally, tax assistance organizations can offer personalized guidance.

For document-related questions regarding the MO W-4 form or using pdfFiller, their customer support team is readily available to provide help.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mo w-4 directly from Gmail?

How can I get mo w-4?

Can I create an electronic signature for signing my mo w-4 in Gmail?

What is mo w-4?

Who is required to file mo w-4?

How to fill out mo w-4?

What is the purpose of mo w-4?

What information must be reported on mo w-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.