Get the free Direct Deposit Agreement Form

Get, Create, Make and Sign direct deposit agreement form

Editing direct deposit agreement form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit agreement form

How to fill out direct deposit agreement form

Who needs direct deposit agreement form?

Understanding the Direct Deposit Agreement Form: A Comprehensive Guide

Understanding the direct deposit agreement form

The direct deposit agreement form is a formal document that enables employers to deposit employee wages directly into their bank accounts. This method of payment has gained popularity due to its convenience and efficiency. By eliminating the need for physical checks, it allows employees to receive their payments faster, fostering better financial management.

Direct deposit plays a significant role in personal finance, helping individuals manage their funds with ease. It guarantees timely payment access, reduces the risk of lost or stolen checks, and enhances record-keeping for tax purposes. The direct deposit agreement form is not just a mere formality; it's a vital document for both employers and employees.

Common uses of the direct deposit agreement form extend beyond employment. Many individuals use it for social security benefits, pension payments, and other governmental disbursements. In each case, the form establishes a secure and reliable method for electronic funds transfer.

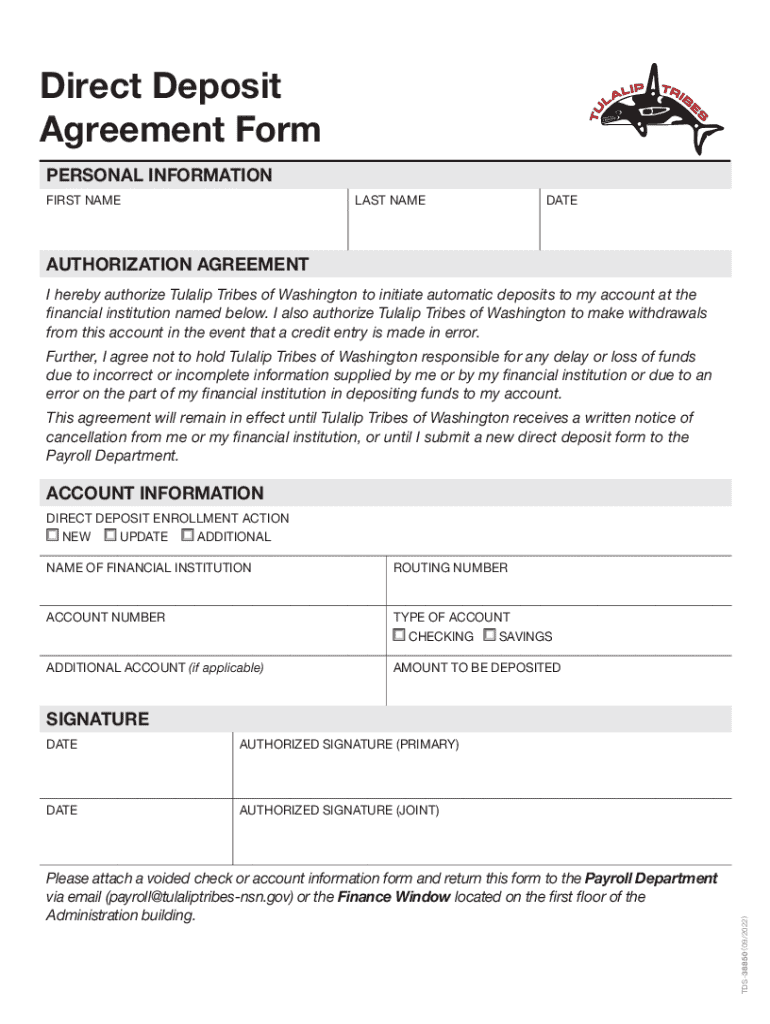

Key components of the direct deposit agreement form

A properly filled direct deposit agreement form includes various key elements, starting with personal identification. The required personal information typically includes your name, address, and Social Security number or Tax ID. These identifiers ensure that the funds are appropriately allocated to the right individual.

Banking information is the next critical component. You'll need to provide your bank's name, account number, and routing number. This data ensures that payments are accurately deposited into your selected account. The form should also include an authorization signature, affirming that you authorize the transactions. Additionally, some forms may feature provisions for various scenarios, such as differences in payment schedules or information updates.

Steps to complete the direct deposit agreement form

Completing the direct deposit agreement form can be straightforward if you follow a structured approach. Start with Step 1: Gather Necessary Documents. Having a valid ID and recent bank statements handy will streamline the process.

Next, move on to Step 2: Fill Out Personal Information. Ensure all your personal information is accurate. For Step 3, provide your banking details, including your account and routing numbers. Step 4 involves a thorough review to confirm all details are correct, as errors can lead to payment delays. After that, Step 5 requires you to sign and date the agreement, followed by Step 6: Submitting the Form. Depending on your employer’s practices, you may need to send it in via email or physical mail to your payroll department.

Editing and customizing the direct deposit agreement form

Editing the direct deposit agreement form can be done easily with tools like pdfFiller. Firstly, upload the document onto the platform. You can use various editing tools to adjust text fields, add your signature, or include any necessary annotations. This flexibility allows you to modify the template according to your specific needs.

Customization can also include adding company branding to the form if it’s for a corporate setting. Adjusting the language or specific form fields can further tailor the document for particular requirements or preferences, making it suitable for various organizational uses.

Digital signing and securing your form

The advantages of eSigning the direct deposit agreement form cannot be understated. Digital signatures offer convenience, allowing you to sign documents from anywhere without physical presence. Using pdfFiller for secure eSigning ensures that your form is both validated and securely stored.

Verifying signatures for authenticity is crucial, particularly for larger companies, as it confirms that the document remains valid. Cybersecurity measures integrated into tools like pdfFiller help protect sensitive information while allowing seamless document handling.

Managing your direct deposit agreement

Storing your direct deposit agreement form on pdfFiller provides numerous benefits. The cloud storage feature enables access from any device, anywhere, which is especially beneficial for remote workers. You can retrieve or modify your agreement easily, ensuring that records are up-to-date for any financial audits or reviews.

Additionally, tracking changes and keeping thorough records over time simplifies financial management. This capability highlights the importance of technology in modernizing and improving document management processes.

Troubleshooting common issues

Even minor errors on the direct deposit agreement form can lead to major issues. Incorrect banking information is a common problem that can result in delays or misdirected payments. It's always recommended to double-check your entries before submission.

If you encounter denied payments or delays, reach out directly to your employer or payroll department. They can provide insights into any discrepancies and help rectify them quickly, minimizing the impact on your finances.

Additional tips for using direct deposit

Once your direct deposit has been enrolled, confirming its successful activation is key. Regular monitoring of your bank account ensures that deposits are received promptly. Establishing a habit of reviewing your direct deposit statements can help you stay on top of your finances.

You may also want to set reminders to check your account statements, ensuring that everything matches correctly with your expected payment schedules.

Benefits of using pdfFiller for your direct deposit agreement

pdfFiller empowers users to manage the direct deposit agreement form seamlessly. The platform integrates smoothly into various workflows, enhancing overall efficiency. One of the standout benefits is the ability to access documents from anywhere, making it particularly advantageous for remote teams that utilize digital tools.

Collaboration features within pdfFiller allow teams to work on documents together, ensuring that all necessary parties can contribute and review essential information without the hassle of back-and-forth emails. This collaborative aspect is vital in a fast-paced business environment.

FAQs about the direct deposit agreement form

Frequently asked questions often arise when filling out a direct deposit agreement form. One common query is, 'What if I change banks?' In such cases, you will need to fill out a new agreement form and submit it to ensure that all future payments are redirected to your new account.

Another common question pertains to the timeframe for activation. While it varies, it typically takes one to two pay cycles for the direct deposit to activate fully. Always confirm with your employer regarding specifics, especially if you're transitioning from paper checks.

Additionally, some might wonder if they can cancel their direct deposit. The answer is yes; however, navigating this requires filling out a specific form, depending on your employer's policies.

Summary of key takeaways

The direct deposit agreement form is crucial for efficient financial management, ensuring that payments are made directly to the bank accounts of employees and individuals alike. Utilizing pdfFiller can significantly enhance the editing, signing, and managing of this form, providing users with a streamlined process.

Understanding the components and management techniques discussed here will equip users to handle their direct deposit agreements with confidence, leading to better financial practices overall.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify direct deposit agreement form without leaving Google Drive?

How can I send direct deposit agreement form for eSignature?

Can I sign the direct deposit agreement form electronically in Chrome?

What is direct deposit agreement form?

Who is required to file direct deposit agreement form?

How to fill out direct deposit agreement form?

What is the purpose of direct deposit agreement form?

What information must be reported on direct deposit agreement form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.