Get the free Multiple Sip With Top-up Form

Get, Create, Make and Sign multiple sip with top-up

Editing multiple sip with top-up online

Uncompromising security for your PDF editing and eSignature needs

How to fill out multiple sip with top-up

How to fill out multiple sip with top-up

Who needs multiple sip with top-up?

Unlocking the Benefits of Multiple SIP with Top-Up Form

Understanding systematic investment plans (SIP)

Systematic Investment Plans (SIP) are a disciplined approach to investing in mutual funds, allowing investors to contribute a fixed amount regularly. This consistent investment method can result in a balanced portfolio and helps mitigate the effects of market volatility through dollar-cost averaging.

The benefits of SIPs are manifold. For individuals and teams, SIPs offer a structured way to save and invest, promoting financial discipline. Additionally, it reduces the burden of making large, one-time investments and provides flexibility in adjusting contributions as financial situations change.

By investing smaller amounts over time, participants can potentially see significant growth due to compounding interest, ultimately leading to substantial wealth accumulation.

What is a top-up SIP?

A Top-Up SIP is an enhancement feature that allows investors to increase their SIP contribution at predefined intervals or whenever they choose. This mechanism serves an essential purpose: to adapt investments in response to increasing earnings or changing financial circumstances.

The key difference between regular SIPs and Top-Up SIPs lies in flexibility. While traditional SIPs remain static, Top-Up SIPs enable investors to escalate their contributions seamlessly, reflecting their growing financial capacity.

Utilizing Top-Up SIPs is ideal in scenarios where investors anticipate income growth, such as career advancements or financial windfalls.

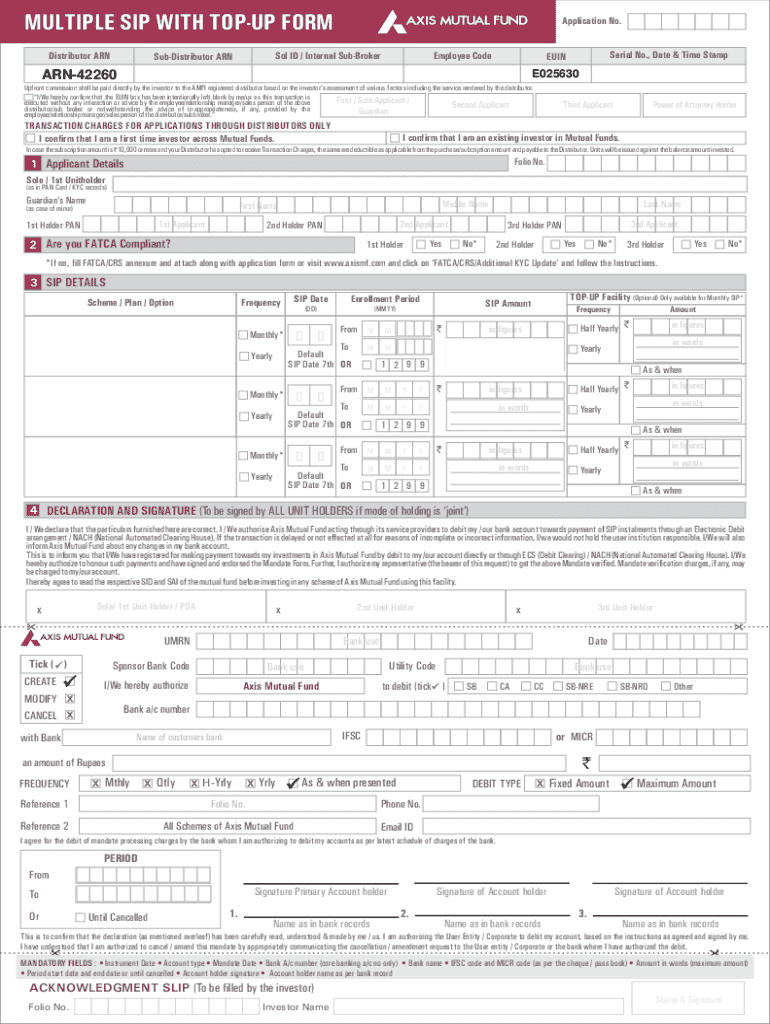

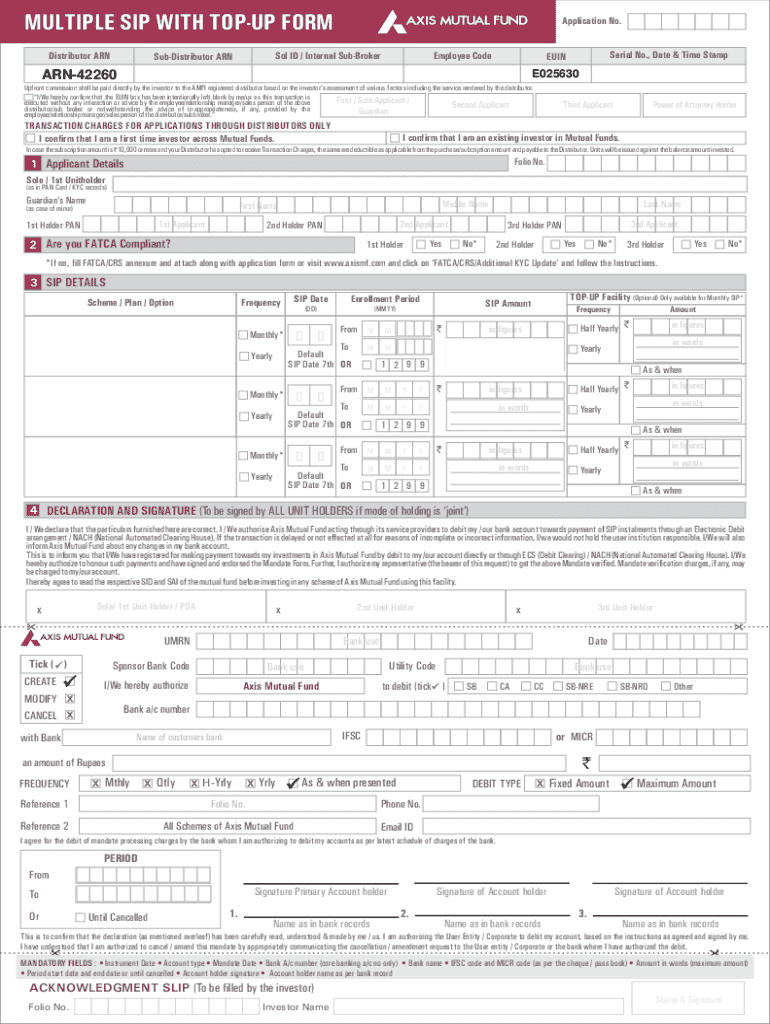

The importance of a top-up SIP form

A Top-Up SIP form is essential for processing the increase in your SIP amount. It ensures that your changes are documented accurately and received by the mutual fund provider.

Key components of the Top-Up SIP form include personal information like name and account number, investment details specifying the fund, and a section for the amount and frequency of the top-up. Providing detailed and accurate information is critical for a smooth investment process.

Common mistakes to avoid while filling out the form include submitting incomplete information, miscalculating the top-up amount, or neglecting to update personal details, all of which can delay your investment adjustments.

Step-by-step guide to using pdfFiller for your top-up SIP form

pdfFiller provides a streamlined method for managing your Top-Up SIP form digitally. First, access pdfFiller to get started with this versatile tool tailored for document creation and management.

To create and edit your Top-Up SIP form, upload an existing document or start with a template. You can add and modify fields as needed, ensuring that all necessary data is accurately captured.

Once your form is complete, eSigning is simple and secure within pdfFiller. There's also an option to collaborate with team members to ensure everyone is on the same page regarding investment strategies.

Advanced features of pdfFiller for top-up SIP management

Employing advanced features of pdfFiller can enhance your Top-Up SIP management experience. One notable feature is the ability to track changes and maintain versioning for your SIP documents. This means you can also revert to previous versions, which is invaluable for keeping track of your investment journey.

Integration with your financial dashboard offers real-time updates, providing insights into how your investments are performing and whether adjustments to your SIP contributions are necessary.

Cloud storage enhances security and accessibility, enabling users to manage their documents from anywhere while maintaining the utmost confidentiality.

Real-life examples of utilizing top-up SIPs

To illustrate the effectiveness of Top-Up SIPs, consider the case study of an investor named Raj. Starting with a monthly contribution of $200, Raj enabled his top-up option each year alongside his annual salary increment. By continually increasing his SIP, he eventually accumulated over $100,000 by retirement, surpassing his initial financial goals.

Furthermore, testimonials from users highlight positive experiences using pdfFiller for managing their Top-Up SIP processes. Users praise the platform’s ease of use and robust collaboration features, making financial planning straightforward and efficient.

Financial tools and calculators for SIP planning

Financial tools like SIP calculators can serve as a powerful ally in forecasting investment growth. Utilizing a SIP calculator allows investors to estimate potential returns based on varying contribution amounts and tenure periods.

For those specifically interested in top-ups, Top-Up SIP calculators enable forecasts specific to increased contributions. Moreover, goal planners assist users in setting financial milestones and tracking progress, contributing to disciplined and goal-oriented investing.

Important notes and regulations

Investors must be aware of the regulatory considerations surrounding SIPs and top-ups. Regulations can vary by region; hence, staying informed is crucial for compliance and understanding rights as an investor.

It's essential to recognize the risk factors associated with investments through SIPs. Market fluctuations can affect returns, and while SIPs can reduce risks, investors should still assess their capacity for risk before making any financial commitments.

Frequently asked questions (FAQs)

Investors often have questions regarding their Top-Up SIPs. One common inquiry is, 'What happens if I miss a top-up contribution?' It’s essential to understand that missing a contribution typically does not affect your existing SIP; you can always resume with your next scheduled contribution.

Another frequent question is whether investors can modify their SIP amount after setting it up. Yes, adjustments are possible by submitting a request to the fund provider. Lastly, documentation required for SIP and Top-Up changes often includes identification proofs and bank details for verification, so having these ready can expedite the process.

Community engagement and learning resources

Engaging with a community of investors can be incredibly beneficial. Joining our Investor Hub creates opportunities for networking and knowledge sharing that can deepen your understanding of SIP investments and strategies for using Top-Up SIPs effectively.

We also offer workshops and learning sessions focusing on various investment aspects, providing interactive platforms for discussion and exploration. Gaining access to product literature and detailed guidelines on SIPs and top-ups keeps investors informed and empowered in their decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in multiple sip with top-up?

How can I fill out multiple sip with top-up on an iOS device?

Can I edit multiple sip with top-up on an Android device?

What is multiple sip with top-up?

Who is required to file multiple sip with top-up?

How to fill out multiple sip with top-up?

What is the purpose of multiple sip with top-up?

What information must be reported on multiple sip with top-up?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.