Get the free Nonmember Retirement Allowance Estimate Request

Get, Create, Make and Sign nonmember retirement allowance estimate

Editing nonmember retirement allowance estimate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonmember retirement allowance estimate

How to fill out nonmember retirement allowance estimate

Who needs nonmember retirement allowance estimate?

Nonmember retirement allowance estimate form – How-to Guide

Understanding the nonmember retirement allowance estimate form

The nonmember retirement allowance estimate form is a critical document for individuals who are considering retirement but do not hold membership in specific retirement systems. This form serves as a preliminary estimate of the retirement benefits available, allowing users to ascertain what they can expect upon retirement.

The purpose of this form is to provide a clear estimate of future retirement allowances tailored to each individual's employment history and contributions. This insight can aid individuals in making informed decisions about their financial futures.

The target audience for the nonmember retirement allowance estimate form includes prospective retirees, financial advisors assisting clients, and team leaders managing multiple retirement scenarios. Accurate completion is essential, as errors may lead to either overestimating or underestimating benefits, which can have significant financial implications.

Who needs to use the nonmember retirement allowance estimate form?

Various individuals may find the nonmember retirement allowance estimate form particularly beneficial. Those considering retirement often utilize this form to project their financial circumstances. This estimation can significantly affect decisions around retirement age and plans, highlighting its importance.

Additionally, team leaders responsible for managing retirement applications for their teams can benefit from the form. It helps them assess various team members' retirement scenarios concurrently, ensuring a smoother transition for all individuals involved.

Finally, financial planners and advisors should understand how to navigate this form. By assisting clients in the completion process, they can provide personalized financial guidance aligned with clients' retirement goals.

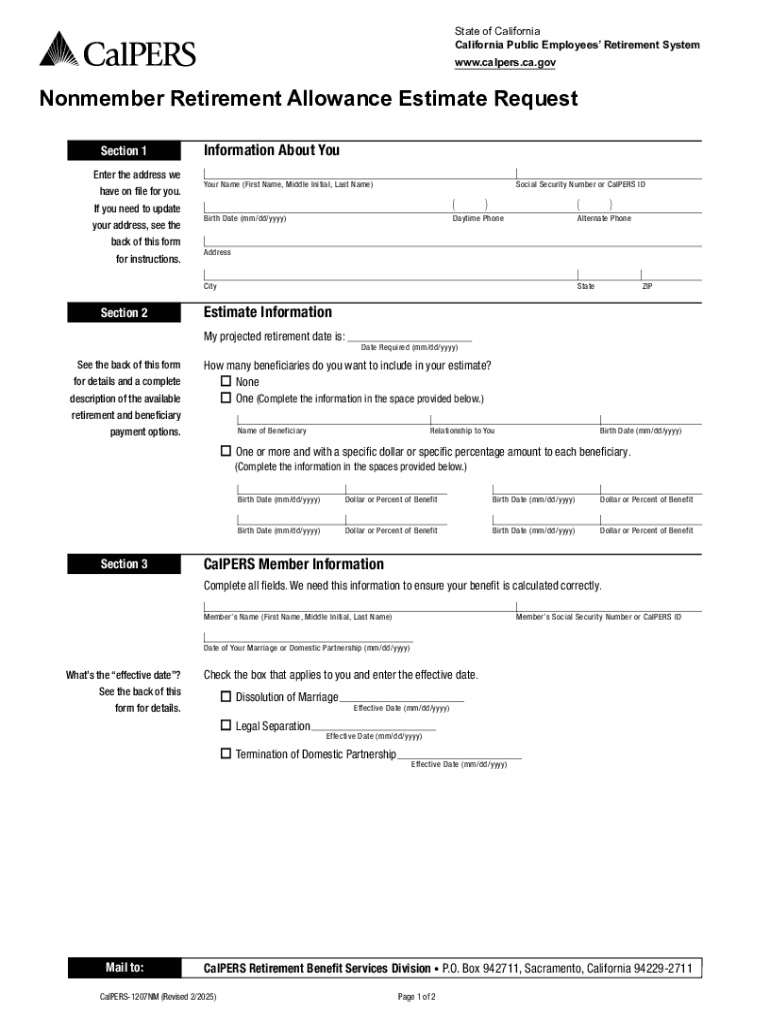

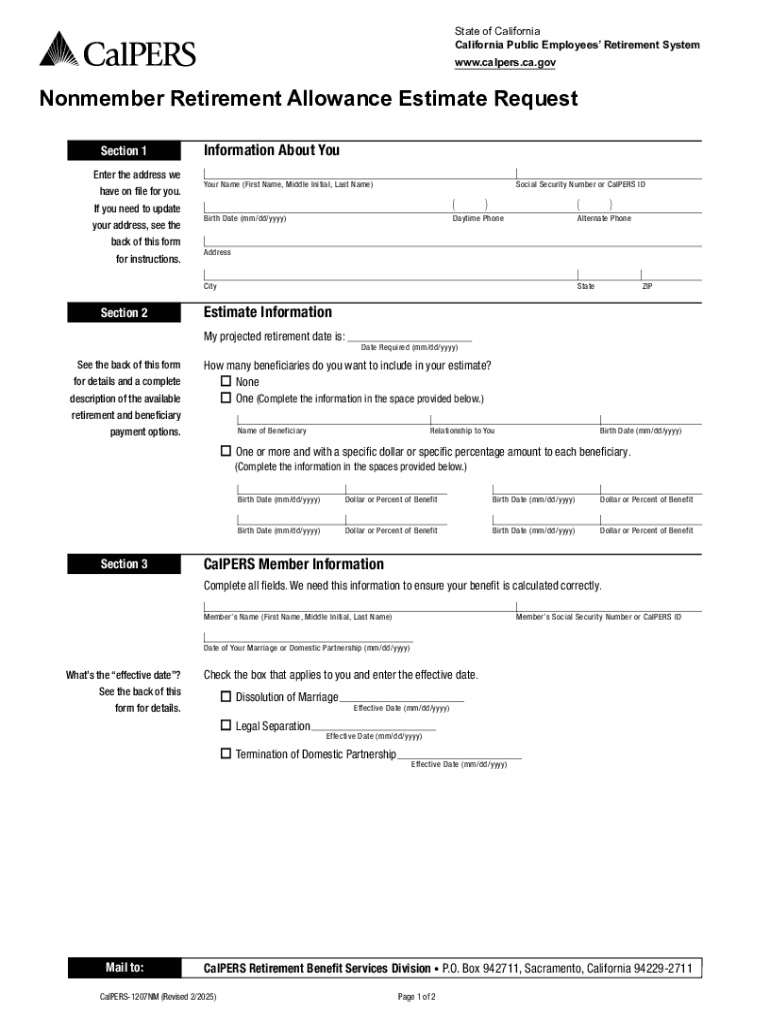

Key components of the form

The nonmember retirement allowance estimate form contains several key components, each requiring careful attention. The personal information section includes essential details such as full name, address, and contact information, ensuring that all communications can be accurately directed.

A critical part of the personal information section is the beneficiary details, which denote who will receive benefits upon the individual's passing. Following this, the employment history section requires detailed entries regarding the employers, the duration of employment, and the roles held, which are pivotal in calculating the retirement benefits.

Finally, the retirement benefits calculation portion breaks down estimates based on individual circumstances and employment history. Factors like salary history, years of service, and contributions to retirement plans influence these estimates significantly, making understanding them crucial for users.

Step-by-step instructions for completing the form

Completing the nonmember retirement allowance estimate form involves several steps. Begin by gathering all required information, including past employment details, pay stubs, and previous retirement documents. Organizing these documents beforehand allows for a smoother entry process.

In the first step, ensure that you have all documents needed for accurate data entry. This preparation helps prevent common mistakes and reduces the time spent revising insufficient information.

Next, fill out the personal information section, ensuring every detail is accurate. Following that, enter your employment history, noting all relevant employers and duration of employment accurately. When calculating estimated benefits, you might find online tools and calculators useful to clarify complex figures and projected amounts.

A final review step is crucial to check for mistakes and omissions, particularly focusing on entry consistency and accuracy. Common errors include typos in numerical entries and missing information, which can be mitigated by carefully re-evaluating the form before submission.

Editing and customizing the nonmember retirement allowance estimate form

Once the nonmember retirement allowance estimate form is filled out, users may find themselves wanting to make adjustments or add specific details. With pdfFiller, it is easy to edit this form to meet your unique needs. The platform provides tools that allow you to add or remove sections effortlessly, streamlining your experience.

If you want to annotate or comment on specific parts of the form, pdfFiller's features enable you to do so without hassle. Additionally, managing changes and ensuring version control is straightforward, allowing individuals to track adjustments over time, which can be particularly useful for multiple revisions or shared access.

Signing the form electronically

Electronic signing of the nonmember retirement allowance estimate form offers numerous benefits compared to traditional methods. These advantages include faster processing times, greater convenience, and enhanced security, making it an optimal choice for individuals on the go.

Using pdfFiller for eSigning is a simple and effective process. First, you upload the completed form to the platform, then follow the prompts to add your digital signature. Each signing session is also encrypted, ensuring your data remains protected and complies with digital signature regulations.

Tracking and managing submitted forms

After submitting the nonmember retirement allowance estimate form, it is essential to track its status. The submission process varies depending on the recipient, so understanding how to navigate this can save time and anxiety.

Keeping track of your submission status is made easier through pdfFiller’s management tools. Users can access a streamlined dashboard that displays all submitted forms and their statuses, enabling you to stay informed about your retirement planning process easily.

Should you need assistance or encounter an issue with your submission, contacting support is made simple through pdfFiller's customer service options, ensuring help is accessible whenever needed.

Common questions and troubleshooting

As users navigate the nonmember retirement allowance estimate form, several frequently asked questions may arise. Understanding how to approach potential challenges effectively is key to a smooth experience. Common concerns include details about eligibility, submission processes, and timeframes for estimated benefits.

If issues arise, it’s important to know how to resolve them. Reaching out to the administrative office responsible for processing the retirement benefits can clarify any uncertainties. Moreover, pdfFiller offers customer support resources committed to assisting users in resolving questions quickly and efficiently.

Related topics and additional considerations

Understanding retirement plans is crucial for effectively utilizing the nonmember retirement allowance estimate form. Various retirement plans come with their own specific rules and structures that can influence the estimates provided through this form.

Moreover, utilizing resources available for estimating retirement savings will provide further clarity on how to prepare financially for the future. Consulting with a financial advisor may also ensure that all decisions made align with both personal goals and legal requirements.

Final tips for success

Best practices for completing the nonmember retirement allowance estimate form involve thorough preparation and attention to detail. Ensure all documents are properly gathered and verify their accuracy before beginning. An organized approach can greatly minimize the time needed to complete the form.

Utilizing pdfFiller for all document management needs enhances the filing process, offering integrated features for editing, eSigning, and archiving forms in one location. Planning ahead for future document requests and retirement considerations can substantially ease stress and build a more secure financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit nonmember retirement allowance estimate on an iOS device?

How can I fill out nonmember retirement allowance estimate on an iOS device?

How do I edit nonmember retirement allowance estimate on an Android device?

What is nonmember retirement allowance estimate?

Who is required to file nonmember retirement allowance estimate?

How to fill out nonmember retirement allowance estimate?

What is the purpose of nonmember retirement allowance estimate?

What information must be reported on nonmember retirement allowance estimate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.