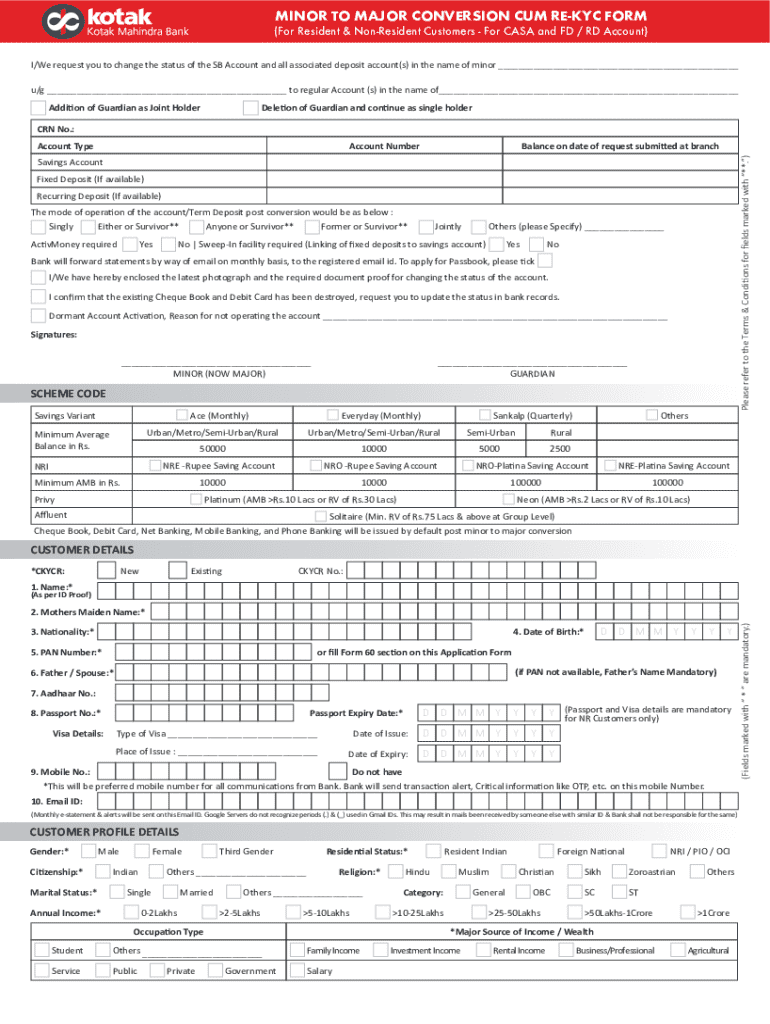

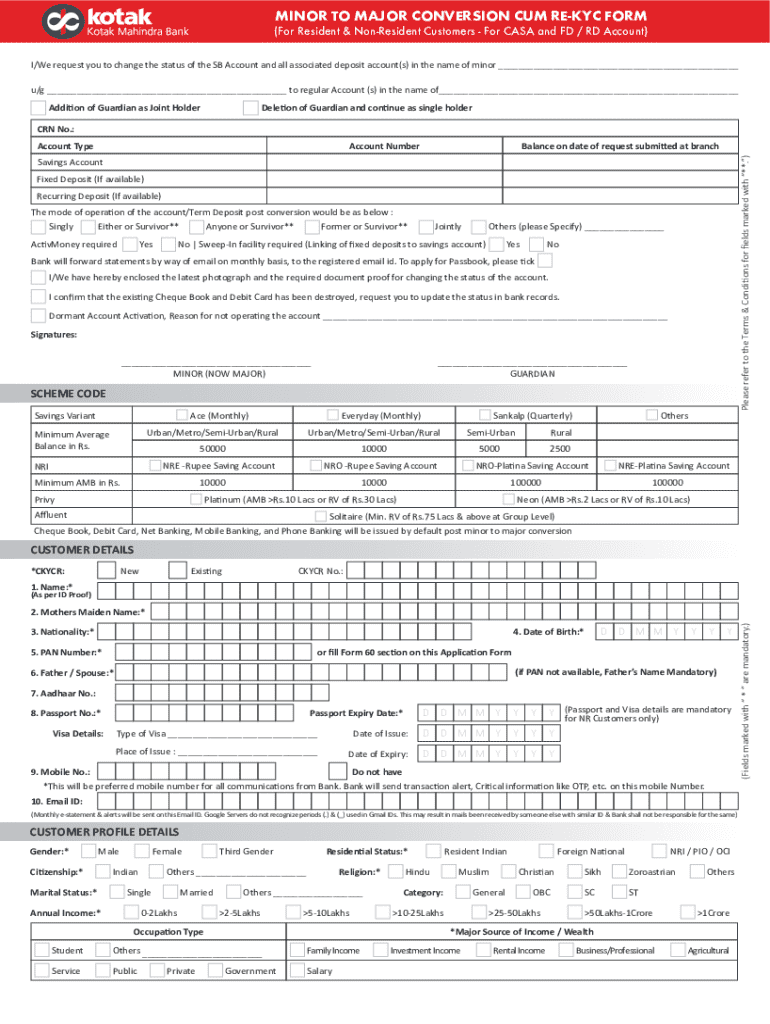

Get the free Minor to Major Conversion Cum Re-kyc Form

Get, Create, Make and Sign minor to major conversion

How to edit minor to major conversion online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minor to major conversion

How to fill out minor to major conversion

Who needs minor to major conversion?

Minor to Major Conversion Form - How to Guide

Understanding the concept of minor to major account conversion

The minor to major conversion form is an essential document for individuals transitioning from a minor account to a major account in the banking system. But what does this mean? A minor account is typically held by individuals below a specified age, often 18 years, who require parental or guardian oversight. In contrast, a major account is designed for adults, allowing for a broader range of financial services and independence in managing one's finances.

There are several key reasons individuals seek to convert their accounts. Firstly, meeting the legal age requirement is a significant milestone. As soon as one turns 18, they naturally move towards accessing a wider array of banking features, including loans, credit cards, and personal investment accounts. Secondly, conversion can facilitate more personalized banking experiences. This process typically opens doors to financial tools that can help in building wealth, planning for the future, or simply experiencing the freedom of financial autonomy.

The conversion process generally involves filling out the minor to major conversion form and providing necessary documentation to the bank. This straightforward yet crucial step establishes one’s identity as a responsible adult ready to manage personal finances independently.

Eligibility criteria for conversion

To be eligible for converting a minor account to a major account, certain criteria must be met. The most apparent requirement is that the individual must have reached the legal age defined by their bank, typically 18 years. However, understanding the documentation needed for this transition is equally important.

Common documentation required includes:

It's important to note special cases. For instance, if a minor account is a dependent on someone else's account, the process may involve additional steps, including reassessment of ownership and possibly setting up a standalone account.

Preparing for the conversion

Preparation is key to ensuring a smooth transition from a minor to a major account. The first step involves gathering all necessary documentation, creating a checklist to ensure nothing is overlooked. This is critical because missing documents can delay the process.

Understanding your bank's policies regarding account types is equally vital. Each institution may have its own specific criteria and guidelines for conversion. Thus, reviewing these before starting the process can save time and frustration. Communicating with parents or guardians is also a good practice, especially if their consent or involvement is needed for the transition.

Steps to convert minor account to major account

Once preparation is complete, it’s time to initiate the conversion process. Here are the crucial steps to follow:

Follow-up actions post-submission

After submitting the conversion form, it’s essential to track your application status. Most banks provide ways to check this, either through mobile banking apps or dedicated customer service portals. Knowing your application’s status can reduce anxiety during the waiting period.

Regarding the expected timeline for approval, it can resemble a range between a few days to a couple of weeks, depending on the institution's workload. Understanding the difference between approval and denial is also important. Common reasons for denial include insufficient documentation or discrepancies in the provided information. Thankfully, most banks provide guidance on how to rectify these issues should they arise.

Frequently asked questions

Navigating the process of converting a minor account can raise several questions. Here are some commonly asked queries:

Related content

Expanding your knowledge about banking can significantly help after your account conversion. Consider the following related content for further insights:

Additional tools and resources

To facilitate a seamless conversion experience, several tools and resources can be instrumental. For example, an interactive fillable PDF for the minor to major conversion form can simplify the document preparation process. Additionally, keeping relevant bank contact information handy can expedite the process if questions arise.

Utilizing financial literacy resources available online can further enhance your understanding of personal banking. Knowledge is power, especially when it comes to managing your finances effectively.

User experiences and testimonials

Hearing from others who have gone through the minor to major account conversion can provide unique insights. Many users share successful experiences that highlight the importance of thorough preparation and clear communication with their bank.

These testimonials often reveal valuable tips, such as double-checking documentation and seeking assistance when in doubt. With each conversion, individual experiences contribute to a collective understanding of how navigating the process can be made easier.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify minor to major conversion without leaving Google Drive?

How can I send minor to major conversion for eSignature?

How can I edit minor to major conversion on a smartphone?

What is minor to major conversion?

Who is required to file minor to major conversion?

How to fill out minor to major conversion?

What is the purpose of minor to major conversion?

What information must be reported on minor to major conversion?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.