Get the free National Pension System (nps) – Subscriber Registration Form

Get, Create, Make and Sign national pension system nps

How to edit national pension system nps online

Uncompromising security for your PDF editing and eSignature needs

How to fill out national pension system nps

How to fill out national pension system nps

Who needs national pension system nps?

National Pension System NPS Form: A Comprehensive Guide

Understanding the National Pension System (NPS)

The National Pension System (NPS) is a government-sponsored pension scheme designed to provide individuals with a sustainable source of income after retirement. Established in 2004, NPS aims to encourage individuals to make regular contributions toward their retirement planning, ensuring financial security during their later years. This system is crucial not only for personal financial stability but also for the broader economic stability by promoting savings and prudent investment practices.

Key benefits of opting for the NPS include tax deductions on contributions up to a specified limit, flexible investment options that can cater to the individual's risk appetite, and the ability to manage and monitor their retirement funds effectively. By investing in NPS, subscribers can choose their asset allocation among equity, corporate bonds, or government securities, thus tailoring their portfolio to their financial goals.

Eligibility for NPS

Eligibility to enroll in the NPS is open to all Indian citizens, including non-residents, who are between the ages of 18 and 70 years. This broad age range ensures that a diverse population can take advantage of this pension plan, encouraging people to start saving early for retirement. Additionally, there are no specific income requirements, making it accessible to all.

To commence the application process, an individual must provide valid identification documents, such as a PAN card, and complete the necessary forms. The NPS scheme aims to be inclusive and transparent, allowing individuals from different walks of life to invest in their future.

Types of NPS Forms

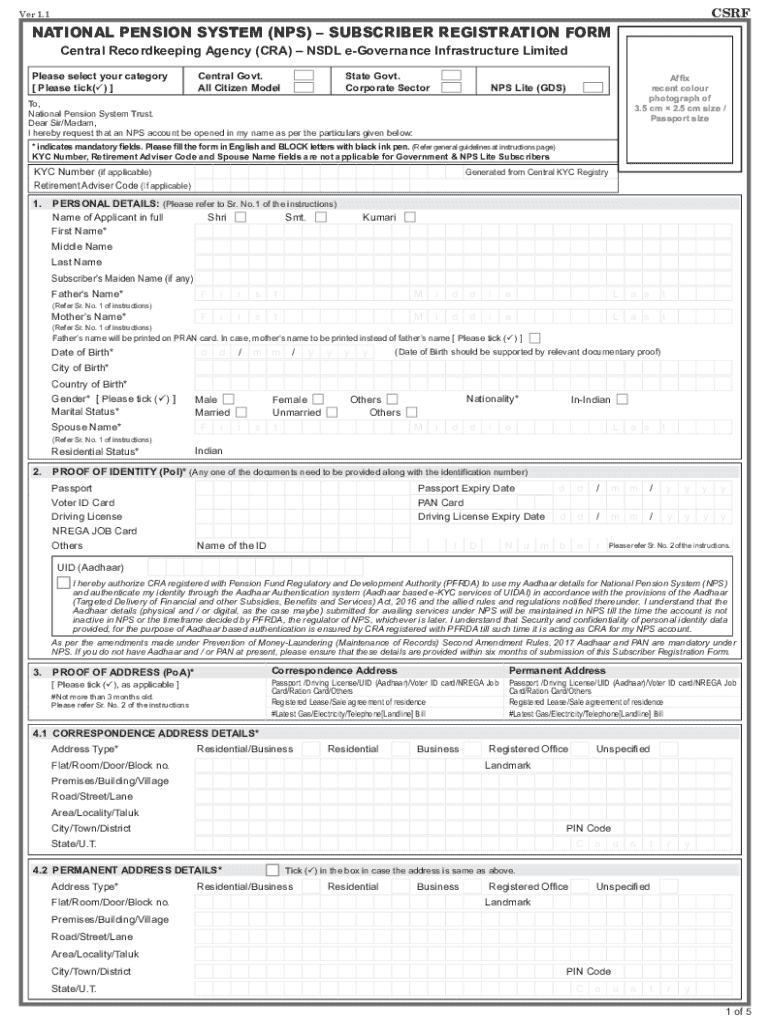

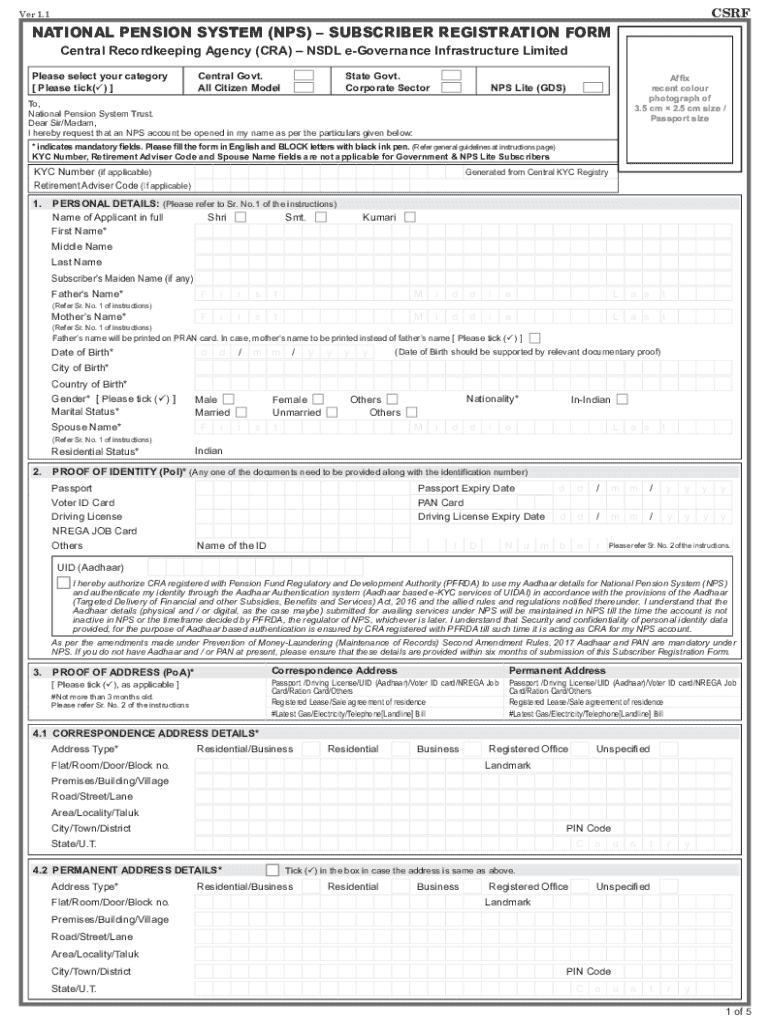

Within the NPS framework, there are several forms that individuals must familiarize themselves with, starting with the Subscriber Registration Form. This foundational document enables individuals to register for the NPS and outlines personal information, such as identity proof and nominee details.

Choosing the correct form depends on your investment strategy and needs. For example, regular contributors may frequently fill out Contribution Forms, while those seeking to contest an issue would require the Grievance Redressal Form.

Step-by-step process to fill out NPS forms on pdfFiller

Filling out NPS forms can be simplified with tools like pdfFiller. Before starting, it's crucial to gather all necessary documents, including your PAN card, Aadhaar card, and bank account details.

Following these steps ensures that form completion is efficient and accurate.

Submitting your NPS form

Once your NPS form is filled out correctly, you have two options for submission: online or offline. Online submission is generally more convenient and allows for quicker processing. To submit online, simply follow the on-screen instructions provided by the NPS website or platform.

Incorporating eSignatures is particularly important for ensuring the authenticity of your submission when using pdfFiller. To add an eSignature, the platform provides user-friendly tools, making it easy to sign your document securely and proceed with submission.

Managing your NPS form post-submission

After submission, it’s essential to keep track of your application status. You can do this by logging into the official NPS portal, where updates about your submission will be available. Alternatively, pdfFiller's document management features allow you to keep tabs on your submitted documents.

Be proactive in addressing any issues that may arise during the process.

Common issues and solutions

When dealing with NPS forms, subscribers often encounter issues such as missing documents, incorrect information, or delays in processing. It's essential to double-check all entries before submission to avoid common pitfalls.

By addressing these common problems with proactive solutions, subscribers can navigate the NPS application process more smoothly.

Interactive tools and features on pdfFiller

pdfFiller offers various interactive tools and features that enhance the experience of filling out NPS forms. One of the most useful is the ability to edit completed forms. If changes are necessary after submission, you can easily access and modify your forms on pdfFiller's platform.

This flexibility makes pdfFiller an essential tool for managing documents effectively.

Collaborating with teams

For teams working together on NPS forms, pdfFiller provides a collaborative environment. Various sharing and collaboration features facilitate collective document handling, enabling multiple users to work seamlessly on a single form.

This ensures that teams can efficiently manage their NPS documentation without redundancy.

Customer support options

In case users encounter difficulties or need assistance with their NPS forms, reaching out to customer support is vital. pdfFiller offers various support options, including live chat, email support, and dedicated help resources on their website. Additionally, for NPS-related queries, subscribers can access toll-free numbers and dedicated helplines provided by the NPS authorities.

This layered support framework ensures that users can find the help they need when managing their NPS forms.

Frequently asked questions about NPS forms

Customers often have general queries regarding the NPS application process. Common questions might include how to amend details after submission or the required timeline for an NPS form to be processed.

Technical queries regarding the functions of pdfFiller are also common. Users may wish to know how to use specific features or troubleshoot issues. The pdfFiller support center provides an extensive FAQ section addressing these concerns, ensuring users feel confident utilizing the platform for their NPS documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit national pension system nps from Google Drive?

How can I send national pension system nps to be eSigned by others?

How can I edit national pension system nps on a smartphone?

What is national pension system nps?

Who is required to file national pension system nps?

How to fill out national pension system nps?

What is the purpose of national pension system nps?

What information must be reported on national pension system nps?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.