Get the free Business Taxes for Motor Vehicle Transactions

Get, Create, Make and Sign business taxes for motor

How to edit business taxes for motor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business taxes for motor

How to fill out business taxes for motor

Who needs business taxes for motor?

Business Taxes for Motor Form: A Comprehensive Guide

Understanding business taxes related to motor forms

Business taxes associated with motor forms pertain to the taxation obligations that businesses must fulfill when owning, selling, or operating motor vehicles. These taxes are crucial for compliance and can significantly affect a company's financial standing. Businesses in the automotive sector, whether they deal in sales, repairs, or services related to vehicles, must navigate various tax obligations to avoid penalties and maintain good standing with tax authorities.

Compliance is vital not solely for legality but for sustaining operations without interruptions. Different types of taxes applicable to motor vehicles include sales tax, motor fuels tax, Title Ad Valorem Tax (TAVT), and annual ad valorem tax. Understanding each type ensures that businesses can allocate their financial resources correctly and plan for impending payments.

Types of business taxes for motor forms

Several distinct taxes apply to businesses dealing with motor vehicles. These include:

Navigating motor form requirements

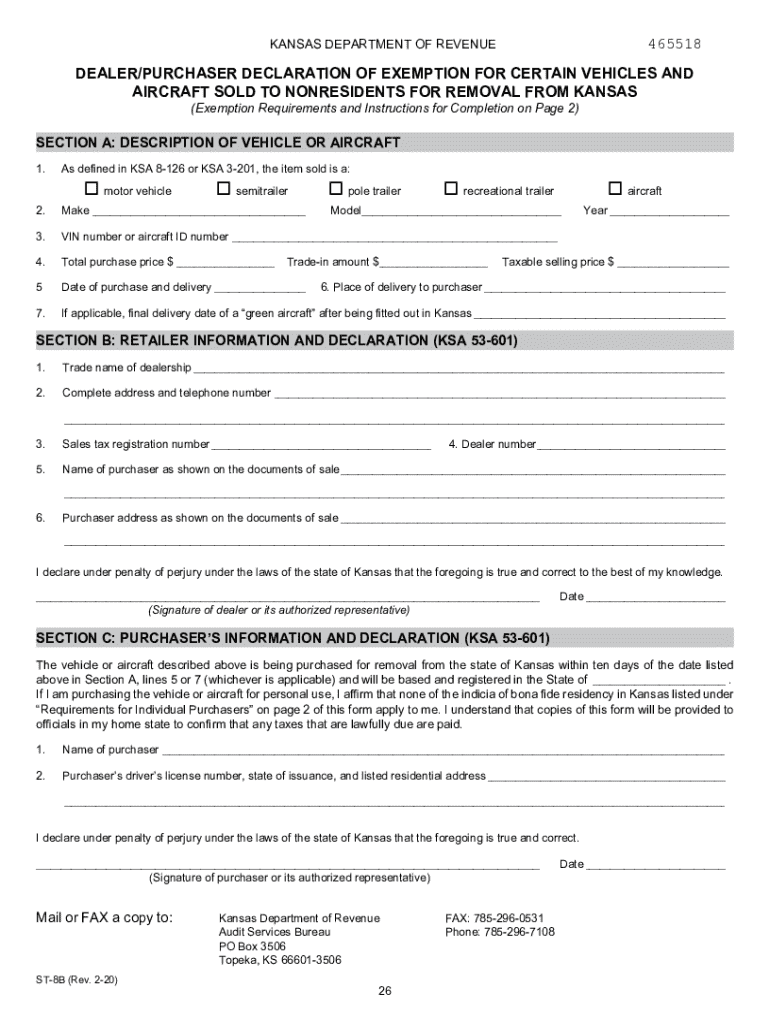

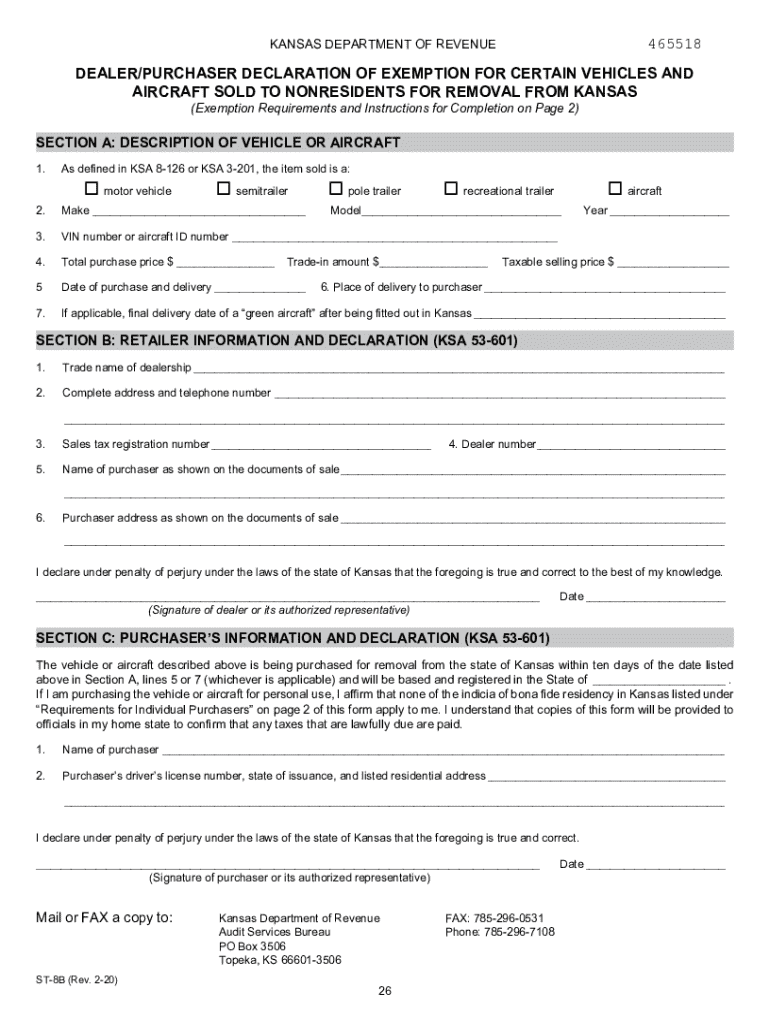

Navigating motor form requirements can seem daunting as various forms denote different tax responsibilities. Essential forms include the state sales tax form, motor fuels tax report, and TAVT forms. Obtaining the correct forms usually involves visiting your state or local tax authority’s website or utilizing platforms like pdfFiller to seamlessly fill and submit forms electronically.

When it comes to filing, businesses can choose between electronic and paper filing. Electronic filing is generally faster and may provide immediate confirmations, while paper filing can be cumbersome and prone to mailing delays. For those opting for electronic filing, pdfFiller offers a step-by-step guide to submitting forms, making it easier to maintain compliance.

Completing the motor forms

Filling out motor forms accurately is essential. Here’s how to ensure each submission is correct and complete:

Common pitfalls include missing deadlines, providing incorrect figures, and neglecting to sign forms. Avoiding these can significantly ease the filing experience.

Utilizing technology to manage business tax forms

Technology simplifies the management of business tax forms significantly. pdfFiller, for instance, allows users to edit PDFs seamlessly, which is crucial when needing to amend forms or provide additional documentation quickly. The interactive tools empower users to complete forms with high accuracy.

Collaboration features facilitate teamwork by allowing various team members to provide input in real-time, fostering quick approvals and reducing bottlenecks in the workflow. This enhances efficiency and ensures accuracy, essential in tax-related documentation.

Reporting and paying business taxes for motor forms

When it comes to paying business taxes for motor forms, various payment methods are typically available. Common avenues include ACH credit transactions, credit card payments, and direct bank transfers. Familiarizing yourself with these methods can save time and introduce flexibility in how your business manages cash flow.

It's crucial to understand due dates for different types of taxes to avoid penalties. Key dates may differ by state, with many falling at the end of the fiscal year or on specific quarterly schedules. Late payments can result in added fees or interest, so keeping track of these deadlines is essential for any business in the automotive space.

Resources for assistance with business taxes for motor forms

Navigating business taxes can be complicated, but numerous resources can help ease this process. Most state tax departments maintain robust online portals where businesses can find detailed information regarding tax rates, forms, and filing requirements. These resources often include FAQs, helpful articles, and direct contact details for tax professionals.

Additionally, businesses may find tax assistance programs available that cater to specific needs, such as those for small businesses or specialized sectors like automotive. Engaging with these resources can provide valuable guidance and reduce unnecessary complications.

FAQs on business taxes related to motor forms

Understanding the nuances of business taxes can lead to numerous questions. Common queries include:

Clarifying these questions can enhance a business's understanding of its tax obligations and ensure compliance.

Latest updates and changes to business tax regulations for motor forms

Keeping informed on changes in tax regulations is crucial for business owners. For the current year, some states may have adjusted tax rates or changed filing requirements, all of which can impact the overall tax burden for businesses operating in the auto industry. Regularly checking with your state tax department can help you stay abreast of such changes.

Subscribing to newsletters or alerts from tax regulatory agencies, as well as professional organizations within the automotive community, can provide timely updates and relevant information that may affect your business.

Community and support for business tax filers

Connecting with others facing similar challenges can provide invaluable support. Online forums and communities focused on business taxes can be excellent resources for advice and shared experiences. Many of these platforms allow for open discussions regarding common pitfalls, tax strategies, and regulatory updates.

Additionally, networking events for businesses in the automotive sector can foster relationships that may lead to partnerships or collaborative tax strategies, further enhancing business operations and tax compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find business taxes for motor?

How do I execute business taxes for motor online?

How do I edit business taxes for motor on an Android device?

What is business taxes for motor?

Who is required to file business taxes for motor?

How to fill out business taxes for motor?

What is the purpose of business taxes for motor?

What information must be reported on business taxes for motor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.