Get the free Business Recovery Package Application Form

Get, Create, Make and Sign business recovery package application

How to edit business recovery package application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business recovery package application

How to fill out business recovery package application

Who needs business recovery package application?

Your Complete Guide to the Business Recovery Package Application Form

Understanding the business recovery package

The Business Recovery Package is an essential initiative designed to support enterprises grappling with the impacts of economic downturns. Its primary purpose is to provide financial aid and strategic resources to help sustain operational continuity. This initiative recognizes the difficulties faced by businesses during crises and aims to foster recovery through various support mechanisms.

The significance of the Business Recovery Package cannot be understated, particularly for small businesses and startups that often bear the brunt of economic challenges. By accessing this program, businesses can not only alleviate immediate financial pressures but also position themselves for long-term growth and stability.

Eligibility criteria for application

Not every business qualifies for the Business Recovery Package, so it's crucial to understand the eligibility criteria. Generally, small businesses, startups, and non-profits are the main beneficiaries of this initiative. Additionally, industries particularly impacted by downturns, such as hospitality and retail, may receive priority consideration.

Eligibility often hinges on specific qualifications, which include having the requisite business licenses and registrations up to date. Furthermore, businesses usually have to meet minimum thresholds related to employee numbers and revenue to be eligible for financial assistance.

Detailed breakdown of grant amounts

Understanding the financial landscape of the Business Recovery Package is critical for business owners. The initiative typically offers a variety of funding avenues, which may include different amounts of grants tailored to the unique needs of each business. Grant amounts can vary widely, and businesses must assess the potential funding options available.

A comparative analysis between grants and loans reveals that grants do not require repayment, making them a more attractive option for struggling businesses. However, the amount a business can receive often hinges on factors such as size, location, and specific operational needs.

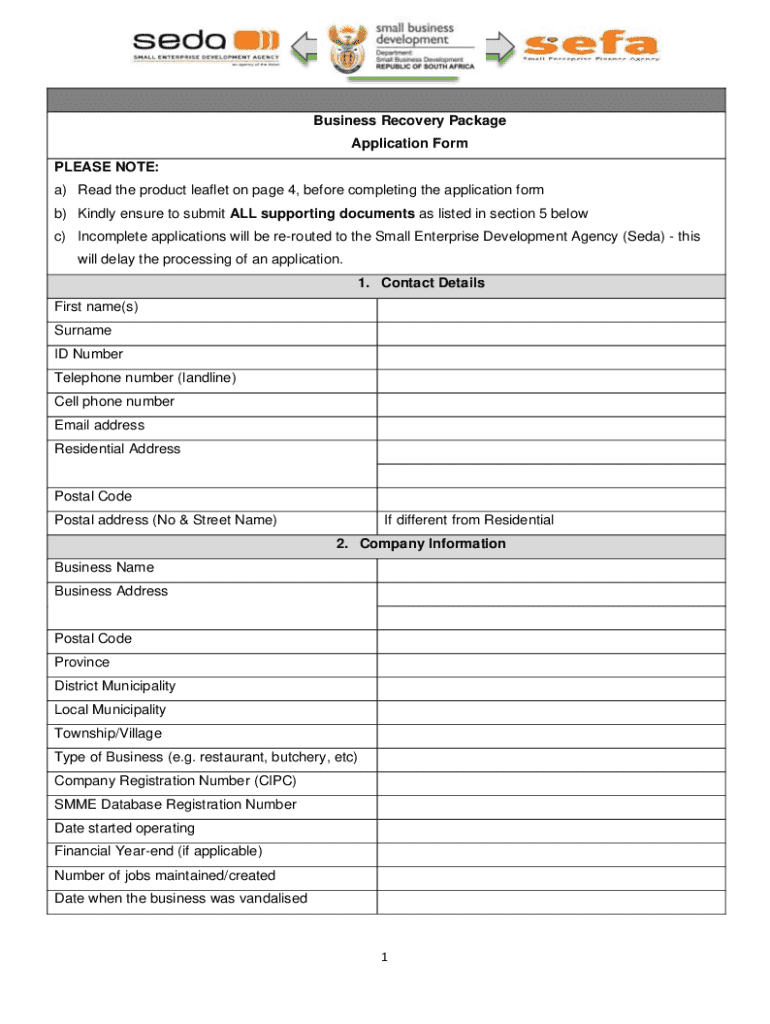

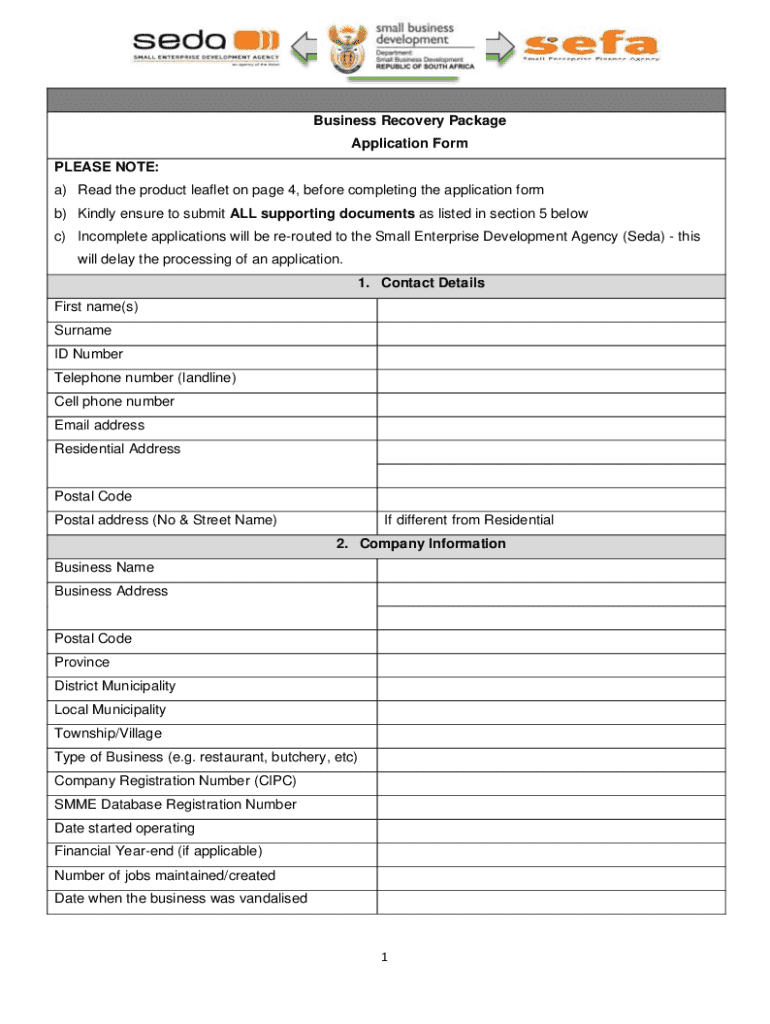

Documentation requirements for application

Completing the Business Recovery Package application requires careful preparation of essential documents. Applicants will need to showcase their business identification and prove ongoing operations, which typically includes various certificates and licenses.

Additionally, financial statements and recent tax returns play a significant role in the application process, confirming the business's stability and need for assistance. Organizing this documentation efficiently can make the application process smoother.

Eligible uses of grant funds

Once received, grant funds from the Business Recovery Package can significantly aid businesses in recovery efforts. Eligible spending categories may include critical operational expenses such as rent, utilities, and payroll, providing essential support to keep the business running.

Beyond covering operational costs, businesses are encouraged to utilize these funds for marketing and applying recovery strategies that will ensure their future sustainability. However, it's crucial to stay informed of restrictions; any misuse of funds can lead to disqualification from the program.

Step-by-step guide to applying for the business recovery package

Applying for the Business Recovery Package can be streamlined using pdfFiller’s tools. The first step involves accessing the application form online. Here, users can navigate through the form using a user-friendly interface designed for intuitive completion. With pdfFiller, businesses can edit documents easily and use interactive tools to ensure all necessary information is provided.

The application requires personal and business information. As you fill out the form, make use of pdfFiller’s functionalities to edit, insert electronic signatures, and review entries for accuracy. After completing the form, follow best practices for submitting your application matter-of-factly and retain confirmation of receipt for tracking.

Managing your grant application after submission

After submitting your application for the Business Recovery Package, staying informed about its status is crucial. Many states or local agencies provide online tools or resources that allow businesses to track their application progress. Regularly checking this status can help you remain proactive in addressing any deficiencies or follow-up needs.

In some instances, reviewers may request additional information to finalize the application. Being prompt and thorough in your response will reflect positively on your application and help expedite the review process.

Frequently asked questions (FAQs)

Navigating the Business Recovery Package application can prompt various questions. Common inquiries often revolve around the timeframe for approval and subsequent funding disbursement. It is advisable to review the guidelines tab for information on estimated processing times, as they can vary notably depending on demand and specific circumstances.

Applicants also frequently seek clarification on eligibility and documentation requirements. Understanding these intricacies early in the process can help preempt any issues. Moreover, having a direct line of communication with the support team can dramatically reduce troubleshooting delays.

Additional information and resources

For business owners seeking further support, exploring related business assistance programs can provide additional avenues for recovery. Comparing the Business Recovery Package with other grants or loans can reveal alternative funding opportunities that might be beneficial based on specific business needs or circumstances.

In addition, local government agencies often have resources available to support struggling businesses. Investigating these community initiatives can uncover invaluable programs tailored to specific industries and regional needs, offering an extensive support network for business recovery.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business recovery package application directly from Gmail?

Can I sign the business recovery package application electronically in Chrome?

How do I complete business recovery package application on an iOS device?

What is business recovery package application?

Who is required to file business recovery package application?

How to fill out business recovery package application?

What is the purpose of business recovery package application?

What information must be reported on business recovery package application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.