Get the free Merchant Statement

Get, Create, Make and Sign merchant statement

Editing merchant statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out merchant statement

How to fill out merchant statement

Who needs merchant statement?

Comprehensive Guide to the Merchant Statement Form

Understanding the merchant statement form

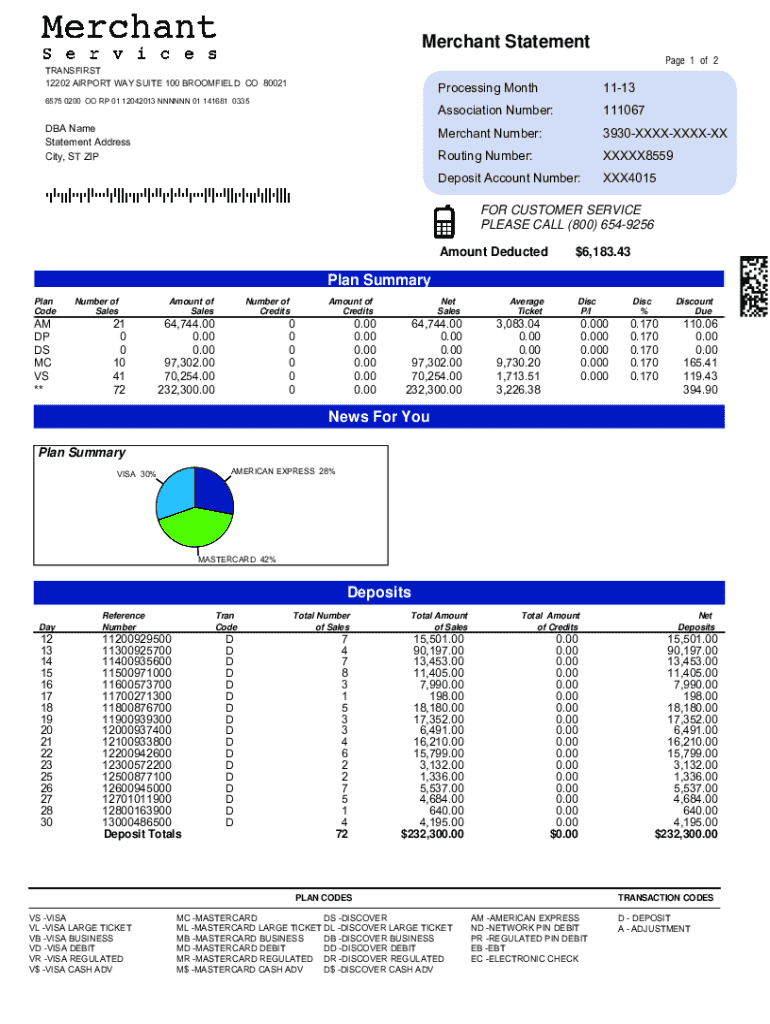

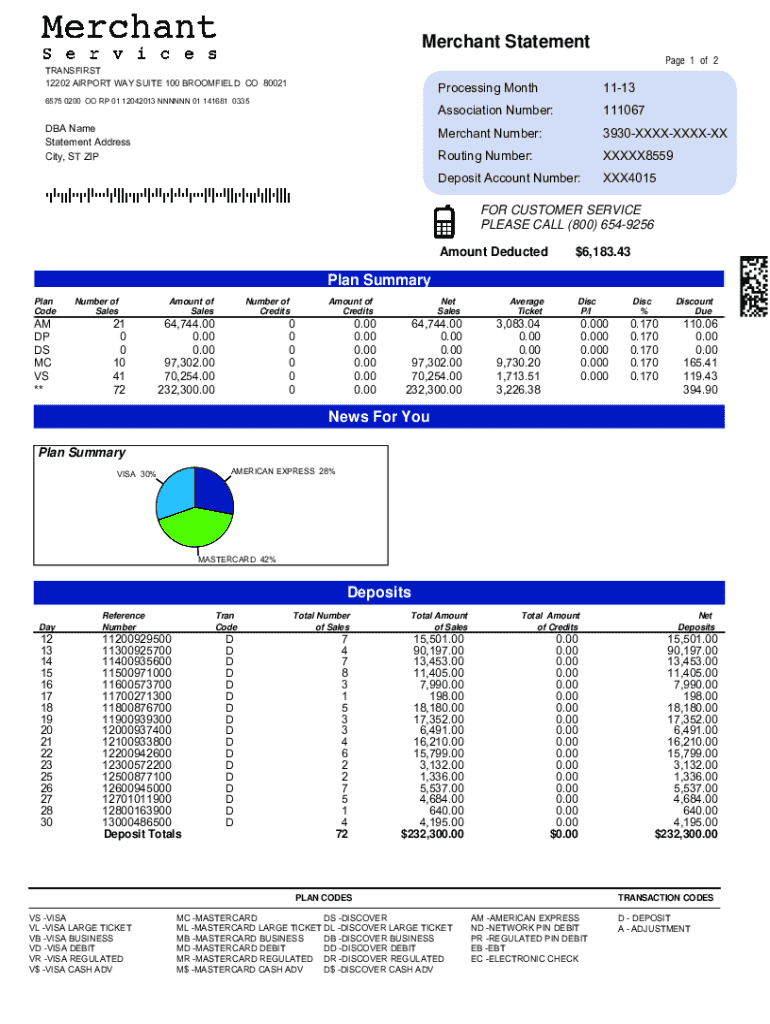

A merchant statement form is a critical document that provides a detailed summary of a business's financial transactions over a specific period. Its primary purpose is to help business owners and accountants track revenue, manage cash flows, and understand the costs associated with card processing fees and other transaction-related expenses.

For businesses, having a clear picture of financial health is essential. The merchant statement form not only consolidates various transactions into a single report but also serves as a tool for reconciling bank statements and preparing for tax season. This form offers insights into customer purchasing behaviors and can influence future business strategies.

Key components of a merchant statement include transaction details (date, amount, and type), fee information (processing fees, chargebacks, etc.), and summaries of funds settled into the merchant's bank account during the reporting period.

Types of merchant statements

Merchant statements can vary in frequency and detail based on the type of transaction being summarized. Understanding these differences is crucial for effective financial management.

The distinctions between these types of statements lie primarily in their frequency, detail, and intended use, with each catering to different management needs.

How to access your merchant statement

Accessing your merchant statement is typically straightforward, especially if you work with a reliable payment processing provider. Most providers have a dedicated online portal for merchants.

Some popular platforms like pdfFiller also offer functionalities to access and manage these statements, ensuring that you can keep all your financial documentation in one place.

Filling out your merchant statement form

When filling out a merchant statement form, ensuring that all essential information is included is crucial. Accurate filling leads to better financial tracking and reporting.

Best practices for accurate filling involve double-checking each entry for errors, maintaining organized records that can be referenced when filling in the form, and utilizing tools like pdfFiller that can aid in filling out forms electronically.

Common mistakes to avoid include neglecting important details, overlooking discrepancies in numbers, and failing to keep your contact information updated.

Editing your merchant statement form

After filling out your merchant statement form, you may find that modifications are necessary. Whether correcting errors or updating details, editing should be done with care.

The editing process generally involves uploading your document to pdfFiller, selecting the text or fields that need modification, and saving the edited version. Consider keeping versions of the old documents for reference.

To effectively manage your edited documents, employ tagging or categorization, ensuring that you can easily retrieve specific past statements when needed.

Signing your merchant statement form

Signatures are a vital part of document management, lending authenticity and legal weight to your merchant statement form. Ensuring your forms are signed, whether digitally or traditionally, is critical for compliance.

Instructions for electronic signing typically involve clicking a dedicated 'sign here' button, choosing your signature style, and confirming the signature placement on the document. It simplifies the process, making it especially effective for remote teams.

Collaborating on merchant statements

Collaboration on merchant statements can significantly enhance your team’s efficiency, especially when dealing with financial documents that require multiple inputs or reviews.

For effective team communication, create a chronological review process where team members can leave notes or ask questions about specific entries, ensuring all concerns are addressed promptly.

Managing your merchant statement forms

Proper management of merchant statement forms can help avoid chaos during audits and enhance overall financial tracking. Digitally organizing these documents has proven to be particularly effective.

Using business management tools that integrate with financial documentation can also provide additional layers of oversight and ease within the tracking capabilities.

Frequently asked questions (FAQs)

It's not uncommon for business owners to have questions surrounding merchant statements. Addressing these queries can demystify the statement process and enhance overall confidence in financial management.

Should you encounter any issues with your merchant statements, detailed documentation of these issues can help facilitate faster resolutions with customer support.

Important notes

The management of merchant statements comes with legal considerations that emphasize data integrity and protection. Additionally, best practices for data security must be adhered to during the handling of sensitive financial information.

Implementing these strategies can fortify your business against potential financial fraud or data breaches, ensuring the integrity of your financial processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute merchant statement online?

How do I make edits in merchant statement without leaving Chrome?

How can I fill out merchant statement on an iOS device?

What is merchant statement?

Who is required to file merchant statement?

How to fill out merchant statement?

What is the purpose of merchant statement?

What information must be reported on merchant statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.