Get the free Charter Nonprofit Corporation (ss-4418)

Get, Create, Make and Sign charter nonprofit corporation ss-4418

How to edit charter nonprofit corporation ss-4418 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charter nonprofit corporation ss-4418

How to fill out charter nonprofit corporation ss-4418

Who needs charter nonprofit corporation ss-4418?

A Complete Guide to the Charter Nonprofit Corporation SS-4418 Form

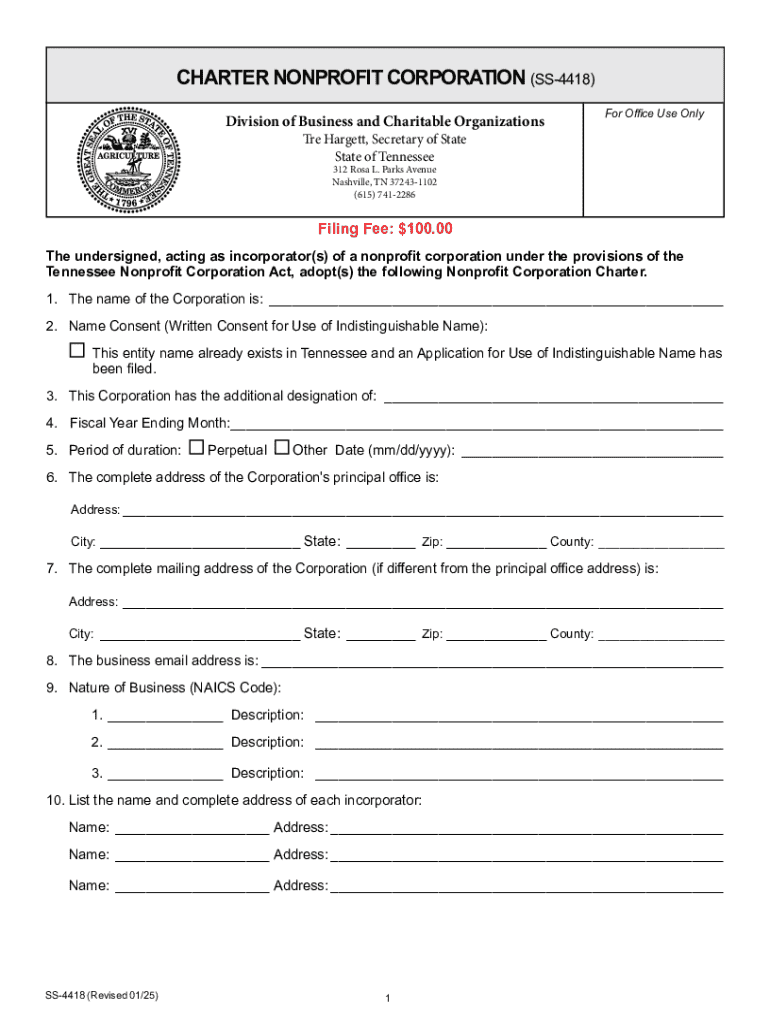

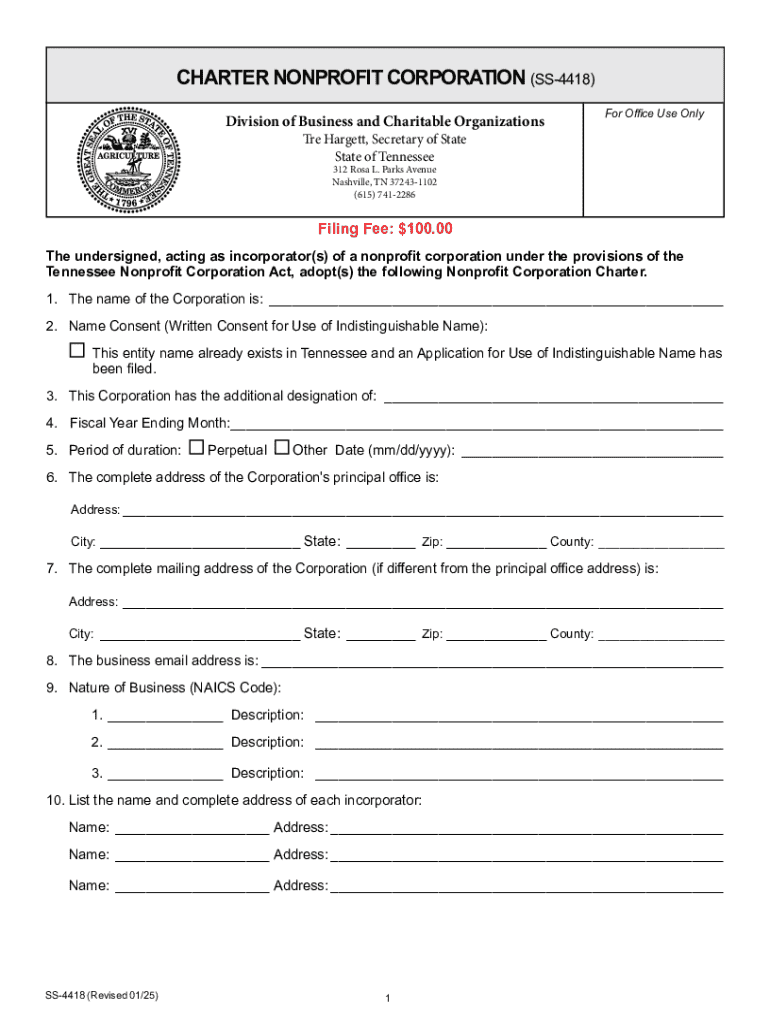

Understanding the Charter Nonprofit Corporation SS-4418 Form

The Charter Nonprofit Corporation SS-4418 Form is a crucial document for anyone looking to establish a nonprofit organization in their state. This form lays the groundwork for registering the nonprofit and defining its governance, ensuring that the organization operates within legal parameters. Its significance extends beyond mere paperwork; it embodies the mission and operational framework that guides the nonprofit's activities.

Each state has specific legal requirements that must be adhered to when establishing a nonprofit, which can vary widely. Compliance with these regulations is imperative. Failure to do so can lead to penalties, loss of nonprofit status, or worse, dissolution of the organization. Understanding these local requirements is the first step in ensuring a solid foundation for your nonprofit.

Steps to complete the Charter Nonprofit Corporation SS-4418 Form

Before diving into the SS-4418 form, several preliminary steps can make the process smoother. A critical first step is conducting a name search to ensure your nonprofit's name is unique and complies with state regulations. Developing a clear and compelling mission statement is also essential, as this will guide your organization and inform potential board members and donors about your goals.

Completing the form involves several sections entailing specific information:

Before submitting the form, conduct a final review. Look out for common pitfalls, such as leaving sections blank or providing incorrect information. These mistakes can delay your nonprofit's establishment.

Interactive tools for document management

Utilizing digital tools can greatly simplify the process of completing the SS-4418 form. PDFfiller is one such platform that offers seamless editing features, enabling users to input information directly into the form. Whether you need to customize fields or add notes, PDFfiller’s robust features streamline the editing process, allowing for a more efficient form completion.

In addition to editing, PDFfiller offers electronic signing options, making the authentication process smooth and secure. This functionality is particularly beneficial as it reduces the need for physical meetings, making it easier for board members or stakeholders to review and sign documents from various locations.

Collaboration is another critical element of using PDFfiller; multiple users can edit and review the SS-4418 form simultaneously. This feature not only saves time but also ensures that everyone involved can contribute to the document, enhancing accuracy and coherence.

Filing the SS-4418 form: what you need to know

Once you've completed the SS-4418 form, the next step is filing it with the appropriate state authority. You generally have the option to file in person or submit it online. Each method has its pros and cons. Filing in person allows for immediate confirmation that your form has been received, but online submission can expedite the process, especially in states with high traffic.

It's important to consider that local postal services can impact form processing times if you choose traditional mail. Understanding the expected turnaround times can help you plan accordingly.

Additionally, be aware of the fees associated with filing the SS-4418 form. These costs can vary significantly depending on your state. Familiarize yourself with the costs involved and the payment methods accepted to avoid delays.

Post-filing steps to launch your nonprofit

After submitting your Charter Nonprofit Corporation SS-4418 Form, you should expect a waiting period as your application is reviewed. Outcomes can vary; you may receive approval, request for additional information, or, in some cases, outright denial. Being ready for possible requests can expedite the process and keep your organization on track.

In addition to the SS-4418, filing for IRS tax-exempt status is a crucial next step. Be prepared to complete Form 1023 or 1024 to address middle-income needs and specific mission-related developments. This is key to ensuring that contributions made to your nonprofit are tax-deductible for your donors.

Each state also has its compliance requirements that need to follow post-filing. This may include obtaining specific licenses or permits, depending on your nonprofit's activities. Staying on top of these requirements is critical to your organization's long-term success.

Common challenges and solutions in filing the SS-4418

Many individuals encounter misunderstandings or make errors when filling out the SS-4418 form. Common mistakes include incomplete sections or misidentified structural details concerning board organization and membership types. Addressing these early and consulting available resources can save time and resources.

Navigating state-specific regulations can also present challenges. Each state has different requirements and may not always have clear guidelines for someone new to the nonprofit world. Thorough research, including consulting with local nonprofit resources, can provide insights and help mitigate these challenges.

Consultation with legal or financial advisors might be necessary if you're feeling overwhelmed. Professional advice can steer you through complex situations and ensure that you’re compliant with all regulations.

Customer support and further assistance

Accessing customer support can be vital during the form-filling process. PDFfiller offers various contact options for users needing assistance with the SS-4418 form. Whether you prefer email, chat or phone support, expert assistance is readily available to ensure you meet your nonprofit goals.

Frequently asked questions (FAQs) can be an invaluable resource, providing clarity on common concerns regarding the SS-4418 form. For instance, you may find answers about processing times, submission requirements, or necessary adjustments for specific situations.

Learning from success stories of similar nonprofit organizations that successfully utilized the SS-4418 form with PDFfiller can serve as inspiration. These case studies often share practical insights and actionable advice that may ease your own filing journey.

Engaging with the nonprofit community

Networking and building relationships within the nonprofit community can significantly impact your organization's success. Consider joining local nonprofit organizations or seeking out online communities where members share their experiences. These resources often provide both support and advice that can guide you during challenging phases of your nonprofit journey.

Collaborative opportunities can also emerge from engaging within these spaces. Partnering with established nonprofits or seeking out community programs can help you broaden your reach and enhance your impact.

Leveraging pdfFiller for ongoing document management

Post-submission, managing your nonprofit's documents is essential for long-term operational success. PDFfiller assists users in keeping track of all important documents, including filings, governing documents, and renewal notices, ensuring you're always prepared.

Moreover, as your organization grows, you may need to fill out other forms or applications. PDFfiller offers a variety of templates and forms, allowing you to streamline any future filings with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the charter nonprofit corporation ss-4418 in Gmail?

How do I fill out the charter nonprofit corporation ss-4418 form on my smartphone?

How do I fill out charter nonprofit corporation ss-4418 on an Android device?

What is charter nonprofit corporation ss-4418?

Who is required to file charter nonprofit corporation ss-4418?

How to fill out charter nonprofit corporation ss-4418?

What is the purpose of charter nonprofit corporation ss-4418?

What information must be reported on charter nonprofit corporation ss-4418?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.