Get the free Reconsideration of Value Request Form

Get, Create, Make and Sign reconsideration of value request

Editing reconsideration of value request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out reconsideration of value request

How to fill out reconsideration of value request

Who needs reconsideration of value request?

Comprehensive Guide to the Reconsideration of Value Request Form

Understanding the reconsideration of value process

A reconsideration of value (ROV) is a formal process that allows property owners to contest the assessed value of their property, potentially resulting in lower property taxes. This request is usually prompted by an annual assessment that does not accurately reflect the market value based on recent sales or changes in the property itself. The ROV process serves as a critical mechanism for ensuring fair taxation, where property owners can rely on accurate assessments to avoid overpaying in taxes.

Understanding the nuances of the ROV process is essential. This process ensures that property values align closely with market realities, which not only influences individual tax burdens but also affects local revenue streams for essential services such as schools and infrastructure.

Who should file a reconsideration of value?

Various stakeholders may find the need to file a reconsideration of value request, ranging from individual homeowners to corporate representatives managing multiple properties. Common scenarios that warrant a reconsideration include changes in the neighborhood, such as new developments that impact property values or when properties adjacent to yours have sold for significantly less than your assessment. Business owners might also file if the assessed value adversely affects operational costs, particularly in areas with high property tax burdens.

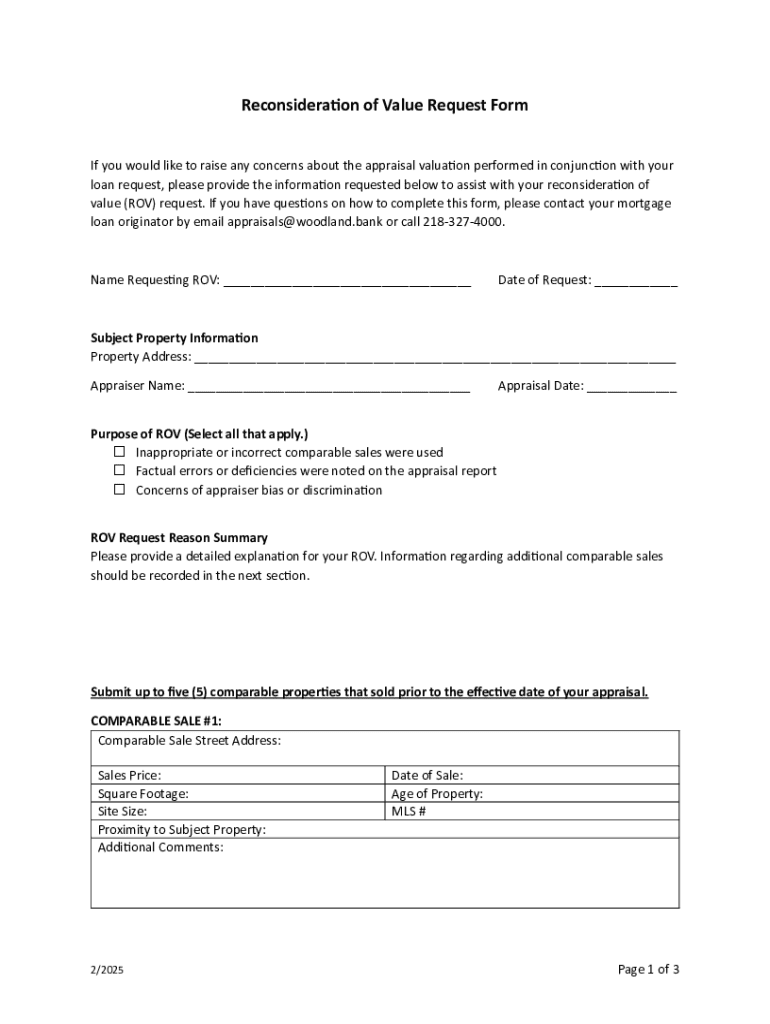

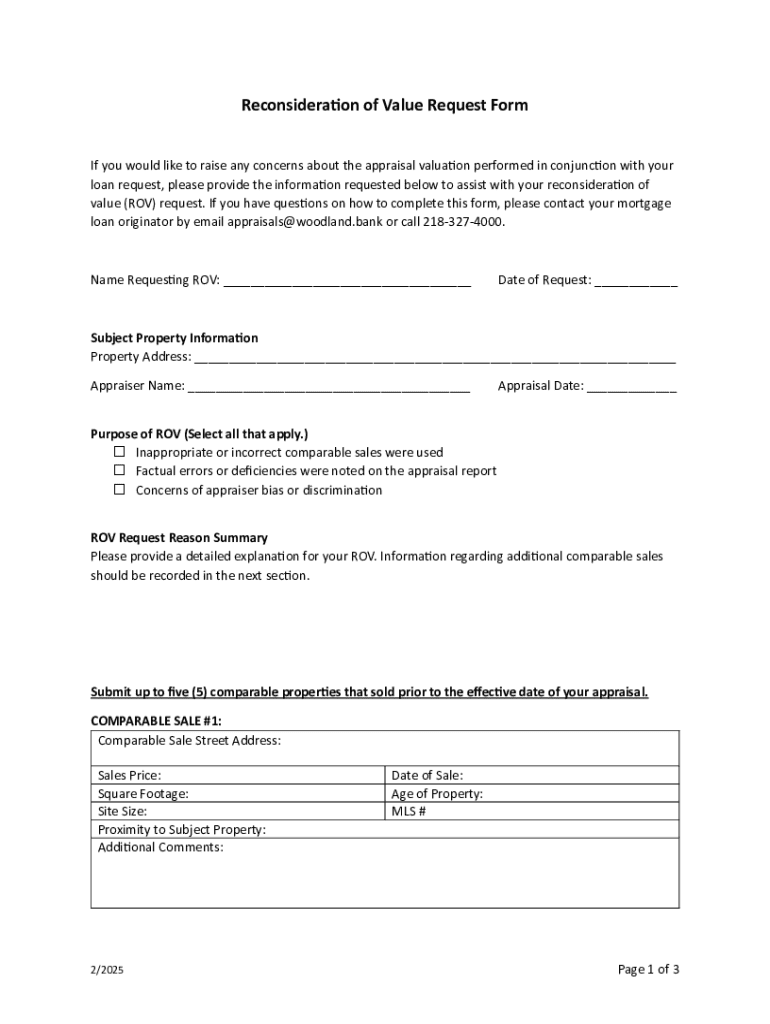

The reconsideration of value request form explained

The ROV request form is the cornerstone of the reconsideration process. This document is designed to collect essential details that support your request for a lower assessment. Key components include property information (address, owner’s name), current assessed value, requested value, and a thorough explanation of why the assessment is questioned. It may also require documentation showcasing market comparables, recent sales data, or physical changes in the property.

Additionally, individuals should be aware of common misconceptions surrounding this process. Many believe that filing an ROV request guarantees a decrease in property tax, while in reality, successful outcomes depend on the strength of the evidence presented and adherence to submission guidelines. Understanding the eligibility criteria for filing is also crucial, as counties may have unique regulations or timelines for submissions.

How to prepare for the reconsideration of value

Preparation is vital in the ROV process, focusing on compiling extensive supporting evidence. Begin by gathering comprehensive information about your property: its size, location, and specific characteristics that could influence its value, such as upgrades or unique amenities. Research market comparables in your area; sales data from similar properties can significantly bolster your argument. Also, consider taking photographs of your property and the adjoining areas to visually document conditions that could impact valuation.

An equally important step is to analyze previous assessments. Compare your current assessment with previous ones to identify inconsistencies. Understanding how values have shifted over time can better prepare you for discussions with assessors and lend credibility to your request. Over time, property values can change significantly due to various factors, and knowing the trajectory of your property’s assessment will help you make a compelling case.

Completing the reconsideration of value request form

Filling out the reconsideration of value request form accurately is essential for a successful submission. Begin by accessing the form via pdfFiller, where you can find an easy-to-navigate layout. Once you have the template, start entering your personal and property details precisely. Be clear and concise in detailing your reasons for reconsideration; the more compelling your rationale, the greater the chance of success. Don’t forget to attach the necessary documentation that supports your claim—this may include evidence of market comparables or photos illustrating your point.

pdfFiller provides useful interactive tools that enhance the assurance that your form is filled out correctly. The platform offers templates that streamline the process, making it easier to customize and complete your request. Additionally, the option for digital signatures simplifies the task of eSigning, eliminating the need for printing and scanning documents, thus saving time and ensuring a more efficient submission.

Submitting your reconsideration of value request

Once your reconsideration of value request form is completed, the next step is submission. Choosing the right method for submitting the form is paramount. While some may prefer a physical submission, others might benefit from the efficiency of online submissions, especially with pdfFiller's capabilities. Ensure you keep records of your submission, particularly if you submit by mail; tracking your submission status can safeguard against misplaced forms or considerable delays.

Further actions may be necessary depending on the outcome of your ROV request. If your request is approved, it could lead to a revised assessment and potentially lower property taxes. Conversely, if denied, understanding the option to appeal is crucial. Each locality might have its unique appeal processes, necessitating that you familiarize yourself with these procedures in advance.

Understanding ROV outcomes

Interpreting the results from your reconsideration of value request is a critical step in the process. Once you receive a decision from assessment officials, the outcome will typically include details on whether your assessment was adjusted and what the new valuation will be. In many cases, if the reconsideration is successful, you can expect a proportional change in your property taxes, which can provide significant financial relief.

After receiving a response, reflect on your options. If your valuation has decreased, you may want to review the implications on your future tax bills and other financial planning. However, if your request is denied, evaluate whether further action is needed—this may involve seeking professional assistance to better understand why your request was rejected or how to strengthen your case for a potential appeal.

Frequently asked questions (FAQs)

The reconsideration of value process often leads to several common questions among property owners. For instance, many wonder about the typical timeframe to receive a response after submitting their request. This can vary from one locality to another, but generally, you can expect results within a few weeks to a couple of months, depending on the volume of requests and the assessing authority's protocols.

Another frequent query arises regarding filing multiple requests in a single year. It's advisable to understand your jurisdiction’s policy; some areas may permit this under certain circumstances, while others may limit it to a single request per assessment cycle. Users also express concern about discovering errors in their assessments post-submission; knowing how to address these discrepancies swiftly can be advantageous in ensuring fair property tax assessments.

Support and resources

Navigating the reconsideration of value request process can be challenging, but there are resources available to help. pdfFiller provides extensive support for users seeking assistance with their request forms. The platform not only houses templates for various forms but also offers a user-friendly interface and guidance throughout the editing and submission process.

In addition to pdfFiller, local government websites often provide vital resources for property assessments, including guidelines for filing ROV requests and contact details for local assessment offices. By leveraging these resources, individuals and teams can navigate their ROV requests more effectively, ensuring they submit comprehensive and well-supported documentation.

About pdfFiller

pdfFiller serves users seeking streamlined document management solutions, offering versatile tools for editing, signing, and collaborating on documents from any device with internet access. The platform's design enhances user experience by integrating essential functions, such as cloud storage and security features, ensuring that users can manage their forms confidently.

Success stories abound for individuals and businesses that have utilized pdfFiller in their ROV submissions. With a focus on efficiency and accuracy, users have reported significantly less hassle in navigating paperwork, showcasing pdfFiller as a go-to resource for anyone needing to manage essential documents including the reconsideration of value request form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit reconsideration of value request online?

Can I create an electronic signature for signing my reconsideration of value request in Gmail?

How do I fill out the reconsideration of value request form on my smartphone?

What is reconsideration of value request?

Who is required to file reconsideration of value request?

How to fill out reconsideration of value request?

What is the purpose of reconsideration of value request?

What information must be reported on reconsideration of value request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.