Get the free esign

Get, Create, Make and Sign esign form

How to edit esign form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out esign form

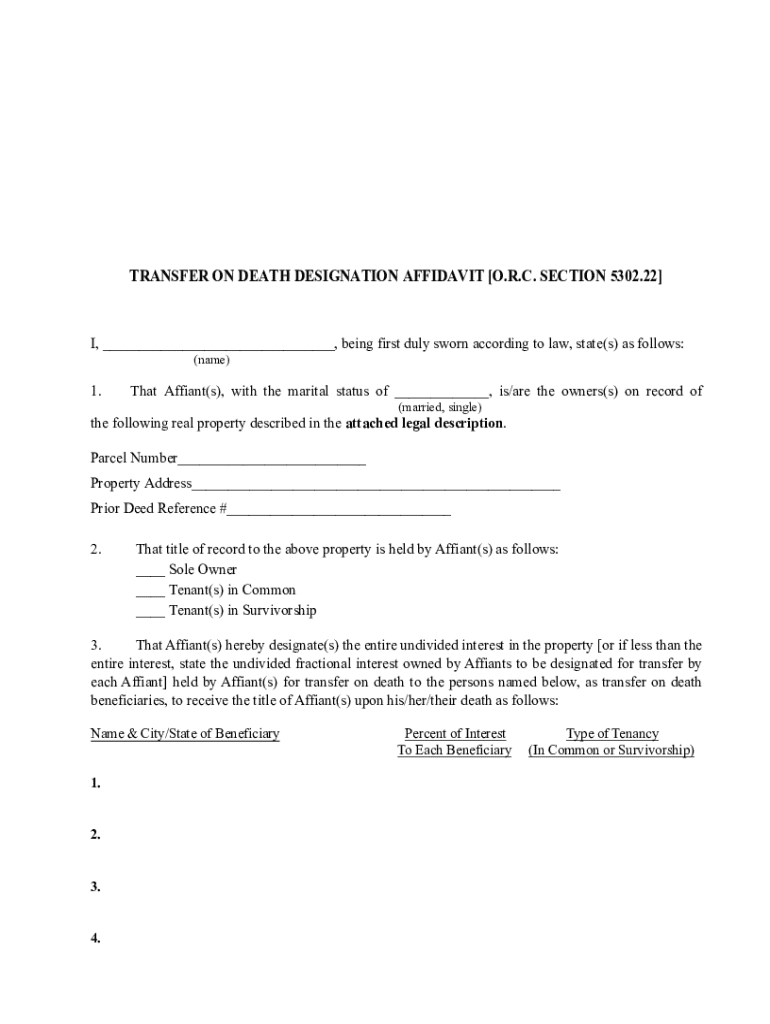

How to fill out transfer on death designation

Who needs transfer on death designation?

Transfer on death designation form - How-to guide

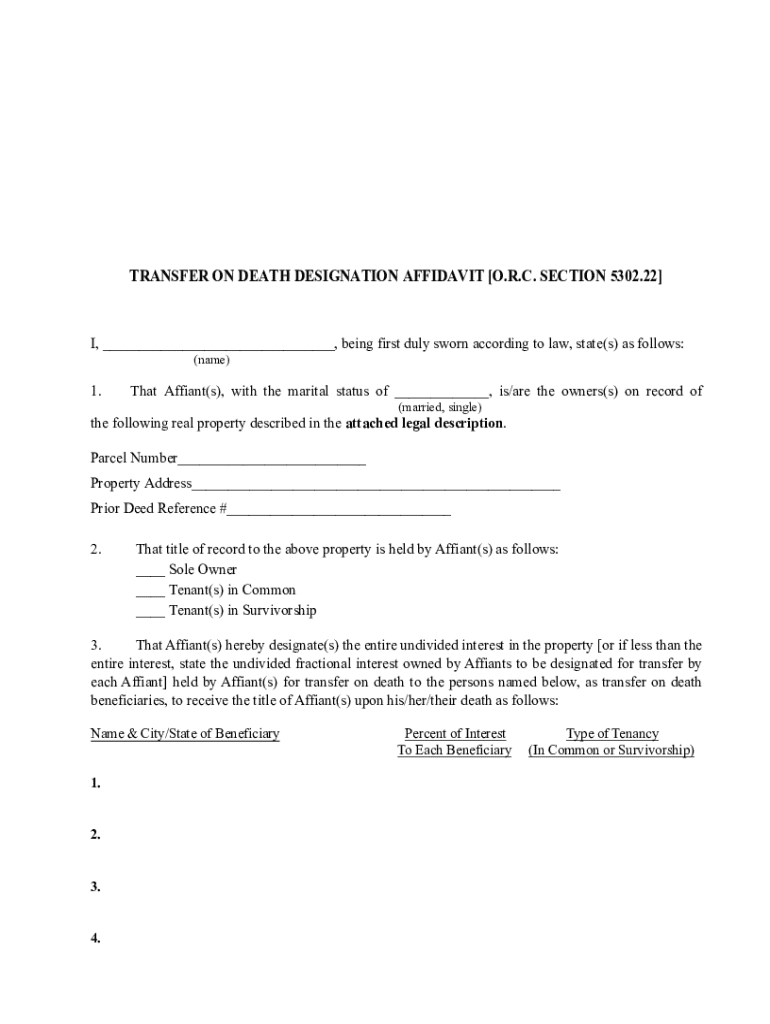

Understanding the transfer on death designation form

A transfer on death designation form (TOD form) is a legal document that allows individuals to specify how their assets should be transferred upon their death without going through the complex and often lengthy probate process. This simplified mechanism is crucial for estate planning, as it ensures that your assets are passed directly to your chosen beneficiaries. Most commonly associated with real estate, financial accounts, and even vehicles, the TOD form can greatly ease the management of an estate after one’s passing.

Having a transfer on death designation is paramount in estate planning. It allows you to maintain control over your assets while also ensuring a smooth transfer process for your heirs. By executing this form, you make clear your wishes regarding asset distribution, reducing the possibility of disputes and confusion among surviving family members.

Situations where a transfer on death designation is beneficial

Different scenarios highlight the effectiveness of a transfer on death designation. It transcends traditional asset types, proving useful in varied contexts. For many, the most significant aspect revolves around real estate considerations. A TOD designation can easily apply to residential properties, commercial buildings, or parcels of land. By completing a TOD form, the owner effectively designates who will inherit their property upon their passing, bypassing probate entirely.

Moreover, TOD designations extend their applicability to financial accounts. Bank accounts, investment accounts, and retirement accounts can include TOD provisions. This ensures that after death, funds are seamlessly transferred to the designated beneficiary, maintaining liquidity and access without complicated legal procedures. Additionally, even motor vehicles can be transferred using this form, making it versatile for various asset types.

Legal framework governing transfer on death deeds

State laws govern the creation and enforcement of transfer on death deeds. Variability exists from state to state, meaning it’s crucial for individuals to consult local regulations before executing a TOD form. For instance, states like California have different procedures compared to states like Florida or New York. Therefore, awareness of the nuances in your jurisdiction can save time and potential legal headaches down the road.

In Texas, specific provisions exist regarding transfer on death designations. Texas residents may also consider the so-called Lady Bird deed as an alternative vehicle for transferring property. This type of deed offers additional flexibility and ensures that the property remains within the grantor's control during their lifetime while also bypassing probate.

Step-by-step guide to completing the transfer on death designation form

Completing a transfer on death designation form correctly is vital for ensuring your wishes are honored. Start by gathering necessary information about the property, the beneficiary, and your personal details. This preparatory step helps streamline the process and minimize errors.

Filling out the form involves several key sections. First, you will detail the property description, clearly identifying the asset to be transferred. Next, provide accurate beneficiary information, including their name, address, and relationship, ensuring there are no ambiguities. Lastly, signatures from you and a notary public may be required to authenticate the document.

After filling out the form, review it meticulously for accuracy. A small error can lead to challenges in executing your wishes. Securely storing the finalized document is equally important. Keep it in a safe place, and consider informing your beneficiaries where to find it.

Managing your transfer on death designation

Managing your transfer on death designation is an ongoing process. As life circumstances change—whether through marriage, divorce, the birth of a child, or the passing of a loved one—updating the TOD form may become necessary. This fluidity ensures that your wishes always reflect your current situation.

Moreover, communicating with your beneficiaries about your estate planning is essential. They should be aware of their roles and how to access important documents. Open discussions can foster transparency and ensure that everyone is on the same page, minimizing potential conflicts in the future.

Common mistakes to avoid

While completing a transfer on death designation form can be straightforward, certain pitfalls are common. A frequent issue involves providing incomplete or incorrect information, which can thereby hinder the execution of your intentions. It is crucial to double-check all entered details.

Another critical mistake involves failing to adhere to state-specific requirements. Each state has different regulations that could cause a valid TOD designation to be disregarded. Lastly, ensuring that the form is stored securely is paramount; misplaced documents can complicate the transfer process significantly.

Interactive tools and resources

Using digital tools can simplify the process of completing and managing your transfer on death designation form. pdfFiller offers powerful editing and eSigning features that aid in filling out the form accurately and efficiently. With its user-friendly interface, you can easily collaborate with family members or legal advisors, ensuring that every detail is correct.

Additionally, pdfFiller provides interactive examples that demonstrate proper form usage. These scenarios can serve as a guide, illustrating common mistakes to avoid and best practices to follow when executing a transfer on death designation.

FAQs about transfer on death designation forms

Understanding the nuances of transfer on death designation forms can be bewildering. To assist, here are some frequently asked questions. What is a transfer on death deed? It allows for the designation of beneficiaries for asset transfer upon your death without going through probate.

Can I revoke a transfer on death designation? Yes, most states allow you to revoke or change your designation at any time as long as you are alive. Lastly, are there tax implications for transfers on death? Generally, the assets transferred via a TOD form do not incur taxes at the time of transfer, but it is wise to consult with a tax professional regarding your specific situation.

Conclusion

Navigating estate planning and understanding transfer on death designations is essential for anyone looking to take control of their assets and prioritize their beneficiaries. The simplicity and efficacy of this form empower individuals to manage their estates with confidence. Leveraging pdfFiller for such documentation not only simplifies the process but also ensures that your wishes are accurately reflected and adhered to.

By utilizing powerful tools for document creation and management, pdfFiller stands ready to assist you every step of the way, ensuring that estate planning is as seamless and stress-free as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my esign form directly from Gmail?

How do I complete esign form online?

How do I complete esign form on an iOS device?

What is transfer on death designation?

Who is required to file transfer on death designation?

How to fill out transfer on death designation?

What is the purpose of transfer on death designation?

What information must be reported on transfer on death designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.