Get the free Tax Information Authorization Tax Disclosure

Get, Create, Make and Sign tax information authorization tax

How to edit tax information authorization tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax information authorization tax

How to fill out tax information authorization tax

Who needs tax information authorization tax?

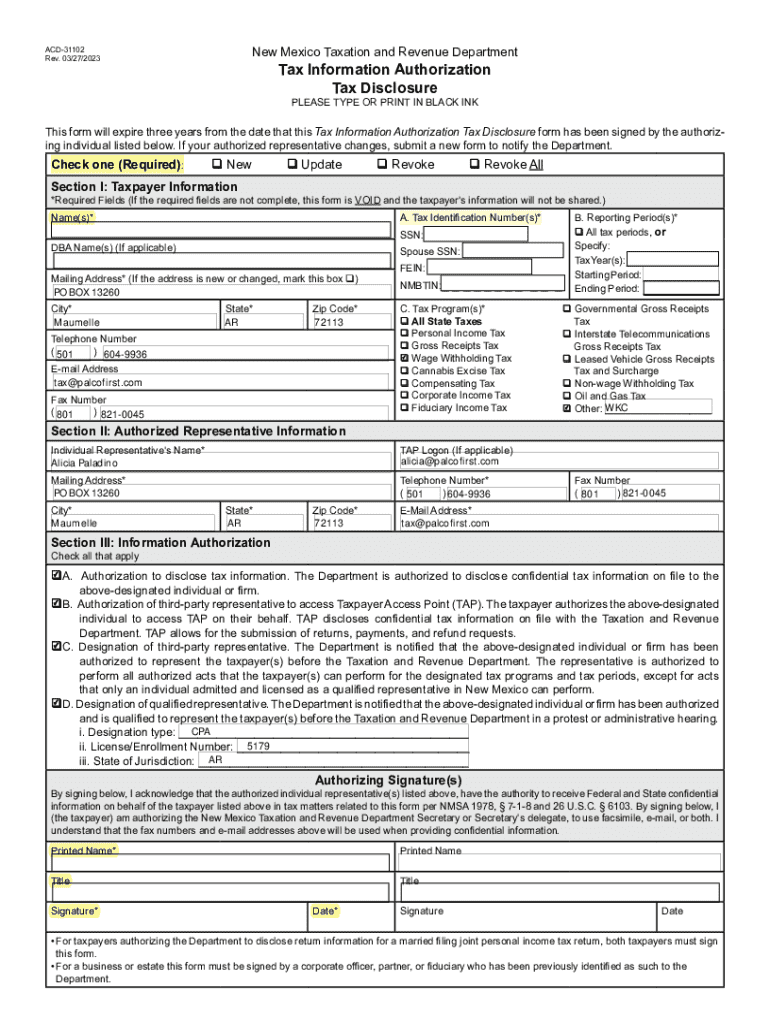

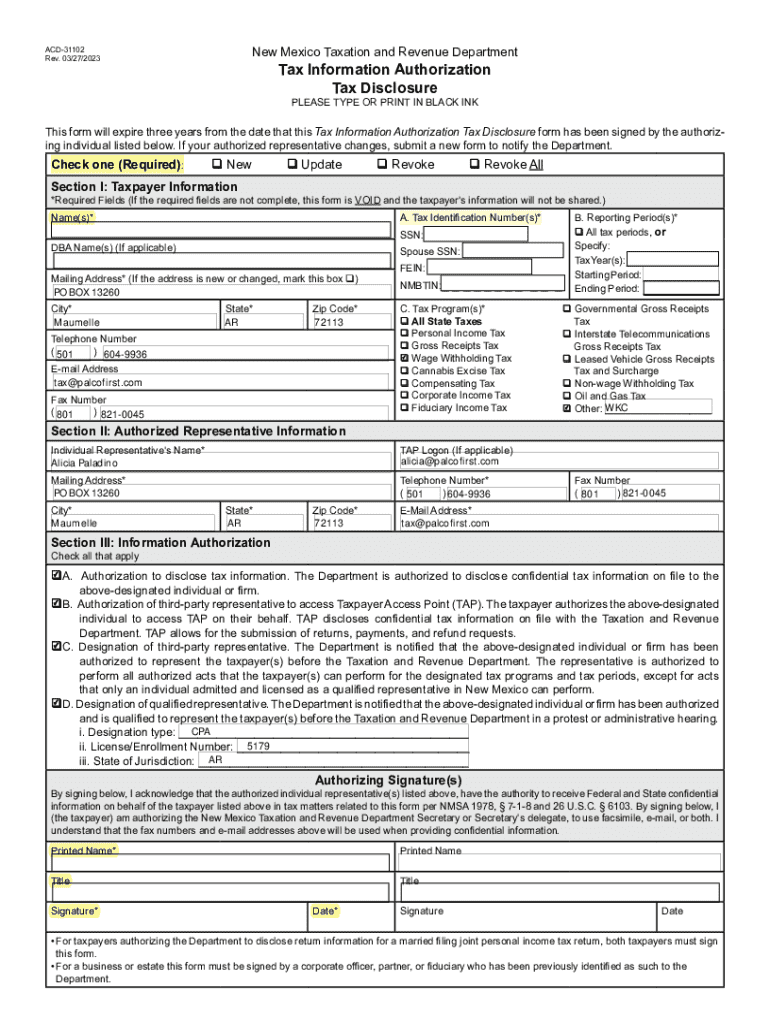

Tax Information Authorization Tax Form: A Complete Guide

Understanding tax information authorization

Tax Information Authorization (TIA) is a critical legal document that grants individuals or entities the authority to access another person's tax information. This form plays a vital role in ensuring that taxpayers manage their tax affairs efficiently, allowing trusted parties like tax professionals to obtain necessary data from the IRS on their behalf.

With TIA, taxpayers can delegate responsibility for managing their tax records, simplifying processes during tax preparation or when addressing IRS inquiries. Form 8821 is the official IRS form used for this purpose and serves as a streamlined mechanism for taxpayers to authorize the release of their sensitive tax information.

What is the tax information authorization tax form?

Form 8821 is the IRS Tax Information Authorization tax form that allows taxpayers to authorize individuals or organizations to receive their tax information. This can include copies of tax returns, transcripts, and other pertinent tax documents. The form is useful in various situations, such as appointing an accountant to manage tax filings or enabling a family member to assist in financial matters.

Taxpayers who want to grant access to their tax information must fill out Form 8821, indicating the scope of the data to be shared and identifying the designees authorized to receive this information. Understanding when and how to use this form can significantly streamline communication with the IRS.

Key components of Form 8821

Form 8821 is broken down into several sections, each serving a specific purpose. Understanding these sections is crucial for properly completing the form and ensuring that it meets IRS requirements.

Section 1: Taxpayer information

In the first section, taxpayers must provide their personal details, including their name, address, social security number (SSN), and type of return information required. This section ensures that the IRS can accurately identify the taxpayer and associate their records with the correct individual.

Section 2: Designees

In Section 2, taxpayers identify who they are authorizing to access their tax information. This could be a tax professional, family member, or friend. It is essential to carefully outline their names, addresses, and contact details to avoid confusion or miscommunication.

Section 3: Tax information

Section 3 specifies the scope of the tax information to be disclosed. Taxpayers can select different types of documents, such as tax returns and account information, and designate whether this access is for a specific tax year or for a continuous period.

Section 4: Specific use not recorded on the CAF

Section 4 allows taxpayers to detail any specific use of the tax information that is not documented on the Centralized Authorization File (CAF). This helps to provide clarity about unique circumstances whereby the authorized designees will use the information.

Section 5: Retention/revoke of prior authorization

In Section 5, taxpayers can communicate if any previous authorizations are to be revoked. This section is essential for maintaining oversight and ensuring that only current, valid authorizations are in effect.

Section 6: Taxpayer signature

Finally, Section 6 requires the taxpayer's signature and date. This signature is critical as it validates the authorization and confirms that the taxpayer agrees to the terms laid out in the form.

Step-by-step guide to completing the tax information authorization tax form

Completing Form 8821 requires careful preparation. Before you start, gather all relevant documents such as your SSN, mailing address, and the details of your designees. Being organized will help you fill in the form efficiently and accurately.

Begin by completing Section 1 with personal taxpayer information accurately and ensure there are no typos in names or numbers. Next, in Section 2, clearly list the designated individuals. Avoid using initials alone for names to prevent confusion.

As you move on to Section 3, specify which types of tax information you wish to authorize for disclosure—be it general or specific to certain years. Pay close attention to the timeframes selected to ensure the designee can receive the correct details during necessary periods.

After completing the form, you have multiple submission options. You may mail it to the designated IRS address, fax it if you prefer, or submit it electronically through the IRS e-Services if eligible.

To monitor the status of your submission, the IRS provides tracking options, so ensure you keep a copy of the filed form for your records.

When to file Form 8821

Form 8821 should be filed when you want to authorize a third party to access your tax records. Situations like preparing for tax season, addressing inquiries from the IRS, or managing estate financial matters may necessitate immediate submission of this form.

Being aware of key timelines is also paramount. If you expect to encounter complex tax issues or audits, filing in advance can ensure that the authorized individuals have ample time to assist you without delays.

Differences between Form 8821 and Form 2848

While both Form 8821 and Form 2848 relate to authorizing individuals to manage your tax affairs, they serve different purposes. Form 8821 is specifically for tax information disclosure, enabling designees to receive tax data but not to act on your behalf legally.

In contrast, Form 2848, known as the Power of Attorney, grants more expansive authority, allowing your designee to represent you before the IRS, handle disputes and communicate directly with the IRS on your behalf. Understanding when to use which form is critical for effective tax management.

Rights and limitations of authorized individuals

Authorized individuals who receive access to your tax information do so under specific rights and limitations defined by Form 8821. They can view your tax data, ask questions, and obtain clarification from the IRS, but they cannot make decisions or file documents on your behalf.

This delineation of rights ensures that while you can obtain assistance, the ultimate control remains with you. Taxpayers must also consider the potential risks associated with authorization, such as sensitive information being shared without due consideration. Understanding these rights is vital to maintaining control over your tax affairs while obtaining help.

Revoking tax information authorization

If circumstances change, and you wish to revoke the authorization granted via Form 8821, it’s essential to do so formally by completing a new Form 8821 indicating the revocation. Clearly communicate this intention, as the IRS requires explicit action to revoke any prior authorizations.

When you revoke authorization, the designees are immediately stripped of their access to your tax information. It is crucial to keep your tax records secure and monitor who has access at all times.

FAQs about the tax information authorization tax form

Many taxpayers have questions about the nuances surrounding Form 8821. Common concerns include whom to list as designees and what specific tax information can be shared. While it’s best to consult the IRS guidelines, here are a few pointers:

By actively seeking knowledge about Form 8821, taxpayers can navigate their responsibilities with confidence.

Bonus: enhancing document management with pdfFiller

pdfFiller simplifies the process of managing the tax information authorization tax form. With user-friendly features, pdfFiller allows you to create, edit, and manage Form 8821 electronically, streamlining the often tedious process of handling paperwork.

Users can enjoy interactive tools for editing, signing, and securely storing forms. As a cloud-based solution, pdfFiller provides accessibility from anywhere, making it an ideal choice for busy individuals or teams that require effective document management.

Video tutorials and visual tools

To assist with the completion of Form 8821, pdfFiller offers various video tutorials that visually guide users through each step of the process. These instructional materials can enhance understanding and reduce the potential for errors during form completion.

Visual tools, including flowcharts, help outline the decision-making process regarding the use of Form 8821 versus Form 2848 or explain designee responsibilities.

Understanding the role of tax professionals

Tax professionals play an essential role in navigating the complexities associated with tax information disclosure. They help taxpayers understand which forms are appropriate based on individual circumstances and assist in filling them out accurately.

Finding reputable tax professionals, whether through recommendations or research, can enhance the overall experience of managing your taxes and ensuring compliance with IRS requirements.

Help and support

For those with further questions about the tax information authorization tax form, accessing customer support is crucial. pdfFiller offers responsive and knowledgeable assistance for inquiries specific to Form 8821, ensuring users receive adequate guidance.

Additionally, utilizing interactive FAQs available on the pdfFiller platform can provide immediate answers, reducing the time spent searching for information and streamlining the support process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the tax information authorization tax electronically in Chrome?

How do I edit tax information authorization tax on an Android device?

How do I fill out tax information authorization tax on an Android device?

What is tax information authorization tax?

Who is required to file tax information authorization tax?

How to fill out tax information authorization tax?

What is the purpose of tax information authorization tax?

What information must be reported on tax information authorization tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.