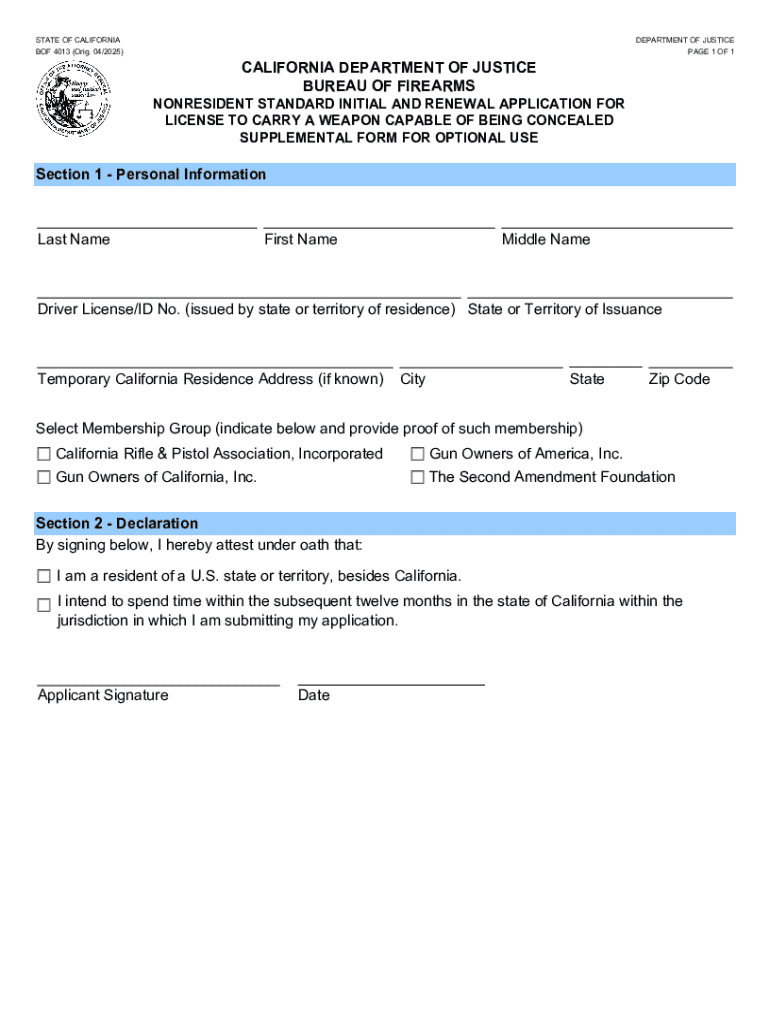

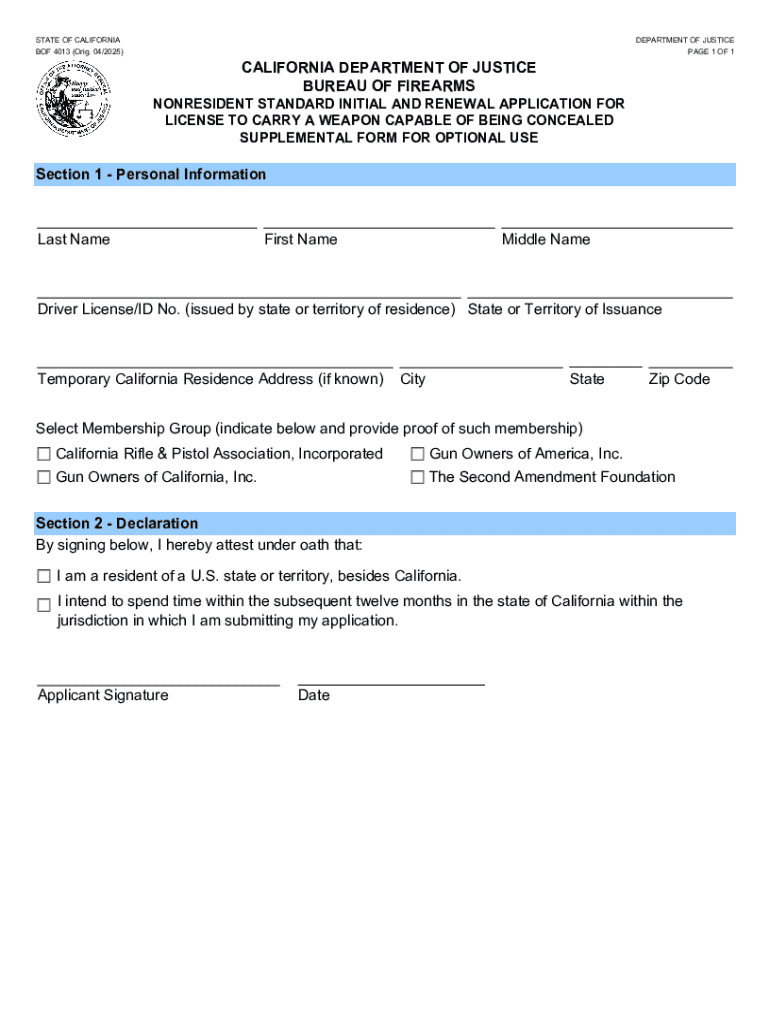

Get the free Nonresident Standard Initial and Renewal Application for License to Carry a Weapon C...

Get, Create, Make and Sign nonresident standard initial and

How to edit nonresident standard initial and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonresident standard initial and

How to fill out nonresident standard initial and

Who needs nonresident standard initial and?

Understanding the Nonresident Standard Initial and Form

Overview of nonresident filing requirements

Nonresidents are individuals who earn income in a state where they do not maintain residency. This status requires them to fulfill specific filing requirements to comply with state tax laws. Accurately completing the nonresident standard initial form is crucial for avoiding penalties and ensuring that one pays the correct tax amount. By understanding these filing requirements, nonresidents can effectively navigate their tax responsibilities.

Nonresidents often face unique challenges due to the complexities of tax regulations. Therefore, it's essential to consider factors such as residency status, type of income earned, and applicable deductions. By being aware of these key considerations, nonresidents can streamline the filing process and avoid common pitfalls.

What’s new for 2024

With each tax year, regulations evolve, and 2024 brings notable changes for nonresidents. Recent updates to tax laws may impact who is obligated to file and changes in the standard initial form that nonresidents must complete. These updates can affect deductions, credits, and overall tax liabilities.

In 2024, nonresidents should pay close attention to important deadlines that affect their filing. Missing a deadline can result in penalties, so awareness of these changes is crucial for compliance.

Understanding nonresident tax obligations

It’s essential to determine whether you are required to file a tax return in a nonresident capacity. Typically, if you earn income in a state, you must file to report that income. This includes wages, business income, or rental income from properties located within the state.

Common tax situations for nonresidents can include income from a job, investments, or property sales. Understanding how these different sources of income influence your tax obligations is vital. Additionally, nonresidents must differentiate between nonresident filings and part-year resident filings, as the requirements and tax treatments vary significantly.

How to access and utilize the standard initial form

Accessing the standard initial form is straightforward through various official state tax websites and platforms like pdfFiller. Users can quickly locate the specific form they need based on their residency status. Enhanced features on pdfFiller allow for easy document management and customization.

Tools available on pdfFiller can simplify the process of filling out and submitting your forms. Interactive features and templates increase efficiency, allowing users to focus on accuracy rather than fumble with paperwork.

Step-by-step instructions for completing the standard initial form

Completing the nonresident standard initial form requires careful attention to detail. Follow these steps to ensure an accurate submission:

Common challenges and solutions for nonresident filers

Filing as a nonresident can present several challenges, including recognizing complexities in state-specific tax laws and potential language barriers in understanding tax documentation. Nonresidents may overlook essential deductions or credits, leading to overpayment.

Solutions for these challenges often involve thorough research, utilizing available resources, and seeking professional help if necessary. Staying informed about state-specific regulations also helps in mitigating common filing errors and ensuring compliance.

E-filing your nonresident standard initial form

E-filing offers significant benefits for nonresidents, including faster processing times, immediate confirmation of receipt, and reduced paper usage. This streamlined approach is particularly advantageous for taxpayers who may find filing preparation cumbersome.

To e-file your form, follow a structured guide: select the appropriate e-filing provider like pdfFiller, input your information accurately, and review all entries prior to submission. Be sure to implement online security measures to protect your sensitive data.

Understanding refunds and payments

Calculating your potential tax refund or balance due is crucial once you've completed your form. Tools available on pdfFiller and various online calculators can assist in simplifying this process. Knowing whether to expect a refund or owe additional taxes helps in financial planning.

When receiving refunds, nonresidents can opt for direct deposit for quicker access to funds, as opposed to paper checks. Understanding the payment methods available, including electronic options, can enhance the filing experience and ensure timely payment for any owed taxes.

Resources for further assistance

There are numerous resources available for nonresidents seeking help with their tax filings. Official state tax websites are invaluable for locating forms and understanding specific filing requirements. Additionally, utilizing pdfFiller's support features can provide immediate assistance and document management.

Online forums and community resources offer avenues for discussing common issues and sharing experiences with other nonresident taxpayers. Engaging with these resources can enhance your understanding and provide additional clarity on complex tax matters.

Frequently asked questions (FAQs)

Many nonresidents have common questions regarding their filing obligations. For example, what to do if you miss the filing deadline? It’s paramount to file even after the deadline to avoid further penalties. Additionally, nonresidents can leverage tax treaties to limit or eliminate taxes on certain income types.

Understanding how residency affects tax status is also crucial; various jurisdictions have their definitions and implications for tax filings. Gathering this knowledge can alleviate confusion and aid in proper compliance with tax regulations.

Summary of key takeaways

Essentially, the process for completing the nonresident standard initial form is multi-faceted. Each step from gathering documentation to submitting your final form requires details to ensure accuracy. Staying informed about changes in tax law and deadlines is equally important in successful filing.

Lastly, encourage consistent record-keeping throughout the year to enhance organization and simplify the filing process in subsequent tax years.

Next steps for nonresident taxpayers

To wrap things up, creating a checklist for preparing and submitting your forms streamlines the filing process. Regular reviews of past tax filings can highlight any recurring issues or gaps that need addressing. Year-round tax planning is advantageous in maximizing deductions and ensuring compliance.

With the right resources and a proactive approach to taxation, nonresidents can confidently handle their tax obligations while optimizing their potential returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute nonresident standard initial and online?

Can I create an electronic signature for the nonresident standard initial and in Chrome?

How can I fill out nonresident standard initial and on an iOS device?

What is nonresident standard initial and?

Who is required to file nonresident standard initial and?

How to fill out nonresident standard initial and?

What is the purpose of nonresident standard initial and?

What information must be reported on nonresident standard initial and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.