Get the free Nri Scheme-cif Conversion Cum Upgrade-downgrade Form

Get, Create, Make and Sign nri scheme-cif conversion cum

Editing nri scheme-cif conversion cum online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nri scheme-cif conversion cum

How to fill out nri scheme-cif conversion cum

Who needs nri scheme-cif conversion cum?

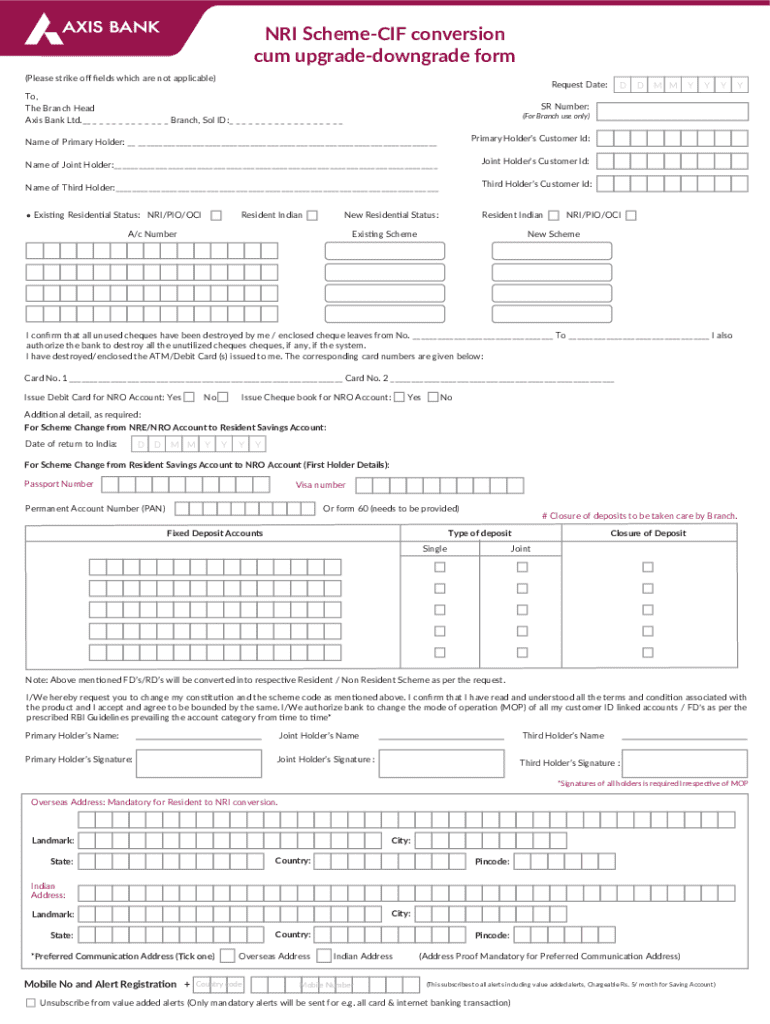

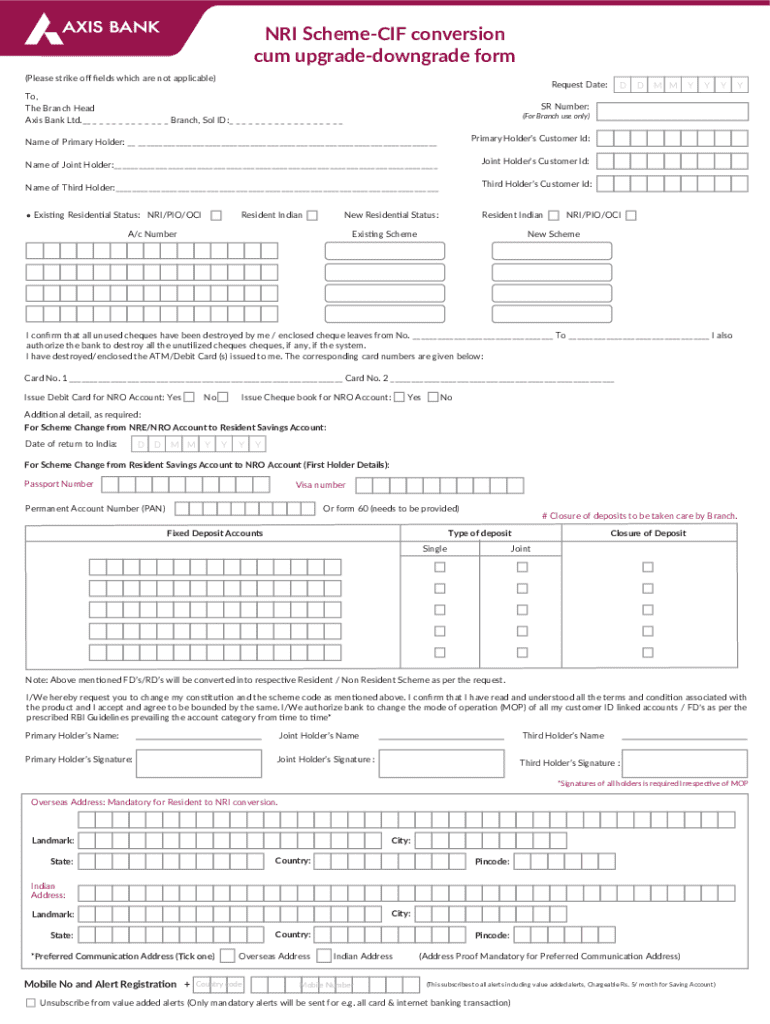

NRI Scheme - CIF Conversion Cum Form: A Comprehensive Guide

Understanding the NRI scheme

The NRI Scheme is specifically tailored for Non-Resident Indians (NRIs) to manage their banking needs seamlessly while residing abroad. This scheme enables NRIs to open and maintain accounts, receive remittances, and invest in India efficiently. With the growing number of Indians establishing their lives overseas, the scheme serves as a crucial linkage between their home country and their foreign domicile, catering to diverse financial capabilities and requirements.

Key benefits of the NRI scheme include hassle-free transactions, attractive interest rates on savings and fixed deposits, and personalized banking services. Furthermore, the CIF, or Customer Information File, plays a vital role in this ecosystem by centralizing all banking information related to a customer, simplifying the process for banks and clients alike.

Overview of the CIF conversion cum form

The CIF Conversion Cum Form is a pivotal document for NRIs seeking to convert their existing bank accounts into NRI accounts. This document enables NRIs to enjoy the benefits and features of banking specifically designed for them while ensuring compliance with regulatory requirements. The process of filing this form ensures that the bank maintains accurate records and enables NRIs to manage their finances from abroad effectively.

Filling out the CIF Conversion Cum Form is crucial for initiating the process of converting a regular account into a one that recognizes the unique needs of NRIs. This includes providing the necessary documentation that proves their NRI status, ensuring that account holders can access NRI services expediently.

Key components of the CIF conversion cum form

Filling out the CIF Conversion Cum Form requires several key pieces of information. Applicants need to provide personal details such as their name, address, and contact information. Additionally, bank details and the type of existing account they wish to convert are crucial. The form typically requires identity documents such as a passport or residential proof of the NRI’s current location, ensuring complete verification.

Understanding common terms used in the form can help avoid confusion. An example is the difference between a 'Savings Account' and a 'NRE/NRO Account'. A Savings Account is straightforward, but NRE (Non-Resident External) and NRO (Non-Resident Ordinary) accounts serve different purposes in terms of currency and tax implications, thus requiring precise documentation.

Step-by-step guide to filling out the CIF conversion cum form

Before diving into filling out the CIF Conversion Cum Form, preparation is essential. Gather all necessary documents, including your identity proof, current address verification, and relevant account details, to streamline the process. Knowing what information is required can save significant time and reduce errors in your application.

The first step involves providing your personal information. Ensure that you enter your name as it appears on official documents. Next, you’ll fill in your bank and account information, selecting which type of account you want to convert. After these details, you will need to complete the identification and verification section, which may include uploading scans of your identification documents. Finally, review all entries carefully before submitting the form.

Editing and managing your CIF conversion cum form

Once you've completed the CIF Conversion Cum Form, you might want to make adjustments or corrections. Utilizing pdfFiller makes editing easy; simply upload the document and access the tools available for modifications. pdfFiller ensures collaborative capabilities, allowing multiple users to make notes or smoothen the review process through tracked changes.

Securing your form is equally important. pdfFiller offers reliable cloud storage, ensuring that your sensitive information is maintained safely but remains easily accessible for future reference or submission.

eSigning the CIF conversion cum form

Digital signatures have become integral to the modern banking landscape, and the CIF Conversion Cum Form is no exception. An eSignature not only expedites the signing process but also provides a layer of security and verification, affirming the identity of the signer. Digital signatures are legally binding and widely accepted, simplifying transactions for NRIs.

Using pdfFiller's eSignature feature is straightforward. Once your form is ready, you can simply add your eSignature directly on the document, streamlining the approval process without the need for physical signatures. This feature enhances the efficiency of your banking transactions, ensuring quick processing.

Submitting your CIF conversion cum form

Once your CIF Conversion Cum Form is completed and signed, submitting it is the next crucial step. Many banks allow electronic submissions through online banking portals, ensuring a fast and efficient processing time. Ensure you keep track of your submission through confirmations received, which may include tracking numbers or application IDs.

Some institutions might also allow physical submission through designated branches or mailing the form to a specified address. Always check with your bank for the preferred submission method. After submitting, you can track your application's status via the bank's online interface.

Common issues and FAQs

While filling out the CIF Conversion Cum Form might seem straightforward, applicants often encounter challenges. Common issues include misunderstanding terminology, inputting incorrect information, or neglecting to attach necessary documents. To alleviate these concerns, it is advisable to refer to the FAQs provided by banks, which often detail frequent questions and offer guidance on the most common pitfalls.

For further assistance, customers can contact bank representatives directly or use support resources provided by platforms like pdfFiller, which can aid in clarifying doubts about the form and submission process.

Additional tools and resources

For NRIs looking to efficiently manage their banking needs, pdfFiller provides invaluable tools and resources. The platform features interactive forms and templates that not only simplify the document creation process but also allow for responsive editing and immediate feedback.

Moreover, guidance on related forms, regulations, and frequently updated resources ensure that NRIs stay informed. These tools enhance users' experiences as they navigate the complexities of NRI banking and documentation.

Connect with us

For any questions or to require guidance regarding the CIF Conversion Cum Form, pdfFiller offers comprehensive customer support. Users can connect through various channels, including direct customer support, community forums, and social media platforms. Engaging with these resources ensures that users receive up-to-date information and can efficiently manage their document needs.

Staying connected allows NRIs to leverage the vast resources available, ensuring a seamless experience as they navigate their banking processes. Don’t hesitate to reach out for clarity, updates, and support as you convert your banking needs to align with your NRI status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nri scheme-cif conversion cum on a smartphone?

How do I fill out the nri scheme-cif conversion cum form on my smartphone?

Can I edit nri scheme-cif conversion cum on an iOS device?

What is nri scheme-cif conversion cum?

Who is required to file nri scheme-cif conversion cum?

How to fill out nri scheme-cif conversion cum?

What is the purpose of nri scheme-cif conversion cum?

What information must be reported on nri scheme-cif conversion cum?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.