Get the free New Jersey Resident Income Tax Return

Get, Create, Make and Sign new jersey resident income

How to edit new jersey resident income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new jersey resident income

How to fill out new jersey resident income

Who needs new jersey resident income?

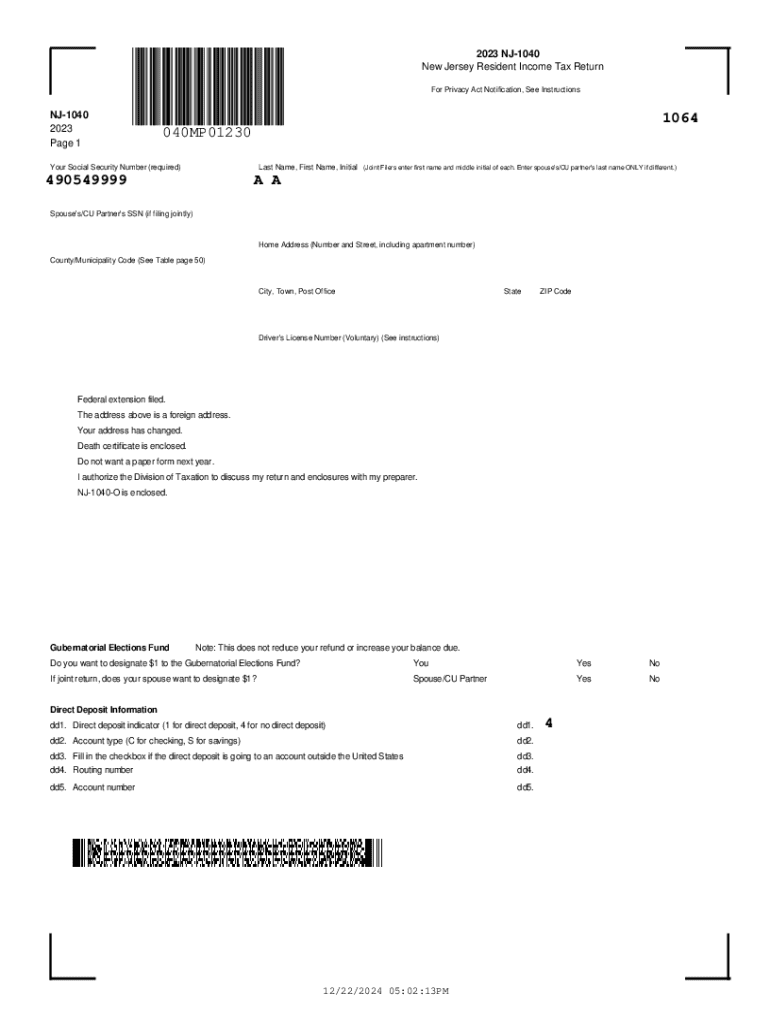

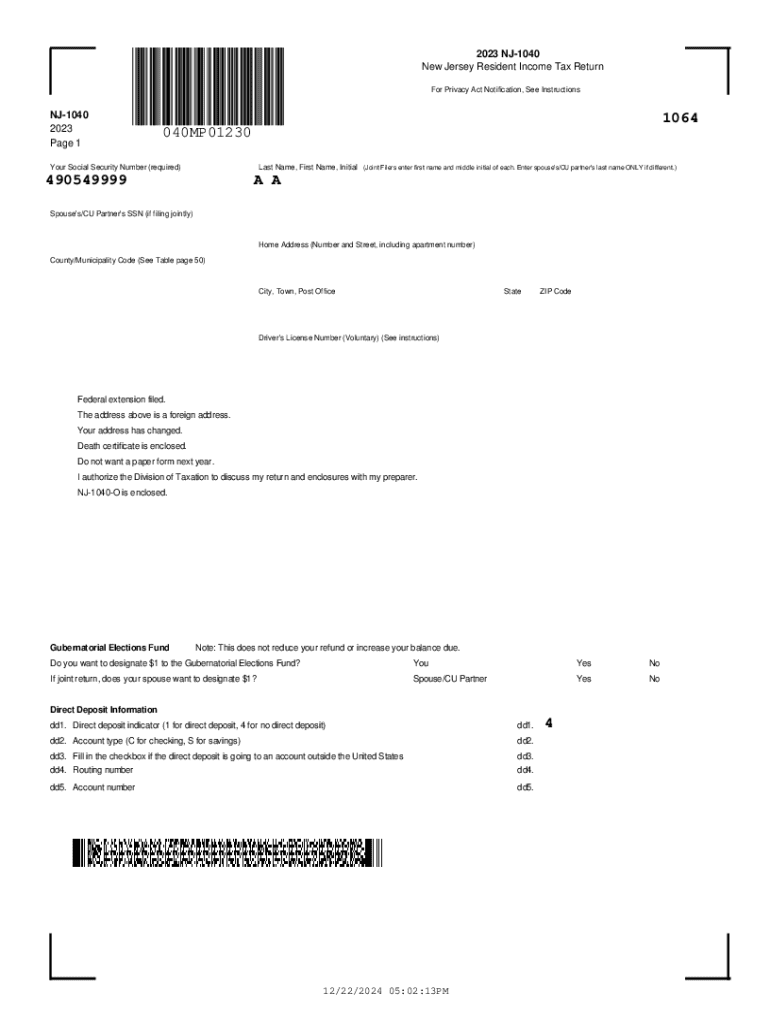

Understanding the New Jersey Resident Income Form (NJ-1040)

Overview of the New Jersey Resident Income Form

The New Jersey Resident Income Form, commonly referred to as NJ-1040, is a critical document for residents of New Jersey to report their income to the state. This form is essential for calculating and fulfilling state tax obligations, ensuring compliance with New Jersey's tax laws.

Understanding the specifics of the NJ-1040 form is vital for avoiding penalties or missed deductions. Failure to file correctly can lead to financial repercussions. Therefore, taking the time to understand this form is crucial for managing your finances.

Eligibility requirements for filing Form NJ-1040

Eligibility to file the NJ-1040 primarily hinges on residency status and income levels. New Jersey residents—those living in the state for more than 183 days—must file this form if their income exceeds the state’s threshold for taxation. Understanding whether you qualify as a resident or non-resident is key to determining your filing requirements.

Specific income thresholds can vary annually, with the New Jersey Division of Taxation setting guidelines based on various factors, including age and type of income. Senior citizens and unemployed individuals may have different filing requirements or may qualify for certain exemptions.

Detailed instructions for completing Form NJ-1040

Filing the NJ-1040 requires careful attention to detail across its various sections. The form typically begins by collecting personal information, including name, address, and Social Security number, ensuring the tax department can accurately process your returns.

Next comes the income section, where you’ll summarize all sources of income, including wages, pensions, and dividends. Deductions and credits are also crucial for minimizing your taxable income. Understanding each section can greatly impact your overall tax bill and eligibility for refunds.

Interactive tools for completing your NJ-1040

Leveraging technological solutions can streamline the process of filling out your NJ-1040. Online form fillers allow users to enter information directly into digital forms, reducing errors and simplifying submission. Calculator tools are also invaluable for estimating tax obligations in real-time.

Additionally, certain platforms, like pdfFiller, provide features allowing users to upload supporting documents directly, ensuring a complete filing package. Using these interactive tools can save time and promote accuracy.

Submitting your New Jersey income tax return

Filing your NJ-1040 can be done through multiple submission methods. The two most common options are e-filing or paper filing, each having its benefits and downsides. E-filing is generally faster and allows for quicker refunds, while paper filing may be preferable for those less comfortable with technology.

It’s crucial to pay attention to deadlines as well; typically, the annual filing deadline aligns with federal tax deadlines, usually on April 15. Extensions may be available but can come with penalties if not handled properly.

Checking the status of your New Jersey income tax refund

Once your NJ-1040 is submitted, it’s natural to want to track your tax refund status. The New Jersey Division of Taxation provides online tools where filers can easily check the status of their refund, enhancing transparency in the process.

Delays in the refund process can occur for various reasons, such as errors in the submitted tax forms or discrepancies in reported income. Awareness of common delays helps taxpayers manage their expectations.

Understanding New Jersey tax refund processing

The timeline for processing NJ-1040 returns can vary, generally taking several weeks to months. After submission, the state conducts audits and checks to validate information. This process influences the timeline of refund disbursement.

Post-submission, taxpayers await further updates regarding their refund amounts, which depend on the accuracy of the reported income and deductions. Understanding this timeline can help taxpayers manage their finances proactively.

Frequently asked questions about Form NJ-1040

Taxpayers often have questions while navigating the NJ-1040 process. Addressing these inquiries proactively can ease stress. Common questions include what to do in the event of a filing error, how to amend returns, and the deductions specific to New Jersey residents.

Specific deductions unique to New Jersey, such as property tax deductions, assist residents in lowering their taxable income and maximizing refunds. Understanding the answers to these questions is essential for a successful filing.

Accessing and editing your NJ-1040 tax documents

Good document management is vital when filing your NJ-1040. With platforms like pdfFiller, residents can access their tax documents from anywhere, thanks to cloud-based solutions. These services also provide version tracking, ensuring that users keep tabs on changes throughout the filing process.

Moreover, easy eSigning features and the ability to invite collaborators for review add a layer of security and efficiency. Utilizing such tools greatly enhances the overall filing experience, making it smoother and error-free.

Troubleshooting common issues with the NJ-1040 form

Even the most prepared individuals can encounter issues while filing their NJ-1040. Common technical difficulties include form submission errors, missing documents, or issues with online platforms. Knowing where to seek help is essential.

The New Jersey Division of Taxation also offers support to address specific inquiries about the NJ-1040 form, ensuring taxpayers can resolve issues without prolonged stress.

Additional resources for New Jersey residents

Various resources are available online to assist New Jersey residents with their tax preparation needs. The New Jersey Division of Taxation provides comprehensive guides and FAQ sections that clarify specific aspects of the NJ-1040 form.

Furthermore, professional tax preparation services can offer personalized assistance, particularly for complex financial situations. Recognizing these resources can ensure taxpayers receive the guidance they need to accurately file their returns.

Key takeaways for New Jersey income taxpayers

Filing your NJ-1040 successfully hinges on understanding the form's sections and meeting eligibility requirements. Properly reporting income, claiming appropriate deductions, and adhering to submission timelines can significantly affect your overall tax experience.

Whether you're a seasoned taxpayer or filing for the first time, keeping organized, utilizing online tools, and seeking out resources can facilitate a smoother process. By integrating these strategies, New Jersey residents can navigate the complexities of tax filing with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the new jersey resident income electronically in Chrome?

How can I edit new jersey resident income on a smartphone?

How do I fill out new jersey resident income on an Android device?

What is new jersey resident income?

Who is required to file new jersey resident income?

How to fill out new jersey resident income?

What is the purpose of new jersey resident income?

What information must be reported on new jersey resident income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.